The good times rolled along again on US stock markets after a good but not great May jobs report, though it was miles better than the April one. The S&P 500 missed a record close by a couple of points, while the Dow was up 180 points. And for worried tech investors, tech led the way overnight.

Like our economy, the US is responding (as hoped) to unprecedented fiscal and monetary stimulus.

Because of the unreliability, the average forecast has become more like a guess. 671,000 jobs were forecasted but 559,000 showed up. But given the April number was 266,000, this result is a good one rather than a great one. However maybe a good one is better for the stock market!

Keeping it positive, the fall in unemployment was notable with a drop from 6.1% to 5.8%, telling us the economy is throwing off the recession effects of the Coronavirus and related lockdowns. But the rebound isn’t too full-on, such that it would spook the Fed to worry about rampant, non-temporary inflation. The numbers also won’t make the central bank start pushing the panic button to start tapering its bond buying that’s giving the US economy lots of demand-creating money.

Yep, it’s time for market commentators to pull out their Goldilocks cliché because the economy looks “just right”, being neither too hot (to create excessive inflation) nor too cold (to worry about employment numbers disappointing in the future).

How do I know this? Well, the good old bond market pushed yields down rather than up. And so the ‘canary’ in the coalmine (which the bond market is for inflation, higher interest rates and an eventual threat to this great stock market rally/bull market) isn’t likely to be dropping off its perch any time soon!

As I’ve headlined it, the good vibes continue and looking at my “What I liked” compared to “What I disliked” lists below, the very solid economic data helps to sustain this surging stocks story.

This from CommSec’s economists this week says it all: “The stimulus continues and further solid economic growth can be expected. Company revenues will continue to lift and so should profits, provided that firms have tight control of costs. Higher earnings are expected to translate to higher share prices.”

The last part of the online broker’s communique told us that “…CommSec has lifted its end-2021 target for the ASX200 to 7350 points.” That’s conservative, given we’re at 7295, but it was an upgrade on previous forecasts and I reckon this will need to be upgraded when we get to November.

With the Government’s Budget predicting economic growth of a huge 4.25% for the upcoming financial year, I think we’ll see the stock market lapping up better outlook statements from CEOs and rising dividends, thanks to the surprisingly good rebound of the overall economy.

The first real worry for stock markets (ignoring what the bully boys in Beijing might do) will be when the US central bank starts seriously talking about tapering bond purchases and considering higher interest rates. The Fed will be doing this out-loud consideration before Dr Phil Lowe and his RBA, who seem to be welded on to a 2024 date for the first rise (which I don’t believe). I expect an earlier U-turn on ‘low rates for longer’ but I do believe it will be beyond 2022, which has to be good for the good vibes for stocks.

