In a weekly investment column, there’s always pressure to provide new investment ideas. Understandably, some readers want a steady stream of new stocks to consider.

But in my experience, stock selection is not always the biggest driver of long-term portfolio returns. Asset allocation – and knowing how to allocate capital – matters more.

That’s not to downplay the importance of buying quality companies when they trade below fair value. Or to overlook the damage from owning overvalued rubbish.

Yet for many investors, the real challenge is portfolio construction and maintenance. That is, knowing how much of your portfolio to allocate to global and Australian equities, fixed income, alternatives and cash – and when to change those allocations.

Perhaps the most complex – and important – asset-allocation decision is how much cash (or cash equivalents) to hold in your portfolio. Cash is not just a defensive asset; it provides the firepower to buy shares when markets tumble and bargains emerge.

Cash is most valuable when nobody has it. Sadly, I recall being fully invested in global equities in the lead-up to the 2008-09 Global Financial Crisis (GFC). The only way to buy more shares as prices tumbled was to liquidate holdings and cop heavy losses.

That’s often how it goes for many retail investors. They are fully invested at the top (often, late to the party), and don’t have available cash on the way down. They are at the market’s mercy, unable to take advantage of heightened volatility by putting cash to work.

In some ways, the most important (and hardest) decision is knowing when to hold more or less cash, as market conditions dictate. This decision separates investors who know when to take profits and hold more cash from the rest.

Now is a good time to reconsider the right level of cash for your portfolio and whether it’s worth holding a higher cash allocation in the next few months.

To be clear, I’m not suggesting readers liquidate their portfolio, take the cash and run for the hills. The Australian share market looks neither cheap nor expensive. It’s about right (or possibly a touch overvalued).

But I can see a more volatile Australian equities market over the next few months. That will present opportunities for bargain hunters to pounce.

As we head into the reporting season next month, expect to see more companies issue gloomy guidance on their outlook. Although the results will give a glimpse of the pressures on consumer spending, the real earnings pain will be in FY23.

The pain consumers face now is nothing compared to what’s ahead in the next 12 months as the full brunt of rate rises is felt and more fixed-rate loans move over to much higher variables, devouring surplus household income.

Some crucial interest-rate decisions in the next few months could also exacerbate market volatility. Yes, every rate decision is important. But as we approach the peak terminal cash rate (another rate rise or two, probably), the pain on households is palpable.

Again, I don’t expect a recession. We should narrowly avoid a technical recession (two quarters of negative GDP growth), although it will feel like one on a per-capita basis.

However, the odds of a recession could shorten further in the next few months if it looks like the economy is not cooling quickly enough and that further rate rises are needed.

Either way, it’s a good idea to have a little more cash in portfolios in the third and further quarters (particularly around the seasonally weak September/October period).

Here are three ways to gain cash exposure through Exchange Traded Funds (ETFs). The main benefit of cash ETFs is liquidity. Unlike term deposits, you’re not locking your capital away with cash ETFs. The downside is cash ETFs yield a little less.

- BetaShares High Interest Cash ETF (ASX: AAA)

