I know at times that I can be quite harsh on the influencers of Wall Street. Mostly it’s justified. But today let me do the opposite and take my hat off to their recognition that after a recession and market crash, the economy is the main game in town.

It shouldn’t be anything new because Bill Clinton made the importance of this big driver of sales, sentiment and stock prices, when he said: “It’s the economy, stupid.”

CNBC explains the positive trading day this way: “…amid growing optimism over the US economic recovery.”

After reading that, I couldn’t help but think: “Well, der!”

The recovery is a given. Wall Street has allowed itself to worry about how much inflation it could create, how much bond yields could rise and so on. But the real question I’ll keep asking (and answering) that will be vital for being long stocks or not, or being pro-growth or defensive stocks, won’t be when interest rates could rise but how many rises there could be.

I think rates will rise before Dr Phil Lowe’s 2024 line in the sand. That will spook Wall Street momentarily. However the economic boom that will cause rate rises via inflation will, for a time, spook stock markets, but then those companies making big profits out of the GDP growth will remain attractive, until further interest rate rises kill the bull market.

Clearly, if I’m right, we have time on our side to play stocks and build wealth.

And there are also powerful innovations that are now driving and will continue to drive stock prices higher, such as Ford this week, which went up 12% on the unveiling of its new electric car plan.

Macroeconomic-wise, an important economic reading added to optimism, with the Core Personal Consumption Expenditure Index rising 3.1% over April. This beat expectations of a 2.9% rise. And actual consumer spending rose 0.5%.

Also pumping up positive economic excitations was the upcoming US infrastructure package. This is in play in Congress as the Republicans put forward a $928 billion plan. But that’s a long way short of President Joe Biden’s $1.7 trillion proposal. Anything in the middle will be seen as another fillip for stocks.

Over the week, fears about inflation being too big and not temporary eased in the US, after Fed comments were seen as credible. This helped stock prices remain positive.

At home, the lockdown news in Victoria will hurt small business owners in particular and those workers who’ll lose pay in a non-JobKeeper world. However, the economic effect of seven days of business closures was put at $1 billion, but in a $1.4 trillion economy, the real effect is small. Meantime, the economic news I really liked was the big jump in business investment. I made a point about business investment after the Budget’s release and the lowish growth forecasts for 2022/23 at 2.5%, after a 4.25% figure for 2021/22. Business investment will be crucial for proving that the Treasurer’s growth forecasts (beyond the upcoming financial year) are too conservative. If I’m right, it’s another plus for investors in stocks.

Also construction data out this week was hugely positive for the sector, the economy and stocks again. But don’t just take my word on the subject, here’s CommSec economist Ryan Felsman’s take on the numbers: “The lift in expected business spending is important for companies in mining services, construction, transport and other industrial sectors.

“Shares of building materials companies and property developers continue to perform well due to strong building and renovation activity, boosting earnings growth. At the timing of writing, the S&P/ASX200 materials index is up 7 per cent year-to-date. The index is 70.6 per cent higher since the March 23, 2020 pandemic low with Boral (up 277.7 per cent) among the strongest performers in the sector.”

