Jaw-dropping statistics abound on COVID’s effect on daily life. From online shopping to education and working from home, the pandemic has vastly changed our way of life.

Nothing beats COVID’s effect on medical appointments. Between 2011 and 2019, there were about 820,000 telehealth consultations across Australia, noted Microsoft. In three months to June 2020, that rocketed to 17.2 million.

Globally, just over one in three patient interactions in 2021 will be online, from about one in five now, predicts Forrester Research. Increasingly, the physician will no longer be the automatic first touchpoint for patients, who instead are “triaged” via online services.

Of course, many people will return to in-person appointments with their doctor when the pandemic subsides. The telehealth boom, impressive as it is, was distorted by lockdowns worldwide last year and the risk of contracting COVID-19 outside the home.

My guess is that a small part of the 17.2 million Australians who experienced telehealth for the first time will stick with it. I will. Truth told, I don’t see my doctor anywhere near as often as I should because an appointment usually means waiting for at least half an hour.

Time-poor people or those in remote locations might find telehealth more convenient and efficient. Just as older students like online learning rather than trudging to a university.

Also true is that many eye-catching statistics on megatrends, such as telehealth, are produced by consultancies that eagerly talk up the opportunity, in order to win business. Some emerging companies latch onto to big forecasts in order to hype their prospects and seduce novice investors.

Caveats aside, there is no doubting the size and duration of telehealth trends. As populations grow, combining in-person and virtual doctor appointments make sense – at least for those who are happy to have online care at the first point of contact.

Clearly, I’m not a medical practitioner, so investors should form their own view on the permanency, size and value of the telehealth boom. As an investor, I see a market that has years of strong growth head, off a low base, as technology is better integrated into service delivery.

Perhaps the future will consist of a software algorithm diagnosing symptoms of some patients, before recommending a telehealth appointment with a real doctor, if needed. In turn, that doctor assesses the patient and determines if an in-person appointment is required.

One can envisage such a model providing benefits for patients (who have better access to treatment) and medical practitioners (who can treat more patients). Hospital systems will also benefit if 24/7 telehealth services mean fewer people presenting to emergency departments.

Again, I don’t want to overhype telehealth’s potential, downplay the importance of in-person care, or to provide anything even remotely construed as medical commentary.

But COVID-19 will quicken the development of hybrid models: bricks-and-mortar shops and online stores; physical universities and online learning; working in the office and at-home; and in-person medical appointments and telehealth.

Investors must look hard to find telehealth exposure on ASX. Most are small- or micro-cap companies that suit experienced speculators.

Here are two telehealth stocks on my radar:

1. Doctor Care Anywhere Group PLC (DOC)

The Initial Public Offering (IPO) of the UK-based telehealth company on ASX was well timed. In December 2020, Doctor Care sought $102 million at 80 cents per CHESS Depositary Interest (CDI).

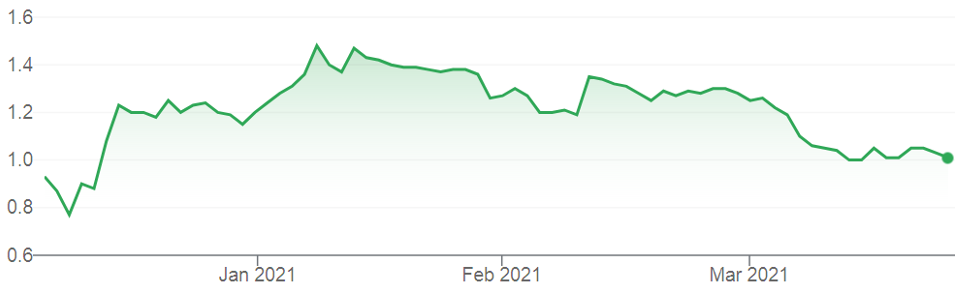

The shares raced to $1.52 within two months of listing, amid soaring interest in telehealth. Doctor Care has since eased to 92 cents, offering a better entry point for long-term investors.