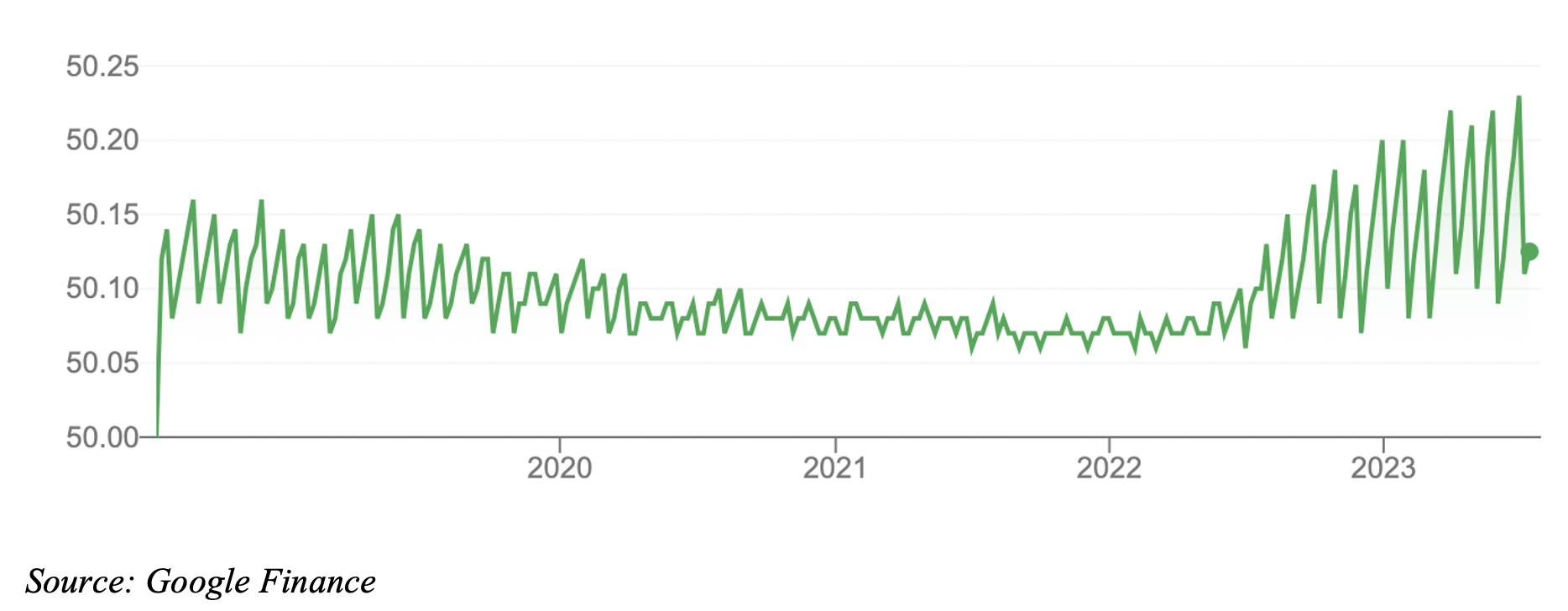

AAA is by far the largest cash ETF on ASX with $3.26 billion in assets under management in early July 2023.

The ETF provides exposure to Australian cash deposits by investing in deposits held in select Australian banks. Interest from AAA is paid monthly at a rate that is competitive with ‘at call’ term deposits and bank deposits.

Like term deposits, AAA’s return should rise as the official cash rate rises and banks pass some of that on through higher deposit rates. Also, AAA has only cash deposits with major banks, meaning it provides capital security and stability, just like cash.

AAA’s current interest rate is 3.91% (after fees). Some term deposits currently pay a variable rate of over 5%, but that can include a honeymoon rate or other conditions (such as regular deposits or use of bank credit cards).

For investors who understand the value of liquidity, sacrificing some cash return through an ETF makes sense.

Much depends on your investment style: long-term investors who buy and sell infrequently might prefer term deposits that pay higher rates (and lock funds away). Active investors who buy and sell more often could use cash ETFs.

AAA’s annual cost is 0.18%.

Chart 1: BetaShares High Interest Cash ETF

- iShares Core Cash ETF (ASX: BILL)

BILL tracks the S&P/ASX Bank Bill Index. The goal is capital preservation and regular income through a diversified portfolio of short-term money-market instruments.

BILL only holds investments that can be sold on a same-day basis, many of which come from international banks. The ETF had an average yield-to-maturity of 4.28% at end-June 2023, according to iShares data.

BILL has a slightly higher return and risk profile than AAA. BILL wins on the fee front with an annual management cost of just 0.07%.

Of the two cash ETFs, I prefer AAA over BILL, principally because the former invests in term deposits of major Australian banks, which I know better.

Still, there’s not much between them. BILL had $676 million in assets at end-June 2023, suggesting there’s good demand from investors who want higher returns from cash ETFs.

