Last week’s note focused on time in the market rather than attempting to time the equity market as such. Fast forward to this week and we have another round of negative short-term headlines and negative short-term equity price action. To me, this is another classic example of when we should be using broader equity index weakness as an opportunity to top up on the highest quality businesses.

Quality is rarely on sale, in fact, it only happens for short periods in times of broader market weakness. That is why I am actually quite excited about “Tariff Man” (aka President Trump), remerging as a dark figure this week because it will give me a chance to deploy cash into great businesses with a margin of safety.

Clearly the markets believed that a “stage 1 “ trade deal was done. They had bid up deep cyclical and value equities, and sold lower beta defensive equities to fund that “risk on” rotation. This week we have seen that reverse with China facing cyclical stocks retreat, led by the miners, heavy machinery manufacturers, aircraft manufacturers, energy and transportation.

The five bellwether US listed equities I consider proxies for “trade war sentiment” are Apple, Caterpillar, Deere & Co, Union Pacific and Boeing. Below is the last three trading days in those five trade war bellwethers.

Those five stocks are down between -3% to 5%, so hardly a big move, while the S&P500 Index is down around -2% from recent highs.

This tells you that Wall St still believes a trade deal is going to be done in some form. Wall St, currently, appears to be of the opinion that President Trump’s signing of the HK legislation, new tariff threats against the EU, Argentina and Brazil, and comments about delaying a trade deal until after the 2020 Presidential election are all just a “negotiating” tactic.

They may well be, and those who have read The Art of the Deal would know this escalation of pressure at the 11th hour is classic Trump.

However, if this is just another Trump “negotiating “ tactic, then we have a larger problem, but particularly for cyclical and value stocks that have rallied ahead of a phase 1 trade deal being confirmed.

What happens if we get to December 15 without a trade deal and the next phase of tariffs take effect? What happens if this isn’t a bluff??

Well, unfortunately, the five bellwether US names above would most likely fall another -5% to 10% and due to their high weightings in US equity indices lead to a further -5% decline in US equity indices. Of course, there would be some offset in a rotation back to defensive, bond sensitive and structural growth equities with US equity indices.

You would also most likely see US 10-year bond yields head down to 1.5% and the US dollar rally as a safe haven. The US dollar rally would also drive lower commodity prices and take industrial commodity equities lower.

Either way, bluff or no bluff, I think we all need to be aware that the BIGGEST downside risks to a “NO DEAL” scenario lies in cyclical and value stocks. That is one reason the ASX200 has done worse than other indices in this pullback. It is full of cyclical and value stocks: i.e. banks and resources. A “no deal” outcome sees banks and resources globally lead equity markets lower.

However, nobody knows what President Trump thinks other than himself. Therefore to position yourself too aggressively is most likely a mistake.

I believe the right course of action is to focus on finding the right risk adjusted entry points to buy great businesses that are growing with or without Trump over the next few years. I am focused on buy more “structural growth” companies and hopefully Mr Market will give me that margin of safety at a stock specific level.

This is the classic Buffett “be greedy when others are fearful” moment and investors need to be prepared with a “shopping list” of stocks they would buy at predetermined prices. The key aspect is to be prepared. The second key thing is to act if it happens.

I may well be completely wrong and we don’t get a deeper sell-off on these “Tariff Man” developments. Interest rates are negative all across the developed world and equity market pull backs have been very shallow in 2019. In fact, every equity market dip has proven a buying opportunity (Peter Switzer’s strategy has been correct).

With ageing populations and no return in cash, you can see why investors do buy equity market dips to either find yield or growth or both. When the alternative is going backwards in real terms it is understandable that there is a bid under the equity market.

That again reminds you not to get too bearish or time the market on these headlines. It is more than likely just another opportunity to deploy cash.

A classic example of a global structural growth stock I am looking to add to into any weakness is the world leader in cashless payments Visa (V.US).

The Visa result in late October was dependably solid and confirmed that the secular payments growth trend is still firmly in place, but I thought it’s probably worth discussing in a bit more detail today. However, let me state the conclusion upfront: this was a very good result, and there’s nothing to be particularly concerned about operationally.

For the quarter, net revenues (i.e. after deducting client incentive cost) came in at $6.14bn – slightly ahead of consensus of $6.08bn – but mostly due to lower-than-anticipated client incentive payments (which were effectively pushed into 1Q20 given that several card agreement negotiations only concluded late in this quarter). OpEx growth was slightly faster than anticipated, leading to operating profits (excluding one-off charges) coming in slightly below expectations (operating margin of 66.89% vs. expectation of 68.12%). Due to a lower tax rate – arguably a low-quality driver – diluted EPS of $1.47 was slightly ahead of consensus ($1.43).

