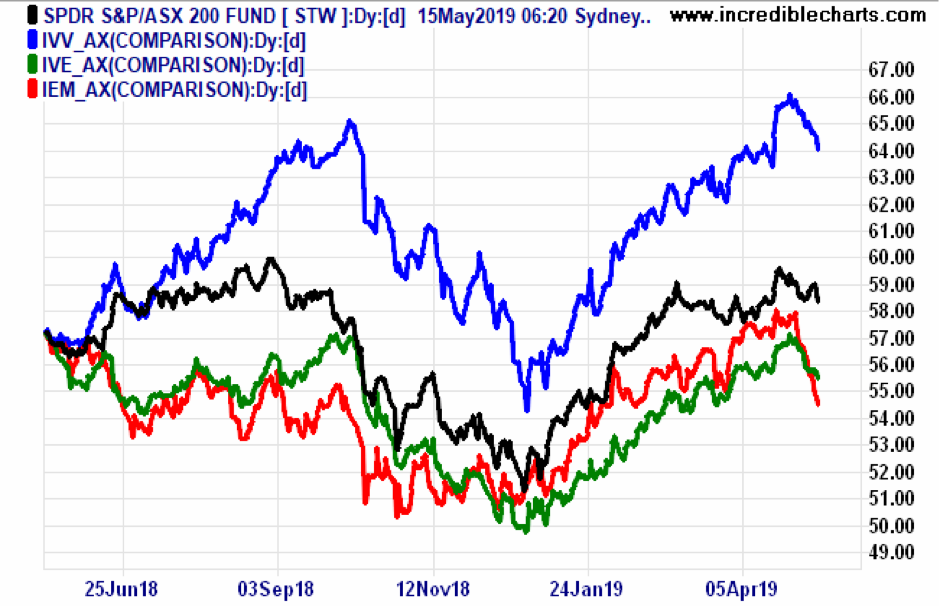

Here’s what occurred to the American (blue), Australian (black), Emerging Markets (Red) and Other Developed Market (green) share price indices over the last year. It’s clear the strong rally since Christmas simply reversed the correction of last year.

More recently, share prices have pulled back because high expectations for a US/China trade deal were dashed.

So are shares taking off, blowing off or melting down?

It largely hinges on the dominant market, Wall Street.

The Bull Case

The optimists point to the US share market surpassing its 20 September 2018 high on the 30 April 2019. In their view, the S&P 500 is just catching its breath before taking off again.

The US/China trade dispute won’t trigger a cash rate or oil price spike, the events that caused almost all previous market crashes. Markets even when top heavy don’t fall over unless pushed by a credit squeeze or an energy crisis. Neither is imminent.

