Wacky Wall Street continues to hate and then love tech stocks! And the enfant terrible, which seems to be influencing the overall direction of the hot growth stocks of 2020, is bitcoin!

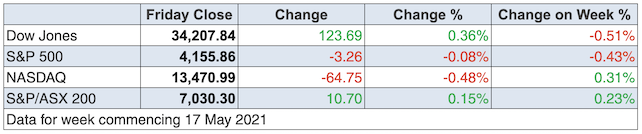

The Dow Jones was up for the second day in a row but was off about half-a-percent for the week. Tech stocks were down overnight but over the week the Nasdaq snuck into positive territory. Bitcoin’s problems remain, with China’s Vice Premier Liu He telling the world that the key cryptocurrency needs to be regulated to protect the financial system. He also pointed to the environmental implications of the mining of bitcoin and its actual trading behaviour.

To understand stocks over the course of the week in the US and here, it has been a game of ping pong with value/reopening trade stocks rising one day as tech gets dumped, to all of a sudden tech being back in and popular again.

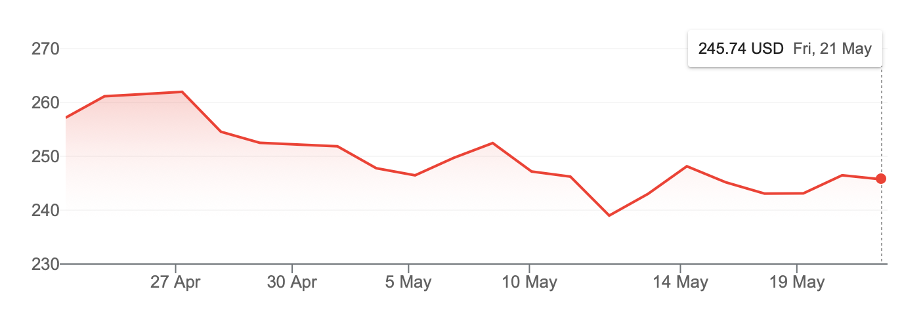

This chart of Microsoft sums up the market recently.

Microsoft (MFST)

Notice the up and down or ping pong like moves of the market, but, like all tech stocks, MFST is losing because of the rotation out of the winner tech plays of 2020.

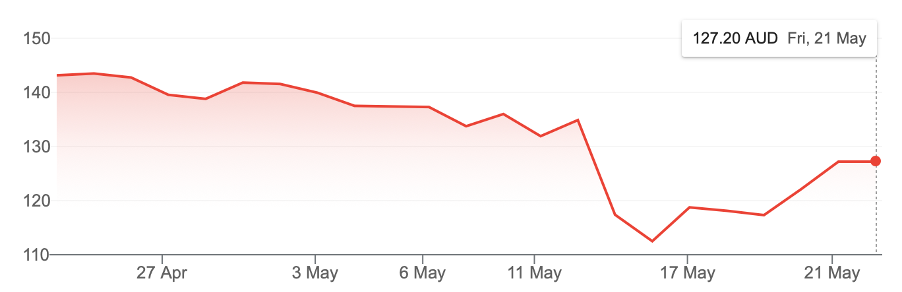

Take a look at our local quality tech company, Xero. The pattern isn’t exactly the same but there’s the up and down on a losing trend.

Xero (XRO)

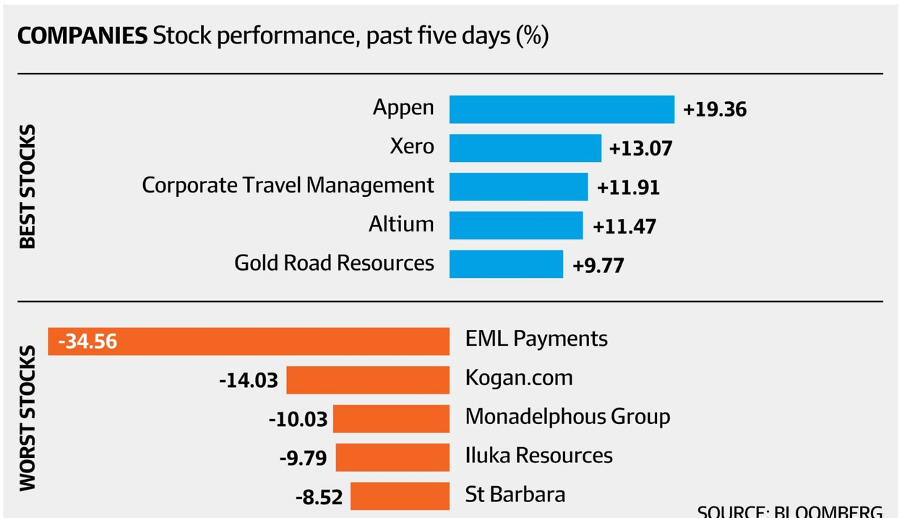

For this week, growth was back and the Xero chart above shows it, with the rise between May 17 and 21. The Bloomberg chart below showing the winners makes my point emphatically about tech’s good week.

