Market talk about another potential commodity “supercycle” inevitably focuses on the market’s largest miners. Less considered are the downstream beneficiaries of higher commodity prices: mining service and mining technology companies.

Higher commodity prices encourage capital raisings in the resource sector. More miners raise funds to explore tenements or move them into production. That’s good for mining service companies and a new breed of mining software suppliers.

In June 2021, I wrote favourably on the outlook for mining-service providers in the article ‘My favourite four companies to emerge from the shadows’. I argued that mining-service share prices had fallen too far given the prospect of rising commodity prices.

I included four stocks in that feature:

- ALS (ALQ); a laboratory-services provider that analyses mining and other samples.

- Worley (WOR); an energy-services provider.

- NRW Holdings (NWH); a mining-services company.

- Mastermyne; a micro-cap coal services group (now MetaRock Group (MYE)).

My call on mining-service stocks was a touch early. I underestimated labour shortages in mining services and wage pressures. Risings costs are never good for companies that rely on the fixed-price contracts that are usually negotiated with mining giants.

This year is a different story. Several mining-service stocks have rallied in the past few months, after some tough years. Investors, it seems, are becoming more interested in the effect of higher commodities prices on mining-services demand.

It’s a better time to look at mining service stocks, although I caution that the sector does not suit conservative investors. Smaller mining-service stocks can be volatile and are not set-and-forget investments. They need to be bought and sold during mining cycles. They can be caught with idle, depreciating equipment and lots of debt.

Mining technology companies are an interesting part of mining services. Australia has a terrific record in METS (Mining Equipment, Technology and Services). That’s no surprise given the calibre of Australia’s resources sector.

As an aside, Australia’s success in METS provides a blueprint for other tech industries. That is, build world-leading technology clusters around our existing industry strengths; agtech in agriculture or edtech in higher education are examples.

Demand for mining software has excellent long-term prospects. Automated trucks and drilling rigs are just the start of what’s ahead. More sensors in equipment mean more parts of a mine talking to each other through the Internet of Things. That creates oceans of data for artificial intelligence to analyse in order to optimise mine efficiency.

Advances in exploration technology are another key development. The latest software is helping mining companies understand more about orebodies before they drill. By “frontloading information” they reduce the risk of costly exploration failures.

However, there are not many mining-software companies to choose from on ASX. That’s a shame given Australia’s success in this field and the long-term prospects for mining technology that increases mine productivity and aids orebody analysis.

The good news is we have strong companies within that small group. The best of them is IMDEX (IMD), the star provider of drilling technologies and analytics software for geographical modelling. RPMGlobal Holdings (RUL) is another quality provider.

Among smaller stocks, EnviroSuite (EVS) develops and sells environmental-intelligence technology solutions. The technology monitors noise, dust, water quality and a range of other mining data, providing real-time info on site.

At the micro-cap end, K2fly is a mining-tech business that provides land and resources management, and Environmental, Social and Governance services. K2fly is well placed for higher demand for ESG information in mining, but its stock is down over 12 months.

For portfolio investors, IMDEX and RPMGlobal Holdings are the best bets. Here is a snapshot of their prospects.

1. IMDEX (IMD)

IMDEX has emerged as one of the market’s best small-cap stocks. The one-year total return (assuming dividend reinvestment) is 42%. Over five years, the annualised averaged return is a whopping 36%. IMDEX is now worth $1.06 billion.

The company provides drilling-optimisation products and technologies that enhance drilling productivity, safety and environmental impact. IMDEX also provides rock knowledge sensors on rock location, grade, mineralogy and texture, and real-time mining data and analytics through its cloud-based software-as-a-service.

In February, IMDEX reported 35% revenue growth to a record $167.8 million for the first-half of FY22. Net profit rose 81% to $24.4 million. The company’s profit margin rose 15%, reinforcing its ability to leverage fixed costs.

IMDEX noted increasing demand for mining-technology solutions in all its key regions. Demand for its services in Australia and the Americas was at or near full capacity, there was steady growth in Europe and Africa, and Southeast Asia was improving.

