On 24 June, there will be more than 350,000 new shareholders in Endeavour Group Limited. That’s the company that is being spun out of Woolworths via a demerger, comprising the number 1 and number 2 retail drink brands in Dan Murphy’s and BWS, and the largest hotel network in Australia. Here’s what you need to know about the demerger and potentially, what to do.

Firstly, it’s important to understand that demergers have a pretty good track record in Australia. Names such as Coles, Treasury Wine Estates, BlueScope, Orora and S32 were all the result of demergers. But there have also been a couple of duds – OneSteel that became Arrium and went under, and what is now called Virgin Money UK, which was spun out of NAB and is just getting back to its first day trading price of $4.01.

The argument goes that a refreshed management team, free from the controls and shackles of the former head office, with its own balance sheet and dedicated focus, is able to thrive. And in the main, share market performance backs this up.

Typically, demergers take a while to shine. Because there is a weight of sellers wanting to get out when the stock first lists and there is no compelling reason to buy, the market price flounders for a few months. But eventually, institutions start to see value in the stock, the management team performs, and the share price rises. More on this later – but the key take for investors watching the share price it is usually “down before up”.

Now to the demerger.

Why is Woolworths getting rid of Endeavour Group?

According to the Woolworths Chairman, this is about: “enhancing shareholder value through a greater focus on each business’ core customers offering and growth opportunities”. The advantages cited in the demerger booklet include:

- Simplified businesses and increased focus for Woolworths Group and Endeavour Drinks;

- Endeavour Group will be able to pursue its own strategy and growth agenda;

- Opportunity for Woolworths and Endeavour to realise the benefits of the strategic partnership agreements;

- Stronger brand clarity for Woolworths and Endeavour; and

- Existing and new shareholders will have flexibility to choose their level of investment in Woolworths and Endeavour.

While these are all valid, particularly the latter, the “real” reason is that Woolies wants to exit the poker machine business. As the owner of 12,400 electronic gaming (poker machine) licences, Woolworths is increasingly off the radar for many fund managers due to ESG concerns. It is the biggest operator in Australia, and its ownership of poker machines has become a real thorn in its side.

What do I get?

You will get 1 share in Endeavour Group for each Woolworths share held.

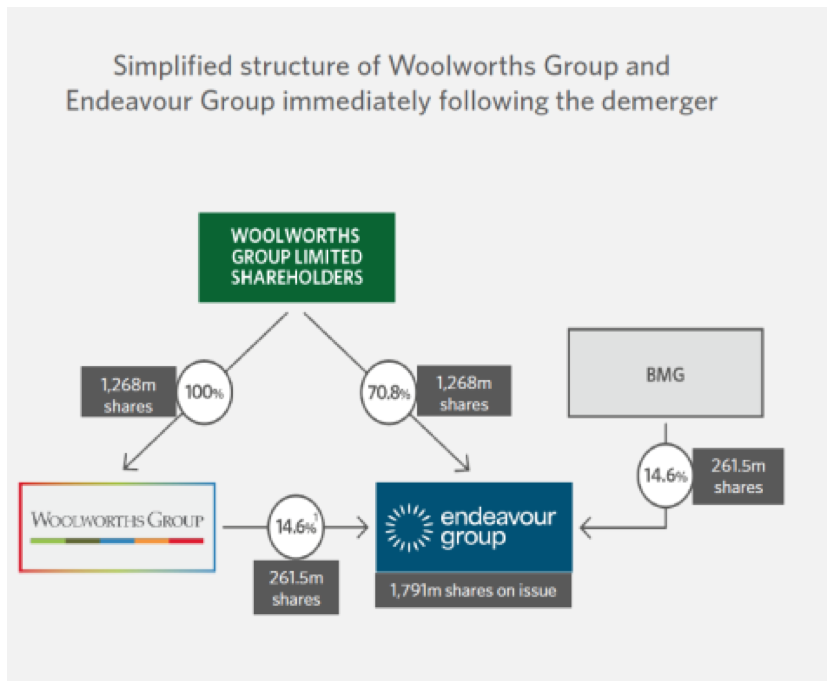

Because Endeavour Group was formed out of the combination of the Woolworths retail drinks business and the hotels business known as the ALH Group (which was part owned by Woolworths and the Bruce Mathieson Group), the Bruce Mathieson Group (BMG) will own 14.6% of Endeavour. Woolworths is directly retaining a 14.6% interest, and the remaining 70.8% will be owned by Woolworths shareholders. The following diagram outlines the structure.

What is the Endeavour Group’s business?

