I recently completed two courses. The first was a master’s degree from a sandstone university. The second was a postgraduate diploma from a private provider.

The diploma had more content than the master’s and greater relevance for industry. It also cost about a sixth of the master’s degree.

That is not meant to be a rant about declining teaching standards at universities or the demise of many masters’ programs. Parts of my master’s degree were exceptional.

Rather, the above anecdote highlights how postgraduate education is ripe for faster disruption after Covid from private providers. That’s great for ASX-listed education technology (edtech) stocks, many of which have taken off in the past few months.

My university experience highlighted a few other things. First, how dependent universities are on international students and how they have geared their programs towards this market. That’s good for IDP Education, which offers student placement and English-language training.

The second insight is how far behind universities are with online teaching. Yes, it’s dangerous to extrapolate a single experience to all programs. Some universities are well advanced with digital learning. But the majority are yet to deliver a truly immersive digital learning experience.

It’s remarkable that it took a pandemic to force some universities to offer more courses online. Online learning is hardly new, yet some universities are still getting their head around offering courses in a dual-delivery model (at campus and online) and letting students choose. There’s so much opportunity for edtech companies with clever products and services.

I’m more convinced than ever about the future of edtech and leading companies in this field. The private sector must play a bigger role in learning and development. As business digitises and becomes even faster, people will need to reskill at light speed. Edtech is critical.

1. IDP Education (IEL)

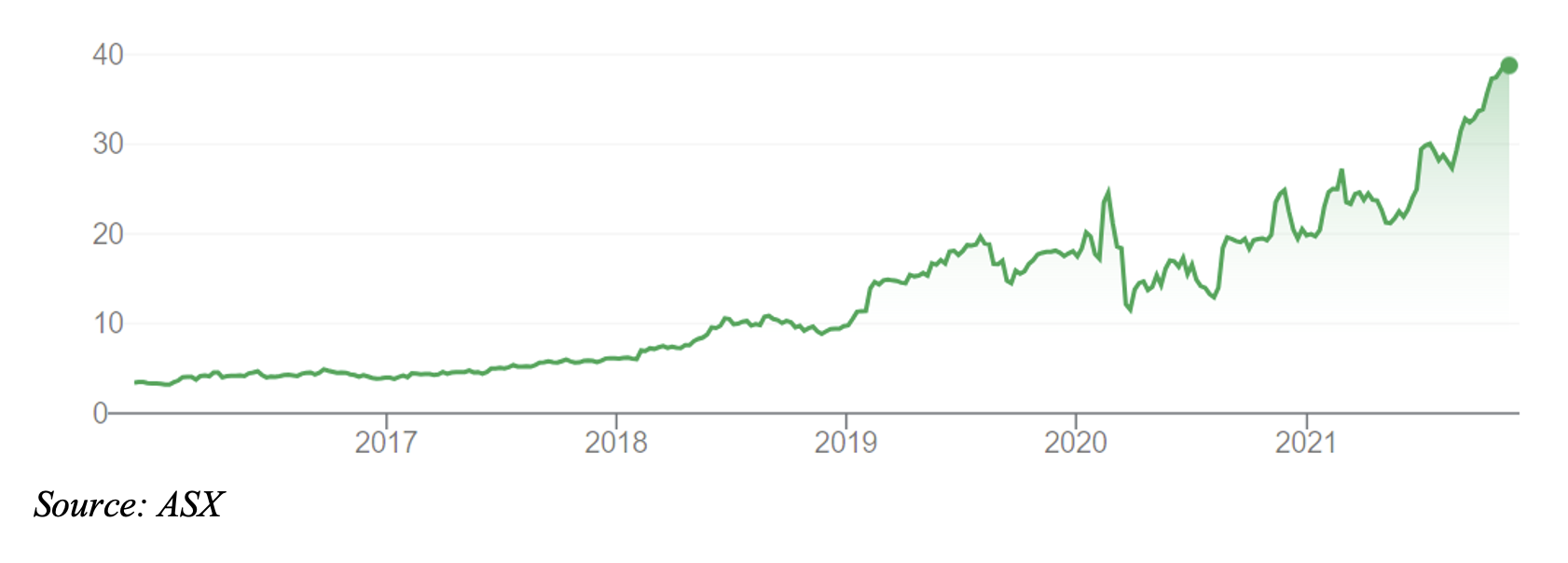

My preferred education stock over the years has been IDP Education. Two years ago, at the annual Switzer investment conference in Sydney, Peter Switzer asked which stock I would buy if I could only buy one. My answer: IDP Education. I’m pleased it’s done well for readers.