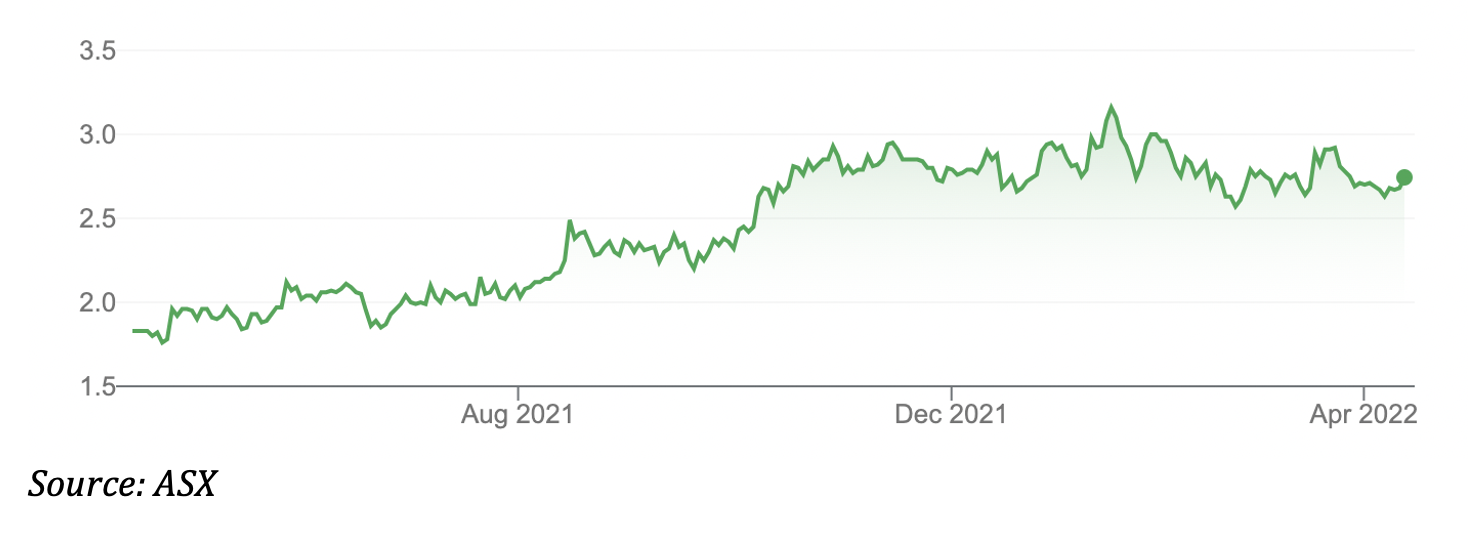

There’s a lot to like about IMDEX. It’s a genuine global leader in a market with good growth prospects. The issue is valuation. At its 52-week high of $3.25, IMDEX had run too far, too fast. It was hard to buy the stock at that price.

Now back at $2.65, IMDEX looks more interesting. That price compares to a consensus analyst forecast of $3.20, suggesting reasonable upside in IMDEX. Care is always needed with consensus forecasts because small-cap stocks are not widely covered by brokers. Good judges like Macquarie and UBS have price targets above $3 for IMDEX.

At $2.65, IMDEX trades on a forecast Price Earnings (PE) multiple of about 20 times FY23 consensus forecasts. That’s not excessive for a company of its quality.

From a technical analysis perspective, IMDEX has been range-bound since about October as the market digests its price gains. Chartists will want to see IMDEX stay above price support at about $2.50 and break through resistance near $3.

IMDEX (IMD)

2. RPMGlobal Holdings (RUL)

Like IMDEX, RPMGlobal has also performed well. Its one-year total return is 22%. Over five years, the annualised average total return is 25%.

The Brisbane-based company provides software for mine scheduling, budgeting, mining simulations and asset management – and it trains employees on how to use the technology. RPMGlobal’s advisory business consults on technical and economic assessment of mines.

Established more than 50 years ago, RPMGlobal has 24 offices overseas and a global client base. Some of the world’s largest mining companies use its software.