A big market issue for the week was the interest in the Fed and others talking about (or maybe just thinking about) the central bank tapering its buying of assets to give the US economy money. The question that is a new one that will have a stock market effect is: could quantitative easing be eased up?

By the way, the fact that the market didn’t get spooked on a potentially less helpful Fed was a plus for stocks, meaning the majority doesn’t think big changes for monetary stimulus will alter any time soon.

This from the Fed minutes is worth a read: “A number of participants suggested that if the economy continued to make rapid progress toward the (policy-setting) Committee’s goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases”.

The other ping pong game going on that could determine the overall direction of the stock market is the bear-v-bulls case. The bears think we’re close to the top and this tapering talk makes them feel comfortable on their position.

The bulls believe the Fed can withdraw stimulus sensibly and slowly with rate rises over time (maybe in 2022) and it won’t spook stock players because the growth story will be so good that the higher interest rates will be manageable.

That puts a lot of pressure on the Fed and other central banks to play a very smart game. Also, this US economic reading that “the prices paid for materials lifted 8.8 points to 83.5 – the highest level since records began in 2001” is worrying those who don’t want early interest rate rises.

And if you’re concerned about this, remember that we will see a spike in inflation, which economists think will be temporary as businesses get back to normal, and price cuts that kept some businesses alive during the pandemic will be able to resume normal pricing. Need an example? Try CBD office rents and airline tickets!

Meanwhile at home, our Reserve Bank policymakers have less ‘interest rates must soon rise’ concerns, as the following from the Board’s minutes shows:

“Future policy decisions would be based on close attention to the flow of economic data and conditions in financial markets in Australia. Members agreed that a return to full employment is a high priority for monetary policy and would assist with achieving the inflation target.”

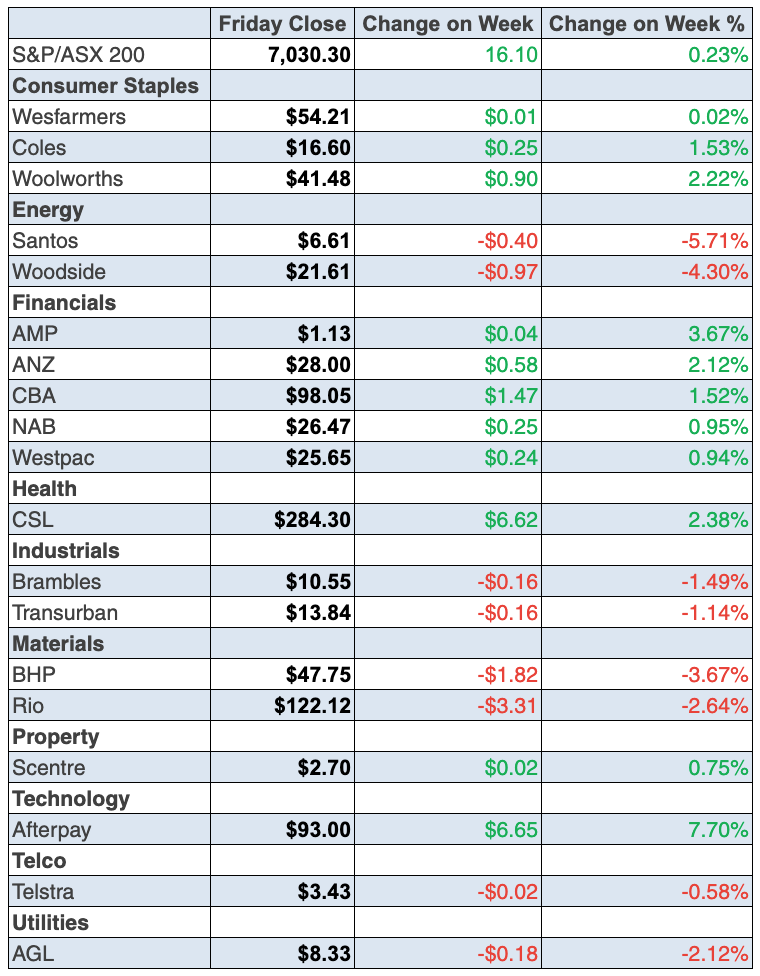

To the local story this week and the S&P/ASX 200 rose 16 points (or 0.2%) to finish at 7030 despite the 1.9 slump on Wednesday. Helping the comeback was the strength of the banks. They had a good week, again, with ANZ surging 2.1% to $28, CBA up 1.5% to $98.05, Westpac rising 0.9% to $25.65 and NAB up 1% to $25.65.

