A friend recently asked for my top Exchange Traded Fund (ETF) ideas. Like many investors, he’s using ETFs tactically in his portfolio to capitalise on shorter-term market moves.

I’ve never liked the description of ETFs as “passive investments”. Buying and selling an ETF – particularly if used to tilt portfolio asset allocations – is hardly “passive” investing. It’s a form of active investing that’s rapidly becoming more popular.

Nor do I like black-and-white distinctions between active and passive investing. Active managed funds and stock selection, and index investing through ETFs, both have their place in portfolios. It’s not a question of one or the other, but how to blend different investment styles.

When Covid erupted in early 2020, readers will recall my bullish view on the global technology sector, which had outperformed after the 2003 SARS pandemic. And how I suggested using technology ETFs to capitalise on a badly oversold tech sector at the time.

The same was true mid-2020 when I became bullish on bank stocks. I initially suggested readers “buy the banking sector” through the VanEck Vectors Australian Bank ETF.

ETFs are an interesting tool for active investors because they provide market or sector exposure, meaning you don’t have to pick stocks – and take on company risk – during bouts of high share market volatility when uncertainty is rampant.

As open-ended funds, ETFs trade near their net asset value, unlike closed-ended funds, such as Listed Investment Companies (LICs) that can trade at large discounts or premiums. ETF liquidity (courtesy of market makers) makes them ideal tools for active investing.

ETFs have a chorus of critics, but their structure held up well during the Covid market meltdown, much to the chagrin of critics who thought ETFs could amplify market losses.

As with any investment product, always look under the “bonnet” to see what the ETF owns and its stock-selection criteria. Take extra care with thematic ETFs in sectors that have fewer large companies. Some thematic ETFs can be highly concentrated or include stocks that arguably are only loosely aligned to the theme, and held mostly in the ETF for liquidity reasons.

With global ETFs, consider using currency-hedged products. Unhedged ETFs are fine if you have a view on the Australian dollar’s direction, but if you want pure exposure to an underlying market, sector or theme – without a layer of currency risk – choose hedged ETFs.

Caveats aside, here are four ETF strategies to consider in FY22. Some of the ETFs below were among the worst-performed index funds last year.

My base case is a faster economic recovery in Europe next year (good for European equities) and continued strong global growth. That should underpin continued high commodity prices (good for the Australian dollar), rising demand for oversold energy companies (good for energy ETFs) and, in time, slightly higher inflation expectations and a weaker US dollar (good for gold).

Here’s a snapshot of each ETF:

1. Europe

The S&P Europe 350 index (in Australian-dollar terms) has returned 22.5% over one year and 8.3% over three years (on average each year) to May 31, 2021.

By contrast, the S&P 500 index in the United States has returned about 20% over one year and 17% over three years. Clearly, the US has massively outperformed Europe over three years.

That’s no surprise. Europe was in a weaker position economically than the US before Covid and Europe’s response to the pandemic (in terms of government stimulus) was far less aggressive. Britain’s messy exit from the European Union (Brexit) was another headwind.

The Eurozone’s negative 6.6% economic growth in 2020 compared to negative 3.5% in the US in 2020. European economic growth in 2021 (4.4%) will also lag the US (6.4%), according to latest forecasts from the International Monetary Fund (IMF).

But in 2022, the European economic growth rate will overtake that of the US as the Eurozone plays catch up. The IMF predicts 3.8% growth for Europe in 2022, versus 3.5% for the US.

As Europe narrows the gap with other advanced economies, European sharemarkets should outperform. Trimming asset allocations to US equities and increasing allocations to European equities for FY22 makes senses.

I’m not suggesting sudden or dramatic changes to global equities allocations in portfolios. But Europe could be among the best-performing markets in the next few years.

The iShares European ETF (IEU) provides exposure to 350 of Europe’s largest stocks. By country, almost 70% of IEU is allocated to the UK, France, Switzerland and Germany. IEU is unhedged, meaning its returns are affected by currency movements.

The BetaShares Europe ETF – Currency Hedged (HEUR) is an option for investors who want to eliminate currency risk. However, HEUR holds European companies that make a substantial portion of their profit outside the Eurozone. I’m looking for more exposure to European economies, so prefer IEU as a recovery play in the region.

From a charting perspective, IEU has just broken through previous price resistance from early 2020 – a potentially promising sign for technical analysts.

Chart 1: iShares European ETF

Source: ASX

2. Australian dollar

Predicting currency moves is always tricky – and a reason why most investors who want pure exposure to an underlying global asset should choose currency-hedged funds.

Still, I expect the Australian dollar, relative to the US dollar, to rise in FY22. Gains will be steady rather than spectacular. The AUD should trade above US80 cents by this time next year as the commodities boom continues and expectations of higher interest rates in Australia strengthen, amid signs of slightly higher inflation.

Also, the Greenback could lose a little steam in FY22 as markets become more concerned about US debt and slowing (though still strong) economic growth as the initial Covid recovery fades.

