The US stock market loved the better-than-expected jobs report, with S&P 500 again closing at record highs. That’s 7-days of record highs!

And better still, this news of 850,000 jobs (rather than the 705,000 tipped by economists in the Dow Jones survey) looks like it’s a Goldilocks survey — not too hot, not too cold but just right!

How do I know that? Well, the bond market didn’t panic and send yields higher.

Helping the stock market is the fact that a Friday before a long weekend has a 65% bias to the upside. The first two to three weeks of July are often good, with the month one of the best, not in terms of size of rises but its frequency for being up.

This helps our July for stocks because the good Wall Street lead mixes in with post-end of financial year buying after tax-loss selling in June. Those who sold in June to use their losses to reduce their tax bill become buyers again in July.

The Tax Office could cancel those losses if they ever see what some investors have done but I suspect that law is more for the big players.

Respected Goldman Sachs chief economist Jan Hatzius said that the jobs report eased concerns about a labour shortage, which would push up wages and inflation possibly faster than what the Fed expects. Also he noted that the unemployment rate coming in higher than expected showed that the recovery still had a long way to go.

If the opposite was the case, the bond market would have reacted, pushing up yields and hurting stocks. In fact, the rise in unemployment from 5.8% to 5.9% might be a statistical aberration but economists tipped the jobless rate to fall to 5.6%, so that’s a big miss and implies the US economy isn’t overheating.

To the global picture and something worth watching are news items such as The Times reporting that Germany was considering a ban on British travellers to the European Union, regardless of their vaccination status, because of this highly contagious widespread Delta variant. Meanwhile, Hong Kong announced a ban on passenger flights from the UK, which led to airlines’ share prices falling by 4-6% after the news broke.

Also CommSec noted at the same time that shares in technology companies rose this week, while cyclicals fell over fears of a spike in Covid-19 cases across Asia. This is suggesting that if the problems with the Delta variant persist, we could see stay-at-home stocks benefit (which tech stocks often are) and reopening trade stocks losing ground, in concert with the inexplicable rush for toilet paper by some unusual shoppers!

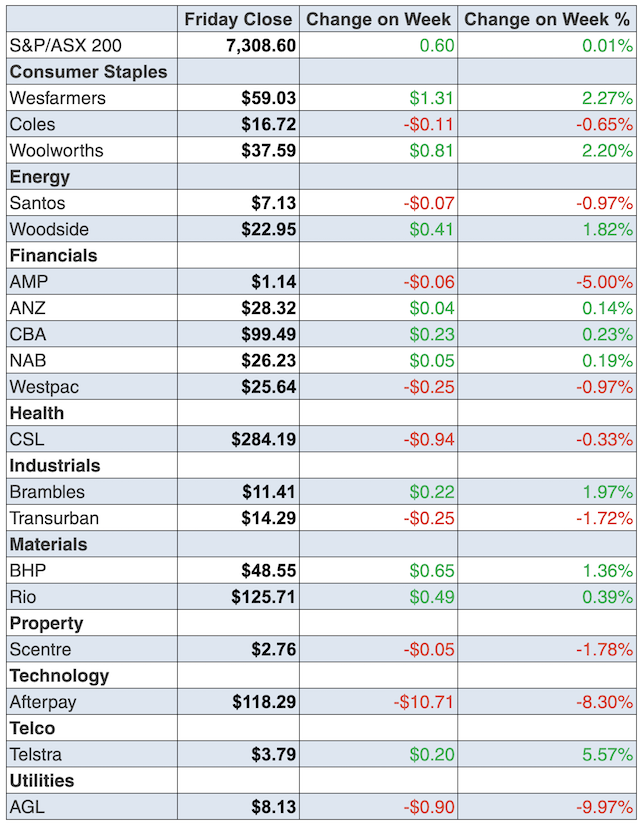

To the local story and the ASX 200 was up 0.01% for the week to end at 7308.6 after a financial year rise of a whopping 24%. Helping the market on Friday was the chasing of travel stocks and this can be explained by two stories. First, there are those who are buying these short-term beaten up stocks for the future when we are all vaccinated and international borders are open. And there would’ve been tax-loss selling in June, which then saw many of those sellers becoming buyers in July.

The same applies to disappointing stocks such as Nuix, which rose 4.3% and A2Milk, which spiked 5.2%.

The huge gainer was IDP Education which surged 20.3% after announcing that “it will acquire the British Council’s Indian International English Language Testing System (IELTS) operations.” (AFR). The stock ended at $29.44.

An interesting debut was BlueBet, which jumped 84% on the opening bell but ended the day up a huge 56%! Like Zip Co, these guys are actually in my building in Spring St, Sydney, so I’ll get the CEO into our studio ASAP.

