While health stocks are a little on the outer due to the “rotation” trade out of growth stocks and into value stocks, the tailwinds behind the sector – such as ageing populations creating demand for demand for more and better services, and correspondingly increased spending by governments – have not gone away. The COVID-19 pandemic has created huge short-term demand for some healthcare services, while putting demand for others on to the back-burner, and markets have struggled to factor-in these changes to stock valuations. But for long-term investors, the prospects for increased healthcare spending through the structural support of the ageing population over-ride the short-term turmoil in the healthcare markets.

Here are six stocks poised to benefit – three high-quality “active” Australian global players, and three “passive” ways to play the global healthcare market. Australia is excluded from these passive plays, so one or two of them could help Australian investors implement a “core-satellite” approach, where the market return is locked-in using the ETF, and the satellite holdings are the individual stocks. Remember, however, that the ETFs profiled use different indices and are thus different investment propositions – do your research to choose the exposure you want.

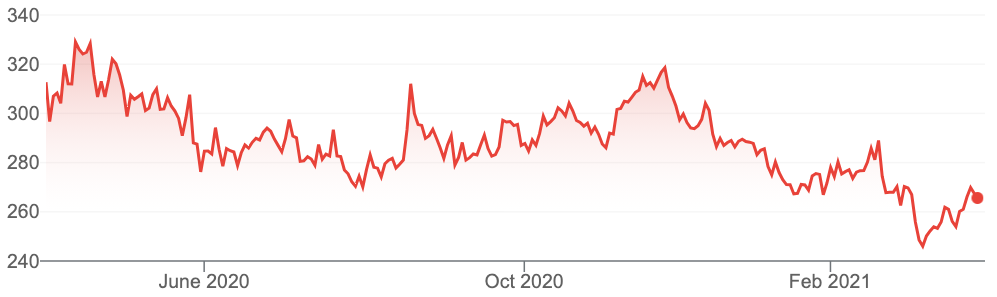

1. CSL (CSL, $267.46)

Market capitalisation: $121.7 billion

Three-year total return: +20.9% a year

Analysts’ consensus valuation: $314.96 (Thomson Reuters), $297.30 (FN Arena)

Australia’s global healthcare giant is offering investors a chance to buy its shares at a bargain. From $336.40 before COVID-19 hit the world, CSL slumped to $248.58 earlier this month, and is still only 7.6% above that recent low. The impact of the pandemic on plasma collections has hurt CSL, which through its CSL Behring business, is one of the world’s largest manufacturers of blood plasma products, providing treatments for people living with conditions in the immunology, haematology, cardiovascular and metabolic, respiratory, and transplant therapeutic areas. CSL Behring generates about 85% of the company’s revenue: the other main division is Seqirus, the vaccine business.

In February, the company delivered a very strong earnings result, with net profit jumping 44% to $US1.81 billion ($2.33 billion) in the half-year to December 31, beating analysts’ forecasts, on the back of an 18.8% rise in revenue to $US5.6 billion ($7.2 billion). A spike in demand for seasonal influenza vaccines helped, with Seqirus division more than doubling earnings to $US693 million ($893 million), while its core immunoglobulin portfolio continued to perform strongly, led by immune deficiency therapy Hizentra, which reported a 19% sales rise.

An expected recovery in plasma collections over this year and next, particularly in the US, as the vaccine rollouts continue, should give CSL much improved operating conditions. The company is also involved in the vaccine rollouts: in Australia, it is partnering with AstraZeneca to produce the latter’s COVID-19 vaccine at its Melbourne facility, and is contracted to make 50 million doses of the AstraZeneca vaccine. Shipments started earlier this month and CSL expects to produce an average of one million doses a week by the end of the year.

Brokers are not universally bullish on CSL – not all analysts see the plasma collections situation smoothly returning to normal, and the company could face new threats in the plasma therapies business – but on consensus there appears to be solid value in the stock. Unfortunately, CSL is not a yield stock, with a small unfranked dividend equating to a forecast 1% yield in FY21. However, it remains a high-quality global healthcare investment.

Source: Google

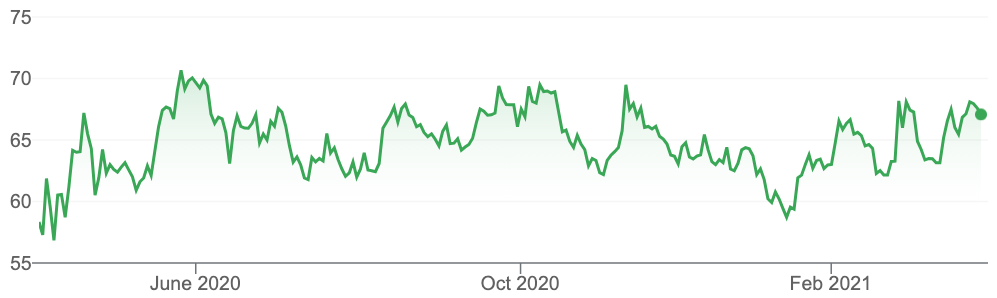

2. Ramsay Health Care (RHC, $67.59)

Market capitalisation: $15.7 billion

Three-year total return: +4.3% a year

Analysts’ consensus valuation: $70.45 (Thomson Reuters), $69.349 (FN Arena)