IDP Education (IEL)

Share-price gains in IDP will be slower from here, and a share pullback or correction wouldn’t surprise given the strength of its rally. But I wouldn’t sell IDP even at these levels, particularly as more international students return to Australia after Covid in the next few years.

Labour shortages will also increase pressure to lift intakes of skilled migrants. That would drive higher demand for IDP’s English-language training services.

2. Janison Education Group (JAN)

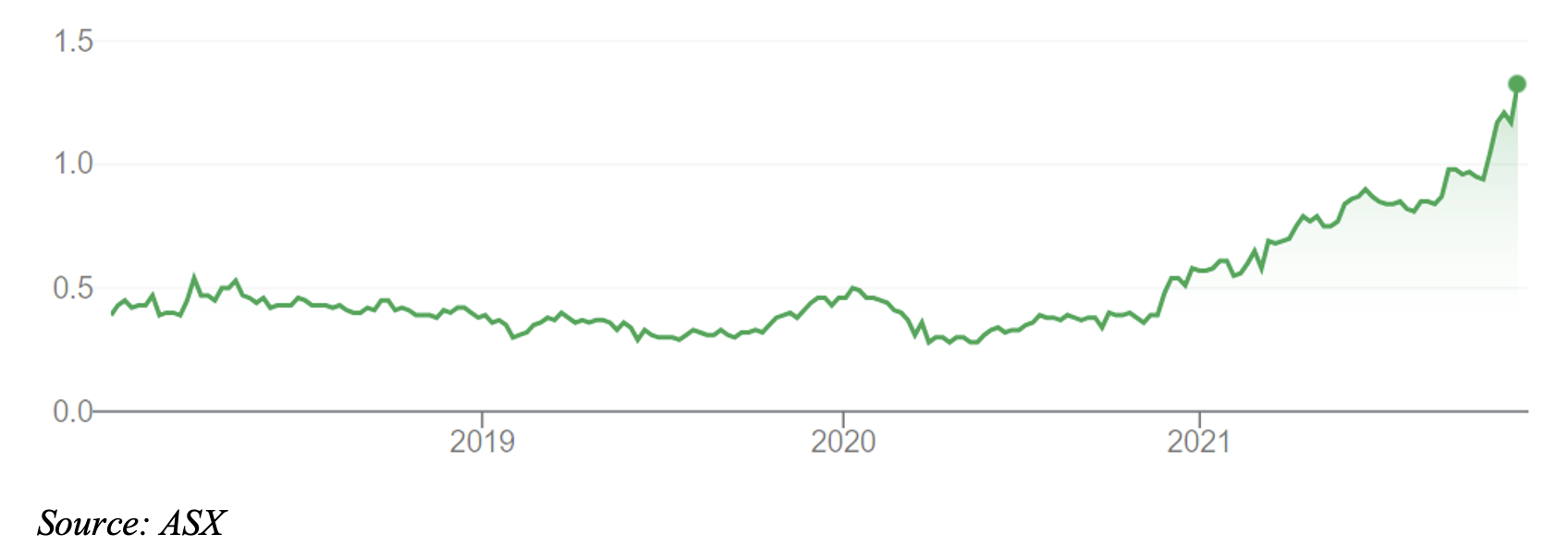

I first identified Janison, a provider of digital learning and assessment solutions, for the Switzer Report in August 2019 at 28 cents a share. Janison now trades at $1.33.

Janison Education Group (JAN)

Janison provides standardised assessment platforms. So far, the company has delivered 6 million digital exams in 117 countries. As more university students learn from home (rather than attend campus) digital exam delivery will grow.

In its latest trading update (released at its AGM), Janison said the global edtech market was worth US$261bn in 2021 and is growing rapidly. By 2025, the global edtech market will be valued at $404bn – or $63bn more than it would have been before Covid.