And it was good to see a stock we’ve argued was over-smashed i.e. Appen be a star performer after its management team came up with restructuring plans that will cut costs until we see the expected rebound in its business in the US.

Others that I’ve seen a future in but have copped it from the market recently, namely Xero, Altium, and Megaport (up 6.4%), have all found new supporters.

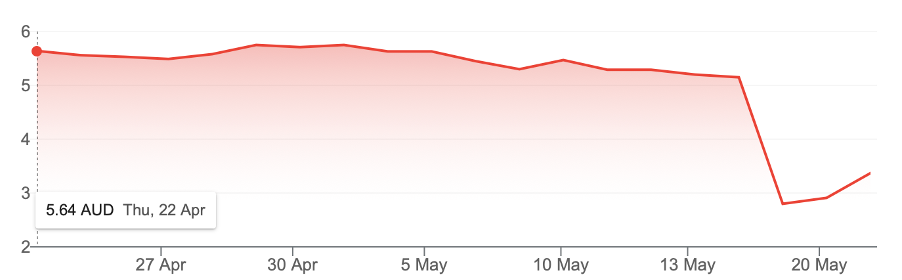

The Bloomberg scoreboard neatly sums it up but regrettably one of my ZEET stable — EML — copped a ‘ello, ‘ello, what’s going on ‘ere question from the Central Bank of Ireland about a recent UK acquisition, which slugged the company’s share price. The stock dropped 46% to $2.35 after the Central Bank of Ireland raised “significant regulatory concerns” about anti-money laundering compliance in EML’s Irish-based subsidiary, acquired in late 2019.

EML Payments

This was bad news but the bounce-back this week might suggest that the market reaction was over-the-top. Over the five days this week, EML is actually up 19.5% after a horror fall of 45% on the bad news. I hope that’s a good omen.

Gold stocks had a good week, with Perseus Mining up 8.9% and my favourite, Northern Star, up 6.7%.

The iron ore miners slipped on news that China is to ramp up local sourcing of iron ore, which looks more political rather than economic! BHP lost 3.7% to $47.75 and Fortescue gave up 2.2% to $22.30.

Energy was also under a bit of pressure, with Woodside off 4.3% to $21.61 and Santos copping it, losing 5.7% to $6.61.

What I liked

- The weekly ANZ-Roy Morgan consumer confidence rating rose by 0.8% to 112.5 (long-run average since 1990 is 112.6). Last week the measure of whether it was a ‘good time to buy a major household item’ jumped by 6.2% to a 15-month high of 22.5 points.

- ‘Preliminary’ retail trade rose by 1.1% in April to stand 25.1% higher than a year ago.

- Employment fell by 30,600 in April after rising by 77,000 in March. While jobs fell by 30,600 in April, full-time jobs rose by 33,800 with part-time jobs down by 64,400.

- The unemployment rate fell from 5.6% to 5.5%.

- The ‘unemployment expectations’ index fell (improved) by 15.3% to a 10-year low of 100.2.

- The National Skills Commission reported that skilled internet vacancies rose by 3.3% (or 7,800 job advertisements) in April to a 12½-year high of 243,500 available positions. Vacancies are 245.8% higher than a year ago and 44.8% above pre-Covid-19 levels.

- The IHS Markit Flash Manufacturing Purchasing Managers’ Index in the US jumped to an all-time high of 61.5 in May from 60.5 in April. Economists polled by Dow Jones had expected the index to hold steady.

- The UK jobless rate fell from 4.9% to 4.8% in the March quarter.

- US initial jobless claims fell by 34,000 to a 14-month low of 444,000 in the past week (survey: 450,000).

What I didn’t like

- The Westpac-Melbourne Institute Index of Consumer Sentiment fell 4.8% in May to 113.1 but it’s still the second highest reading since April 2010.

- US housing starts fell by 9.5% in April to an annual rate of 1.569 million units (survey: -2.1%) after rising 19.8% in the previous month.

- Chinese data was slightly less than expected. Retail sales expanded at a 17.7% annual rate in April (consensus: 25%). Industrial production rose at a 9.8% annual rate (consensus: 10%). Fixed-asset investment expanded by 19.9% in the first four months of 2021 from the same period ayear earlier (consensus: 20%).