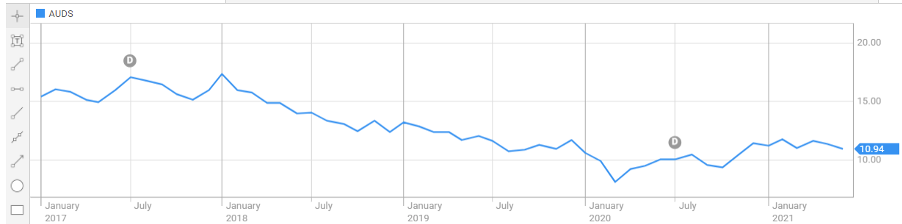

Australian investors seeking exposure to a rising Australian dollar relative to the US dollar could use the BetaShares Strong Australian Dollar Fund (hedge fund) (AUDS). The fund expects to return 2% to 2.75% for a 1% rise in the Australian dollar against the US dollar (and vice versa), on any given day.

AUDS has returned 35% over one year to May 31, 2021. But over three years, AUDS has an average annual return of almost minus 5%.

As a geared fund, AUDS suits experienced investors. Gearing magnifies gains and losses, so a 1% fall in the Australian dollar against the Greenback would amplify losses.

Risks aside, the Australian dollar should have a few tailwinds in FY22 thanks to the commodities boom, strength of our economy and growing risk appetite. The main risk is a larger Covid outbreak due to Australia’s underperformance with the vaccine rollout.

After being largely range-bound since 2015 (between US60-US70 cents), the Australian dollar should slowly climb a little higher in FY22.

Chart 2: BetaShares Strong Australian Dollar Fund (hedge fund)

Source: ASX

3. Energy Stocks

Global energy stocks have had a tough few years. The BetaShares Global Energy Companies ETF – Currency Hedged (FUEL) has returned -10.1% each year on average over three years to May 2021. The loss would be even higher if not for FUEL’s 25% return over one year.

Energy stocks badly underperformed as Covid sparked global recession and falling energy prices, and as capital rotated from fossil-fuel producers to clean-energy companies, such as hydrogen producers. The boom in funds using Environmental, Social and Governance (ESG) filters to choose stocks is a long-term headwind for fossil-fuel companies.

But every stock has its price. Global economic growth has rebounded strongly this year and energy multinationals, such as ExxonMobil and Chevron, have attractive yields. If energy share prices stay low, higher mergers-and-acquisitions activity in the sector is likely.

Either way, I expect the BetaShares FUEL ETF to have a better year in FY22. About half of FUEL is invested in integrated oil-and-gas companies. By country, about half of FUEL is invested in US energy companies, followed by those in Canada, The Netherlands and France.

Strong global economic growth will support higher energy demand, yet the energy sector has underperformed. ESG considerations in fossil-fuel companies have created a large valuation discount in energy stocks. That could be an opportunity in FY22.

Chart 3: BetaShares Global Energy Companies ETF – Currency Hedged

Source: ASX

4. Gold

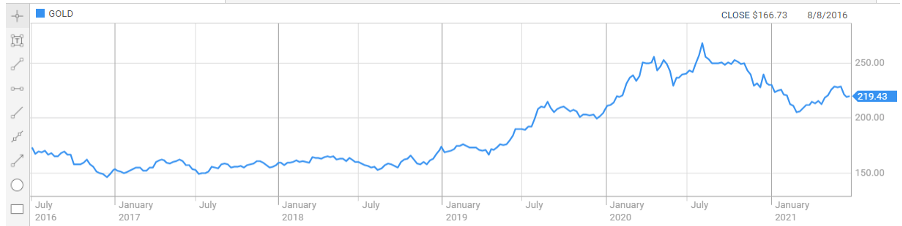

I include GOLD in this list for two reasons. First, most portfolios should have an allocation (0-5%) to gold as a form of insurance. It’s the old investment saying: include gold in your portfolio and hope it’s the worst-performing asset (if it is, equities will have rallied).

The second reason is more tactical. GOLD returned -6.1% over one year to May 2021 as investors favoured growth assets over defensive ones. Over five years, GOLD has returned an average 7.5% each year.

However, as inflation expectations rise in FY22, GOLD should have a better year. That’s not hard: it was among the five worst-performed ETFs in FY21, according to Stockspot, a leading online investment adviser.

The consensus market view is that higher inflation is transitory because of Covid-related supply-chain bottlenecks and labour shortages. Over 6-12 months, global supply chains will adjust to Covid shocks and will go back to minuscule global inflation rates, inflation doves argue.

I’m not so sure. Not for a minute do I think the world is on the cusp of 1970s-style inflation (when inflation hit 17% at one point), as some high-profile commentators have argued. Central banks didn’t have inflation-targeting regimes back then, so it’s not a valid comparison.

But nor am I convinced that higher inflation is just a Covid-related blip. The world is awash with government stimulus and hyper-accommodative monetary stimulus. Consumers, particularly in advanced economies, have stockpiled savings. Massive consumer demand could drive inflation a little higher than the market expects in FY22 – and provide a boost to gold.

The ETF Securities Physical GOLD ETF (GOLD) is the best way to gain exposure to gold bullion. It’s unhedged for currency movements, so take that into account.

I don’t expect big gains in GOLD in FY22. But as the global equities rally reaches new highs, adding extra portfolio protection through GOLD makes sense.

Chart 4: GOLD

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at June 30, 2021.