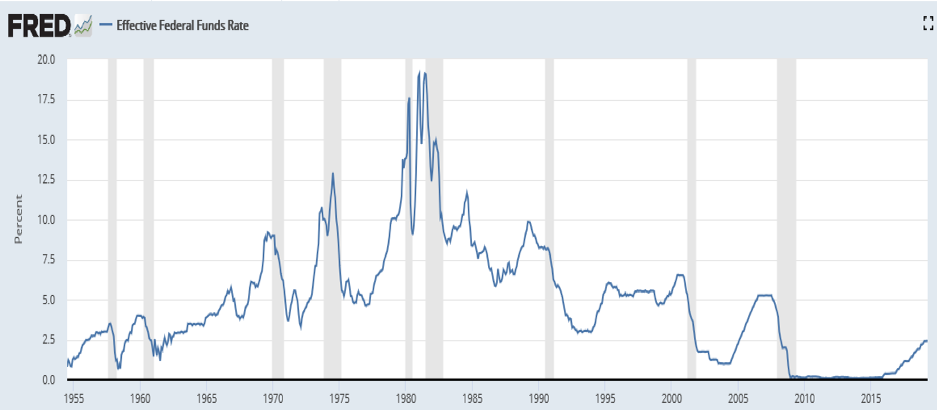

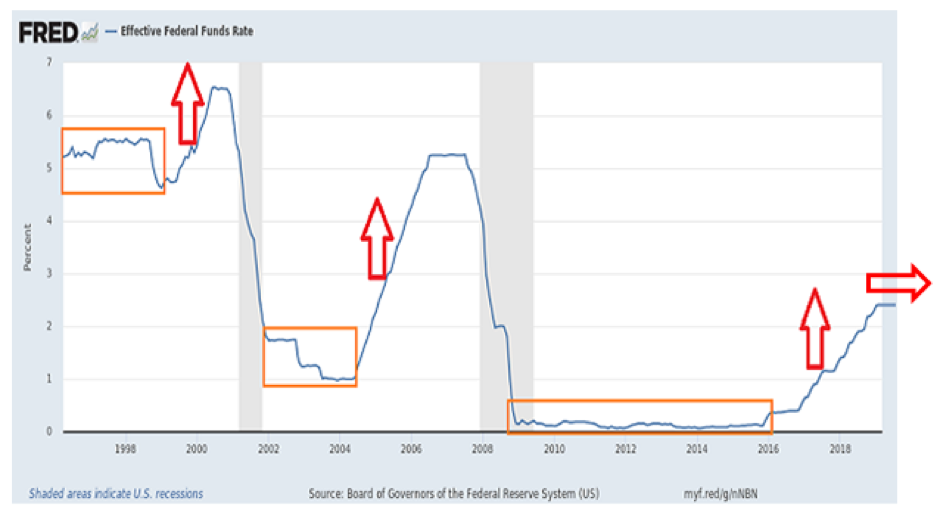

The US Federal Funds rate is below the levels that triggered recessions in the past and furthermore was put on hold last Christmas. Economic shocks almost always coincided with credit squeezes, whereas this time the Fed has stopped well short of that.

Source: https://fred.stlouisfed.org/series/FEDFUNDS

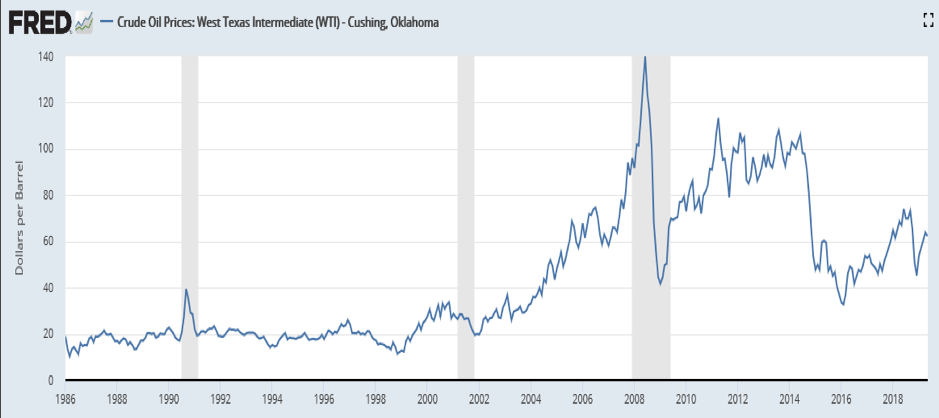

The jump in the price of oil since its December 2018 low has now stalled as can be seen below.

