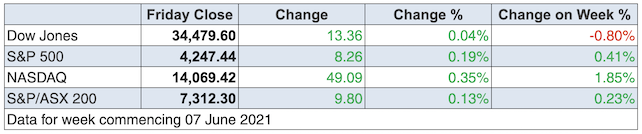

Tech and healthcare stocks had a better week on Wall Street, which suggests growth is taking a bit of ground off value plays. But that makes sense as the recent rotation the other way has undoubtedly taken some value stocks to “too expensive” levels.

Also powering the hunt for stocks that have been too sold off and are attractively priced is the expectation that second quarter earnings in the US is going to be “the mother of all reporting seasons”, as CNBC’s Bob Pisani put it.

I met Bob at the New York Stock Exchange where he worked daily for CNBC, interviewing the big name brokers getting a feel for what the market was saying as stock prices gyrated in both directions. I rate highly the market narratives he shares with his colleagues and audiences.

Bob also says the fact that the bond market isn’t pushing up yields and the consensus is agreeing that inflation spikes will be transitory, is good for growth/tech stocks.

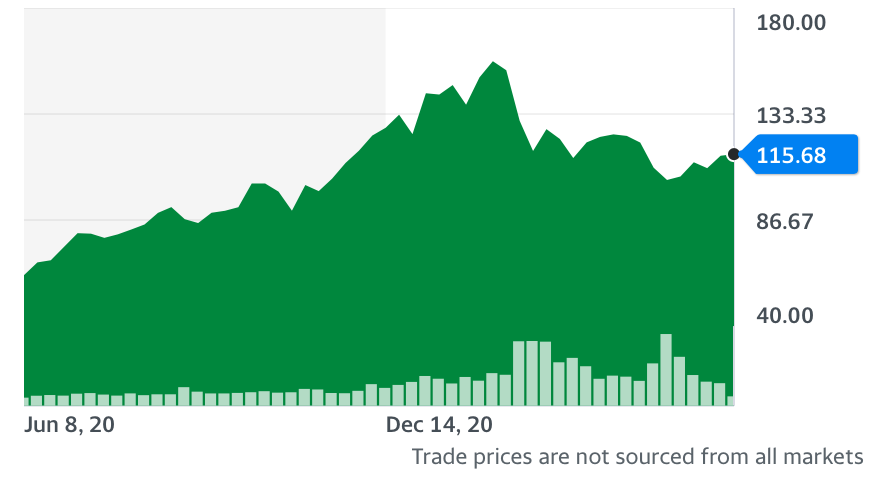

ARK Innovation ETF (ARKK)

All this says ‘re-fishing’ for over-beaten tech stocks makes sense. I wrote about this and Cathie Wood’s ARK innovation ETF a few weeks ago. The chart above shows how it fell from $US159.70 in February to around $104 on May 10 but is now trending back.

ARKK is up 17% since May 13 and stocks like Zoom Video Communications is up 25% over the past month.

I hope this trend persists as it’s helping our beaten up tech stocks.

On the subject of inflation referred to above, the 5% rate revealed this week was higher. Wall Street has looked at the numbers, listened to the Fed and is certainly buying the “inflationary will be transitory” story. If that changes, stock prices will fall. But can you trust these views?

Right now the answer is “yes” and it’s the bond market reaction that best explains why. The 10-year Treasury bond actually fell to 1.44% after the inflation number came out and that contrasts with a high of 1.77% earlier this year.

Both the bond and stock market are buying the central bank argument that inflation won’t stop them keeping interest rates lower for longer. In fact, this week, the RBA’s Assistant Governor Christopher Kent reiterated that rates aren’t likely to rise until 2024!

Adding to positivity was the oil price in the $US70 a barrel level. Last week global crude oil prices rose by as much as 5% to their highest levels in more than two years, and this screams that a big economic boom is demanding oil big time. You might recall the price of oil futures actually went negative at the beginning of the Coronavirus crash of the stock market.

“April 20th, 2020, was the first day in history where oil recorded negative prices. US oil benchmark West Texas Intermediate (WTI) fell from $17.85 at the start of the trading day to negative $37.63 by the close,” globalriskinsights.com reminds us. And weren’t they the craziest of days?