The pandemic has quickened the move to online learning and assessment. But an edtech market worth $404bn in 2025 is still only 5.5% of the total education market, notes Janison.

Yes, emerging tech companies love to wow investors with talk of giant addressable global markets. In Janison’s case, the estimates could be conservative, such is the push towards online learning.

Janison has an early-mover advantage in a large, growing global market: online assessments. Schools are worth just over half the global edtech market. They can be a hard market for edtech providers to crack, but a valuable barrier to entry once secured as customers. Janison has 3,500 school customers across many countries for its two main assessment products.

As for guidance, Janison expects strong underlying revenue growth in FY22 and continued gross margin growth. The company’s main performance metrics are heading in the right direction.

However, as with IDP, Janison is due for a share-price pause after its recent rally. Its stock was up 8% on the day I wrote this column, despite the absence of company news. Janison stock could be getting a little overheated. But there’s no doubting the company’s long-term prospects as more exams are delivered online.

3. ReadyTech Holdings (RDY)

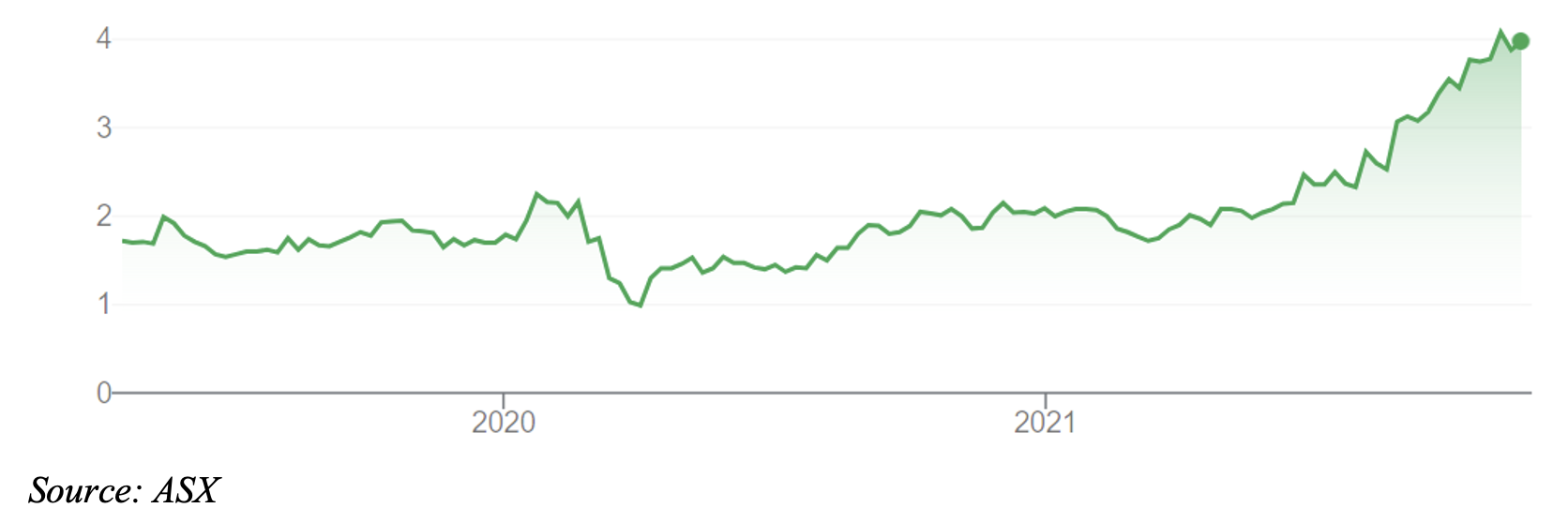

My other preferred edtech play is Readytech. It provides software that helps customers comply with regulatory and legislative reporting obligations, and manage large numbers of students and payrolls. Many universities and TAFEs use ReadyTech software for student administration.

I covered ReadyTech, Janison and 3P Learning (for this report in August 2020 (“Online learning races to front of class). ReadyTech shares have rallied in the past few months.

ReadyTech’s FY21 result impressed. Announced in late August, the result showed strong growth in Software-as-a-Service (SaaS) revenue growth and underlying earnings (EBITDA).