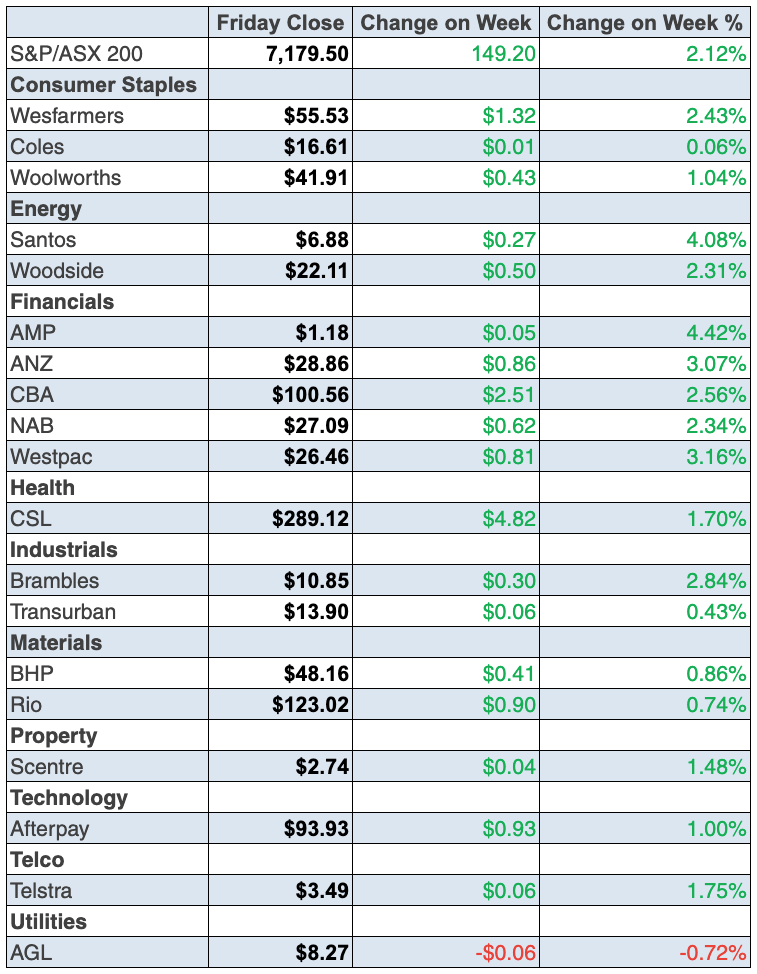

To the local stocks story this week and the S&P/ASX 200 index ended up 2.12% to finish at a new high of 7179.5. And CBA joined the ‘record high club’ closing out at $100.56. And the story might have been more positive if poor old Victoria wasn’t forced into lockdown, again!

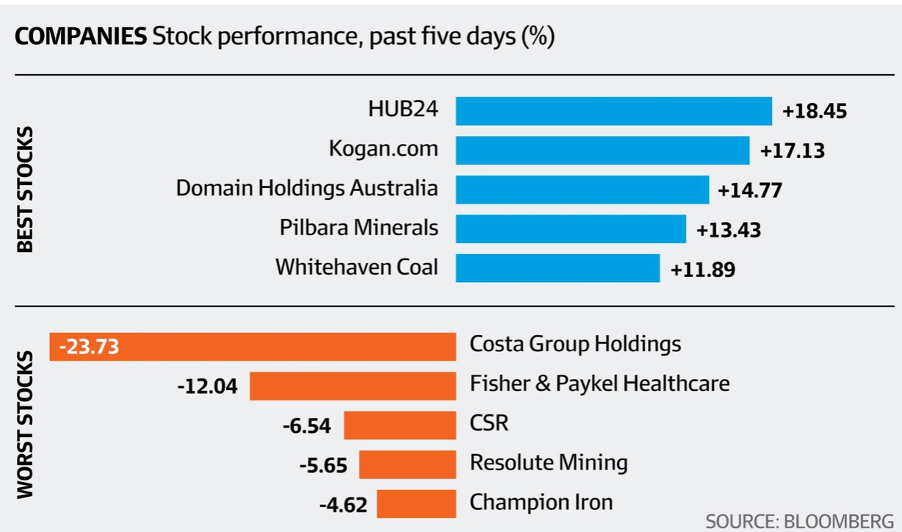

Happily, there is a broad-based rally going on and it makes sense, given the great economic readings here and in the likes of the US and UK. Here are the winners and losers of the week.

The AFR’s William McInnes pinpointed to some good performers with the following: “Discretionary retail stocks were among the best performers this week. Kogan.com climbed 17.1 per cent to $10.19, Carsales.com advanced 10.4 per cent to $19.46, Collins Foods firmed 9.5 per cent to $12.49, ARB Corp rose 9.1 per cent to $42.06 and Ingham’s closed 8.6 per cent higher at $3.41.”

Miners have been strong despite China’s efforts to suppress the iron ore price. And it’s the copper price that reminds us that we have a real, global economic boom on the way. Dr Copper’s price jumped 2.4% to $US10,212.2 a tonne, which is a great omen for the world’s economic activity ahead.

Here are the big risers in mining on Friday:

- BHP up 2.9% to $48.16.

- Rio up 2.6% to $123.02.

- Mineral Resources up 4.3% to $45.90.

- South32 up 5.6% to $3.

- IGO up 4.3% to $7.61.

- OZ Minerals up 4.7% to $25.42.

AMP has shot up 11.3% since Thursday on rumours Macquarie is looking to take over the troubled insurer and wealth business. It finished the week at $1.18. Desperate AMP shareholders praying on a Macquarie offer, I wouldn’t expect too much. The Ares offer for AMP, which fell through, was pitched at $1.85.

What I liked

- New business investment (spending on buildings and equipment) rose by 6.3% in the March quarter – the biggest quarterly lift in spending in almost nine years. The second estimate of expected investment in 2021/22 was 14.9% higher than the equivalent estimate for 2020/21 – the biggest annual gain in nine years.

- Construction work done rose by 2.4% in the March quarter – the most in 3½ years. Home building rose by 5.1% in the quarter – the biggest lift in 6 years – with alterations and additions (renovations) up by 10.8% to record highs.

- The weekly ANZ-Roy Morgan consumer confidence rating rose by 1.5% to a 19-month high of 114.2 (long-run average since 1990 is 112.6).

- The US economy (as measured by GDP) rose at a 6.4% annual pace in the March quarter (survey: 6.5%).

