With Sydney going into lockdown and Melbourne just out, and US stock markets at all-time highs, I wasn’t surprised to get a phone call from one of our financial planning clients asking if it’s time to lighten up on stocks.

It was a bit of a surprise as this client isn’t usually jumpy so I guess they’ve read something that has spooked them. Now let me say, we don’t go to cash for financial planning clients unless they ask or I’m really getting worried about the market because the key indicators I watch are starting to look like red flag time.

So let me say upfront that I’m not red flag worried right now. Frankly I expect a couple of years of rising stock prices before I start getting concerned. That’s not to say that there won’t be sell offs (there will be) but the overall trend will be positive, until we’re really worried about rising interest rates.

Right now the interest rate concerns are all about the first rise in the USA coming in 2023 rather than 2024. And there’s a lone wolf call out there by the St. Louis Fed President, James Bullard, who told CNBC last week that it “could” be in 2022 that the first rise comes.

The market was worried for a couple of days until President Joe Biden trumped rate worriers with his $1US trillion infrastructure spending programme, that also came with bi-partisan support. That’s rare in the USA.

And this comes as we saw how powerfully the US is growing right now. On Friday, we learnt that the Yanks were growing at a 6.4% annual pace in the March quarter, which was bang on economists’ expectations.

And it’s the growth story that not only might speed up the arrival of interest rate rises earlier than expected but it will simultaneously give us breathing room for investors committed to stocks.

You see, the first rate rises won’t smash growth. In fact, turbo-charged economic activity will pump up company profits. And it will be when these start to look challenged that stocks will go off the boil.

If you need arguments to allay your fears, here’s a decent list that explains my positivity for stocks:

- On Saturday with my Switzer Report, I look at what I liked about economic and market data over the week. Last Saturday, like nearly every Saturday since we beat the virus and were helped by both fiscal and monetary stimulus on steroids, the “what I liked” versus “what I didn’t like” numbered 12 to 2 and I really stretched my objectivity to find negatives!

- In Australia, total household wealth (net worth) rose by 4.3% to a record high $12,664.5 billion in the March quarter. A record high!

- The All-Ord’s share price index is now up 66% from its crash low of 23 March 2020 and is above the level it was when the Coronavirus struck.

- If you’re worried about inflation going ballistic and pushing up rates and KO’ing stocks, you should know that Consensus Economics, which surveys economists worldwide, found that in North America (the USA and Canada) the general view was that inflation would spike in April and then fall.