The Endeavour Group comprises the following:

- The #1 and #2 preferred retail drink brands in Australia through Dan Murphy’s and BWS, which operate the largest network of 1,630 stores. Estimated 40% market share;

- Largest hotels network in Australia with 332 hotels (49 owned, 283 leased on long term leases);

- 1,775 liquor licenses and 12,364 poker machine licences;

- Specialty businesses Langton’s, Cellarmasters, Shorty’s Liquor and Jimmy Brings;

- A products and services capability through Pinnacle Drinks (wineries and wine services); and

- Strong digital presence (apps, online sales etc) and 5.1m My Dan’s loyalty members.

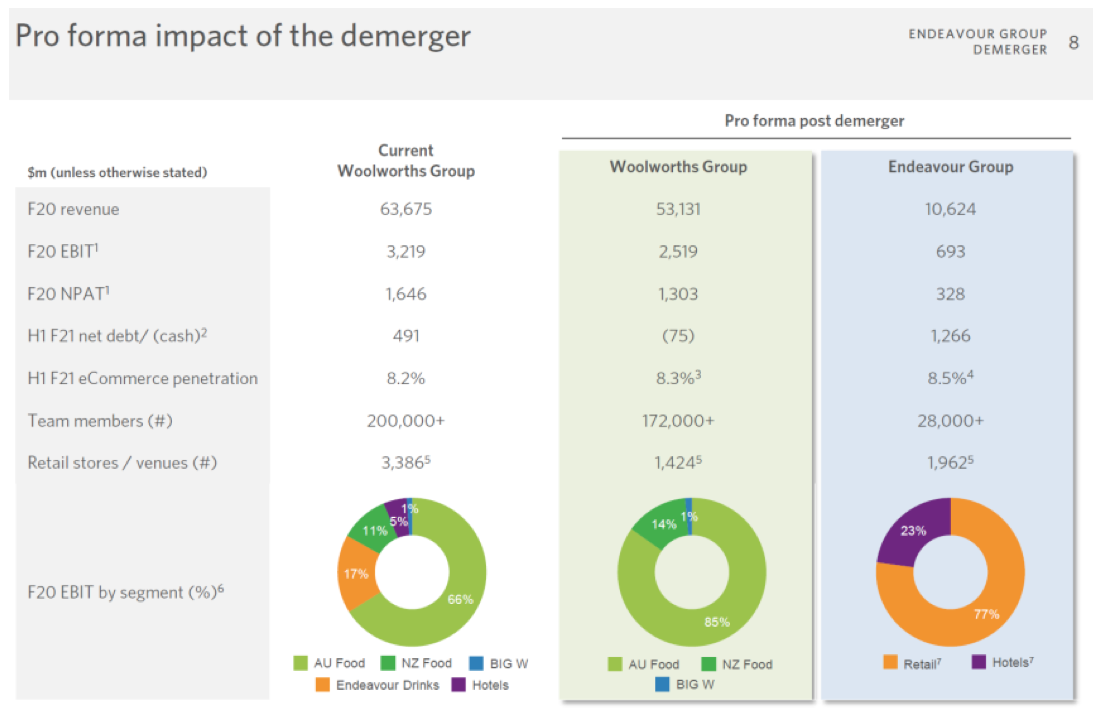

In FY 20, Endeavour Group generated a proforma EBIT of $693m and NPAT of $328m on revenue of $10.6bn. This was heavily impacted by Covid-19, with the retail business seeing very strong growth in sales, and hotels hit by lockdowns and government restrictions.

Pre Covid (FY19), the retail business contributed 83% of total revenue and hotels 17%. However, hotels were more profitable, accounting for 38% of EBIT.

What is Endeavour’s growth strategy?

Drinks retailing and running hotels/hospitality venues are not traditionally high growth areas. Pre Covid, retail liquor industry revenue in Australia had a CAGR (compound annual growth rate) of 3.0% pa. Hospitality industry revenue experienced a negative CAGR of 0.5%.

Endeavour says that its strategy for growth is:

- Growing digital engagement (lifting ecommerce share, make digital the front door to all brands including hotels);

- Strategic expansion of the network (roll-up and development of new hotels etc);

- Enhancing the existing footprint, particularly hotel refurbishments;

- Expand product range and reach – leverage Pinnacle Drinks to support new category growth and support premiumisation; and

- Enhance end to end efficiency.

How much will the shares be worth?

The market will tell us on 24 June when Endeavour Group shares start trading on the ASX. Over the next few weeks, we will see some valuations from the broker analysts.

One early estimate is an enterprise value for Endeavour of close to $15bn. With net debt of $1.3bn, this gives a market capitalisation of $13.7bn, equivalent to a share price of $10.80. Notwithstanding that FY20 was impacted by Covid, this would put the business on a hefty historic PE multiple of 42 times earnings.