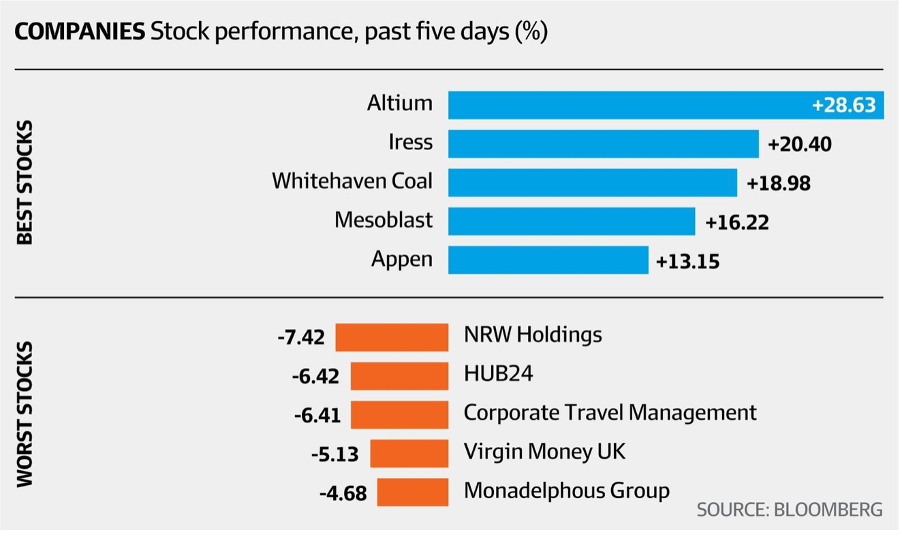

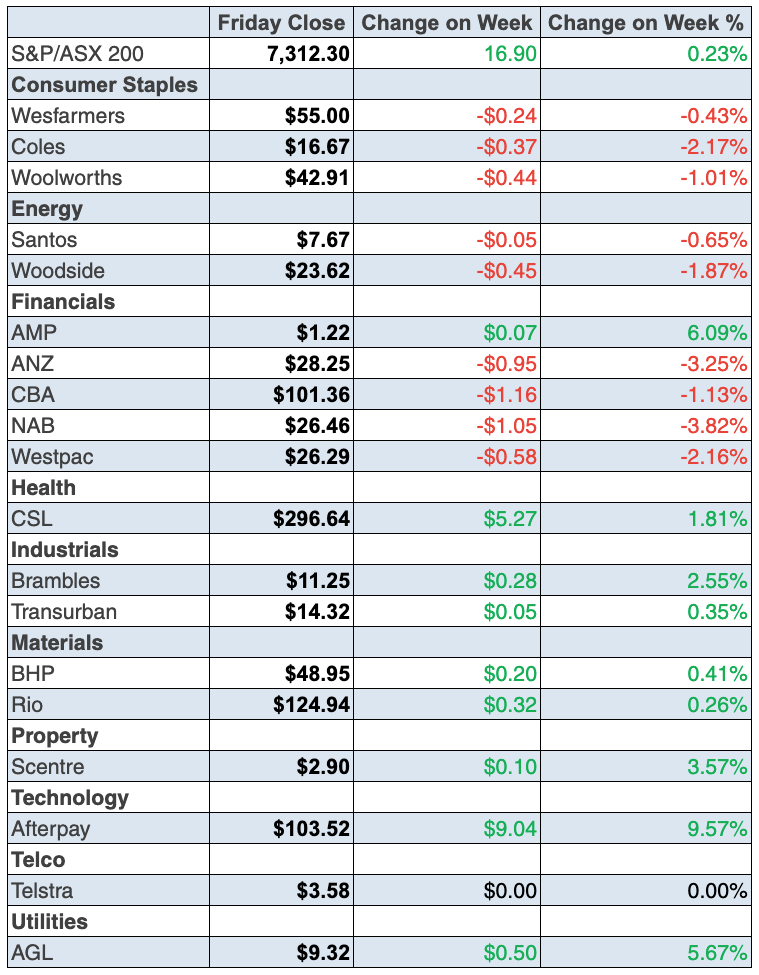

To the local story and I’ve been writing that tech would have a second wind once value stocks like the banks have been overbought. We saw a bit of that this week. In fact, the AFR’s William McInnes summed up the share market’s week in review with the headline: “Tech leads ASX to record high.”