Source: https://fred.stlouisfed.org/series/DCOILWTICO

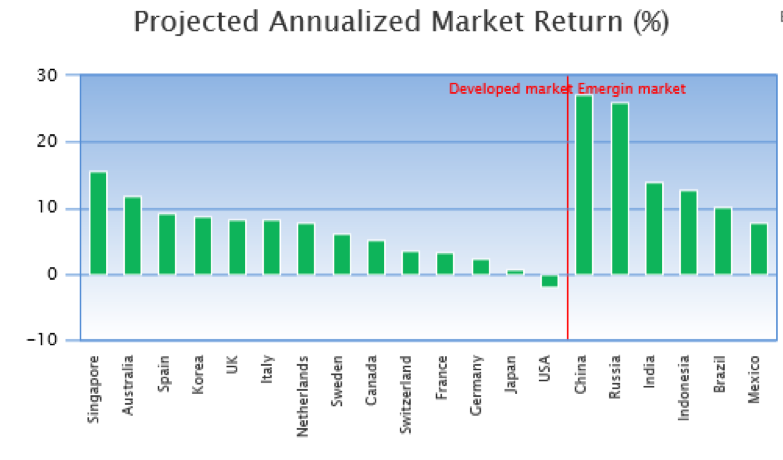

Even if American shares (especially hi-tech) are overpriced, those in most other markets offer strong returns over the next eight years based on their economic prospects, dividend yields and price/earnings ratios, as one noted analyst illustrates below.

Source: https://www.gurufocus.com/global-market-valuation.php

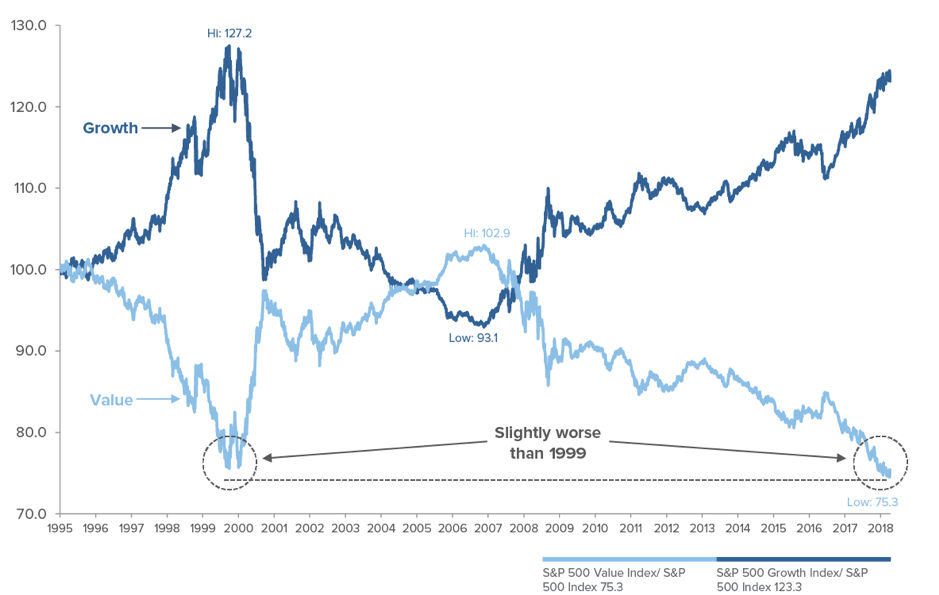

Also value shares are due for a rally after ceding ground to growth stocks over the last dozen years. The chart below misses the March quarter 2019 when the gap between the value of US Growth and Value stocks overshot the previous extreme at the height of the tech bubble in 1999. This growth stock binge is not confined to the USA.

US Growth and Value Stocks – Relative price performance for past 25 years

Furthermore the US Federal Reserve has done a U-turn, ending its planned escalation of the cash rate and foreshadowing an end to QT (quantitative tightening) that reined in liquidity. The Fed wants to bolster the stock market (and thereby investor and consumer confidence) since price inflation poses no threat.