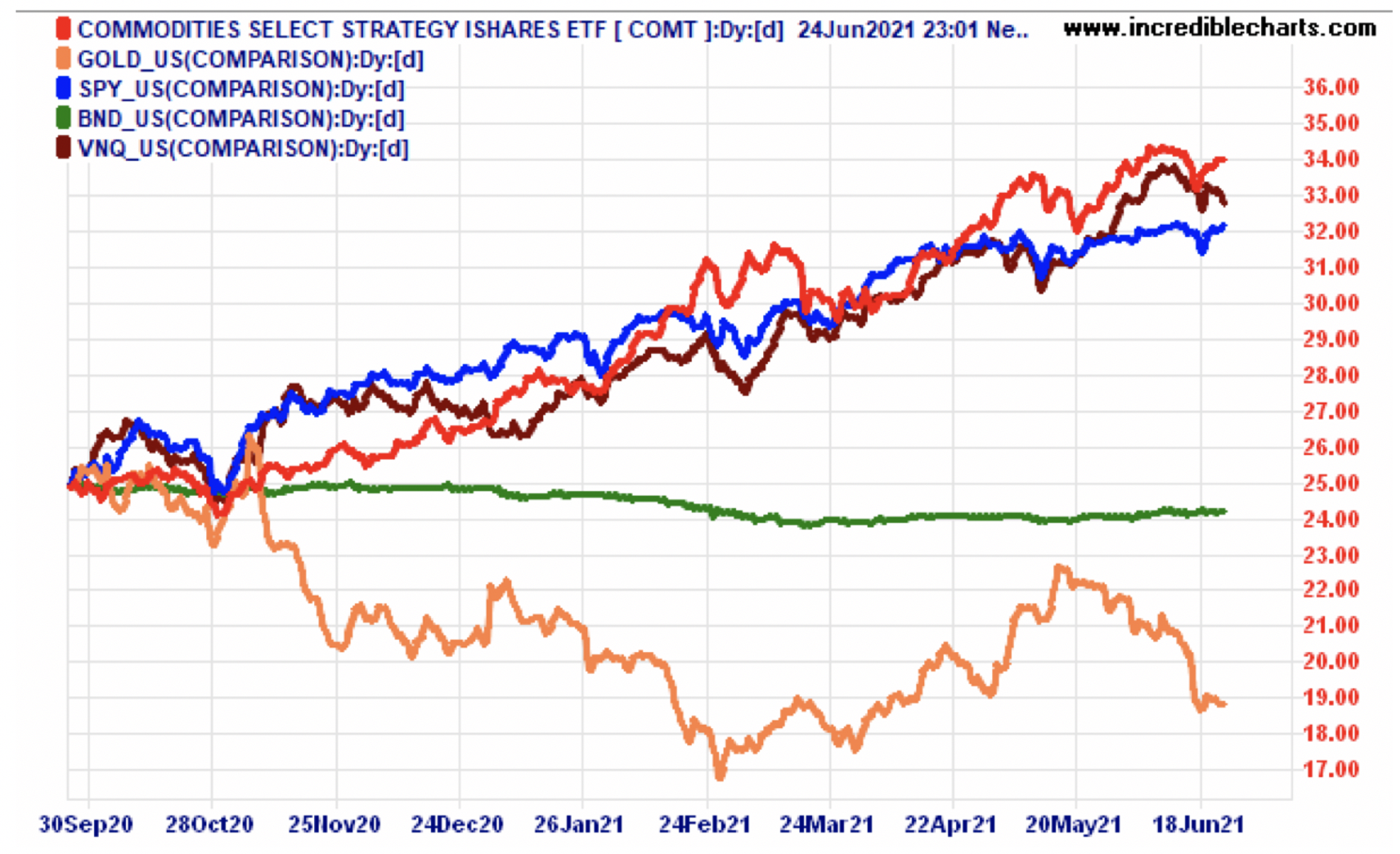

- The former NSW Treasury boss, Percy Allan, is comfortable with the bond market: “Falling US 10-year Treasury bond yields appear to confirm that financial markets accept that the jump in consumer prices over the year to May 2021 was abnormal and therefore only temporary. See next chart.”

- Usually if inflation is expected, gold prices spike.

The opposite is happening as the orange line shows (Five US ETFS with the same base – red commodity fund, brown property fund, blue share fund, green bond fund and orange gold fund).

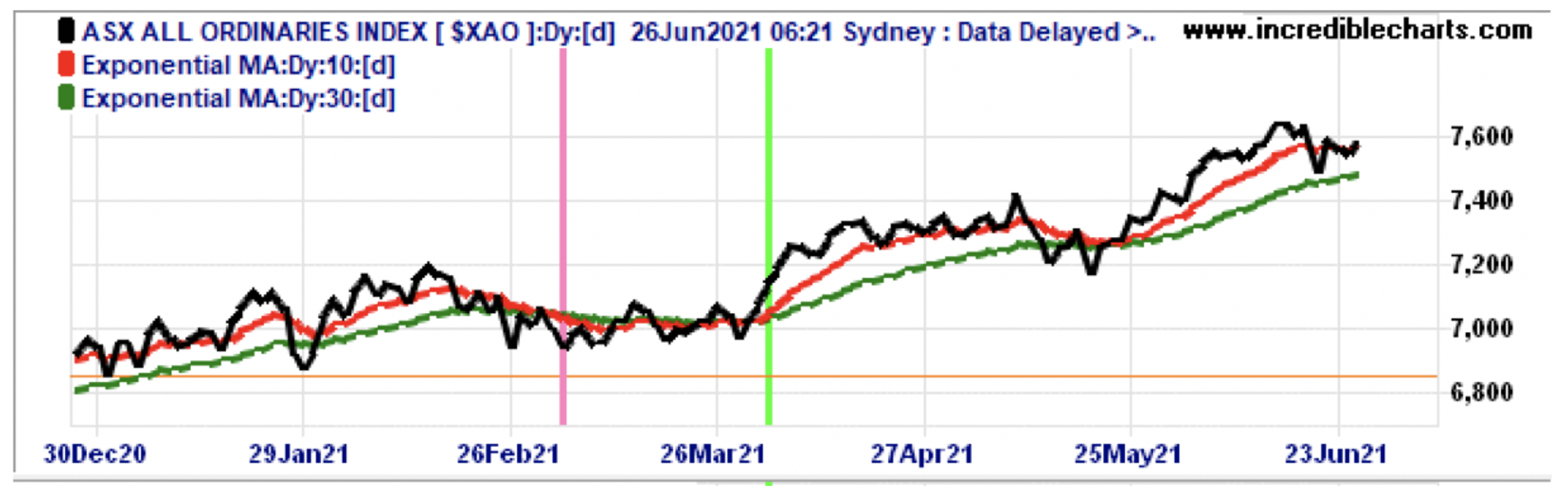

- Percy’s analysis of short, medium and long-term trends for Australian stocks remains positive. “The Australian stock market is bullish on short-to-medium-term trend analysis. The All-Ords red 10-day trend line came close to falling below its dark green 30-day one on the 20th May, but then soared. Its price momentum as measured by its MACD oscillator went positive thereafter, but turned negative again last week.” And if you need pretty pictures to prove it, well check this out:

In the world of chartists, the red line running away from the green one is a positive sign for stocks.

- Right now, the governments of the world and central banks know how important it is to keep the economic growth and positive stock market stories on the road. And it means any sell off that’s driven by short-term developments such as a lockdown (that’s now hit Sydney) ultimately becomes a buying opportunity. For example, today Qantas is at $4.51 and the analysts think it has 29.5% upside. If the world gets pretty well vaccinated by 2023 and international borders open up for Aussie and overseas travellers, one of the best airlines in the world will see its share price rebound. It’s a gamble but playing stocks always is. However, if you buy quality and you’re patient, returns will reward you.

Seriously, I could go on selecting many reasons for sticking to stocks but I’ll conclude with this from Percy Allan: “Should the economic rebound from the pandemic stoke higher interest rates stock markets globally could recoil. But at present both short-to-medium and medium-to-long term trend analysis show the Australian and American equity markets remain bullish with a buffer before any market pullback let alone a correction would make them bearish.”

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.