With the US S&P 500 back at its 200-day moving average, I thought it would be interesting to focus on what has driven returns. In my view, a company’s balance sheet has played a major role and will continue to.

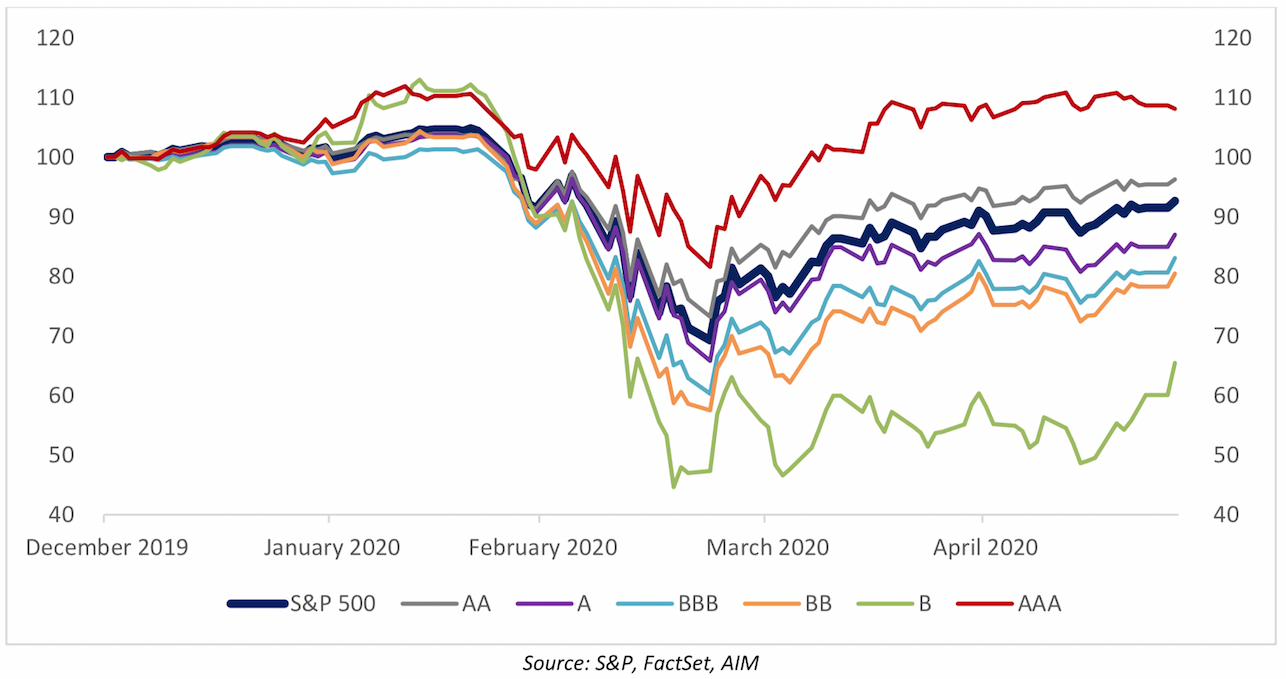

As the COVID-19 crisis has worked its way through markets, the strength of corporate balance sheets and sustainability of cash flows have been outsized determinants of the relative winners and losers for the calendar year to date. The chart below shows the returns of the S&P 500 (in US dollars) since 31 December 2019, with the companies split into different cohorts depending on their credit rating as assigned by Standard & Poor’s. For simplicity’s sake, companies with no rating were excluded, and the performance was calculated by holding an equal-weighted exposure to all companies in each credit grade, rebalanced daily.

There are some quirks in the underlying data worth mentioning. For example, there are only two companies assigned a AAA credit rating by S&P (Johnson & Johnson and Microsoft). The AA cohort contains oil majors and technology businesses, which have obviously seen materially different return profiles over the last five months; clearly, strong returns from the latter have more than offset the weak returns from the former.