Source: https://fred.stlouisfed.org/series/FEDFUNDS

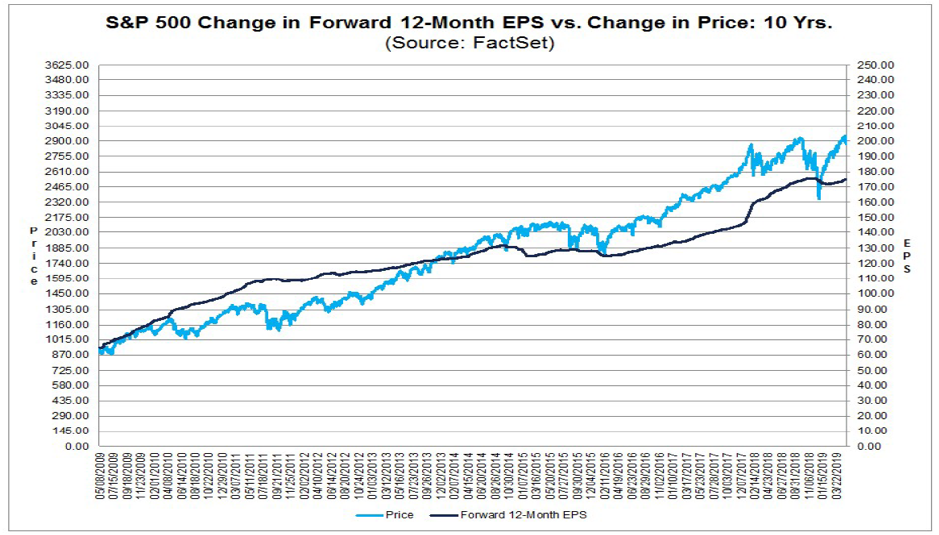

US corporate earnings per share surprised to the upside in the March quarter 2019 after slumping in the previous quarter. Three quarters of S&P 500 companies reported a positive earnings per share surprise and three in six reported a positive revenue surprise. That’s a good omen for stock prices in 2019.

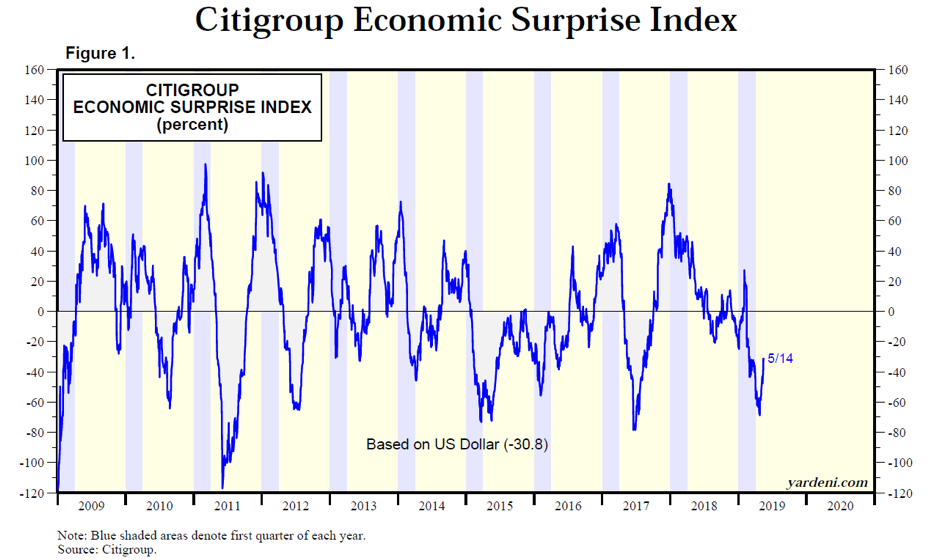

Even Trump’s shock decision to whack China with further tariff increases has not significantly elevated CitiGroup’s Economic Surprise Index from its sub-normal reading.

Source: https://www.yardeni.com/pub/citigroup.pdf

The present market pullback offers an opportunity to load up on shares at discount prices. Don’t be put off by the doomsayers.

So says the bulls!

