An older colleague and his wife are selling their family home. They don’t want to leave the neighbourhood, but booming property prices have incentivised them to sell.

Like many “empty nesters”, they are downsizing to smaller accommodation. In their case, from a four-bedroom home to a two-bedroom villa in a retirement village.

The sale will free up funds to bolster their retirement savings. The villa is low maintenance and allows them to live independently; support services are there if needed. When the time comes and assisted care is required, they will move into the aged-care centre next door.

Downsizers are often forgotten in property booms, even though this trend creates opportunities for a range of companies that provide retirement accommodation for older people. Property commentary usually focusses on buyers rather than sellers.

Downsizing is complicated. Understandably, many retirees want to stay put as long as possible because they are part of a community and cherish memories from their home. Others don’t want to sell because the income from that capital could affect pension eligibility.

Also, I suspect baby boomers will be more reluctant than the previous generation to move to retirement villas and aged-care centres. Having put their parents in aged-care facilities, and watched horror stories emerge from the sector, they will resist aged care as long as possible.

Launched in 2019, the Federal Government’s downsizer scheme hasn’t taken off as expected, even though it allows retirees to put proceeds from their property sale into superannuation. In this week’s Federal Budget, the government sensibly lowered the access age for the downsizing scheme from 65 to 60 – a change that will enable more people to sell and divert up to $600,000 (for couples) into their superannuation.

The magnitude of this property boom will also encourage more retirees to sell their property and downsize. For sellers, the next 18 months are probably as good as it gets for a while.

Moreover, COVID-19 has enhanced demand for family homes in middle-ring suburbs in capital cities. More people will want larger homes if they work a few days a week from there, and the pandemic will see some activity move out of CBDs to the suburbs.

At the same time, low returns on cash and fixed interest are hurting retiree incomes. Downsizing is often about freeing up capital from house-price gains to supplement incomes. For retirees who own a family home in Sydney or Melbourne, a year’s worth of capital gains (based on recent price growth) could provide at least a few years of income in retirement.

To be clear, I’m not suggesting a boom in downsizing is imminent. Far from it. Rather, slightly faster growth in downsizing as the property boom encourages selling and regulatory change makes it easier for younger retirees to downsize.

Even that growth would be enough to boost retirement-accommodation providers such as Lifestyle Communities (LIC) and Ingenia Communities Group (INA). Or New Zealand companies Ryman Healthcare (listed on the NZX) and Summerset Group Holdings (dual listed on ASX, SNZ).

There’s a theory that rising property prices also boost aged-care providers, such as Japara Healthcare (JHC), Regis Healthcare (REG) and Estia Healthcare (EHE). That’s because higher house-sale prices make it easier for families to afford the Refundable Accommodation Deposit (RAD) for an elderly parent to get a room in an aged-care centre.

Aged care is always complex, and especially so when it is undergoing a period of regulatory reform. For now, I prefer the retirement-accommodation providers. Here are two to watch:

1. Lifestyle Communities (LIC)

I like Lifestyle Communities on a few fronts. First, the stock is barely covered by stockbroking analysts, even though its market capitalisation is $1.4 billion. When only a few brokers cover a small-cap stock, the potential for mispricing and opportunity increases.

Second, Lifestyle Communities has a lower-risk business model. The company builds, owns and operates affordable land-lease communities for older Australians. The focus is entirely on building communities and selling homes in Melbourne and Geelong’s growth corridors.

It’s a boring, although highly effective, “cookie-cutter” strategy. Many great entrepreneurs over the years have built their fortune by replicating a strategy over and over in low-risk markets. Unlike some small-caps, Lifestyle is not rapidly expanding overseas or taking big bets on growth. It has a consistent management team with a consistent strategy in one market.

