What I might suggest as an investing or, more correctly, a speculative play is really based on the old sporting adage of “no guts, no glory”. And given the potential for stock market sell-offs right now, it will take guts to consider my suggestions.

In case you’ve missed it, the high inflation readings in the US in particular, and even here, have led to higher yields in bond markets, as a prelude to rising interest rates, starting in March in the States but later here. Economists think August will bring the first rise in the official cash rate of interest of our RBA, but its Governor, Dr Phil Lowe, has hinted strongly that he won’t be pushed around by banking economists. He will raise rates when he thinks the economy will need it.

In the US, they revealed a huge jobs report over the weekend, which now has experts telling us that the Yanks will get seven rate rises in a year, when before it was thought that there’d be four or five. Also, the first rate rise in March could easily be 0.5% rather than 0.25%. This really should have been bad news for tech stocks on Friday, when the employment report was released. However, the Nasdaq (the home of tech stocks) actually rose 1.58% on the news!

Why? Well, there could be a belief that the good economic news from the labour market is actually saying US economic growth will be so good it will trump the negativity from rising interest rates.

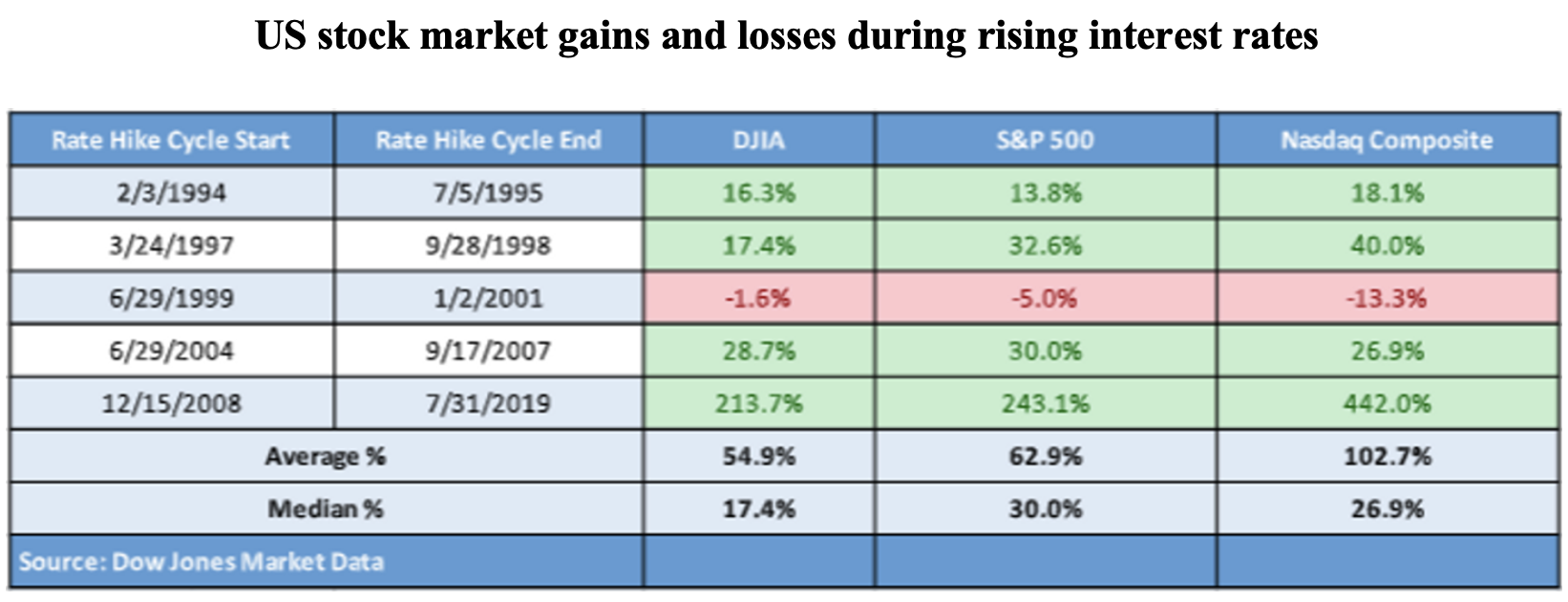

In fact, I’ve shown before that stock markets tend to rise when the interest rate cycle kicks along in earnest, despite some negativity at the beginning of the rate rises. Check this table out:

Note how in four out of six rising cycles for interest rates, the stock market indexes rose solidly. The two negative periods were weakened by the dotcom bust and the GFC.

So the question for me is this: is it time for a gutsy play of buying tech stocks now for a wait-and-see good return down the track? Right now, tech stocks have been smashed and while it would be silly to expect a rebound soon, the old proverb of “good things come to those who wait” can apply to stocks.