The Bear Case

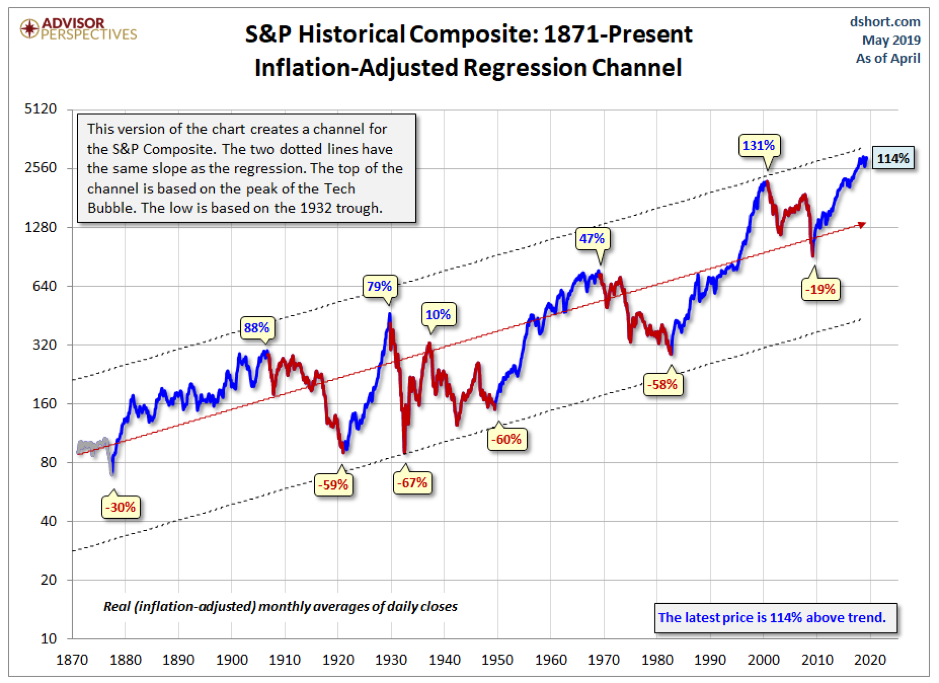

The pessimists warn the US market is at or towards the end of a prolonged and overextended bull market that has lifted the S&P 500 index 114% above its long-term trend line. Indeed it’s close to the upper limit of its historic channel.

An average of four valuation indicators suggests it is more overpriced now than at any time since 1900 except for dotcom share spike of 1999.

Source: https://seekingalpha.com/article/4259478-market-remains-overvalued?ifp=0

John Hussman, the well-known CEO of Hussman Funds, expects “a 60-65% market loss over the completion of this cycle (assuming) that reliable valuation measures will simply revisit their historical norms, rather than breaking below them as they have in most bear markets…”

