Wall Street found its mojo after three down days in a row, with retail sales a big beat, up 1.9% against an economists’ estimate of 0.7%, on top of a strong consumer sentiment reading. Meanwhile, Pfizer gave those of us sweating on a breakthrough on the vaccine front a reason for positivity, with the drug maker applying for an emergency use rating for its vaccine, which it expects to have the needed safety ticks by late November.

The company’s share price spiked over 3% on the news. This comes as rising cases of infections in the UK, France and Germany are imposing restrictions on their population, regions and businesses, which all have potential economic implications.

If you need proof, then think about this from the AFR on Friday afternoon. “Australian shares ran out of puff on Friday as the scourge of COVID-19 appeared to test European and US equities heading into a northern winter that could be once again punctuated by lockdowns and activity-limiting measures,” wrote Vesna Poljak. “In commodities, WTI crude sank on Thursday in anticipation that COVID-19 would curtail demand. WTI fell 0.9 per cent to $US40.68 a barrel.”

These developments underline the importance of a vaccine to the economic story and then the stock market. I’ve always interpreted that the surprising confidence of the stock market, especially in the US, is based on a belief that a vaccine will ride to the rescue, like what happens in traditional Hollywood movies.

Overnight we learnt that the Trump team has signed up CVS Health and Walgreens (the big pharmacy groups in the US) to administer vaccines to the elderly and staff working in long-term care operations. The vaccine story is the gamechanger that will make or break stocks in coming months.

In the interim, economic stimulus (both fiscal and monetary from governments and central banks) is keeping the economies and stock markets of the world positive. However, if a vaccine doesn’t show early enough and stimulus decisions underwhelm markets, then a sell off is possible. That said, I don’t expect a crash of March (this year) proportions but more like a notable pull back until a vaccine looks imminent. In such a situation, more stimulus will be required to keep stock players from going too negative.

Everyone has to be mindful of this possibility.

This potential stimulus has been playing out in the US as the November 3 election looms and the Trump forces keep playing ducks and drakes, with the Democrat’s Nancy Pelosi over the size of the stimulus.

Like with most Trump dealings, uncertainty prevails. His “Treasury Secretary Steven Mnuchin said Thursday that the White House won’t let differences over funding targets for Covid-19 testing derail stimulus talks with top Democrats,” CNBC tells us. “Later, President Donald Trump said that he would raise his offer for a stimulus package above his current level of $1.8 trillion. House Democrats have passed a $2.2 trillion bill.”

This is the crazy stuff we’ve learnt to expect out of Washington, as jobless claims rise because assistance to many of the unemployed has dried up. This lack of action on stimulus is happening as the US Federal Reserve Vice Chairman, Richard Clarida, said the US economic recovery “has a long way to go” and “additional support from monetary and fiscal policy will be needed”.

To the local stocks story, and we added another 1.2% for the week, with the S&P/ASX 200 Index finishing at 6176.8. That means we’re up about 5% for the month. That’s huge considering the challenge for our cousins in Dan-land Victoria.

For the week, the stars were Unibail Rodamco Westfield, which put on 12% on Friday to finish at $3.34 after dissenting shareholders mounted a challenge ahead of an EGM to approve a $5.8 billion capital raising.

Link was up 21% on a takeover push and BOQ surprised to rise 9.86% on profit green shoots and a surprise dividend payment.

The stocks on the outer were Flight Centre down 9.09%, Mesoblast 7.72%, Webjet 7.16%, Zip 7.14% and Avita Therapeutics off 6.06%.

The notable upgrade came from CSL, which narrowed the range of its fiscal 2021 guidance, by lifting the bottom end of the range by $2.17 billion.

Telstra told us its 16 cents dividend is safe, even if the company has to break its payout rule. And I’ve talked Paul Rickard into seeing that the company is looking like a buy even now!

The great debut of the week was Aussie Broadband, which spiked 91% to $1.91.

