The S&P 500 rode into record territory with the latest news about President Biden getting his $US1 trillion infrastructure bill up, helping to power Wall Street higher. This bill included $US579 billion in new spending and it has bipartisan support.

Anyone spooked about stocks and their recent rises needs to know that it’s the growth of economies and profits that’s driving markets higher. And even our local index was able to rise on Friday, despite parts of Sydney being forced into a minimum seven-day lockdown.

It’s about the big picture trumping the small picture.

As you’d expect, steel and material prices are reacting positively to the infrastructure news. And there seems to be a drift to the old rotation play, with the US bank index up about 5% for the week.

Another positive force for US stocks this week was inflation news. Despite the price level rising 3.4% for May (the fastest rate since the early 1990s), economists expected it to be around this level. The more important core inflation number was up 0.5%, which was below the 0.6% forecast.

Why are the readings so high? Economists blame the “base effects”, which basically says all the prices that were smashed in 2020 (because of the Coronavirus lockdowns) are now rebounding to old or even higher levels, as consumers and businesses ramp up demand.

However, the central banks are arguing that this is only transitory and these prices will either fall or stay the same, which doesn’t add to inflation. Inflation is the rise in the price level and if prices are staying the same or even falling, on average, the rate of the price level rise tails off (that is, less inflation). That’s what Wall Street is believing and because the bond market is a believer too, the yields aren’t worryingly spiking. They’re rising, but not madly, and Wall Street likes that.

Anyone wondering why last week’s inflation and interest rate concerns (that hurt stock prices) aren’t a big issue needs to understand that this is what stock markets do — they climb the wall of worry and often jump at shadows created by speculation. And that’s my job: to work out when we have to take short-term trends and reactions seriously.

As US market indices are in record territory, a sell off can’t be ruled out. However, initiatives such as Biden’s bill for huge spending, plus a good vaccination roll out in the US, the UK and Europe, plus developments such as the EU rebooting tourism and even the summer US cruise ship season restarting (with ramped up Coronavirus-handling processes in place), all tells us to expect big economic growth numbers to persist.

That’s great news for stocks and it’s expected to be reflected in the earnings projections of companies.

Want an example? Try Nike, which revealed its latest results overnight that impressed the analysts. But the one revelation that drove the stock price up over 15% was the forecast of strong growth out to 2025!

This reinforces the view that stocks are early in the cycle, and that marries up with my best guess.