In February, RPMGlobal reported 12% growth in revenue to $38.1 million for the first half of FY22. Underlying earnings (EBITDA) were $3.9 million in the half.

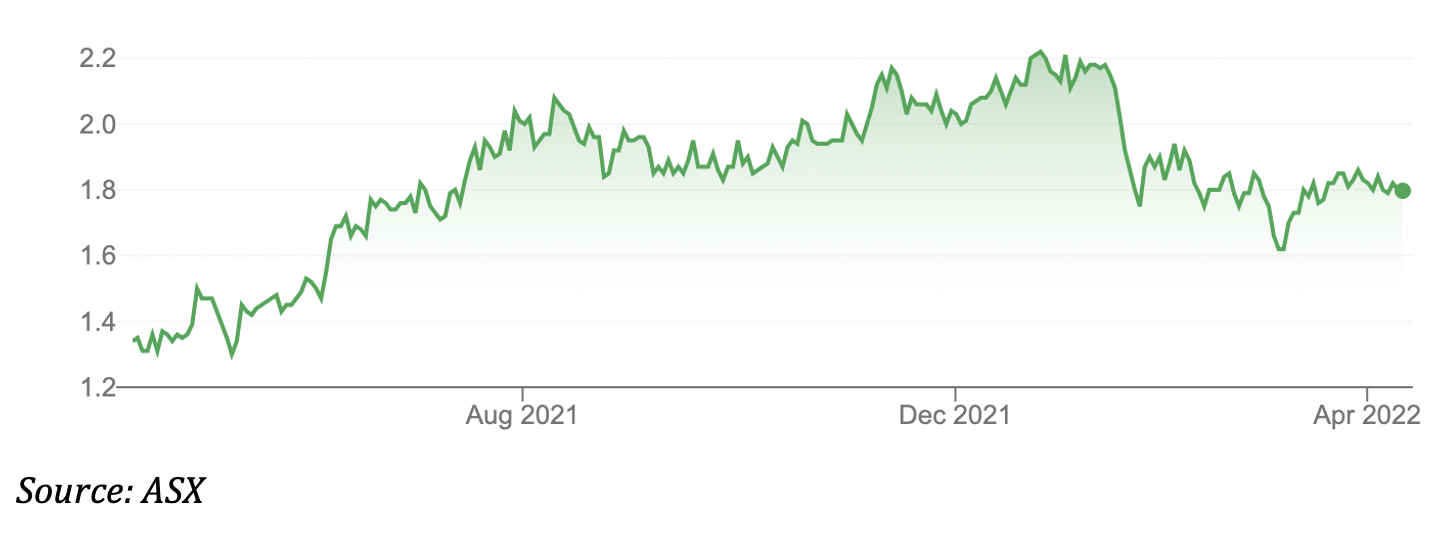

The market was lukewarm on the result. RPMGlobal fell from a 52-week high of $2.27 in January 2022 to $1.62 in early March. It is now $1.77.

RPMGlobal continues to make bolt-on acquisitions to expand its offering and is reinvesting heavily to grow. The company is adding more ESG products into its offering – a big growth area in mining – and expects to release five new products this year.

In its outlook statement in the FY22 interim result, RPMGlobal said: “We expect a real lift in software sales once mining countries open their borders and our people can again travel to mine sites. Selling complex software solutions to global companies is best done in person rather than via a computer screen.”

Clearly, border closures and the broader sell-off in tech stocks have affected RPMGlobal this year. As commodity prices rise, and more resource companies raise capital and expand, RPMGlobal should have stronger tailwinds for its products and services.

Capitalised at $413 million, RPMGlobal does not suit conservative income investors. However, RPMGlobal has more substance than many software companies its size and a global footprint in a growth market. The valuation does not look demanding.

Software-as-a-service is a great business model when its works. Mission-critical software in mine operations has high switching costs and provides recurring, higher-margin revenue. RPMGlobal looks well placed for stronger mining activity.

RPMGlobal

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 13 April 2022.