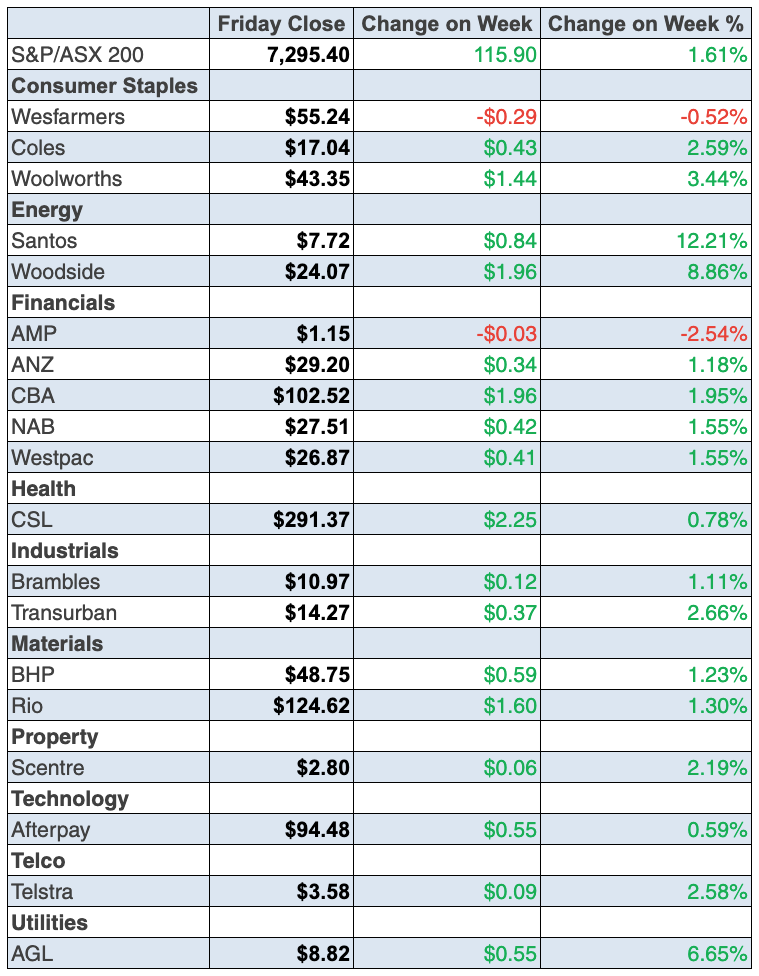

To the local story and the S&P/ASX 200 rose 1.6% or 115.9 points to finish at 7295.4, with the strong economic growth number for the March quarter making many think that a 7.2% annualised growth rate has to help profits and share prices going forward. Energy stocks did well with OPEC+ reporting strong demand for oil. Woodside was up 8.9% and Santos wacked on 12.2%.

AGL rose 6.7% on news that a demerger was on the agenda. And the miners had a good week, with BHP up 1.2% to $48.75, Rio up 1.3% to $124.62 and Fortescue rose 3.8% to $22.97.

And what about those banks! CBA put on 1.9% and is now $102.52. NAB put on 1.6% to $27.51, ANZ added 1.2% to $29.20, while Westpac was up 1.5% to $26.87.

But gold bugs had a tough week at the office, with the likes of Resolute Mining down 7.9% and Silver Lake Resources off 12.6%. Why did that happen? That’s one for our experts, so watch this space.

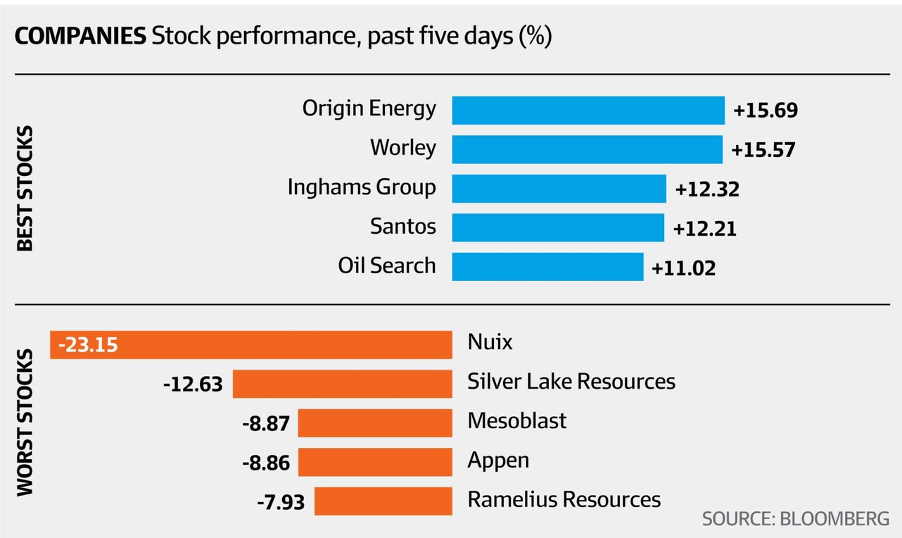

Here are the winners and losers (thanks to the AFR and Bloomberg) and tech stocks remain under pressure.

What I liked

- The Australian economy (as measured by gross domestic product or GDP) grew by 1.8% in the March quarter after rising 3.2% in the December quarter and lifting 3.5% in the September quarter. The economy now exceeds the pre-pandemic highs, up 1.1% on the year. It has been the fastest recovery from recession in 45 years.

- Total council approvals to build new houses rose by 3.4% to record highs.

- The value of new loan commitments for housing rose by 3.7% to a record high $31.06 billion in April. Owner-occupier loans were up 4.3% to an historic high $23 billion in March. And investor loans were up by 2.1% to a near 4-year high of $8.05 billion. Renovation loans soared 26.5% to 17-year highs of $403.1 million. The average mortgage hit a record high of $563,600.

- The CoreLogic national home value index rose by 2.2% in May to be up 10.6% on the year – the strongest annual growth rate in almost 11 years. Home prices hit record highs in 66 of the 88 surveyed regions across Australia in May. And prices rose in 81 of the 88 surveyed regions in the month.