- The Philadelphia Fed manufacturing index fell from a 48-year high of 50.2 to 31.5 in May (survey: 41.5).

What I liked about what I didn’t like!

A lot of the negative stuff in my “What I didn’t like” is coming off very high levels, so the readings are still good. I like the fact that as economies become more normal we get more normal economic data, which makes it more reliable for predicting trends. Sure, I got the market and economy trends right back in the crazy days of April last year after the market bottomed and huge stimulus came, but I prefer to make calls in more normal economic settings.

P.S. Below we remind you about our great stories for the week and I must admit that I forgot to check out my AAA stocks story that pre-empted a better week for Appen, Altium and A2Milk. It’s nice to get it right sooner than you expected! Let’s hope it’s the start of an upward trend.

The week in review:

- Forget our credit rating, the AAA issue I care about is when my three holdings – Appen (APX), Altium (ALU) and A2 Milk (A2M) – will start justifying my confidence in these stocks. All three companies have broader headwinds that are hitting their share prices. Should you buy more? Here’s my take on these quality companies.

- If you don’t own Xero (XRO), you should be looking at it for your core portfolio. If you aren’t ready to buy, then put it on your watch list. Here’s why Paul Rickard is backing Xero.

- Here’s a snapshot of 3 large-caps and 3 small-caps that have takeover potential from Tony Featherstone, including: Treasury Wine Estates (TWE), A2 Milk (A2M), Challenger (CGF), Lark Distilling (LRK), Life360 (360) and Monash IVF (MVF).

- There are some interesting listed royalty players on the ASX but for quality and reliability, James Dunn says it’s Deterra Royalties (DRR) and then daylight.

- For our “HOT” stocks of the week, Burman Invest’s Julia Lee chose Computershare (CPU) and Morgans’ Raymond Chan selected Sonic Healthcare (SHL).

- In our Chart of the Week, Fairmont Equities’ Michael Gable highlighted Evolution Mining (EVN).

- There were 10 upgrades and 8 downgrades in the first Buy, Hold, Sell – What the Brokers Say this week, and 10 upgrades and 4 downgrades in the second edition.

- In Questions of the Week, Paul Rickard answered your question about Appen, the best bank to buy, ETFs domiciled overseas and Pendal’s share purchase plan.

- Watch the recording of this week’s Boom! Doom! Zoom! session to hear our thoughts on EML Payments (EML), Appen (APX), travel stocks, gold prices and more.

Our videos of the week:

- Boom! Doom! Zoom! | May 20, 2021

- Altium (ALU), Appen (APX), A2Milk (A2M), are the AAA stocks worth buying? | Switzer Investing

- Are these ASX stocks a buy: NXL, AVH, TWE, MP1, ALL, XRO + how to borrow to buy stocks? | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday May 25 – ANZ-Roy Morgan consumer sentiment (May 23)

Tuesday May 25 – Preliminary international trade in goods (April)

Tuesday May 25 – Weekly payroll jobs & wages (May 8)

Tuesday May 25 – Discussion paper on inflation

Wednesday May 26 – Construction work done (March quarter)

Thursday May 27 – Labour force (April, detailed)

Thursday May 27 – Business investment (March quarter)

Thursday May 27 – Business conditions and sentiments (May)

Overseas

Monday May 24 – US National activity index (April)

Tuesday May 25 – US Home prices (March)

Tuesday May 25 – US Consumer confidence (May)

Tuesday May 25 – US New home sales (April)

Tuesday May 25 – US Richmond Fed manufacturing (May)

Thursday May 27 – US Durable goods orders (April)

Thursday May 27 – US Economic growth or GDP (March quarter)

Thursday May 27 – US Pending home sales (April)

Thursday May 27 – US Kansas City Fed factory index (May)

Thursday May 27 – China Industrial profits (April)

Friday May 28 – US Personal income/spending (April)

Friday May 28 – US Goods trade balance (April)

Friday May 28 – US Chicago purchasing managers index

Food for thought:

“The market does not beat them. They beat themselves, because though they have brains they cannot sit tight.” – Jesse Livermore