Ramsay Health Care, Australia’s largest private hospitals operator and one of the largest private healthcare providers in the world, was also slammed by COVID-19, as elective surgeries went by the wayside globally, and Ramsay’s hospital capacity was effectively commandeered to deal with the pandemic. Ramsay is one of the largest and most diverse private healthcare companies in the world, with more than 500 facilities across Australia, France, the United Kingdom, Sweden, Norway, Denmark, Germany, Italy, Malaysia, Indonesia and Hong Kong, handling more than eight million admissions/patient visits a year.

At its December 2020 half-year result, Ramsay reinstated its dividend with an interim of 48.5 cents a share – down from 62.5 cents a year ago – after reporting its first-half net profit fell 12.5%, to $226 million. That was on the back of a 6.6% drop in revenue from patients, as operational restrictions across Australia, Europe and the UK, combined with lower demand for non-surgical services, ate into earnings. Ramsay needs to see normality return to its business as the vaccines are rolled-out – the uncertainty on this front means that the company has not given full-year guidance – but the bottom-line with this stock is that Ramsay owns highly valuable medical infrastructure, from primary care to complex surgery, as well mental health care and rehabilitation, that will come back into its own as Ramsay’s facilities start to deal with the large backlog of elective surgeries and consultations that has built-up in the pandemic. Brokers see a bit of value in the stock price, and for FY22, a 2.9% grossed-up dividend yield.

Source: Google

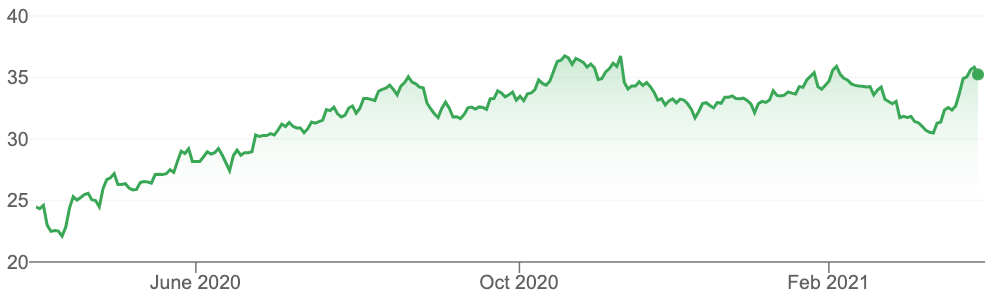

3. Sonic Healthcare (SHL, $35.84)

Market capitalisation: $17.1 billion

Three-year total return: +19.1% a year

Analysts’ consensus valuation: $36.71 (Thomson Reuters), $37.364 (FN Arena)

Australia’s Sonic Healthcare has grown to become one of the world’s leading providers of medical diagnostics, in the pathology, diagnostic imaging, radiology, primary care medical services and laboratory medicine fields, with operations in Australasia, Europe and North America. SHL was initially smashed by the pandemic, as pathology testing levels – particularly in its crucial US and European markets – fell sharply. The company was able to pivot to provide COVID-19 testing, performing more than 18 million tests in the first half of FY21, and this boost helped the share price – going forward, analysts still expect testing this to provide a material contribution as the base business continues to recover, as the vaccine rollouts at least allow us to envisage a post-COVID world.

Sonic’s successful pivot saw net profit more than double in the first half, to $678 million, well ahead of market expectations. Now, analysts expect rising demand for COVID-19 serology testing (immunity status) to provide an added tailwind for SHL, as volumes in the other testing services continue to recover.

The price of success, however, is that analysts’ consensus sees SHL as reasonable fairly valued, with Credit Suisse and Morgan Stanley the most bullish, with share price targets of $40 and $39.70 respectively, which imply double-digit upside. SHL only franks its dividend to 30% at present and Thomson Reuters’ consensus collation expects a grossed-up yield of 3.3% in FY22. But the stock is a high-quality exposure to global healthcare.

