The dilemma of too-low “safe” yields but higher “riskier” yields isn’t going away for investors. At present, about the best that an investor can do on a 24-month term deposit from one of the major banks is an interest rate of about 0.3% to 0.4%. With a $100,000 investment throwing-off just $300–$400 of interest a year, it’s clear that income-oriented investors have to look elsewhere.

The move to listed shares for yield has been a compelling move over the last four years, even with the major caveats that come with share dividends. First, a stock market dividend yield can’t be considered as certain, because the dividend amount is at the discretion of the company, every reporting period. Second, when holding stocks for the dividend yield, you are incurring capital risk.

This risk blew-up in investors’ faces last February-March, in a general market slump, but no investor could say it hadn’t already shown itself: Telstra fell by 60% between February 2015 and June 2018 – heavily punishing investors who focused only on yield.

But while most investors have well and truly learned the lesson of incurring capital risk, the stark arithmetic of available yields continues to draw them back to the share market.

Here are three listed situations where investors can get 7% plus effective yields, with reasonably acceptable levels of risk.

1. Telstra (TLS, $3.02)

Market capitalisation: $35.9 billion

Three-year total return: –1.7% a year

Analysts’ consensus FY21 yield: 5.3% fully franked (7.6% grossed-up)

Analysts’ consensus valuation: $3.55 (Thomson Reuters), $3.48 (FN Arena)

Source: Google

Telstra has been a big disappointment for income investors in recent years, as the NBN rollout hit its earnings, and led to a succession of dividend cuts. It wasn’t that long ago that investors regarded 31 cents as a sacrosanct Telstra annual payout, but that was cut to 22 cents in FY18, and then 16 cents in FY19 and FY20.

But if Telstra can maintain that 16-cent payout over FY21 and FY22 – as the consensus estimate of Stock Doctor’s panel of 11 broking-firm analysts expects – that flows into forward (prospective) fully franked yields, at the current price, of 5.3% nominal, equivalent to 7.6% grossed-up. That will prove fairly attractive for income-oriented investors – especially with the analysts seeing scope for share price gains as well.

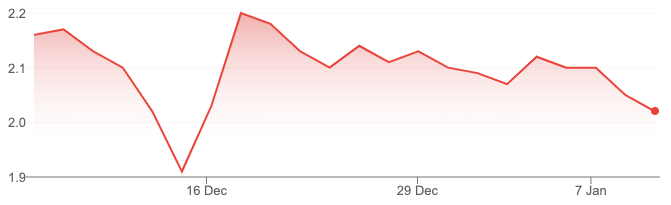

2. Dalrymple Bay Infrastructure (DBI, $2.05)

Market capitalisation: $1 billion

Three-year total return: n/a

Analysts’ consensus valuation: n/a

Source: Google

The income-bearing cohort on the ASX got a boost in December with the floating of Dalrymple Bay Infrastructure Limited, which holds the 99-year (including extension option) lease over the Dalrymple Bay Terminal, a coal export terminal that services miners in Queensland’s Bowen Basin.

It is the world’s largest metallurgical coal export terminal, handling 15% of global export metallurgical coal volumes in 2019. DBI generates revenue from its users through access charges, with all terminal operating costs passed-through to the users.

DBI is the only coal terminal in Australia that is regulated, and provides a regulated utility-like risk profile that is expected to deliver predictable and stable cash flows. Importantly, there is no volume risk – the terminal charges users for access to its export capacity on a take-or-pay per contracted-tonne basis, and the terminal is fully contracted from 2023 to 2028. Yes, it is a coal investment – but 80% of its throughput is steelmaking coal. The way in which revenue is derived minimises DBI’s exposure to volume, coal price and operating cost risk.

DBI is seeking to have its regulation changed to allow it to negotiate with its customers individually, rather than have the Queensland Competition Authority (QCA) set its revenues. Broker Morgans is bullish on the earnings upside that could come from this decision, which will be made shortly, and will apply from 1 July.

In its prospectus, DBI committed to paying a 7% unfranked yield on the IPO price of $2.57. With DBI now trading at $2.06, that prospective yield has lifted to 8.7% – one of the highest yields available on the ASX in the utility-like space, with much of the risk mitigated. DBI also committed to growing its dividend at 1%–2% a year (but it is unlikely to be franked for a number of years, given that DBI is not expected to be in a tax-paying position). However, to boost the potential total return, broker Morgans has a $2.50 price target on DBI.

3. MyState (MYS, $5.01)

Market capitalisation: $461 million

Analysts’ consensus FY21 yield: 5.2% fully franked (7.5% grossed-up)

Analysts’ consensus valuation: $5.43 (Thomson Reuters)

Source: Google

Tasmanian-based bank MyState is chugging along quite nicely in its strategy of building a highly scalable digital banking and funds management business capable of attracting retail customers across Australia’s eastern states. More than 60% of the home loan book is now outside Tasmania, with the home loan portfolio growing by 5.1% to $5.1 billion in FY20, while deposits increased by 7.6%, to $3.9 billion.

I looked at MyState in January 2019 as a yield stock: at $4.57, it offered an FY19 estimated yield of 7% fully franked, based on an analysts’ consensus expectation of a dividend of 30.8 cents. In the end, FY19 saw a full-year dividend of 28.75 cents, for a yield of 6.3% fully franked, or 9% grossed-up. The analysts’ consensus target price at the time was $5.00. Here we are a year later, and MYS has achieved that consensus target price – it recently traded at $5.01, and is now at $4.95.

However, the business was hurt by COVID in FY20. MyState reported a net profit that was down 3%, to $30.1 million, and took an impairment charge of $4.9 million (half of that related to COVID and half an increase in the general reserve). Without the charge, earnings would have risen by 12.9%. MyState did not pay a final dividend, so the full-year dividend remained at the interim payout, of 14.25 cents a share. The directors said the board expected to resume dividends for the first half of FY21.

MyState has started FY21 well – the first quarter showed a 20.6% increase in core earnings – and analysts expect earnings per share (EPS) to grow by 14.7%, to 37.7 cents, with a full-year dividend of 26.2 cents. That places MYS on a prospective fully franked yield of 5.3%, or 7.6% grossed-up. For FY22, analysts’ consensus expects a dividend of 28.3 cents, implying a prospective fully franked yield of 5.7%, or 8.2% grossed-up. And with Thomson Reuters showing an analysts’ consensus valuation of $5.43, the total-return prospects for MYS look attractive once more.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.