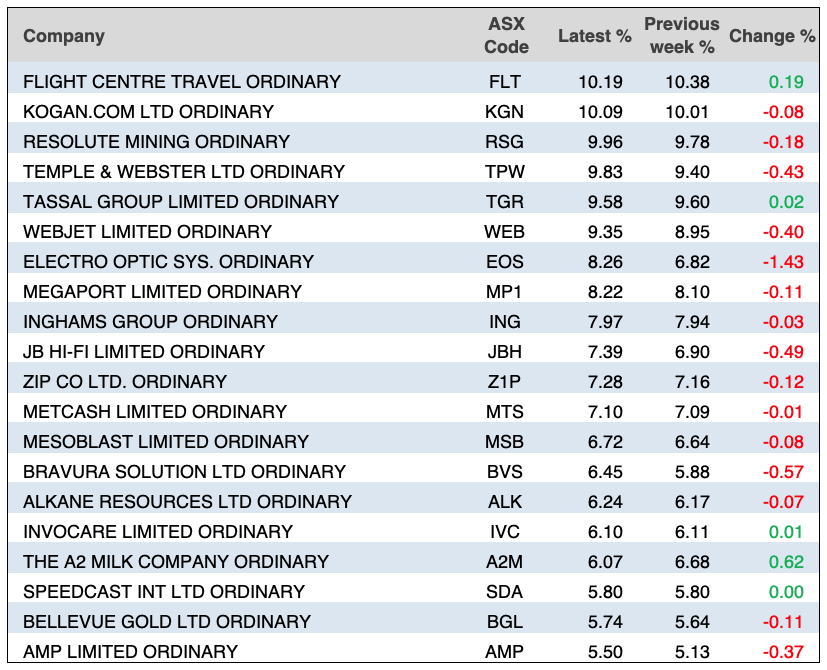

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

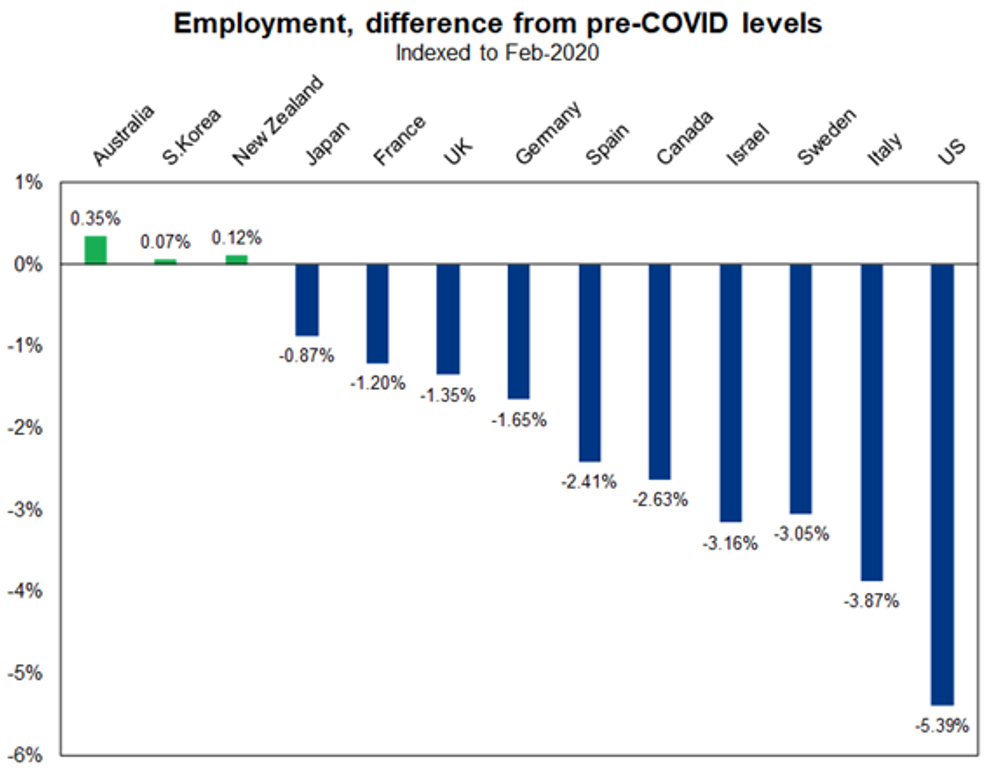

AMP Capital’s Shane Oliver shared the following table this week that shows how Australia’s labour market has recovered in comparison to other similar countries:

Top 5 most clicked:

- Should you buy more of Appen, Altium and A2 Milk? – Peter Switzer

- 6 potential takeover targets – Tony Featherstone

- Why Xero should be a core stock in your portfolio – Paul Rickard

- Questions of the Week – Paul Rickard

- Why this listed royalty company is better than mining stocks – James Dunn

Recent Switzer Reports:

- Monday 17 May: Should you buy more Appen, Altium & A2 Milk?

- Thursday 20 May: 6 potential takeover targets

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.