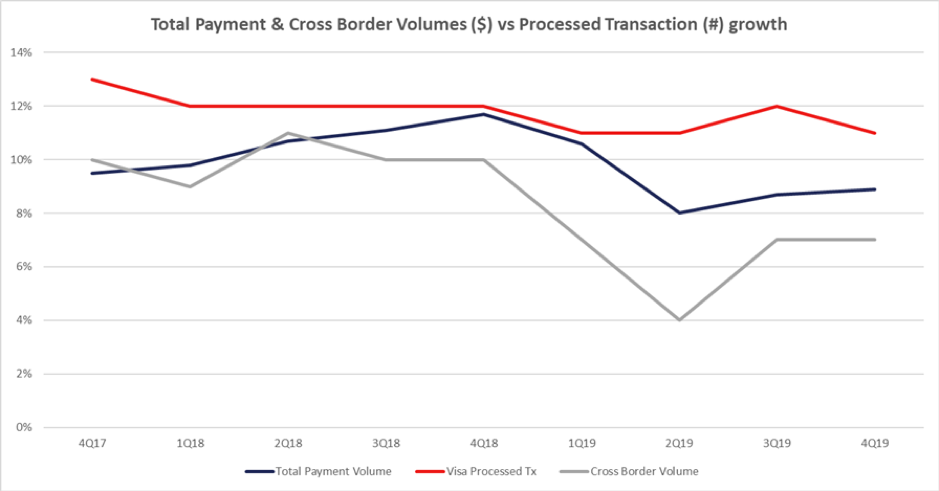

Critically, the payments volumes were up a solid 9% year-on-year for the quarter (with the processed number of transactions up 11%.) Given worries around the macro-economic environment, there were concerns that this number might slow appreciably, but this was not the case.

Guidance for FY20 was also better than feared, with management confirming low double-digit revenue growth and mid-teens EPS growth – essentially more of the same from FY19. Several sell side analysts noted the buy side was looking for FY20 revenue growth of sub-10% (I was forecasting 11%).

Over the longer term, the story here remains one of a secular growth of B2C payments, and substantial upside in the growing B2B segment, which would essentially represent new payment flows that Visa is not capturing at present. The company has just gone through a substantial contract renewal process – and with more due in 1H20, will lead to higher incentive fees in the near term – but it likely de-risks the concerns around near-term share losses with major issuers. Finally, management commented on the fact that many Fintech business who a few scant years ago were seen as competitors to Visa (and Mastercard) have effectively come to the realisation that they’ve succeeded in building closed loop payment wallets, and to grow beyond that, they need to partner with the major payment processors to allow for interoperability. In short, it means they have partnered with the incumbents, and now behave more like issuers than competitors – a very good arrangement for Visa/Mastercard from a competitive standpoint.

Longer term, this business is essentially the poster child for a compounder: it earns excess returns on capital and reinvests these returns to widen the moat and address faster growing segments of the market. The combination of secular tailwinds also remains intact:

- A consumer-led cash to card transition around the world.

- Rising e-commerce penetration (given that in most geographies, consumers still need a card to conduct a purchase online, though this is less relevant in EM).

- Expanding total addressable market (TAM) in the form of B2B payments.

- Tailwind from governments favoring card over cash, since they can more easily track and tax.

Some notable items:

- Underlying volume trends were stable: total purchase volumes grew ~9% in organic constant currency (in line with 3Q19). Volumes grew ~10% when adjusting for the impact of dual-branded card product rolling off in China. The uncertain UK macro continued to be a drag on volumes. Visa has a more significant business in the UK vs Mastercard, and would likely benefit from any resolution there. Worth pointing out that volume metrics very modestly benefited from extra processing day in 4Q.

- Visa Direct (real-time payments direct to debit accounts) is only ~1% of revenue, but growing at +100% rates, meaning there seems to be some traction and that it could start being a more meaningful contributor to revenue growth in the next 2/3 years. This has applications in B2B and P2P payments.

- Visa is looking to launch their Click-to-pay offering (similar to what PayPal offers now) more broadly in 2020. Mastercard is also pushing hard in this space. Combined, this potentially presents the most material threat to the PayPal model today, as Visa/Mastercard has substantially more brick & mortar relationship to leverage for online payments. These offerings are also being built using the latest secure technologies (tokenization, 3D Secure 2.0, etc.) to position it for longer-term viability than past efforts (V Checkout, Masterpass) from the payment networks.

- Contactless payments continue to gain share in the US, where it is currently a low-single digit percentage of all transactions (vs +50% on Visa’s global network ex USA last quarter). As this penetration grows, it should further entrench V/MA cards as ‘easy’ solutions for secure everyday payments (buying a coffee, etc.), and ultimately protect against mobile wallets, QR-code based payments, etc.

All in all, Visa is exactly the style of ultra-high quality structural growth stock (compounder) I am looking to add to into any equity market weakness. Tariffs or no tariffs, this debt-free company that doesn’t lend anyone any money, rather clips the ticket on transactions, will outperform in my opinion as it rides the structural tailwind of the move to a cashless society.

Next time you “tap and go” for your morning coffee, ask yourself: why you don’t own Visa (or Mastercard). My fund owns both.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.