The Reserve Bank’s “surprise” decision to increase the cash rate by 0.5% has put interest rates back under the spotlight. I say “surprise” because of the 29 economists polled for their predictions, 15 expected the increase to be 0.25%, 11 were at 0.40% and only 3 “smarties” went for the full 0.5%. Moreover, the RBA said that it is going to meet the inflation challenge head-on, which has led many economists to forecast another 0.5% increase in July and some even going for the trifecta with a follow up 0.5% in August. That’s why the share market has sold off since the announcement.

Higher interest rates hurt most stocks in the short to medium term. Firstly, if economic activity slows, then sales can be impacted and if revenue falls, profits and earnings fall too. So-called ‘cyclical’ stocks – those that are exposed to the business cycle – are impacted the most. Discretionary retailers are a good example. Secondly, many companies are leveraged – so in time, they will incur a higher interest expense as rates increase. Finally, if interest rates go up, interest-paying investments become relatively more attractive. For example, if bank term deposits now pay 3.0%, bank dividends yielding 4.5% don’t look quite so attractive given the extra risk. In response, share prices tend to fall, which in turn leads to an increase in the dividend yield.

But some stocks are “winners” from higher interest rates. Here’s a rundown of the winners among the top 100 companies.

1. Major Banks?

The major banks are winners in the short term and could be losers in the medium term. That’s why I have the ‘?’ in the heading.

Until very recently, the market has been saying that the banks win from higher interest rates. While that is certainly the case in the US, it is less the case in Australia because most of the interest rate risk in their books is swapped out to a 90-day exposure. Unlike their US counterparts, they don’t write loans priced off the 30-year bond rate. However, they do still win as they have a truckload of ‘zero interest or near-zero interest’ deposits that aren’t repriced when the RBA raises the cash rate.

When the RBA moves, banks are able to rapidly reprice their loan books, usually by the full amount of the increase. But the interest rate on the ‘zero or near-zero’ deposits doesn’t change – it stays at zero – so their net interest margin (NIM) expands. Higher NIM means higher revenue which means higher profits.

The medium-term picture is more complicated, though. If the RBA raises rates too aggressively or raises them too far, economic activity could come to a crashing halt. The dreaded ‘R-word’ becomes part of the lexicon. In this environment, mortgage distress is a serious issue, businesses go bust and default, and bad debts soar. That’s what spooked the market yesterday with the sell-off in bank shares – the realization that it is not all plain sailing when it comes to higher interest rates. In a worst-case scenario, a blowout in bad debts will have a bigger impact on profits than the increase in the net interest margin.

No one can say with any real confidence how this scenario will play out. Only time will tell whether the RBA can get on top of the inflation bogey without sending the economy into a spin. Following Tuesday’s tougher stance, I think there is more reason to back them, so I am not selling any bank shares. But I do caution about being materially overweight banks, notwithstanding the very attractive dividends.

2. Insurance Companies

Insurance companies have a large pool of investible capital, policyholder reserves and reserves for claims incurred but not paid. While the main driver of profitability is the underwriting margin (that is, premiums received fewer claims paid and administrative expenses), investment income on the reserves can be significant. The reserves are typically invested in low-risk government bonds and other interest-paying investments – so when interest rates increase, investment income increases and profits are boosted.

The major listed insurers are general insurers QBE and Insurance Australia (IAG), bank assurance group Suncorp (SUN) and health insurers Medibank Private (MPL) and NIB (NHF).

The table below shows what the major brokers think – with an implied upside/downside based on the difference between the last ASX price and the consensus broker target price.

A headwind for general insurers has been concerns by some investors about the impact of climate change and increasing ‘natural perils risk’ (floods, fires, storms etc). The share market hasn’t been particularly kind to the insurance industry over the last 12 months, as illustrated by the graph for IAG.

Insurance Australia (IAG) – last 12 months

QBE, which has business in many countries and covers a broader range of insurance (ie unrelated to natural perils risk), has fared better and may be a more reliable play.

QBE Insurance (QBE) – last 12 months

Medibank Private is a great “defensive” stock and performing strongly in winning customers and gaining market share. When you are the industry leader with a share of over 27%, this is no small feat. But the industry also faces its own headwinds (cost of medical treatments, ageing policyholder base and unaffordability of health insurance).

Bottom line – I don’t think the prospect of higher interest rates is a sufficient reason to buy the insurers. Think of it as a bonus – fundamentally, you want to have confidence in the industry, company and management team first.

3. Challenger and Computershare

Two more interesting candidates are Challenger (CGF) and Computershare (CPU). The latter is Australia’s best performing “tech” sector stock in 2022.

Challenger wins in two ways. As a life insurer and writer of annuities, it wins like the general insurance companies from higher investment income on its policyholder funds, reserves and capital.

But importantly, it should be a winner in the medium term because annuities will become more attractive to retirees, so sales and revenue will increase. An annuity, which is a series of guaranteed payments in the future in return for an upfront payment, is essentially priced off the bond rate. When bond yields are low, the guaranteed payments are low, and they increase when bond yields increase. So higher interest rates mean annuities become a more attractive investment option for retirees.

After a tough few years, the market has been more receptive to Challenger recently. The share price has been steadily rising, and at $7.42, is now higher than the consensus target price of $7.27. According to FNArena, the range is a low of $6.40 from Morgan Stanley through to a high of $8.30 from UBS.

Challenger (CGF) – last 12 months

Computershare has significant leverage to rising interest rates from the margin income it makes from servicing corporate and issuer trust accounts. When interest rates are near 0%, it cannot earn interest on the monies it becomes a “custodian” of. As interest rates rise, it is able to invest these funds in money market deposits at higher rates, and improve its bottom line.

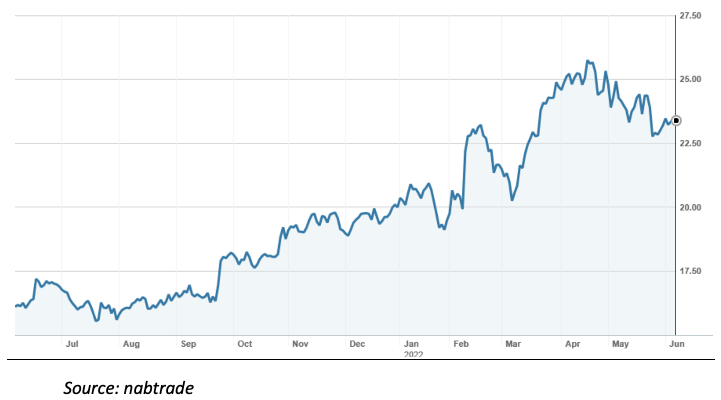

The market has priced much of the improvement in margin income into its share price, as the chart below shows. However, the major brokers still see upside in the company. According to FNArena, the consensus target price is $26.14, about 10.6% higher than the last ASX price of $23.60.

Computershare (CPU) – last 12 months

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.