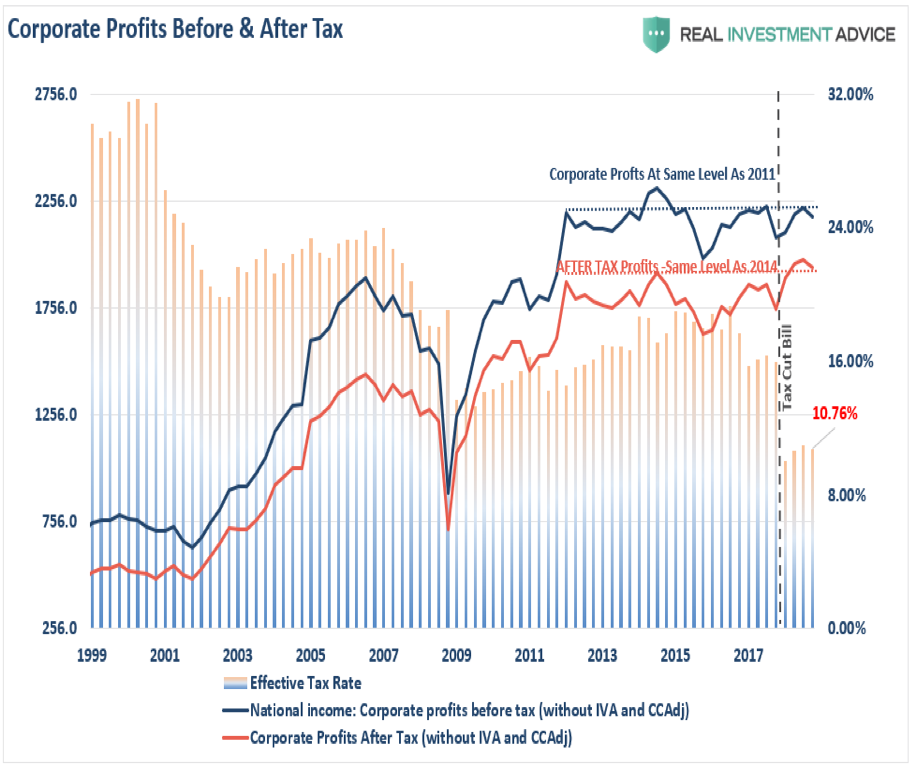

The global economy is slowing, notwithstanding America’s recent growth burst. Trump’s tax cut gave American profits (and shares) a sugar hit that won’t be repeated.

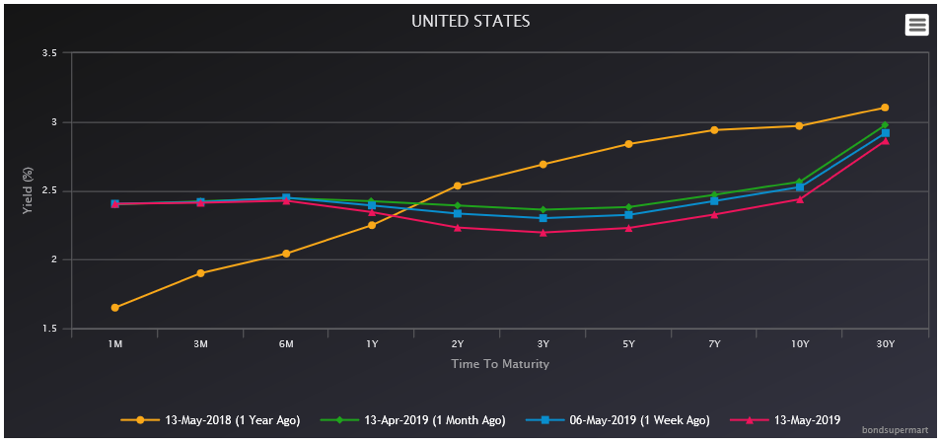

America’s negative yield curve continues to get worse. Also, it exists in Europe and Australia, which is ominous since it is the most reliable harbinger of stock market crashes followed by recessions.

Source: https://www.bondsupermart.com/main/market-info/yield-curves-chart

While the March quarter profit announcements were better than expected, the bar was set low because earnings are down on a year ago. Excluding share buybacks and tax cuts, US corporate profits have been flat since 2011. See chart below.

Source: Lance Roberts, The Bull Is Back…But Will It Stay?, Real Investment Advice, 27 April 2019.

The US share boom of the last eight years was due to financial engineering, not genuine wealth creation. Unless corporate profits grow of their own accord, the bull market is over. America (and other share markets) has now entered the six-month period (May to October) traditionally marked by lacklustre returns or market setbacks.

Now is not the time to commit heavily to shares, lest America’s market rolls over and takes Australia and the rest of the world with it. So says the bears!

Investor options

The bulls say that corporate America is healthy and will surprise to the upside. Don’t miss the next rally that will take the world with it. The bears say the US market is poised for a major crash. Don’t get sucked into a bull trap.

Market Timing Australia’s view is that the safest course of action is not to predict the market, but to respect its trend and momentum. While these are strong, stay with the bulls. If they weaken, retreat with the bears. Here are our thoughts.

- Have a diversified portfolio of shares, property, bonds and cash to reflect your risk profile.

- Tilt the portfolio more towards shares when Market Timing Australia’s Market Meter is Green and more towards cash or bonds when it’s Red.

- If too nervous at this late stage of its bull run consider market neutral funds or shift to mostly bonds from May to October when shares market ructions mainly occur.

- Otherwise stay fully committed to shares while their uptrend lasts as gauged by Market Timing Australia.

These are not investment recommendations, but simply ideas for discussing further with your professional financial planner and adviser.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.