- Initial jobless claims (i.e. claims for unemployment benefits) fell from 444,000 to a 14-month low of 406,000 last week (survey: 425,000).

- In response to the upgrade in production targets by Airbus, shares in Boeing rose by 3.9%, with shares in General Electric up by 7.1%. These are good omen stock price rises for the US and global economic recovery.

- The S&P/Case-Shiller 20-city home price index rose by 1.6% in March (survey: 1.3%). The FHFA house price index lifted 1.4% in March (survey: 1%).

What I didn’t like

- Poor old Victoria’s latest lockdown!

- Durable goods orders in the US fell by 1.3% in April (survey: 0.8%) but this is small beer.

- The Conference Board consumer confidence index eased from 117.5 to 117.2 in May (survey: 118.8) but really this is me trying to be objective. This is a small drop from very high levels.

My lack of dislikes

The set up for stocks remains positive as my likes versus dislikes above indicates. The job ahead is to pick quality businesses that might be excessively beaten up. They are there and we’ve tried to pick those this week in this Report, so check out these stories below and have a great weekend.

The week in review:

- Over the next few months and maybe years, I will increase my exposure to foreign stocks. Here’s what I’ll be doing to diversify my foreign holdings of companies of the future and best-of-breed in the tech space, including: Zoom Video (NASDAQ:ZM), Tesla (NASDAQ:TSLA), ETFS FANG+ (FANG) and the ARK Innovation ETF (NYSE:ARKK).

- Paul Rickard wrote this week that LICs are down but not dead, and suggested 4 LICs from different sectors to consider buying, and 2 to consider selling.

- James Dunn looked at three of the ASX’s best small-cap and micro-cap stocks that are outstanding global leaders in their respective fields: VEEM (VEE), Audinate Group (AD8) and Atomos (AMS).

- Tony Featherstone put forward 4 ways stock market investors can benefit from the property boom.

- For our “HOT” stocks of the week, Morgans’ Raymond Chan selected Sydney Airport (SYD) and Fairmont Equities’ Michael Gable chose James Hardie (JHX).

- There were 11 upgrades and 9 downgrades in the first Buy, Hold, Sell – What the Brokers Say this week, and in the second edition there were 4 upgrades and 2 downgrades.

- In Questions of the Week, Paul Rickard answered your question about buying Woolworths (WOW) to get access to the Endeavour Drinks demerger, buying the BetaShares Australian Dividend Harvester (HVST) for higher income, Crown Notes (CWNHB) and Monadelphous (MND).

- Watch the recording of this week’s Boom! Doom! Zoom! session where we discuss Commonwealth Bank (CBA), Appen (APX), Altium (ALU), telco stocks and more

Our videos of the week:

- Boom! Doom! Zoom! | May 27, 2021

- ASX Stocks the experts like: Z1P, ALU, CSL, GNC & is EML a buy after the sell-off? | Switzer Investing

- Charlie Aitken names his best OS and OZ stocks: MSFT, MC, GOOGL, CSL & more | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday May 31 – Private sector credit (April)

Monday May 31 – Melbourne Institute inflation gauge (May)

Tuesday June 1 – Purchasing manager surveys (May)

Tuesday June 1 – Reserve Bank Board meeting

Tuesday June 1 – CoreLogic Home value index (May)

Tuesday June 1 – Building approvals (April)

Tuesday June 1 – Business indicators (March quarter)

Tuesday June 1 – Balance of payments (March quarter)

Wednesday June 2 – National accounts (March quarter)

Thursday June 3 – International trade (April)

Thursday June 3 – Retail trade (April)

Friday June 4 – Lending activity (April)

Overseas

Monday May 31 – China official purchasing manager surveys

Tuesday June 1 – US Purchasing manager surveys (May)

Tuesday June 1 – US Construction spending (May)

Tuesday June 1 – China Caixin purchasing managers (May)

Wednesday June 2 – US Federal Reserve Beige Book

Thursday June 3 – China Caixin purchasing managers (May)

Thursday June 3 – US Purchasing manager surveys (May)

Thursday June 3 – US ADP employment report (May)

Thursday June 3 – US Challenger job cuts (May)

Friday June 4 – US Non-farm payrolls (May)

Friday June 4 – US Factory orders (April)

Food for thought:

“The stock market is the story of cycles and of the human behaviour that is responsible for overreactions in both directions.”– Seth Klarman