Another way to value the parts is to consider the whole. In FY 20, on total revenue of $63.7bn, Endeavour Group contributed $10.6bn to the Woolworths Group or 17%. On EBIT, Endeavour’s contribution was $693m or 21.5% and on NPAT, 20%.

Using an NPAT split of 80% and 20%, and a current Woolworths share price of $42.00, this would imply a split post demerger of a “new” Woolworths share being worth $33.60 and an Endeavour Share being worth $8.40.

Supporting an argument that Endeavour is worth “more” than the notional split above is that the impact of Covid-19 was damaging to Endeavour. By the first half of FY21, with hotels re-opening, Endeavour’s share had risen to almost 25% of Woolworths Group EBIT. Further, Endeavour is a higher margin business than the Woolworths food business – in 1H21, Endeavour earned 8.1% of sales, whereas Woolworths operating EBIT margin was 5.2%.

Against this is that some investors will not want to have anything to do with a business that has poker machines. This will remove some of the “premium” Endeavour may have had for being a business with a higher operating margin.

My guess (in the absence of analysts’ discounted cash flow valuations) is that an Endeavour share will be worth around $10.00.

What are the tax implications?

Assuming that tax demerger relief is obtained, there shouldn’t be any tax implications for Australian resident shareholders from the demerger per se. If you subsequently sell your Endeavour shares, then you may have to pay capital gains tax.

One thing that will change is your cost base for your Woolworths shares. Following the demerger, the Company will provide an ATO approved “split” to be used where you apportion your current Woolworths cost base between your Endeavour shares and your Woolworths shares.

Let’s take an example. Suppose you purchased your original Woolworths shares for $30.00 each. The Company, following confirmation from the ATO, advises that the approved apportionment is 75% for Woolworths and 25% for Endeavour. This means that your cost base for Woolworths now becomes $22.50 (75% of $30.00), and your cost base for your Endeavour shares is $7.50 each (25% of $30.00).

You will deemed to have purchased your Endeavour shares on the same date that you acquired your original Woolworths shares.

How will the demerger be implemented?

Shareholders will be asked to approve the demerger via a resolution at a general meeting on Friday 18 June. A simple majority is required. There is also a capital reduction resolution (this is also a formality, and won’t have any impact for Woolworths shareholders taking demerger tax relief ).

After the resolution is approved, the demerger will be implemented on 1 July. Woolworths shareholders will be issued Endeavour Group shares which are expected to commence trading on the ASX on Thursday 24 June.

Do I have to vote?

No, the demerger is a forgone conclusion to be approved. If you do want to vote, the meeting is scheduled for 11.00am on Friday 18 June. You can attend in person, complete the proxy form, or vote online at www.linkmarketservices.com.au

A reason to vote against the demerger are the costs, although many have already been occurred. In FY21, Woolworths will incur separation costs of $50m. Endeavour Group will incur additional corporate and operating costs of $47m pa for its ASX listing, share registry, funding facilities, insurance, workers’ compensation and maintaining a separate board and management team.

Should I take part in the share sale facility?

If you own less than 800 Woolworths shares (meaning that you will end up with a parcel of less than 800 Endeavour shares), you can elect to have these shares sold through a share sale facility. Elections must be made by 21 June.

The only advantage of doing this is the saving on brokerage – which on a tiny parcel of shares, could be considerable. But with many brokers charging low minimums, in 2021, this is not that big a deal.

The disadvantages? You won’t get the funds for over a month and have no control over the price you will receive.

How will Endeavour Group shares trade?

I said at the outset that demerged companies typically do well on the ASX. But they get off to a slow start because there is a weight of sellers wanting to get out upon listing and there is no compelling or urgent reason to buy. It takes a while for buyers to recognise the value, and as the management team starts to perform, the share price rises.

Endeavour looks ready to fit this bill. In particular, the dependence on poker machines means that Endeavour will be off the buy list for some fund managers, while other existing holders will use the demerger to exit Endeavour now that they can.

My bet: four weeks after the listing, Endeavour will be lower in price than where it first trades on the ASX, and 12 months later, higher in price.

Should I buy Woolworth’s shares now to get access to more Endeavour shares?

My sense is that a most of the Endeavour “action” is already priced into Woolworths. The stock has been very well supported, and I expect this to continue until the last date of “cum” entitlement trading (the last day you can buy Woolworths shares to get the Endeavour shares), which is 23 June.

But if Endeavour trades like previous demerged companies and comes under selling pressure at the outset, I would wait a few weeks until I bought. You can be patient with this stock.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.