What I liked

- In September, we saw 29,000 jobs created, while economists expected us to lose 40,000.

- Unemployment only snuck up from 6.8% to 6.9%, while economists expected the jobless rate to go to 7%. But it’s still well below the 10% once predicted.

- The IMF is forecasting global growth (GDP) to shrink by 4.4% in 2020 (prior forecast: minus 5.2%) before expanding by 5.2% in 2021 (prior: 5.4%). Australian GDP is expected to contract by 4.2% in 2020 (prior: minus 4.5%) with growth of 3% in 2021 (prior: 4%). I think our rebound will be better.

- The Westpac-Melbourne Institute Index of Consumer Confidence rose by 11.9% in October, lifting from 93.8 in September to a 27-month high of 105 points. A reading above 100 points denotes optimism!

- The weekly ANZ-Roy Morgan consumer confidence rating rose by 2.1% (the most in 7 weeks) to a 19-week high of 97.7 This reading of Aussie consumers is now up 8 out of the past 9 weeks!

- CBA card spending last week was up 6.9% on a year ago — the most in 9 weeks. Online spending has risen 24.7% on a year ago.

- Private new detached home sales rose by 3.8% in September to be up 28.9% over the quarter. In the seven months since COVID-19 restrictions came into effect (in March), sales are 11.8% higher than at the same time last year.

- The Philadelphia Fed manufacturing index rose from 15 to 32.3 points (survey: 14.8).

- The University of Michigan’s Surveys of Consumers for October climbed to 81.2 from a September level of 80.4. It was the highest level since March and exceeded economists’ expectations.

- US retail sales for September surged 1.9% against a forecast of 1.2%. Does this sound like something we’re seeing here? “Sales at U.S. retail stores surged in September and rose for the fifth month in a row as Americans bought more clothes, went out to eat and splurged on new cars and trucks, suggesting an economic recovery was still well underway at the start of fall.” (marketwatch.com)

What I didn’t like

- The number of dwelling starts fell by 5.6% to 42,448 units in the June quarter. There are currently 183,120 homes being built across Australia. In original terms, work started on 171,274 new dwellings over the 12 months to June – the lowest number in 6½ years. (This is actually OK considering the June quarter has the worst COVID-19 months of April, May and June. And Victoria was no help!)

- On Wednesday, US Treasury Secretary Steven Mnuchin downplayed the chances of striking a stimulus deal before the election.

- The COVID-19 impact on European business, with curfews and restrictions set to reduce the quality of the global economic recovery.

- In October, the Empire State manufacturing index in the US fell from 17 to 10.5 points (survey: 14).

- US share markets fell on Thursday as the number of Americans filing new claims for jobless benefits hit two-month highs last week.

- The ICAC’s job on Gladys and the plonker she unwisely dated! Back in 1992, when I was the political and business commentator for the Triple M network, I covered ICAC’s grilling of NSW Premier Nick Greiner, who ultimately resigned. I recall making the comment on radio that “If you’re called to ICAC, then you cack!”

One worrying dislike

The age of computers and their role in investing, independent of people who might make judgment calls on news, means that stocks are headline-driven like never before, so the flow of headlines becomes an excessive driver of stock prices. Let’s hope the news on stimulus, the US election, infections and vaccines tends to the positive.

The week in review:

- One thing I’ve personally learnt this year is the power of small cap companies to drive your portfolio’s value higher. In Monday’s Switzer Report, I wrote about a number of small companies I like.

- Paul Rickard wrote that knowing how short sellers are positioned can be important data input into investment decisions.

- While Tony Featherstone doesn’t think the banks are out of the woods yet, he is seeing value in one or two in particular.

- James Dunn’s view is that there are some great opportunities on offer at present on the ASX in terms of energy stocks.