- Retail trade rose by 1.1% in April, to be up 25% on a year ago.

- The trade surplus increased from $5.8 billion in March to $8 billion in April. Australia has posted 40 successive monthly trade surpluses. The value of rural exports climbed 3.8% in April to be up 11.9% on a year ago – the strongest annual growth rate in two years.

- The Australian Industry Group and Housing Industry Association Performance of Construction index (PCI) fell from 59.1 to 58.3 in May.

- The ‘final’ IHS Markit services purchasing managers’ index (PMI) fell from a record 58.8 to 58 in May. Readings over 50 denote an expansion in activity and the falls are from very high levels, which is why I like the result.

- The AiGroup Performance of Manufacturing index rose by 0.1 point in May to 61.8 points – the strongest level since March 2018.

- The ‘final’ IHS Markit Manufacturing Purchasing Managers index rose from 59.7 points in April to a record 60.4 points in May. Readings above 50 points indicate an expansion in activity.

- The current account surplus hit a record high of $18.3 billion in the March quarter. Company operating profits fell 0.3% in the quarter. Wages & salaries (includes changes in wages and employment) rose 2% in the quarter to be up 2.7% on the year.

- The ISM manufacturing purchasing managers index (PMI) in the US rose from 60.7 to 61.2 in May (survey: 60.9). The Markit PMI rose from 60.5 to a record high of 62.1 in May (survey: 61.5). Construction spending rose 0.2% in April (survey: 0.5%).

- The ‘final’ IHS Markit services index in the US lifted from 64.7 to 70.4 in May (survey: 70.1). The ISM services index rose from 62.7 to a record 64 in May (survey: 63.2).

- According to the latest US Beige Book, “the national economy expanded at a moderate pace from early April to late May, a somewhat faster rate than the prior reporting period. Manufacturers reported that widespread shortages of materials and labour along with delivery delays made it difficult to get products to customers.”

- The US-based IBD/TIPP economic optimism gauge rose from 54.4 to 56.4 in June.

- The IHS Markit final reading of euro zone factory activity rose to 63.1 in May, above an initial 62.8 “flash” estimate and the highest since the survey began in June 1997.

What I disliked

- The weekly ANZ-Roy Morgan consumer confidence rating fell by 2.5% to 111.4 (long-run average since 1990 is 112.6) and I’d link that to Victoria’s lockdown.

Shares -v- Property

CommSec’s Ryan Felsman has done the numbers on property versus shares and this is what he found: “Total returns on national dwellings rose by 14.3 per cent in the year to May, with houses up 16.3 per cent and units up by 8.8 per cent on a year earlier. In contrast, the S&P/ASX All Ordinaries Accumulation Index rose by 30 per cent over the year to May.”

And don’t forget to catch up on the big stories from the Switzer Report, which we’ve listed below. I especially liked Tony Featherstone’s take on five companies that Tony believes will permanently benefitted from the Coronavirus madness of 2020 when lockdowns and stay-at-home lifestyles dominated our lives.

The week in review:

- “Picking & sticking” is a good investment strategy, provided what you select is a quality company in an industry that has growth ahead. Here are 4 good companies that I’m sticking with: Qantas (QAN), Webjet (WEB), Corporate Travel Management (CTD) and Flight Centre (FLT).

- Paul Rickard looked at what you need to know about the demerger of Endeavour Group from Woolworths (WOW) and what actions you may need to take.

- James Dunn shared 5 stocks in the $5 range that look to offer good buying opportunities: CSR (CSR), Lynas Rare Earths (LYC), TPG Telecom (TPG), Bega Cheese (BGA) and Life 360 (360).

- Tony Featherstone put forward 5 stocks that will structurally benefit in the medium term from the effects of Covid-19 – and still offer value: Booktopia Group (BKG), Collins Food (CKF),com (KGN), Janison Education Group (JAN) and Doctor Care Anywhere Group Plc (DOC).

- For our “HOT” stocks of the week, Burman Invest’s Julia Lee selected GrainCorp (GNC) and Fairmont Equities’ Michael Gable chose Rio Tinto (RIO).

- Super Guardian’s Tim Miller wrote that, with certain rules applying, you can legitimately make extra contributions this year and take up the tax benefit but allocate this extra amount to your contributions cap for next year.

- There were 9 upgrades and 8 downgrades in the first Buy, Hold, Sell – What the Brokers Say of the week, and in the second edition there was 1 upgrade and 4 downgrades.