ReadyTech announced 21 new high-value customers across its education, workforce solutions and governance and justice divisions. The customers are worth a combined $5 million of annual revenue to ReadyTech, which should tick over, year after year.

Like Janison, ReadyTech is targeting a large, addressable market in tertiary education, training and government-funded back-to-work skills programs.

My initial favourable view on ReadyTech was based on its prospects in the corporate and government sectors. As the labour-market volatility increases after Covid, many organisations will have higher staff turnover and greater training needs.

In turn, more people undertaking training at universities, private colleges or other institutions means higher demand for software to record and manage this. Education institutions will need next-generation student-management systems that cover everything from student acquisition and enrolments, to graduation, work placements and alumni programs.

As with IDP and Janison, ReadyTech is due for share-price consolidation after the extent of its recent gains. Prospective investors should watch and wait for better value after some steam comes out of edtech share prices.

But there’s a lot to like about the long-term fortunes of Readytech as edtech transforms the global education sector.

ReadyTech Holdings (RDY)

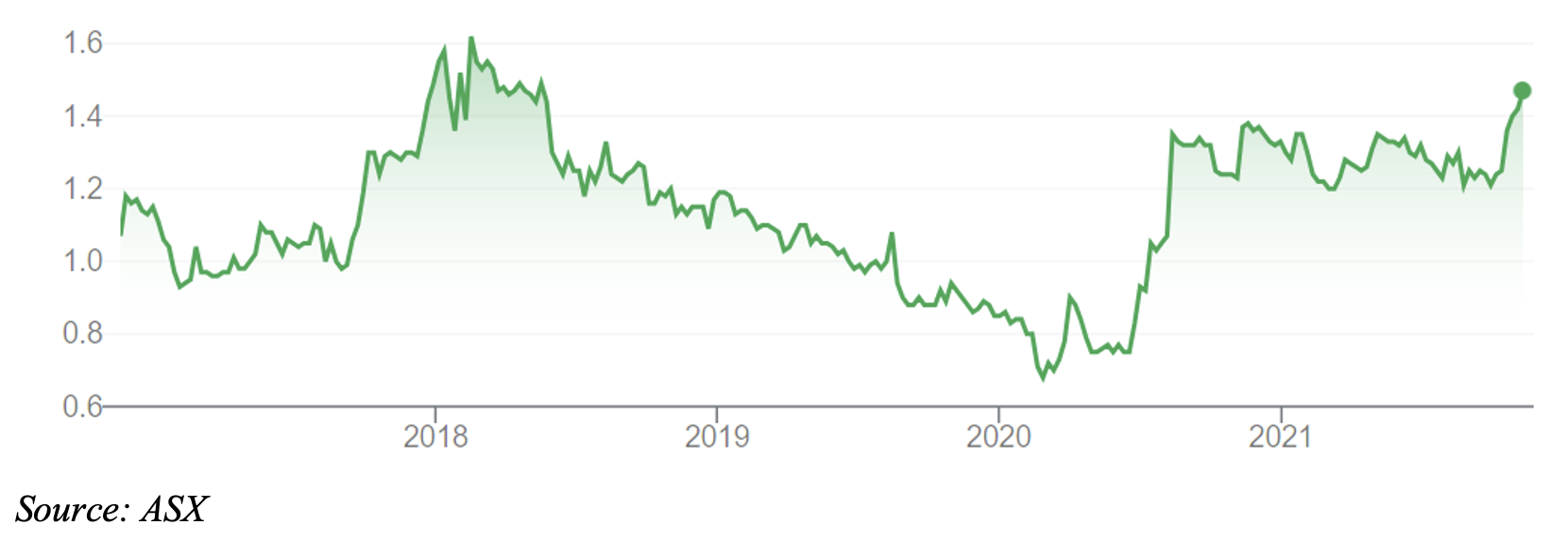

Briefly, 3P Learning (3PL), a provider of popular online learning programs, has also had a strong 12 months. Its shares have broken through price resistance at about $1.40, after tracking sideways for a year. Technical analysts should watch its chart.

I’ll cover 3P Learning in more detail in this report in coming weeks.

3P Learning (3PL)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 17 November 2021.