Despite some of these oddities, we think the chart paints the overall picture reasonably well: the market is favouring businesses with strong balance sheets; the more robust, the better. Based on this chart, we think it is fair to say that investors are more defensively positioned than is generally appreciated, but the nature of the recession caused by COVID-19 obscures this. To a large degree, being defensively positioned right now favours owning extremely well-capitalised technology and internet businesses, mainly because their operations are generally more insulated (though not immune) from this downturn.

This is very different from previous recessions, when defensive positioning generally implied owning businesses in the consumer staples, health care and utilities sectors. Depending on the pre-crisis levels of leverage and the ability to continue delivering its goods or services during the lockdown, not all businesses in those sectors have proven to be particularly defensive this time around.

As we indicated last month, we readily admit to being surprised with the speed with which markets have recovered since the March lows. Given our focus on balance sheet quality and long-term trends, it presents an interesting conundrum in portfolio construction at present.

High-quality businesses with strong balance sheets that we introduced into the fund (or added to) in March have generally rallied very strongly, to the point where some are now trading at or modestly above our estimate of fair value in our base case. Consider Amazon: like many businesses, it initially fell precipitously in March. Based on our assessment of fair value and the belief that the lockdowns required by COVID-19 accelerates e-commerce adoption –particularly for groceries, which we see as a catalyst for increasing overall online retailing –we elected to increase the holding. The subsequent 40%-plus rally means it now trades slightly above our (admittedly inexact) estimate of fair value.

Normally, we would prefer to leave well enough alone for a business where we expect our investment case to play out over years instead of quarters. In this case, we believed other portfolio holdings were offering a better margin of safety, and therefore modestly trimmed the Amazon holding to redeploy into businesses like Coca Cola.

To our thinking, there is a critical distinction between adding to a holding (for which we require a margin of safety) and being happy to hold tight to a business where we have conviction in the long-term thesis that is potentially slightly overvalued in the short term.

Seeking value amidst uncertainty

We only sell out of an investment on valuation grounds if it trades at a price higher than our estimate of intrinsic value using our most optimistic estimates for a bullish scenario.

As outlined in April, we continue to believe that the most likely path of the economic upturn is a U-shaped recovery stretching into 2021, and not a sharp, V-shaped recovery. Our belief is based on our assessment of labour market dynamics:

- Not all the jobs that have been lost will be coming back – some firms will use this opportunity to downsize or automate, as appropriate.

- Many small businesses will have shut their doors permanently, meaning they will not rehire anyone.

- Frictional factors (such as seasonality or businesses and employees relocating) will mean the pace of rehiring is likely to be slower than the pace of letting staff go.

- Health care regulations around social distancing may make it uneconomical to employ the same number of employees as prior to the pandemic. This risk is particularly acute in the services industries, which have lost the most jobs.

At present, many countries are starting to relax their lockdown regulations. The pent-up demand from being at home for nearly two months, combined with the first rounds of fiscal stimulus (such as JobKeeper here in Australia) will likely cause an initial surge in consumer spending.

However, we think that as governments start to proverbially wean the patient off the morphine, there is substantial risk in the second half of the year as the reality of the economic downturn sets in.

Moreover, there remains the risk around the pandemic itself. Many of the assumptions of a sharp recovery are dependent on there being no second wave of infections. Certainly, the cash flows and financial strength of many companies will remain under pressure if harsh social distancing measures need to be reintroduced. Because this is not a financial markets risk, we feel we have no edge in assessing the likelihood of a new round of public health interventions derailing the recovery.

For all these reasons, we remain intensely focused on the balance sheet quality of the portfolio.

To us, the risk of a permanent loss of capital outweighs the potential upside of buying something optically cheap but with a materially challenged financial position. Normally, you need the economic cycle to improve for such businesses to survive, and we do not think anyone can call the cycle with any great degree of certainty at present.

To paraphrase the American race car driver Rick Mears, to have any chance of finishing first, you must first finish.

Stick to fortress balance sheets.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.