Two wine bars are about to open in my area, joining a handful of others nearby that have started in the past 12 months. So much for COVID dampening socialising.

Trendy wine bars are becoming a bigger feature of inner-city suburbs, and yet another sign of a fast-changing liquor market, as consumer tastes and behaviours change.

Today’s twentysomethings are likelier to drink craft beer and cider in trendy pubs or at home. Pleasingly, fewer young adults drink alcohol compared to 20 years ago.

Cyclical and structural change – and left-field events, such as Chinese wine tariffs – is creating opportunity in Australian alcohol-related stocks, after heavy share-price falls last year.

COVID is driving cyclical trends. The pandemic initially boosted online and takeaway alcohol sales, as people stocked up and alcohol consumption increased. With pubs and hotels closed, both here and overseas, more beer and wine has been consumed at home.

That’s not enough to offset the decline in alcohol sales in pubs, clubs and restaurants, particularly overseas where COVID is rampant. European Union beer sales dropped by at least 20% last year, according to industry reports.

Australian companies exporting alcohol or its ingredients, such as malt, have had a hellish time. But they have good recovery prospects when European, UK and US lockdowns are lifted.

Industry forecaster IBISWorld said in a recent report on the beer-manufacturing industry: “Once COVID-19 is contained, economic conditions are projected to improve substantially. The industry is expected to recover over the five years through 2024-25.”

Long-term structural trends appeal. Continued strong growth in premium and craft beers is likely, as traditional beer consumption declines. Alcohol consumption per capita might be falling, but we’re drinking pricier alcohol that has higher profit margins.

Next time at the bottle shop, look at how many craft beers and ciders are in the fridges. And how many boutique whiskies, gins and other spirits are being offered.

With that will come even more of a tie-up between large brewers and independent providers, small alcohol outlets (such as wine bars and micro-breweries) and less demand for traditional beer and large pubs, some of which will have to reinvent themselves.

Choice in alcohol stocks on the ASX is limited. Treasury Wine Estates (TWE) is by far the largest player and United Malt Group (UMG) is an interesting new opportunity after its demerger from GrainCorp (GNC).

Australian Real Estate Investment Trusts that own pubs are another way to play the trend. ALE Property Group (LEP) and Hotel Property Investments (HPI) are the main choices.

Micro-caps include Digital Wine Ventures (DW8), Good Drinks Australia (GDA), Broo (BEE), Australian Vintage (AVG) (owner of McGuigan Wines) and the impressive whiskey-focussed Lark Distilling Co (LRK) (I’ll cover Lark in a future column). Maggie Beer Holdings (MBH) is another option due to its cellar products, but is mostly a food company.

Here are ways to play a global recovery in alcohol sales in the next two years, assuming COVID is eventually contained in Europe and the US. And also to benefit from long-term structural change as demand for higher-margin boutique alcohol increases.

1. Treasury Wine Estates (TWE)

China’s decision in November to introduce massive tariffs on Australian wine heaped more pain on TWE, a former market darling. The stock has almost halved from its 52-week high to $8.98.

The tariffs basically shut TWE’s most lucrative export markets, and a key profitability driver. Although China accounts for less than 10% of TWE export volumes, it is a bigger contributor to the company’s profitability, due to sales of Penfolds and other premium wines.

TWE is reallocating wine exports to other global markets. But that strategy will take time to implement, particularly during a pandemic. Other export markets are unlikely to replace all the lost income and China’s hard-line stance on trade with Australia is intensifying.

Lots of bad news is factored into TWE’s share price. Morningstar expects the company to have limited income growth over the next two years and for its profitability to trail global wine leaders.

Although near-term volatility will persist, Morningstar expects an earnings rebound in TWE over the longer term and values it at $11 a share.

TWE is bombed out due to all the negativity around China’s tariffs. That is an opportunity for contrarian, long-term investors to buy into Australia’s wine star at a depressed price.