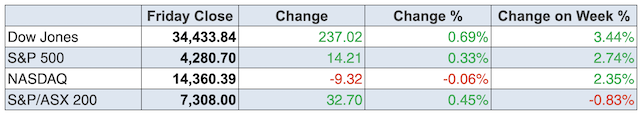

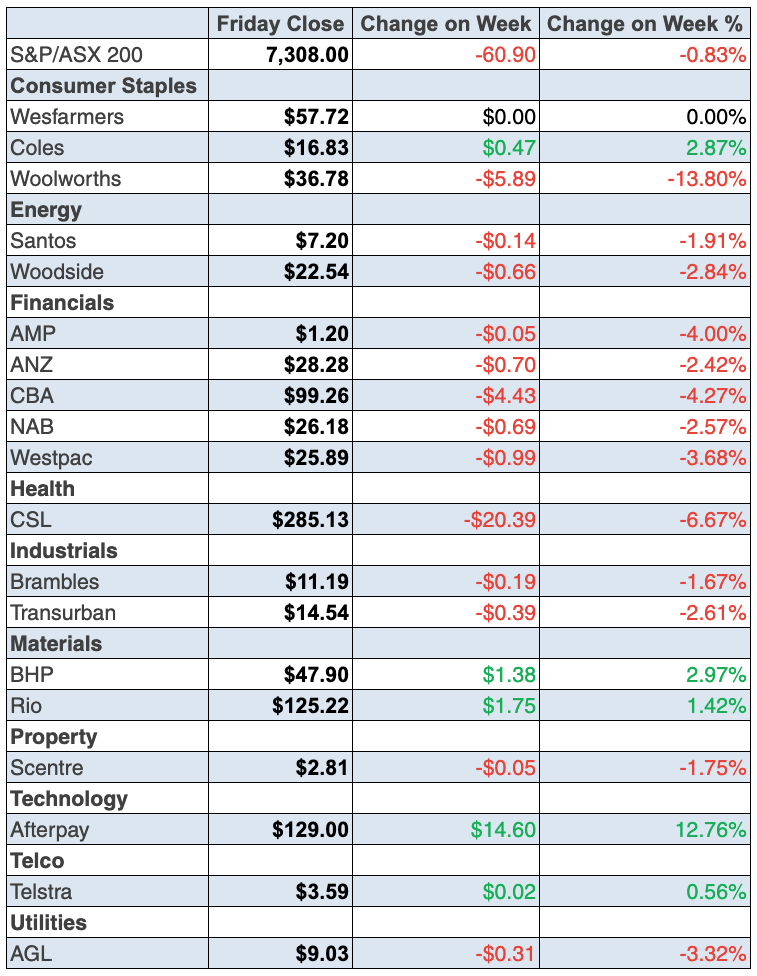

To the local story and the S&P/ASX 200 lost 0.8% for the week when there were push-and-pull factors for stocks. The S&P/ASX 200 index ended at 7308 and

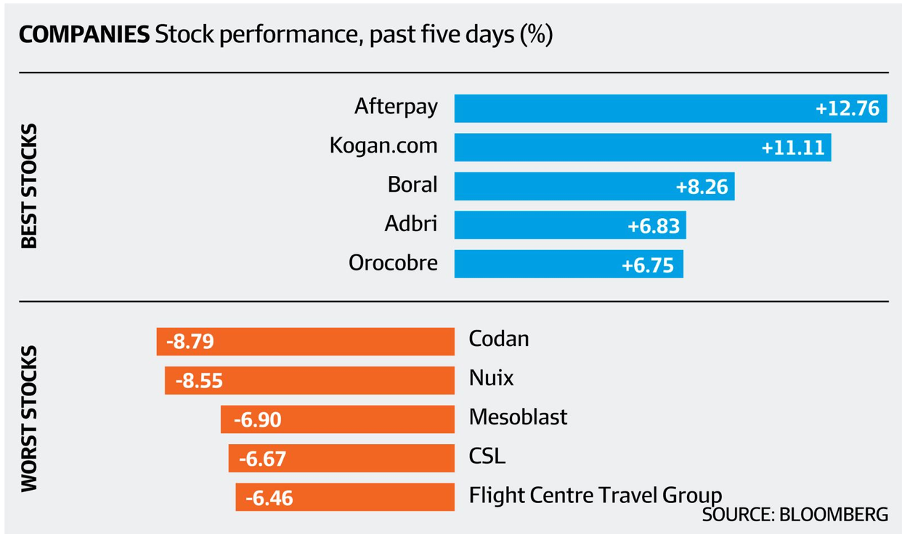

the ‘silly season’ created by the Sydney lockdown (hot on the heels of Melbourne’s lockdown) helped stay-at-home stocks like Kogan and Temple & Webster perform well. The former put on 6.09%, while the latter rose 1.8% on Friday.

This Bloomberg chart shows the winners and losers this week.

The infrastructure bill helped the likes of BHP, which was up 4.5% for the week to $47.90, while Rio was up 3.1% to $125.22.

