In last week’s column, I considered what teenagers might buy when lockdowns in NSW and Victoria end – and companies that will benefit. This week’s column examines services for younger consumers.

To recap, I argued that teenagers were among the most affected by Covid lockdowns, so would be a source of stronger demand when they’re able to live normally again.

My preference was youth-focused retailers: fashion group Universal Store Holdings (UNI), disposable-jewellery provider Lovisa Holdings (LOV), and shoe chain Accent Group (AX1). Of them, Accent looks most interesting on valuation grounds after heavy price falls during the latest lockdown.

I’m extending that focus to companies that provide services for teenagers and twentysomethings. Think movies, theme parks, gyms and thrill-seeking adventures. I know at least a few teenagers eager to go to the movies with their friends!

The international experience with lockdowns ending is instructive. Gym membership in some countries is above pre-Covid levels. Travel demand has skyrocketed. Cinemas are less clear-cut, with demand lagging in some markets. But that could be because of fewer blockbuster releases.

Yes, it will take time: probably another six weeks in Victoria before life returns to something like normal. Also, expect some parents to be reluctant to allow their kids, even if fully vaccinated, to visit shopping centres or cinemas as Covid infections peak in the summer.

Timing aside, it’s a no-brainer that teenagers and twentysomethings, like everybody else, will crave outings when lockdowns end. Pent-up demand for experiences will be huge.

The key is valuation. Most companies leveraged to the “reopening” have already rallied. Some look badly overpriced and overhyped. The trick is finding stocks that

- will benefit from permanently higher demand,

- have used the crisis to restructure the business and become more efficient or

- look undervalued because the market is not sufficiently rating them.

Experienced investors comfortable with the features, benefits and risks of micro-cap investing could consider theme-park operator Ardent Leisure Group (ALG) or ExperiencCo (EXP), a provider of skydiving experience and higher-risk recovery play.

I prefer these two companies that will benefit when lockdowns end and young people pour money saved up during Covid into experiences – just as they should.

1. Event Hospitality and Entertainment (EVT)

The property and entertainment group is focused on young and older consumers. Event’s hotels and resorts business includes Rydges and the Thredbo Ski Resort in NSW. In cinemas, Event owns Greater Union and other chains in Australia, New Zealand and Germany.

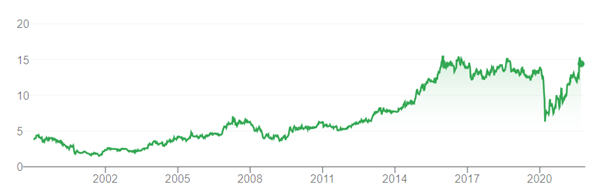

Event was pummelled when global equities markets crashed in March 2020. Its shares slumped from almost $14 in early 2020 to $6.30 in March. At one point, Event was trading at its net asset backing (after subtracting debt). The market ascribed no value to its operations.

Event has since rallied to $14.45, but is only back to levels achieved in 2018. Take out the “V-shaped” fall and rise, and Event has mostly traded sideways for the past five years. As crazy as it sounds, the pandemic could set Event up for sustained higher earnings growth.

I’m most interested in Event’s entertainment business, which is about half its revenue. Event said there was an immediate return of patrons when cinemas traded between lockdowns. Customers not only returned to the movies; they spent more on a premium cinema experience, having been starved of going to the flicks during lockdown.

Three factors bode well for Event’s cinema business.

First, a longer lockdown should mean even greater pent-up demand to go to the cinema and buy premium tickets.

Second, blockbuster movies will be released in summer as lockdowns end. Several big movie franchises are in the “can” and waiting to be released. These include the next James Bond movie, the Tom Cruise Top Gun sequel, Dune, The Matrix 4 and so on.

Assuming people feel confident to attend the movies when lockdowns end, this could be a great summer for local cinemas given the amount of blockbuster content on the way.