Founded in 2013, Doctor Care focuses on the UK private healthcare market. Healthcare spending the UK has more than doubled between 1997 and 2018.

Doctor Care’s prospectus notes the global telehealth market will be worth US$14.9 billion in 2024, from US$5.3 billion in 2019. That’s compound annual growth of 23.1%.

The company has a clever business model. Rather than source patients through a business-to-consumer channel, Doctor Care services more than 1,500 corporate and small-enterprise clients, through its relationship with AXA PPP Healthcare Group and HCA Healthcare UK.

Its relationships with private healthcare insurance providers create a barrier to entry of sorts in UK telehealth. Two healthcare insurers that Doctor Care works with have about 2 million of the UK’s 7 million private healthcare customers.

This model also appeals to large companies overseas that pay health insurance premiums for their workers. Telehealth through an approved provider, such as Doctor Care, should be a faster way to access primary medical care, meaning less worker downtime for employers.

Doctor Care is growing quickly. Its FY20 revenue doubled over the previous year and fourth-quarter FY20 revenue beat prospectus forecasts. Telehealth consultations at Doctor Care tripled to 214,700 in FY20.

Growth will come as Doctor Care adds more channel partners (it added Allianz Partners for European clients) and more companies to its service. Sourcing patients this way (rather than going direct) is potentially a lot quicker, cheaper and “stickier” (as employees and members of Doctor Care partners use the service).

In spite of these operational gains, Doctor Care is well off its 52-week high since listing. That often happens as IPO hype fads and early investors in a float take quick profits.

Doctor Care is capitalised at $165 million and its top nine shareholders own more than 80 per cent. A thinly traded stocks, Doctor Care is not for conservative or risk-averse investors.

But for those seeking leverage to rapid growth in telehealth, and are happy to get that exposure in the UK, telehealth is worth watching as it adds more companies, channel partners and ultimately patients who use its virtual services.

Chart 1: Doctor Care Anywhere Group (DOC)

Source: ASX

2. Global Health (GLH)

This Perth-based company is another play on telehealth through software-as-a-service technology, which connects doctors and patients.

Global Health has been around, in one form or another since 1992 when it provided patient administration records. In April 2000, the business (then known as Working Systems) merged with Grant Thornton Management Consulting (WA). In 2008, it focused entirely on healthcare.

Today, Global Health’s technology is used by more than 1,000 healthcare organisations and 10,000 healthcare providers. Its software supports more than 1.5 million people, the company says.

The technology connects healthcare providers and enables secure message delivery. For consumers, it empowers the management and sharing of one’s healthcare records with a medical practitioner. For patients, the platform allows online bookings and patients.

Global Health forecasts its revenue to grow by up to 20 per cent to $7.2 million in FY21. The company is targeting revenue growth of at least 20% each year, on average.

Like other successful software-as-a-service businesses, Global Health benefits from repeat revenue. About 70% of total customer revenue is recurring; once practioners and patients get used to the software, they usually stick with it.

Supporters might have expected Global Health to deliver faster revenue growth through the pandemic. I suspect the company’s big challenge is the lead-time in signing up healthcare practitioners, who sensibly have a conservative approach when choosing technology. Raising awareness of Doctor Care among patients is also time-consuming and costly.

After going nowhere for years, Global Health has more than doubled to 45 cents since September 2020. Capitalised at $20 million, Global Health suits speculators who understand the features, benefits and risks of emerging, thinly traded stocks.

Risks aside, there’s no doubt that the telehealth boom will require a far more connected health ecosystem between doctors and patients., and secure record keeping. I’m betting multinational software companies will fill that void, rather than tiny players such as Global Health.

But there’s plenty of room to grow in telehealth technology. SaaS models can be highly lucrative when they work and reduce investor risk through recurring revenue.

It’s too soon to know if Global Health will finally deliver on its potential, but the stock warrants a spot on speculator watchlists.

Chart 2: Global Health (GLH)

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 30 March 2021.