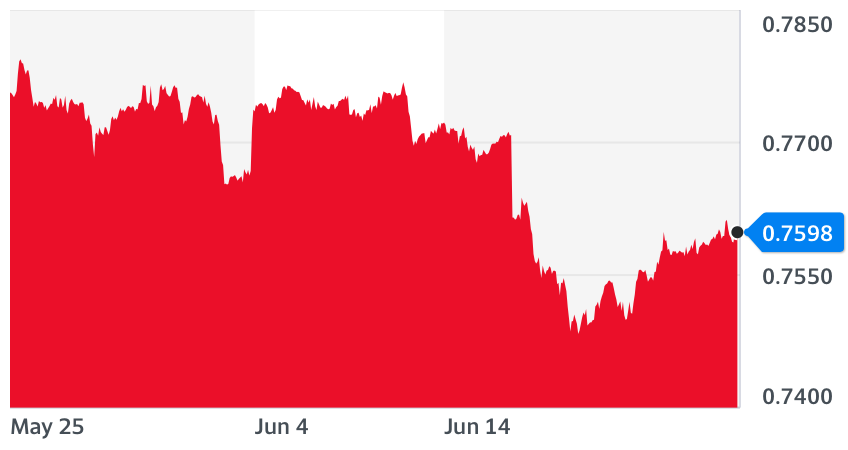

On the losers such as Nuix (down 8.55%), there has to be end-of-year tax selling, while CSL could be a victim of profit-taking after a nice surge in recent months — the stock was up 23% since March. Some of that could have been on a falling Aussie dollar, which has started to rebound.

$A one month

What I liked

- Spare capacity – as measured by underemployment and underutilisation – has been reduced and job vacancies are at 12½-year highs, with skills shortages emerging across some industries. With the labour market tightening, Commonwealth Bank (CBA) Group economists expect the jobless rate to fall from 5.1% in May to 4.5% at year end.

- Total household wealth (net worth) rose by 4.3% to a record high $12,664.5 billion in the March quarter. Average (per capita) household wealth rose by $19,494 (or 4.1%) to $492,055.

- Total council approvals to build new houses rose by 3.4% to record highs.

- The weekly ANZ-Roy Morgan consumer confidence rating rose by 1.3% to 112.4 (long-run average since 1990 is 112.6).

- Consumer inflation expectations over the next two years rose from 3.9% to a 14-month high of 4.2% last week. (These guesses can’t be believed to be accurate but it tells you that inflation is likely to rise.)

- In seasonally-adjusted terms, employment rose by 158,400 in the three months to May. Jobs rose in 12 of the 19 industry sectors. Over the 12 months to May, 983,500 jobs were added across 13 out of 19 industry sectors. A record 13.148 million people were employed.

- ‘Preliminary’ retail trade rose by 0.1% in May to be 7.4% higher than a year ago. (Victorian sales fell by 1.5% in May, but spending rose by 1.5% in both Queensland and Western Australia).

- Fed boss Jerome Powell said: “Inflation has increased notably in recent months”, but “as these transitory supply effects abate, inflation is expected to drop back toward our longer-run goal”.

- USdurable goods orders rose by 2.3% in May (survey: 2.8%). The economy grew at a 6.4% annual pace in the March quarter (survey: 6.4%). New claims for unemployment insurance fell by 7,000 to 411,00 in the latest week (survey: 380,000). The goods trade deficit rose from US$85.73 billion to US$88.11 billion in May (survey: US$84 billion). A rising deficit means growth is happening.

- US President Biden has embraced a $1.2 trillion bipartisan Senate deal on infrastructure spending. Reuters reports that the “$579 billion in new spending includes major investments in the nation’s power grid, broadband internet services and passenger and freight rail”.

- The IHS Markit manufacturing index rose from 62.1 to a record 62.6 in June (survey: 61.5).

- Investors attributed the market gains in the EU to encouraging comments on the economic recovery from Christine Lagarde, head of the European Central Bank.

What I didn’t like

- Company operating profits fell 0.3% in the quarter, but that’s small.

- The US services index fell from 70.4 to 64.8 in the month (survey: 70)

Honestly, I can’t find really bad news except…

The run of economic data here and overseas remains positive, except for the lockdown problems here in Australia and the silly monitoring processes of irresponsible limo drivers, who’ve been badly supervised. Have a look at my Weekend Switzer story for my scathing views on Brad Hazzard as NSW Health Minister. If we stick it to Dan Andrews, even Gladys has to cop a bit too, though she doesn’t go into full lockdown at a drop of a hat like Dan!

I’m also disappointed at the vaccine rollout but I do think the medical failure of AstraZeneca is at the core of the problem. And while I like to blame politicians when they’re in the wrong, this time I think it was more a failure of the vaccine designers.

These two failings will have economic and market consequences but if we can get Pfizer or Moderna here ASAP, it should be manageable.

And don’t forget to catch up on this week’s great stories in this Report below.

The week in review:

- Is Mesoblast (MSB) set to blast off again? Read my article this week to find out.