Third, Event has cleverly used the crisis to rationalise aspects of its entertainment business, such as cinema opening times. It will emerge from the crisis with a leaner cinema business and better services as it invests in the “cinema of the future”.

A rebound in cinema patronage should be accompanied by stronger demand for Event hotels and resorts when lockdowns down. Heaven knows, many of us want to travel.

The bears might argue the market has already priced in stronger demand for Event hotels and cinemas when lockdowns end. At $14.45, Event is on a forecast Price Earning (PE) multiple of almost 25 times, which on paper looks pricey. Morningstar values Event at $12.

I see it differently. Event can grow faster than the market expects in FY22 (which would put it on a lower PE). That, of course, depends on NSW and Victoria opening up in the next two months, and not being forced into lockdown again in 2022.

I don’t believe the market fully appreciates the progress the well-run Event is making during Covid. Or Event’s leverage to a recovery in cinema and hotel demand in 2022. Also, I don’t buy the argument that fewer people will go to the movies because of rising demand for streaming content services. Plenty of people have written off the cinema business over the years, yet it remains an entertainment mainstay.

Chart 1: Event Holdings (EVT)

Source: ASX

2. Viva Leisure (VVA)

The Canberra-based gym owner listed on ASX in June 2019 through an Initial Public Offering (IPO) that valued Viva at $52.6 million. Established in 2004, Viva had 29 clubs at listing, and was due to buy another three and open another eight.

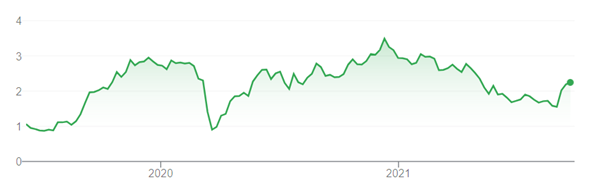

The market couldn’t get enough of Viva when it listed. The company’s share, offered at $1, rallied to about $3 within a month of listing. When Covid struck, Viva sank to 90 cents.

It didn’t stay there long. Viva soared to $3.49 in December 2020 as the market looked forward to gyms reopening. But the stock more than halved this year as lockdowns emerged in NSW and Victoria. It has since rallied to $2.02.

Care is needed with share-price comparisons before and after Covid. Viva raised $11.7 million in an institutional placement in August (so has more issued shares) to shore up its balance sheet.

Still, Viva has been a rollercoaster ride for investors since the float (and an excellent ride for those who bought during the IPO and held their shares). That is to be expected in an industry that is among the first to close and last to reopen when lockdowns bite.

Viva rallied this month as the market looks focused on gyms reopening in NSW, Victoria and the Australian Capital Territory later this year. But there’s more to Viva’s progress than lockdowns ending.

The company has done an excellent job during Covid. In June 2020, it had 79 locations. In July 2021, that had grown to 115 locations. Viva is adding to its network in the ACT and NSW with faster growth in Victoria and more recently in Queensland, off a low base.

Memberships at its owned locations are up 33% over the year, thanks to acquisitions and gym openings. Viva has the balance sheet and scale to grow rapidly through acquisitions and organic growth – and become the market’s only specialist exposure to the health-club sector.

Covid has been a massive disruption for the gym industry, but also an opportunity for cashed-up gym operators, such as Viva. I expect Viva will have many more acquisition opportunities, at better prices, after the pandemic as smaller operators leave the industry.

Longer-term, it almost seems mandatory for younger people to have a gym membership these days. My local gym was full of older teenagers and twentysomethings before Covid. Some used their gym session as much to catch up with friends and socialise, as they did for fitness.

When lockdowns end in NSW and Victoria, watch gym memberships roar back to life as more people crave a workout – or want to lose extra pounds gained during Covid.

That’s good for Viva in the short term. But its long-term story is about building a much larger, national gym network and greater economies of scale.

Chart 2: Viva Leisure (VVA)

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 21 September 2021.