- Our “HOT” stock of the week from Fairmont Equities managing director Michael Gable was Ardent Leisure

- For Buy, Hold, Sell – What the Brokers Say this week, 17 upgrades and 5 downgrades made up the first edition and 7 upgrades and 3 downgrades made up the second edition.

- And in Questions of the Week, Paul Rickard answered questions about ANZ dividend franking, Link’s proposed takeover and CommSec Pocket ETFs.

Our videos of the week:

- Boom! Doom! Zoom! | October 15, 2020

- What stocks will head higher thanks to the budget & Julia Lee on Mesoblast! | Switzer TV: Investing

- Here’s a masterclass on winning at auctions! Plus, how to find the best home loan! | Switzer TV: Property

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday October 20 – CBA Household spending intentions

Tuesday October 20 – Weekly consumer confidence (October 18)

Tuesday October 20 – Weekly payroll jobs & wages (October 3)

Tuesday October 20 – Reserve Bank Board meeting minutes

Tuesday October 20 – Speech by Reserve Bank Assistant Governor

Wednesday October 21 – Preliminary retail trade (September)

Thursday October 22 – Reserve Bank Deputy Governor speech

Thursday October 22 – Business impacts of COVID-19 (October)

Thursday October 22 – Detailed labour force (September)

Friday October 23 – IHS-Markit purchasing managers’ index (October)

Overseas

Monday October 19 – China economic growth (September quarter)

Monday October 19 – China retail/production/investment (September)

Monday October 19 – US NAHB housing market index (October)

Monday October 19 – US Budget statement (September)

Tuesday October 20 – China home prices (September)

Tuesday October 20 – China 1- and 5-year loan prime rates

Tuesday October 20 – US Housing starts & building permits (September)

Wednesday October 21 – US Federal Reserve Beige Book

Thursday October 22 – US Conference Board leading index (September)

Thursday October 22 – US Kansas City Federal Reserve survey (October)

Thursday October 22 – US Existing home sales (September)

Friday October 23 – US IHS-Markit purchasing managers’ indexes (Oct.)

Food for thought:

“Time is your friend; impulse is your enemy.” – John Bogle

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

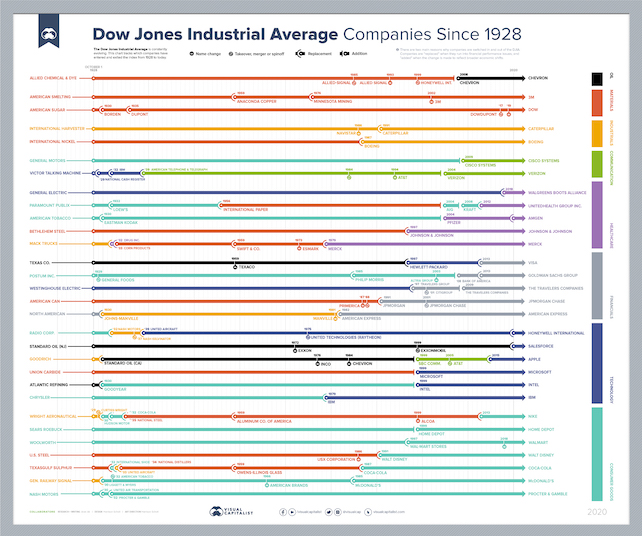

August saw the exit of ExxonMobil, Pfizer and Raytheon Technologies from the Dow Jones Industrial Average. The following chart from Visual Capitalist shows the 93 changes to the index that have taken place since 1928:

Click here to view the chart full screen.

Top 5 most clicked:

- Lots of smaller companies I like – Peter Switzer

- Would I buy the Big Four banks? And if so, which bank? – Tony Featherstone

- 4 energy stocks – James Dunn

- Can we learn anything from the short sellers? – Paul Rickard

- Questions of the Week – Paul Rickard

Recent Switzer Reports:

- Monday 12 October: Smaller companies I watch or buy

- Thursday 15 October: Would I buy the Big 4 banks?

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.