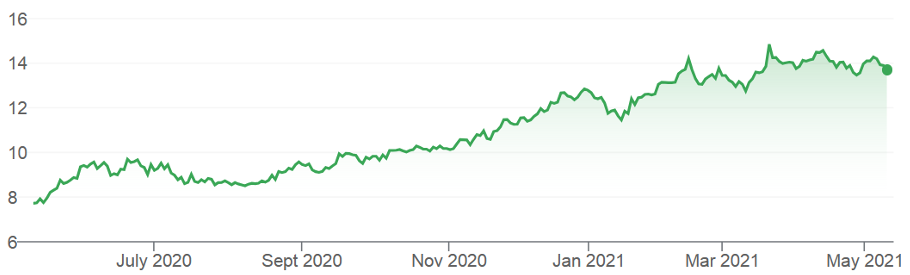

Prospective investors could be turned off by Lifestyle’s recent share-price gains. The one-year total shareholder return (including dividends) is 47%. Over three years, the annualised return is almost 38%, making Lifestyle one of this market’s unheralded, great small-cap stocks.

Lifestyle looks expensive on a trailing Price Earnings (PE) multiple of 37 times (the PE is arguably inflated because of the way it treats some costs). And the PE will come down as Lifestyle’s future earnings grow steadily.

Lifestyle’s best trait is its growing annuity income from new-home settlements, rental increases and re-sales of existing homes. It benefits as retirees in its communities downsize and move into aged care. Lifestyle had 2,625 homes under management at the end of the first half of FY21.

After strong gains this year, I expect a period of consolidation or a share-price pullback for Lifestyle. More likely is the stock tracking sideways for a while as the market digests recent gains. It needs to hold price support around $13 (the latest price was $13.75).

Any price weakness would be a buying opportunity for one of the market’s best-run small-caps, which is superbly leveraged to downsizing trends.

Chart 1: Lifestyle Communities (LIC)

2. Ingenia Communities Group (INA)

Formerly known as ING Real Estate Community Living, Ingenia owns, manages and develops retirement and holiday communities across Australia.

The company’s $1.3-billion property portfolio includes 42 lifestyle and holiday communities and 26 Ingenia Garden Communities. Most of its communities are in New South Wales and Ingenia has an expanding presence in South East Queensland.

Ingenia has a different risk profile to Lifestyle Communities. It owns a number of holidays parks that have budget cabins and camping sites that appeal to families. The company should recover strongly after COVID-19 as demand for driving holidays increases.

Ingenia says there has been strong growth in sales enquires and settlements for its coastal residential properties, underpinned by an ageing demographic and “sea and tree” changes from capital-city residents. COVID-19 has increased the focus on a sense of community, it says.

Moreover, Ingenia says older Australians are taking advantage of current housing-market strength to escape city living and move to connected communities. Self-funded retirees who downsize have greater capacity to pay, thanks to rising house prices in capital cities.

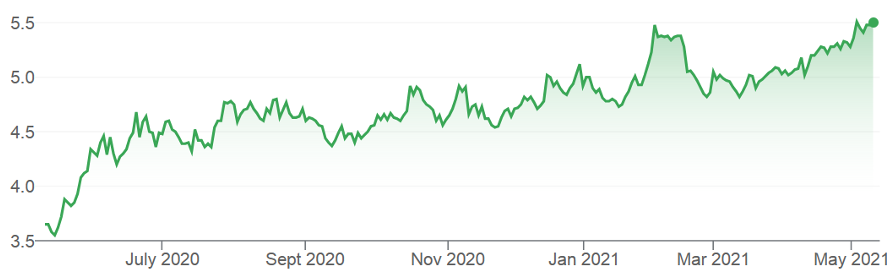

Ingenia has returned 28% over one year and is on a trailing PE of about 22 times. COVID-19 last year affected Ingenia’s sales volumes and its exposure to the tourism sector and State border-closure risks were headwinds. But the core business is performing solidly.

Like Lifestyle, Ingenia also has an expanding rental base and annuity income stream. It’s retirement villages, in particular, have high occupancy rates.

Ingenia is in an interesting segment of the property market. There are synergies between retirement villages, budget holiday parks for “grey nomads” and rental communities in retiree hotspots, such as Harvey Bay in Queensland.

Ingenia has the balance-sheet capacity to fund more developments. In an ageing population, and as more retirees downsize and leave the big cities, it’s a stock to watch.

From a charting view, Ingenia has broken through points of key resistance, suggesting a new up leg in its price trend could be forming. Ingenia recently traded at $5.44.

Chart 2: Ingenia Communities Group (INA)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 12 May 2021.