- In Questions of the Week, Paul Rickard answered your question about investing in US tech stocks, Magellan’s Global Equities Fund (MGF/MGOC), receiving dividends from US shares and a class action on A2 Milk (A2M).

- Catch up on the recording of yesterday’s webinar with special guest Charlie Aitken, where Charlie shared his top 8 Australian stocks: CSL (CSL), Woolworths (WOW), Wesfarmers (WES), Brambles (BXB), ASX (ASX), Sonic Healthcare (SHL), Cochlear (COH) and Computershare (CPU). We’ll be publishing a transcript next Monday so keep an eye out for the link in Monday’s Switzer Report newsletter.

Our videos of the week:

- What are the best stocks in Australia from Charlie Aitken’s point of view?

- ALU & APX really a buy? Should you buy Woolies ahead of the demerger with Dan Murphy’s? | Switzer Investing

- Are these ASX hot stocks a buy: AIS, ALC, MP1, AD8 + The CEO of Bendigo Bank, is this a buy too? | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday June 7 – ANZ job advertisements (May)

Monday June 7 – Credit & debit card lending (April)

Tuesday June 8 – Weekly consumer sentiment (June 6)

Tuesday June 8 – NAB business survey (May)

Wednesday June 9 – Weekly payroll jobs & wages (May 22)

Wednesday June 9 – Monthly consumer confidence (June)

Wednesday June 9 – Labour account (March)

Wednesday June 9 – Speech by Reserve Bank official

Thursday June 10 – Consumer inflation expectations (June)

Overseas

Monday June 7 – China international trade (May)

Monday June 7 – US Consumer credit (April)

Tuesday June 8 – US NFIB small business optimism index (May)

Tuesday June 8 – US JOLTs job openings (April)

Tuesday June 8 – US International trade balance (April)

Wednesday June 9 – China inflation (May)

Wednesday June 9 – US Wholesale inventories (May)

Thursday June 10 – US Consumer price index (May)

Thursday June 10 – US Weekly initial jobless claims (June 5)

Thursday June 10 – US Monthly budget statement (May)

Friday June 11 – US Consumer sentiment index (June)

June 9-15 – China credit growth data (May)

Food for thought:

“There are two ways to approach the market. You can guess which direction prices will go in next, or you can figure out what businesses and their securities are really worth.” – Kelly Evans

Stocks shorted:

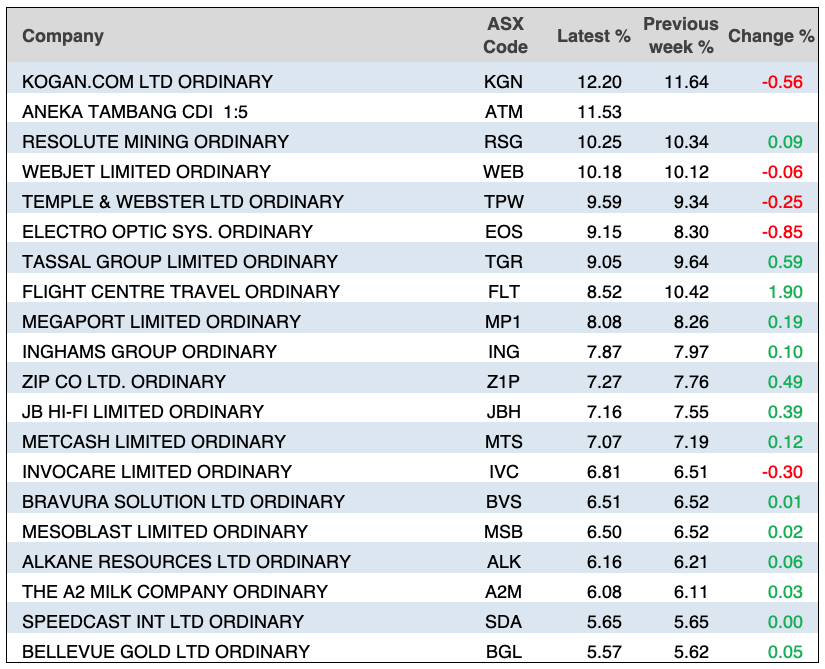

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

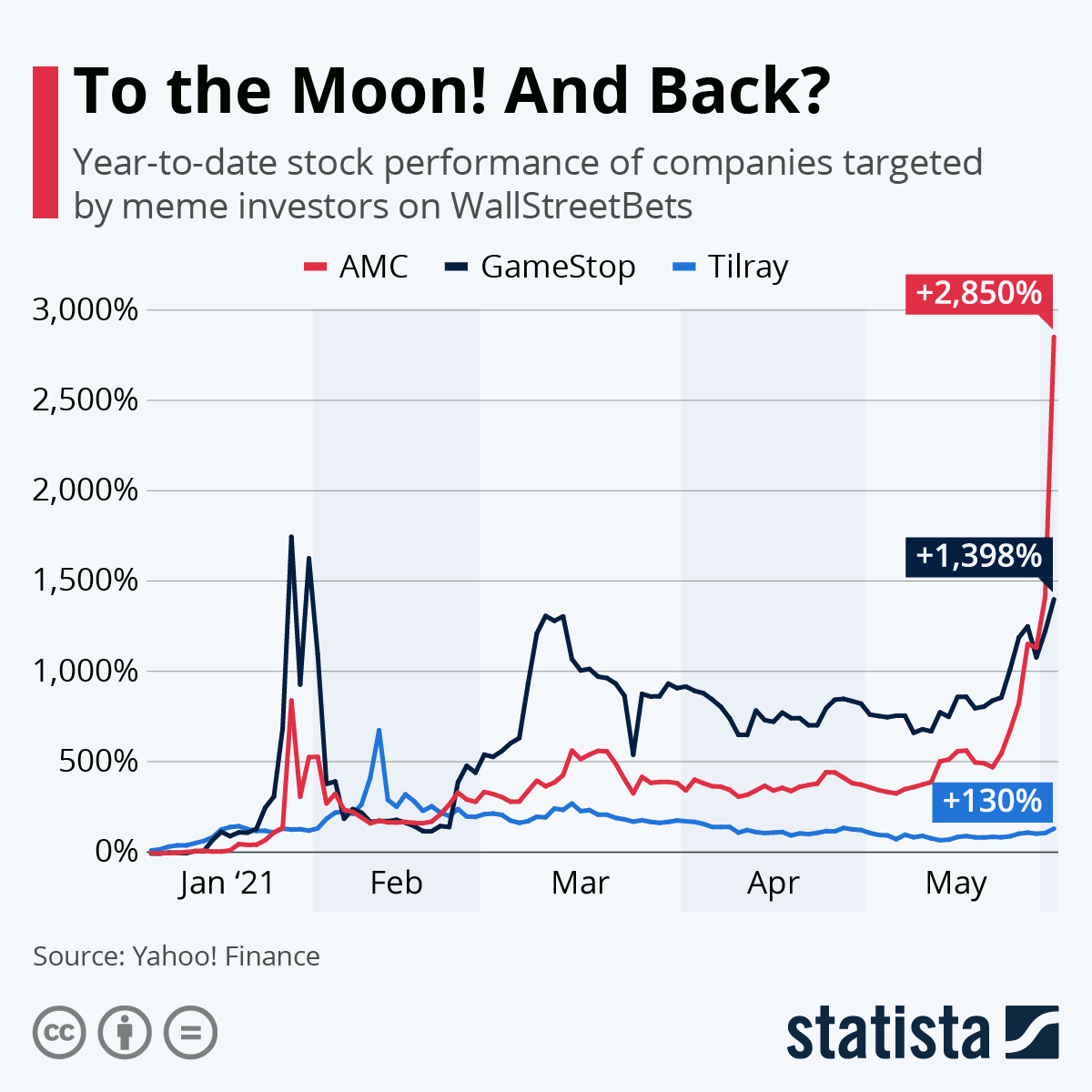

Chart of the week:

The following chart from Statista looks at the ups (and downs) of three key ‘meme stocks’ in the US: cinema chain AMC, video game retailer GameStop and Canadian cannabis company Tilray. As Statista’s Felix Richter noted, “What goes up, must eventually come down and for every lucky investor making a windfall on GameStop, AMC or Tilray, there’s going to be a few that got burned for being late to the party.”

Top 5 most clicked:

- 4 stocks I’m flying high with for the long haul – Peter Switzer

- Five $5 stocks – James Dunn

- Woolworths & Endeavour Drinks – what you need to know and do – Paul Rickard

- 5 small-caps to benefit from COVID-19 consumption trends – Tony Featherstone

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

Recent Switzer Reports:

- Monday 31 May: 4 stocks I’m flying high with for the long haul

- Thursday 3 June: 5 small-caps to benefit from COVID-19 consumption trends

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.