- I also shared the details of a tech business that could have a great future and one that interested players could be involved in from the ground up.

- Paul Rickard looked at 4 ASX-listed riskier alternatives to term deposits that don’t include growth assets such as shares and property.

- James Dunn thinks these 3 potential ‘boomtime’ new-age material stocks might have the goods: Element 25 (E25), Hastings Technology Metals (HAS) and American Pacific Borates (ABR)

- Tony Featherstone shared 2 ways to play the childcare sector on the ASX: Arena REIT (ARF) and G8 Education (GEM).

- Our experts had 2 “HOT” stocks this week: Raymond Chan from Morgans highlighted Computershare (CPU) and Michael Gable from Fairmont Equities chose CSL (CSL).

- In Buy, Hold, Sell – What the Brokers Say this week, there were 6 upgrades and 15 downgrades in the first edition, and 6 upgrades and 9 downgrades in the second edition.

- In Questions of the Week, Paul Rickard answered your questions about the cost base of Endeavour Group (EDV) shares, whether Challenger (CGF) is worth hanging onto, index versus active managers and super actions you can still take before the end of financial year.

- In this week’s Boom! Doom! Zoom! session, we discussed Woolworths (WOW) and the Endeavour Group (EDV) demerger, BNPL stocks, how the movement of the Aussie dollar will impact companies like CSL (CSL) and more.

- And don’t forget to register for our monthly webinar on what to expect from the next financial year.

Our videos of the week:

- Boom! Doom! Zoom! | June 24, 2021

- ASX share prices of ALU, APX, A2M & NXL have taken off! + The best income-paying stocks you need! | Switzer Investing

- Should you invest in bitcoin – Pros & Cons. Ray Chan 3 ASX stocks: WBC, CPU, NXT | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday June 29 – Weekly consumer sentiment (June 27)

Wednesday June 30 – Speech by Reserve Bank Governor

Wednesday June 30 – Private sector credit (May)

Wednesday June 30 – Engineering construction (March quarter)

Thursday July 1 – CoreLogic Home Value index (June)

Thursday July 1 – International trade (May)

Thursday July 1 – Job vacancies (May quarter)

Thursday July 1 – Purchasing manager indexes (June)

Friday July 2 – Lending indicators (May)

Overseas

Tuesday June 29 – US Home prices (April)

Tuesday June 29 – US Consumer confidence (June)

Wednesday June 30 – China purchasing manager indexes (June)

Wednesday June 30 – US ADP employment (June)

Wednesday June 30 – US Pending home sales (May)

Thursday July 1 – China Caixin purchasing manager index (June)

Thursday July 1 – US purchasing manager indexes (June)

Thursday July 1 – US Construction spending (May)

Thursday July 1 – US Challenger job cuts (June)

Friday July 2 – US Non-farm payrolls (June)

Friday July 2 – US Factory orders (May)

Friday July 2 – US Trade balance (May)

Food for thought:

“As time goes on, I get more and more convinced that the right method in investment is to put fairly large sums into enterprises which one thinks one knows something about and in the management of which one thoroughly believes.” – John Maynard Keynes