And for anyone wondering if bank stocks can keep going higher, I told our webinar yesterday that I thought bank stocks can keep sneaking higher and the strong numbers for housing loans that you can see below, adds weight to my argument. “There is no indicator more relevant for assessing the prospects of banks,” said CommSec’s Craig James. “And there are few signs that lending is slowing, underpinned by low interest rates and a strong job market. In fact, the lift in investor loans will be closely assessed by financial sector regulators.”

Over the week, CBA rose 0.8% to $99.49, NAB was up 0.7% to $26.63 and ANZ put on 1% to $28.32. Westpac did nothing, with a story about a potential $200 million fraud not great reading for the market.

What I liked

- The value of new loan commitments for housing rose by 4.9 % in May to a record high of $32.56 billion.

- The CoreLogic national home value index rose by 1.9% in June to be up 13.5% on the year – the strongest annual growth rate in 11 years.

- Private sector credit rose by 0.4% in May to be up 1.9% on the year. “It showed that Aussies are cautiously starting to take on new personal and business debt.” (CommSec)

- US consumer confidence rose from 120 to 127.3 in June (survey: 119).

- The S&P/Case Shiller home price index rose by 2.1% in April (survey: 1.9%), to be up 14.9% for the year.

- The Challenger survey in the US found there were 20,476 job cuts in June (survey: 30,000). Construction spending fell by 0.3% in May (survey: 0.4%). The ISM manufacturing purchasing managers index (PMI) fell from 61.2 to 60.6 in June (survey: 61). New claims for unemployment insurance (jobless claims) fell from 415,000 to 364,000 in the past week (survey: 390,000). (The news here is overall positive, with the falls small, leaving the readings at high levels.)

- The ADP report on private payrolls in the US showed that 692,000 jobs were created in June (survey: 600,000).

What I didn’t like

- Delta variant stories and concerns worldwide.

- The energy sector of the share market is up 32% on October 2020 lows. The rising cost of petrol may constrain consumer spending in coming weeks, impacting retailers.

- The Chicago Purchasing Managers index fell from 75.2 to 66.1 in June (survey: 70).

News better than…

Clearly the greatest economic threat to the optimistic scenario for stocks is the Delta variant. Could it close down borders and create lockdowns worldwide? This kind of fear won’t go away until the world has a much higher vaccination rate. So the best economic news I heard this week was when I saw that shares in Moderna rose 5.2% to a record high after the drug-maker’s COVID-19 vaccine showed promise against the Delta variant. Vaccination and better vaccines are critical to rising stock markets.

And if you’re a victim of lockdowns this weekend, make sure you catch up on the great stories below from the Switzer Report over this week.

The week in review:

- If you need arguments to allay any fears you might be currently having, here’s a decent list that explains my positivity for stocks.

- This week, Paul Rickard shared the way he intends to play Endeavour Group (EDV) and 5 important changes that kicked off with the new financial year.

- Share price levels are arbitrary measures, but occasionally we like to put together lists of promising stocks united solely by their similar share prices. For his latest article, James Dunn looked at 4 stocks under 40 cents: Micro-X (MX1), Tietto Minerals (TIE), Spirit Technology Solutions (ST1) and ioneer (INR).

- If you want exposure to Europe, the Aussie dollar, energy stocks and/or gold, read Tony Featherstone’s article about 4 index-fund strategies to consider as global economies continue on their upward path.

- For out “HOT” stocks of the week, Julia Lee from Burman Invest picked Qantas (QAN) and Michael Gable from Fairmont Equities selected Goodman Group (GMG).

- Tim Miller from SuperGuardian wrote about changes to the ‘Bring Forward’ rule.

- In Buy, Hold, Sell – What the Brokers Say, there were 8 upgrades and 12 downgrades in the first edition, and 8 downgrades in the second edition.

- In Questions of the Week, Paul Rickard answers your questions about the best ETF to gain exposure to Europe, the performance of the Aussie dollar, whether Qantas (QAN) is a buy and the top performing ASX sector in 2021.

- And catch up on the recording of yesterday’s webinar for a look at what to expect from this financial year. A transcript will also be available in Monday’s Switzer Report.