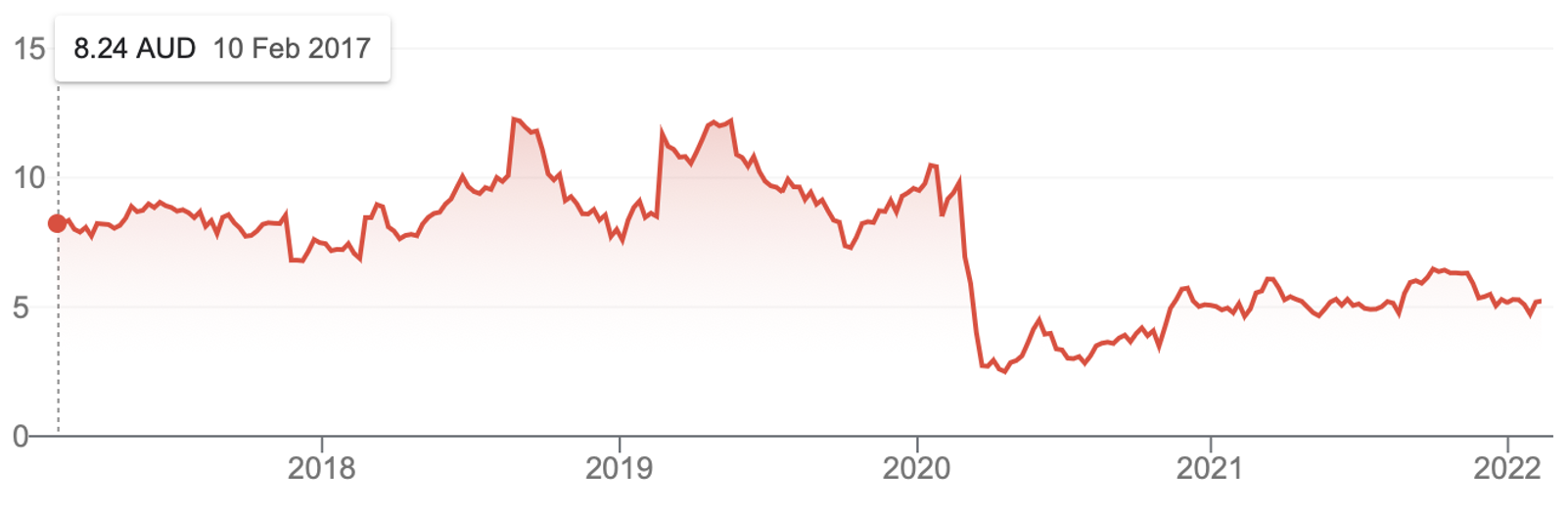

Look at Webjet that I recommended when the Coronavirus crash and lockdowns KO’d the travel sector.

This chart shows that even though the full force of the positives of the reopening of the travels sector has not come about yet, the share price rebound has been rewarding.

Webjet (WEB)

Before the pandemic was declared, Webjet was a $9.80 stock but it fell to $2.50 and those who bought it then now have made 108% on their investment over less than two years.

So let’s turn to tech stocks and the likelihood of a rebound.