- iShares Core Cash ETF (ASX: BILL)

- BetaShares US Dollar ETF (USD)

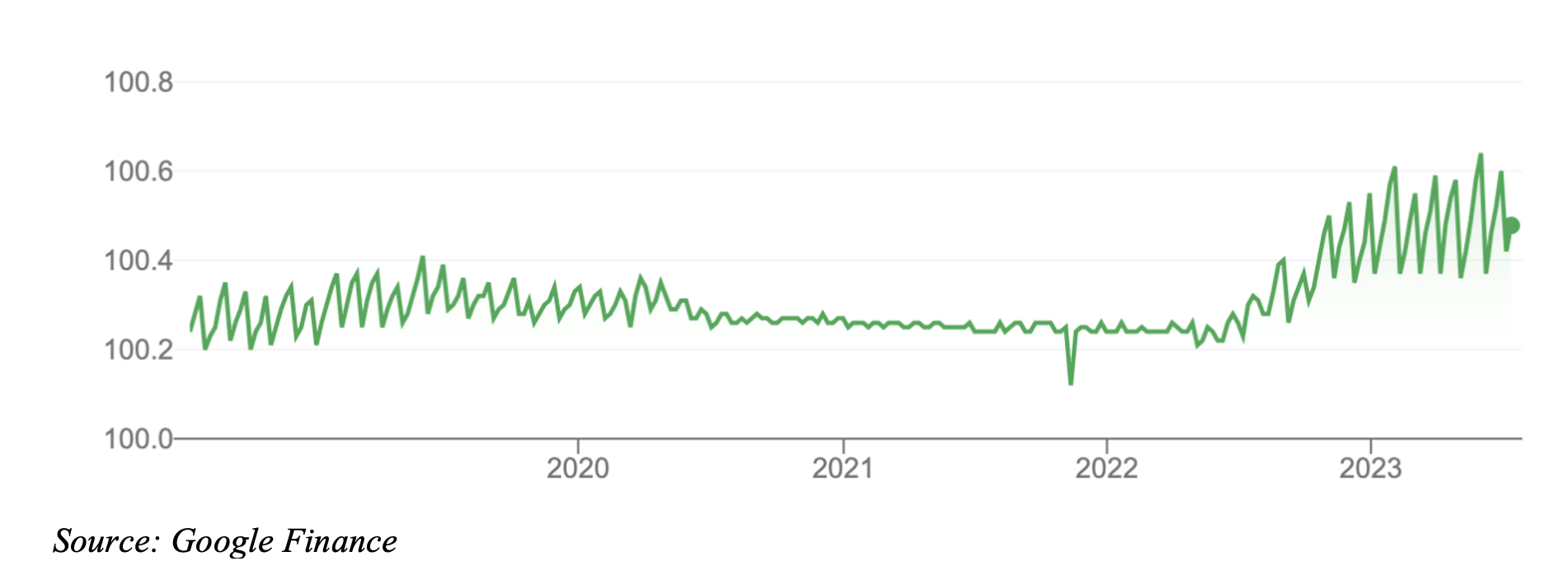

Betashares’ US Dollar ETF (USD) is a currency rather than a cash ETF, and not a strategy for conservative investors or those whose only focus is portfolio liquidity through cash.

Risks aside, ETFs like USD that hold assets in offshore bank deposits can be a source of yield and liquidity. With US interest rates above those in Australia – and likely to stay that way for some time – US bank deposits have relatively higher rates compared to their Australian equivalents.

USD tracks the performance of the Greenback against the Australian dollar. If the US dollar rises 10% against the Australian dollar, the fund is designed to rise 10%, and vice versa. USD holds its capital in US-dollar bank deposits.

At end-May, USD earned 14.09% over one year. Within that was a 4.63% interest rate (the rate earned on USD’s bank deposits). USD is not designed to provide income and distributions are “at least annually” according to Betashares, rather than monthly.

The key issue is currency risk: a falling US dollar against the Australian dollar would hurt returns. Investors in USD obviously need a view on our currency, not just an appetite for higher returns from US bank deposits compared to those in Australia.

Chart 3: BetaShares US Dollar ETF (USD)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 12 July 2023.