Chart 1: Treasury Wine Estates (TWE)

Source: ASX

2. United Malt Group (UMG)

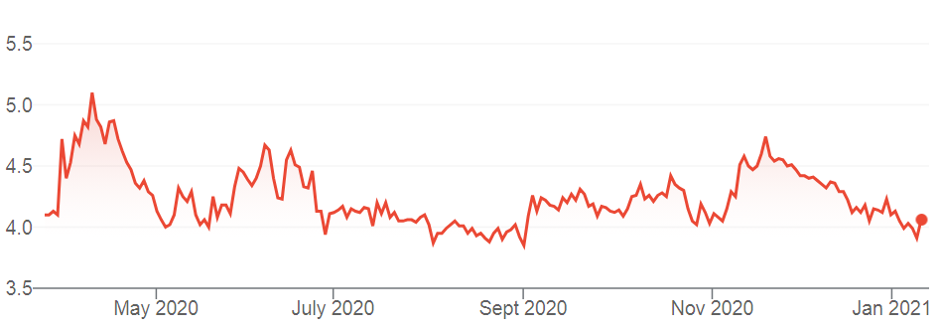

UMG has had a challenging 12 months after demerging from GrainCorp in 2020 at the peak of the pandemic. The stock is down from a 52-week high of $5.24 to $3.91.

UMG is the world’s fourth-largest commercial maltster with 13 processing plants in Canada, the United States, Australia and the United Kingdom. Customers for its malts include global brewers, distillers, craft brewers and food companies.

Beer production accounts for 90 per cent of global malt demand. Growth in emerging markets should underpin demand for beer (and thus malt) over the next five years.

Craft beer is important for malt producers because it requires higher malt inclusion rates and better-quality malts. UMG is strong in US craft beer, a booming growth market.

UMG has been affected by lower demand for craft beer with governments here and overseas locking down on-premise alcohol consumption at different times. With pubs shut, people bought more alcohol for the home, but that tended to favour cheaper beers (with cheaper malts).

UMG’s revenue fell 2.1% to $1.3 billion in FY20, due mostly to lower malt demand and a change in product mix. The company expects subdued malt volumes until social-gathering restrictions are lifted and mass gathering returns overseas.

UMG has done a good job during the pandemic. Its malt volumes are around 90% of pre-COVID levels, yet the share price is well off its 52-week high. The company has a strong market position, is well run and governed and is expanding nicely in Scotland and other markets.

UMG could be an unheralded winner when COVID is finally contained, craft-beer demand resumes its upward trend and global demand for the company’s malts recovers.

Chart 2: United Malt Group (UMG)

Source: ASX

3. Digital Wine Ventures (DW8)

I’m reluctant to include speculative, thinly traded micro-caps in this column. But the more I look at Digital Wine Ventures the more interested I am in its strategy and early performance.

I emphasise that DW8, capitalised at $72-million, suits experienced investors who understand the benefit, features and risks of investing in emerging companies.

DW8 has big plans. It wants to invest in early-stage technology-driven ventures that can disrupt parts of the global beverages industry. Its core WINEDEPOT business uses a cloud-based, software-as-a-service platform to drive direct-to-market wine sales.

DW8 said WINEDEPOT shipped almost 25,000 wine cases in December, up more than 1,000% month on month (off a low base). The company’s orders more than doubled.

It’s an good strategy. Add more Australian and international wine producers to the platform, attract many more customers, and run faster than competitors. Then, get customers to spend more through digital marketing, loyalty promotions and wine clubs.

WINEDEPOT’s potential is connecting regional wineries to city-based customers. And using its technology to offer same/next-day wine delivery at lower rates. Winery deliveries can be expensive and take 7-10 days to complete, which is too long for many customers.

WINEDEPOT has a network of strategically located depots that hold inventory on consignment. Like other successful online marketplaces, it can potentially solve problems for suppliers and buyers, and take a lucrative cut as it connects them.

It’s early days for DW8 and many execution risks remain. But interest in boutique wineries is rising, just as demand for craft beers keeps growing.

A dominant online marketplace that enables smaller wine producers to tap a larger wholesale and retail market – and improves their supply-chain efficiencies – is yet to emerge in Australia.

That explains recent gains in DW8’s share price to 5 cents. If the company can rapidly add more wine producers and customers, and deliver large gains in case volumes, the price has upside.

DW8 said it is unaffected by China’s wine tariffs. If anything, the tariffs could benefit DW8 if more Australian wine that was headed for China is sold locally, at lower prices.

Chart 3: DW8

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 12 January 2020.