Our videos of the week:

- Webinar: What to expect from the next financial year

- Lockdown plays – QAN, EDV, WOW, TYR + risky ones: EPY? | Switzer Investing

- 4 ASX stocks under 40c & 3 great income stocks + expert says: DON’T BUY new apartments! | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday July 5 – Retail trade (May)

Monday July 5 – Building approvals (May)

Monday July 5 – ANZ job advertisements (June)

Monday July 5 – Melbourne Institute inflation gauge (June)

Monday July 5 – New vehicle sales (June)

Tuesday July 6 – Weekly consumer sentiment (July 4)

Tuesday July 6 – Weekly payroll jobs & wages (June 19)

Tuesday July 6 – Reserve Bank Board meeting

Tuesday July 6 – Reserve Bank Governor speech

Thursday July 8 – Reserve Bank Governor speech

Overseas

Monday July 5 – China Caixin services index (June)

Tuesday July 6 – US Markit services index (June)

Tuesday July 6 – US ISM services index (June)

Tuesday July 6 – US IBD/TIPP economic optimism index (July)

Wednesday July 7 – US JOLTs job openings (May)

Wednesday July 7 – US Federal Reserve meeting minutes (June)

Thursday July 8 – US Initial jobless claims (July 3)

Thursday July 8 – US Consumer credit (May)

Friday July 9 – China consumer and producer prices (June)

Friday July 9 – US Wholesale inventories (May)

Food for thought:

“Your success in investing will depend in part on your character and guts, and in part on your ability to realize, at the heights of ebullience and the depths of despair alike, that this, too, shall pass away.” – Jack Bogle

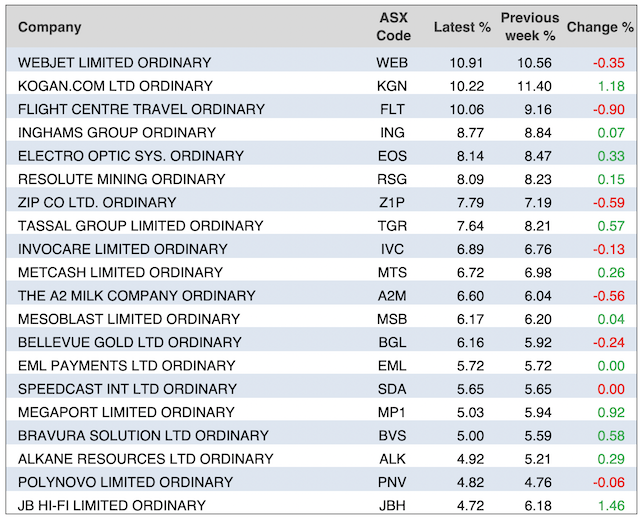

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

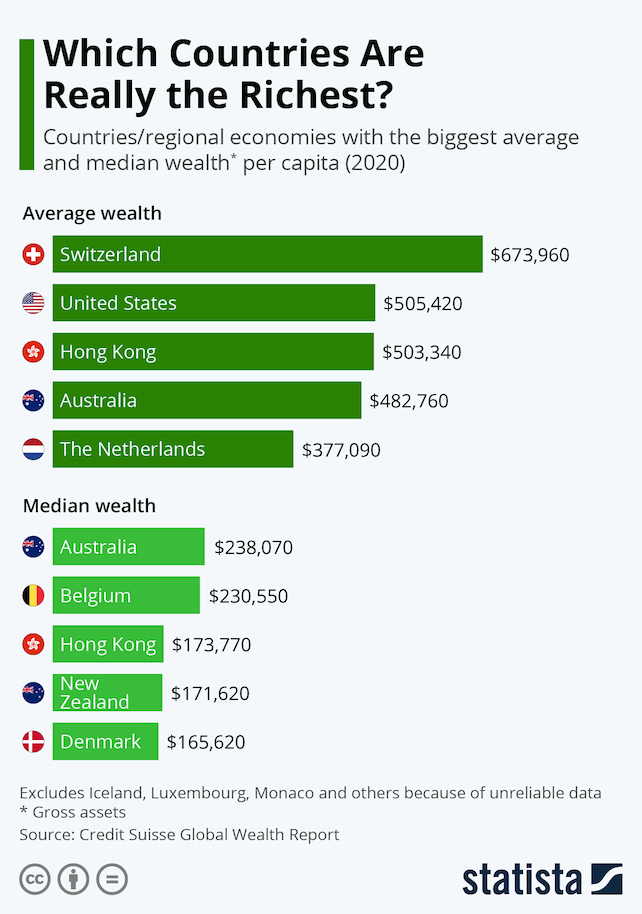

Chart of the week:

Credit Suisse’s latest Global Wealth Report showed that Australia is the richest country in terms of median per-capita wealth and fourth in terms average per-capita wealth as shown in this chart from Statista:

Top 5 most clicked:

- 8 reasons to stick with stocks – Peter Switzer

- Endeavour Group will be a BUY – Paul Rickard

- 4 stocks under 40 cents – James Dunn

- 4 ETF ideas for this financial year – Tony Featherstone

- Questions of the Week – Paul Rickard

Recent Switzer Reports:

- Monday 28 June: 8 reasons to stick with stocks

- Thursday 1 July: 4 ETF ideas for this financial year

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.