Source: Google

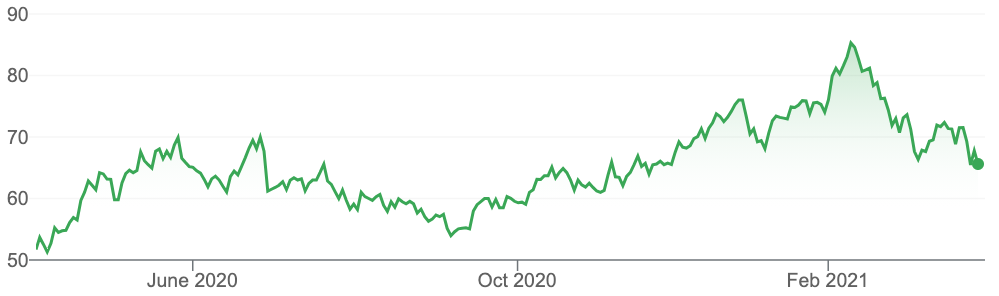

4. CURE ETF (CURE, $65.89)

Market capitalisation: $44.9 million

Three-year total return: n/a

Analysts’ consensus valuation: n/a

ETFS’ S&P Biotech ETF (CURE) is an exchange-traded fund that provides exposure to a diversified portfolio of US biotechnology stocks, which ETFS considers sub-industry within the health care sector. The fund uses an equally weighted strategy which gives higher exposure to small and mid-cap stocks held within the fund. CURE aims to provide investors with a return that tracks the performance of the S&P Biotechnology Select Industry Index, before fees and expenses. This index covers companies working in research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering, examples of which include the development of immunotherapy treatments and vaccines to treat human diseases. CURE is not currency hedged, so foreign exchange fluctuations can affect returns. Since inception in November 2018, CURE has gained 23.8% a year, versus 24.5% a year for the index. CURE costs 0.45% a year for management.

Source: Google

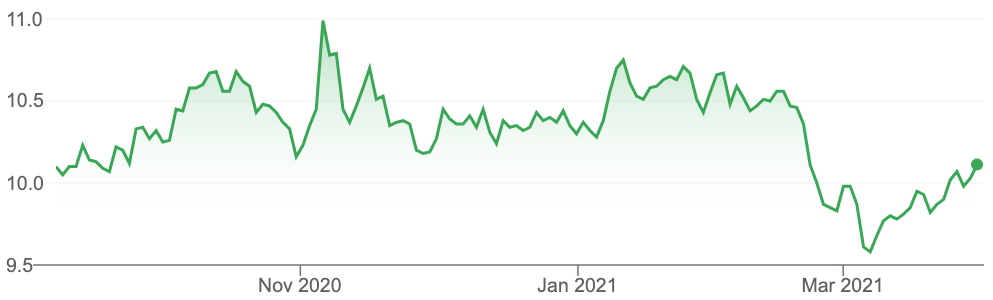

5. VanEck Global Healthcare Leaders ETF (HLTH, $10.15)

Market capitalisation: $42.6 million

Three-year total return: n/a

Analysts’ consensus valuation: n/a

HLTH gives investors exposure to a diversified portfolio of about 50 of the largest international companies from the global healthcare sector, with Australia deliberately excludes. HLTH aims to provide investment returns before fees and other costs which track the performance of its benchmark index, the MarketGrader Developed Markets (ex-Australia) Health Care Index, before fees and expenses. Listed in September 2020, the unhedged HLTH costs 0.45% a year,

Source: Google

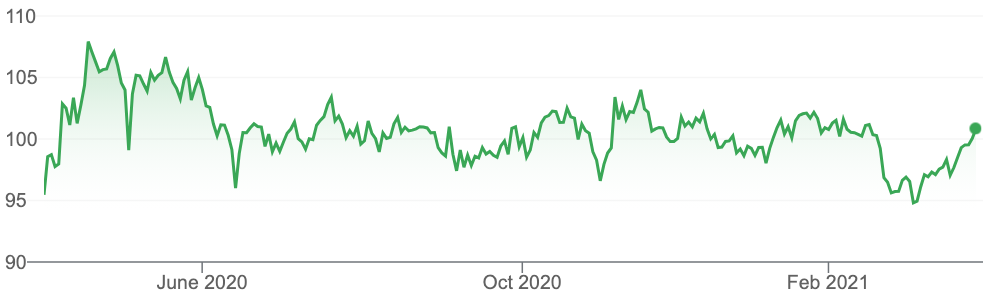

6. iShares Global Healthcare ETF (IXJ, $100.89)

Market capitalisation: $810 million

Three-year total return: 13.8% a year

Analysts’ consensus valuation: n/a

IXJ is an exchange-traded fund seeking to give investors a return that corresponds to the price and yield performance of the healthcare sector of the economy, as represented by the S&P 1200 Global Healthcare Sector Index, before fees and expenses. The index is designed to measure the performance of global biotechnology, healthcare, medical equipment and pharmaceuticals companies and may include large-, mid- or small-capitalisation stocks. IXJ has much more of a “big pharma” bent than the other two, with top ten holdings including Johnson & Johnson, UnitedHealth Group, Roche, Novartis, Merck & Co., Pfizer, Abbott Laboratories, AbbVie, Thermo Fisher Scientific and Medtronic. Since inception, the unhedged IXJ has returned 7.8% a year, versus 7.9% a year for its benchmark. IXJ is managed for 0.46% a year.

Source: Google

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.