The S&P/ASX 200 rose 16.9 points (or 0.2%) to finish at 7312.3, despite the headwind of Melbourne being in lockdown for most of the week. The IT sector wacked on 6.96% for the week and this Bloomberg table shows two of my “triple-A” stocks have had a good week, along with that enfant terrible, Mesoblast, which shot up 16.22% for the week but no one seems to know why!

The surge for IRESS is linked to talk that it could be in the sights of a big share buyer eyeing off its shares but the company had no heads up on the matter. The Australian says “Iress has called on Goldman Sachs to provide defence advice after a private equity firm made efforts to buy up to 10 per cent of the company for between $13 and $14 per share.”

For those wondering why travel stocks had a hard week at the office, well, just think lockdowns and the extension of the overseas travel ban.

Corporate Travel Management lost 6.4% to $20.58, Webjet 4.3% to $5.07, Flight Centre 4.5% to $15.26 and Qantas 3.3% to $4.71. (AFR)

But remember these sell offs are from short-term market players and if you believe that one day we will travel like old times, these companies’ share prices will ride higher again.

What I liked

- Love the determined RBA on rates, with the Assistant Governor at the Reserve Bank, Christopher Kent, again telling us that the preconditions for higher cash rates won’t be met before 2024.

- The NAB business confidence index eased from a record high of 23.5 points in April to 19.8 points in May. But the conditions index rose from 31.9 points to a record high 37.2 points in May.

- NAB’s business conditions index rose from 31.9 points to a record high 37.2 points in May.

- Australian home prices have lifted by almost 11% over the past year, raising concerns about weakening housing affordability. But for the two-thirds of Aussies who either own their homes outright or are paying off a mortgage, higher home prices serve to boost wealth levels.

- ANZ job advertisements rose by 7.9% in May to a 12½-year high of 213,894 available positions. Ads have lifted for 12 successive months to be up 219.8% from a year ago and up 38.8% on the pre-pandemic level.

- National payroll jobs rose by 8.8% over the year to May 22, with wages up by 11.5% over the period.

- Skilled job vacancies rose 1.9% to 12-year highs in May.

- Consumer prices (CPI) lifted 0.6% in May to be up 5% (the most sinceAugust 2008) on a year ago (survey: 4.7%). The core CPI rose by 0.7% in May to be 3.8% higher on a year ago — the largest increase since June 1992 (survey: 3.5%).

- Initial jobless claims in the US fell by 9,000 to a 15-month low of 376,000 in the past week (survey: 370,000).

- US chain store sales in the past week were up 14.5% on a year ago, compared with a 13% annual gain in the prior week.

- Chinese consumer prices rose by 1.3% over the year to May, with producer prices up 9% – the strongest pace since 2008.

What I didn’t like

- Consumer confidence fell by 5.2% in June, reflecting the Melbourne lockdown!

- The NAB business confidence index eased from a record high of 23.5 points in April to 19.8 points in May.

- The NFIB business optimism index in the US eased from 99.8 to 99.6 in May (survey: 101) — it’s a small fall and of little concern but I have to be objective and not always positive!

This is the stock player’s friend trend

News like this is set to trickle through over the next six months: “Major airline share prices rose around 3% after the US Centers for Disease Control and Prevention (CDC) said it was easing travel recommendations on 110 countries and territories.” (CommSec) Why? Thank the vaccination programme as it will add to the reopening trade. So travel stocks selling off this week simply reflects short-term trades and creates money-making opportunities for the longer-term investor. But what’s new? I’m always telling you that because it works, provided the company is a quality business.

And don’t forget to catch up on our stock stories of the week and it’s great to see the overseas-investing fund manager, Charlie Aitken, give his top 8 local stocks here in the Switzer Report.

The week in review:

- With the US stock market seen as expensive based on the Buffett Indicator, should you be concerned that a big stock market sell off is around the corner?

- The end of the financial year is just around the corner. This week, Paul Rickard shared 7 actions to take before June 30.