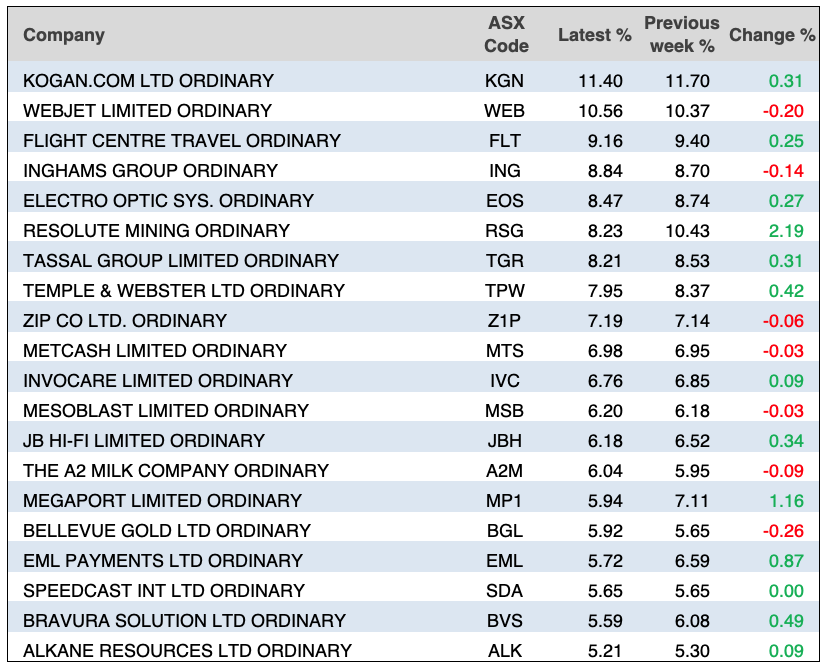

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

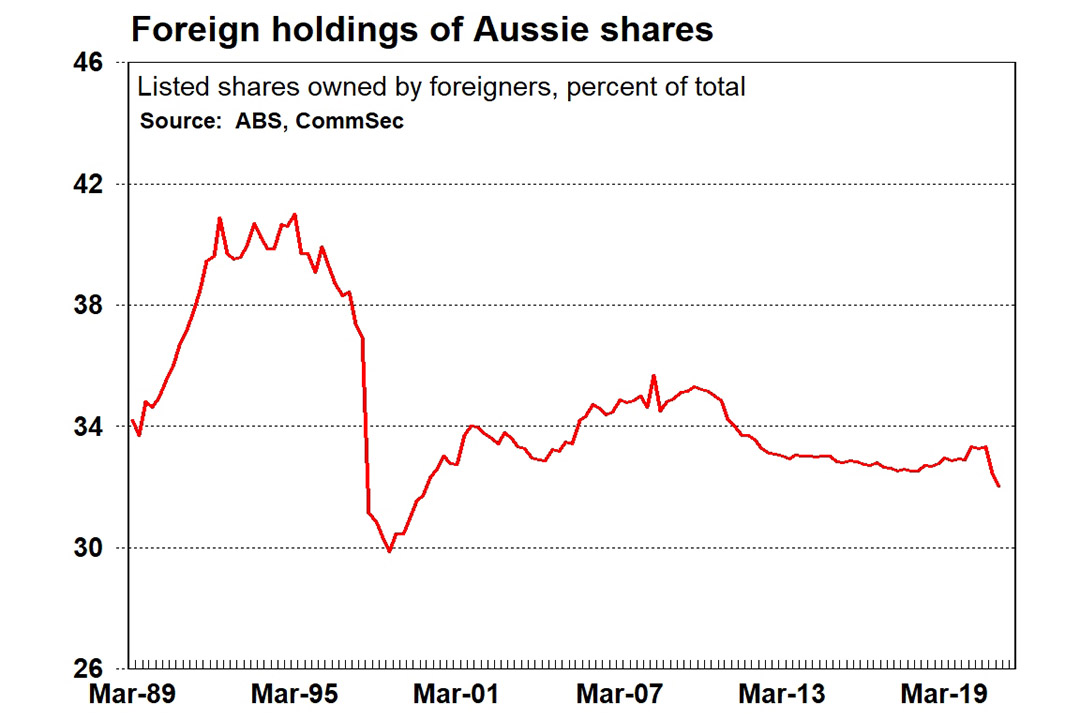

Chart of the week:

CommSec’s Craig James highlighted the following findings from the Finance and Wealth publication by the Australian Bureau of Statistics. While foreigners held a record $746.5 billion of Australian shares in the March quarter, this is a 21-year low in percentage terms at 32.05%:

Top 5 most clicked:

- Is Mesoblast set to blast off again? – Peter Switzer

- Tired of term deposits? 4 ‘riskier’ alternatives – Paul Rickard

- 3 potential ‘boomtime’ new-age material stocks – James Dunn

- Questions of the Week – Paul Rickard

- 2 ASX listed childcare stocks – Tony Featherstone

Recent Switzer Reports:

- Monday 21 June: Is Mesoblast set to blast off again?

- Thursday 24 June: 2 ASX listed childcare stocks

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.