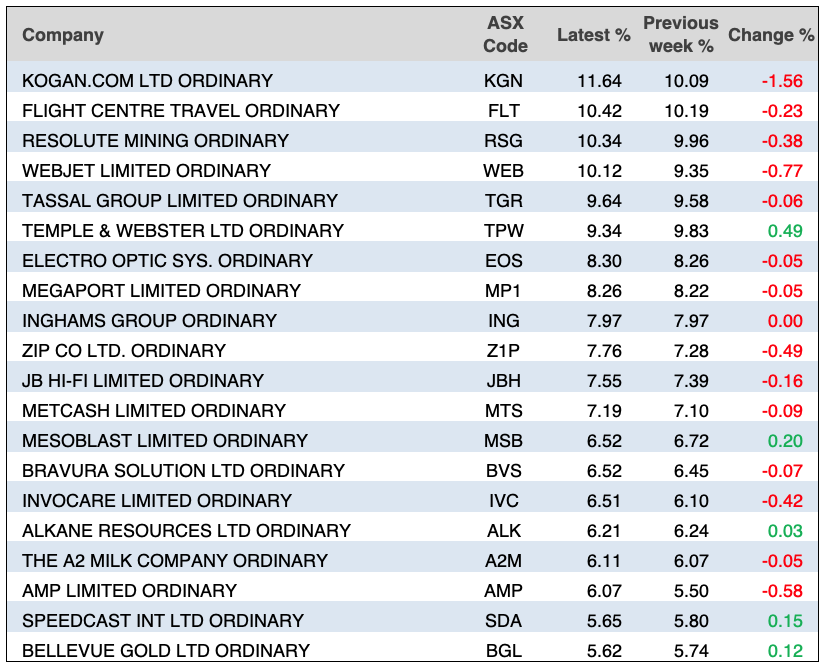

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

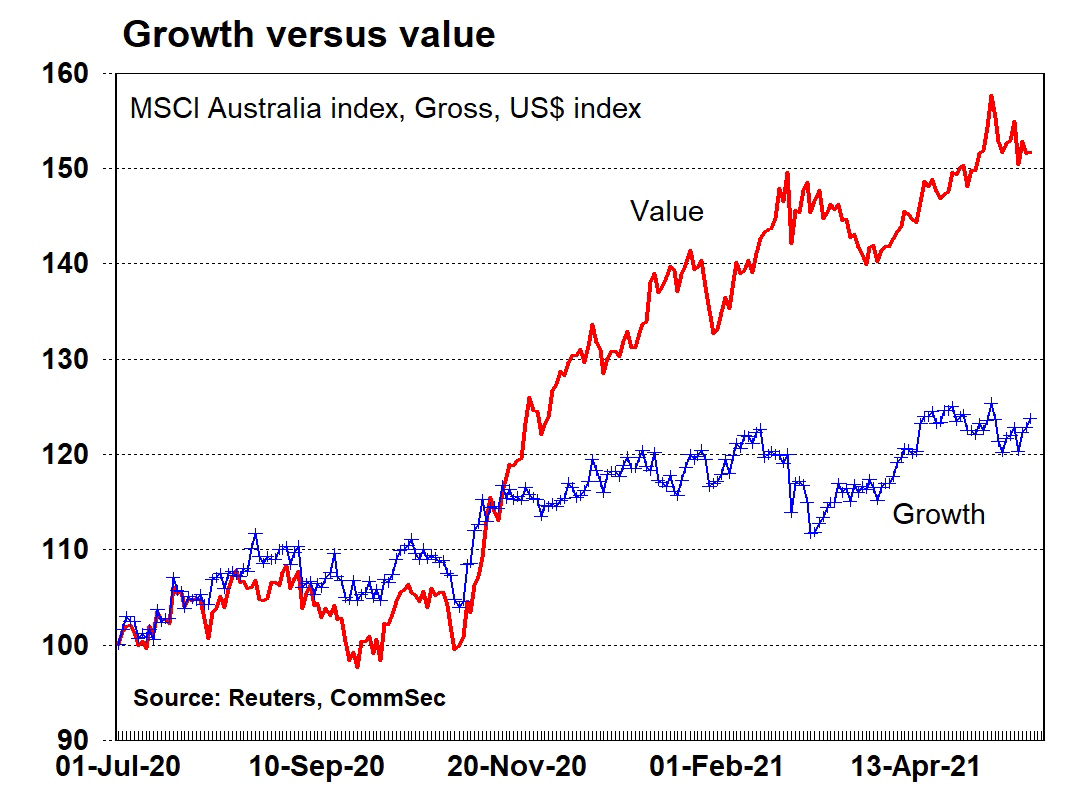

Chart of the week:

CommSec’s Craig James shared the following chart this week that shows the performance of growth versus value stocks since the middle of 2020:

Top 5 most clicked:

- EXPOSED! Here’s the way I’m buying best-of-breed overseas tech stocks – Peter Switzer

- 4 LICs to buy and 2 to sell – Paul Rickard

- 3 small cap shining stars to check out – James Dunn

- 4 stock plays to benefit from the property boom – Tony Featherstone

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

Recent Switzer Reports:

- Monday 24 May: Exposed! My international favourite tech plays

- Thursday 27 May: 4 stock plays to benefit from this property boom

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.