- James Dunn looked at four stocks that recently made 52-week highs, where the outlook seems to justify buying them if you don’t hold them already, or to think about buying more if you do: Telstra (TLS), Australian Agricultural Company (AAC), People Infrastructure (PPE) and QBE Insurance (QBE).

- Tony Featherstone analysed 4 companies to emerge from the shadows as resource exploration and production gains momentum: ALS (ALQ), Worley (WOR), NRW Holdings (NWH) and Mastermyne Group (MYE).

- Charlie Aitken listed his top 8 ASX-listed stocks in last week’s webinar, and here they are for you to review: CSL (CSL), Woolworths (WOW), Wesfarmers (WES), Brambles (BXB), ASX (ASX), Sonic Healthcare (SHL), Cochlear (COH) and Computershare (CPU).

- Our experts had two hot stocks this week. Woodside Petroleum (WPL) was highlighted by both Michael Gable from Fairmont Equities and Raymond Chan from Morgans, while Julia Lee from Burman Invest put forward CSR (CSR).

- There were 6 upgrades and 6 downgrades in the first Buy, Hold, Sell – What the Brokers Say of the week, and in the second edition there were 5 upgrades and 6 downgrades.

- In Questions of the Week, Paul Rickard answered your questions on concerns about inflation, investing in currency hedged share funds, Xero (XRO) and the government super co-contribution.

- And in Boom! Doom! Zoom! this week, Michael Wayne from Medallion Financial Group answered your questions on Elmo (ELO), Altium (ALU), Nuix (NXL) and more. Michael also shared his three stocks to buy for the long term, so make sure you catch up on the recording here.

Our videos of the week:

- Boom! Doom! Zoom! | June 10, 2021

- Why Altium is up 34%? Experts like: IGO, TRO, XRO, TPG & turning a bad investment into a tax gain! | Switzer Investing

- Value stocks: Qube, Bravura Solutions, CSL, ELO, Resmed, Aristocrat+ investing in a mortgage fund | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday June 15 – House price index (March quarter)

Tuesday June 15 – Overseas Arrivals & Departures (April)

Tuesday June 15 – Household Spending Intentions

Tuesday June 15 – Weekly consumer sentiment (June 13)

Tuesday June 15 – Reserve Bank Board minutes

Tuesday June 15 – Queensland State Budget

Wednesday June 16 – Household impacts of Covid-19 (May)

Thursday June 17 – Population data (December quarter)

Thursday June 17 – Employment/unemployment (May)

Thursday June 17 – Speech by Reserve Bank Governor

Overseas

Monday June 14 – US Consumer inflation expectations (May)

Tuesday June 15 – US Retail sales (May)

Tuesday June 15 – US Industrial production (May)

Tuesday June 15 – US Producer prices (May)

Tuesday June 15 – US Empire State index (June)

June 15-16 – US Federal Reserve decision

Wednesday June 16 – US Export/import prices (May)

Wednesday June 16 – US Housing starts (May)

Wednesday June 16 – China monthly activity (May)

Thursday June 17 – China House prices index (May)

Thursday June 17 – US Leading index (May)

Thursday June 17 – US Philadelphia Federal Reserve index

Food for thought:

“Being rich is having money; being wealthy is having time.” – Margaret Bonanno

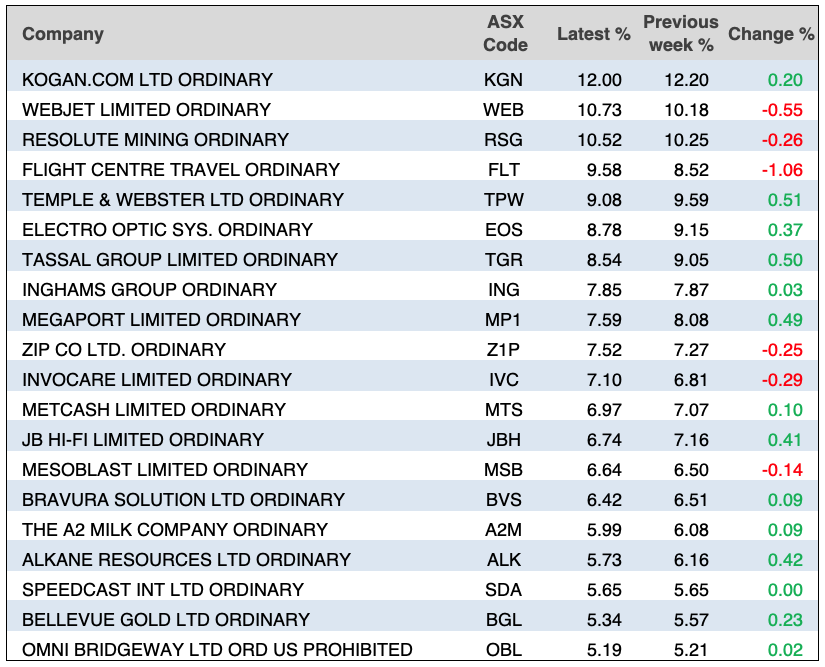

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

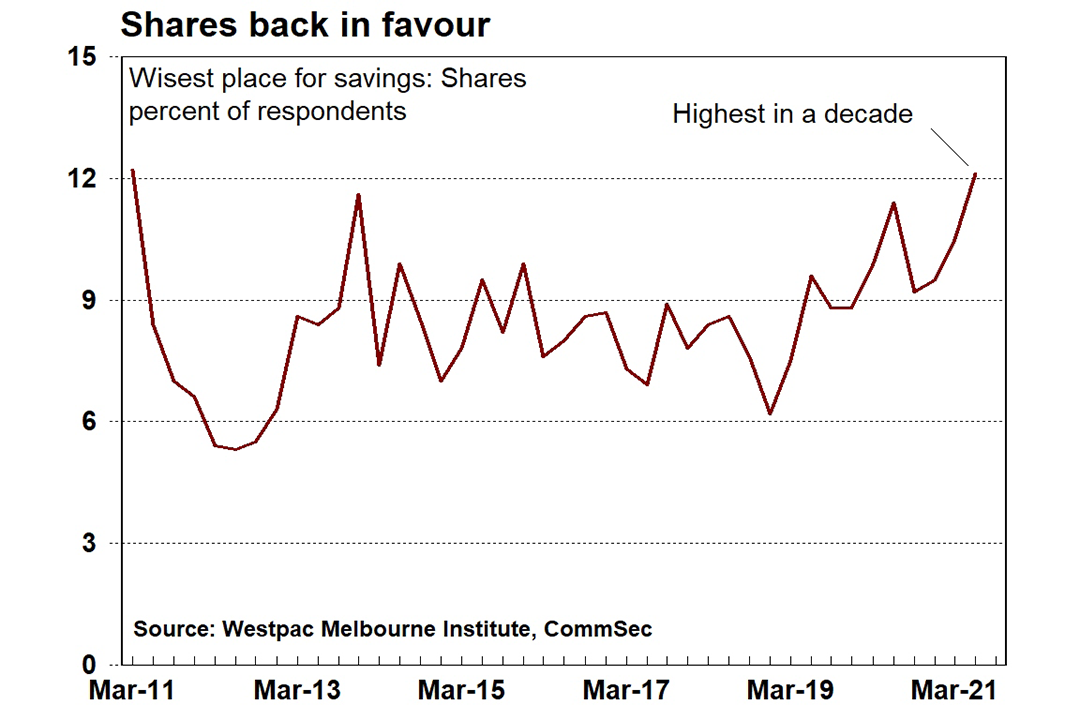

Chart of the week:

In the latest Westpac-Melbourne Institute Index of Consumer Sentiment survey this week, 12.1% of respondents said that the sharemarket was the wisest place for savings. As CommSec’s Craig James shows in the following chart, this is the highest level in a decade:

Top 5 most clicked:

- Buffett Indicator flashes red light. Should you be worried? – Peter Switzer

- 4 stocks set to keep rising – James Dunn

- 7 actions to take before the end of the financial year – Paul Rickard

- My favourite 4 companies to emerge from the shadows – Tony Featherstone

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

Recent Switzer Reports:

- Monday 7 June: Should you be worried about the stock market?

- Thursday 10 June: My favourite 4 companies to emerge from the shadows

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.