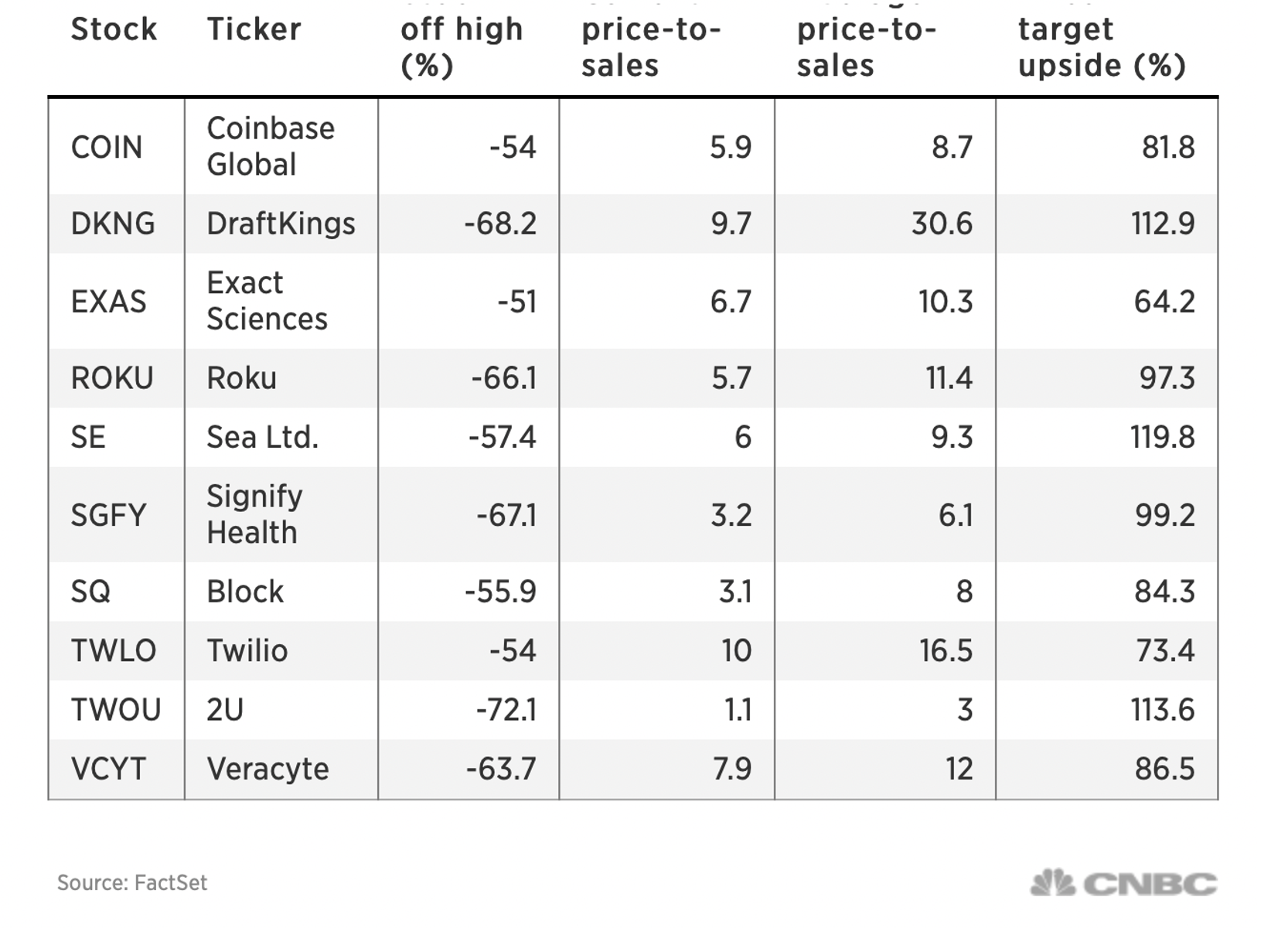

Currently, big US investment houses are calling many tech stocks as oversold. Goldman Sachs likes Coinbase with the professional analysts tipping it has an 81.8% upside. A company such as Draft Kings is tipped to rise 112.9%, Roku 97.2% and Block that has bought our Afterpay is seen as 84.3% cheaper!

Why do the professionals like these companies? Well, because they are good businesses that were overvalued but now they’re undervalued. And the same applies to local tech stocks.

In 2020 I explained how my ZEET stocks looked like they had a lot of potential and for about a year they outperformed the WAAAX stocks and the S&P/ASX 200 Index.

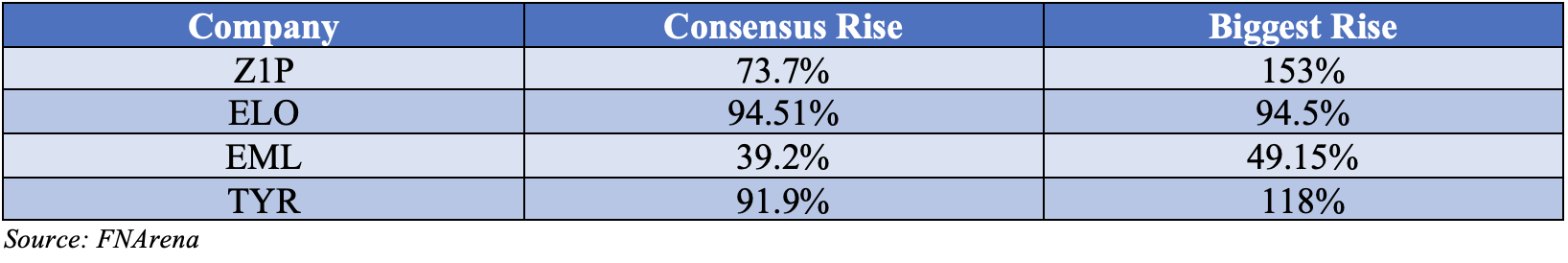

But they’ve had a shocker since tech stocks have copped it. Now I’m not afraid to dump stocks I like but I do prefer it if the professionals agree that it’s time to say goodbye. So, what are they saying about Zip, Elmo Software, EML Payments and Tyro?

I think you can see why I can’t easily dump these stocks and you might also note they are not only tech stocks but also payments companies and the payments sector has been beaten up as you can see from what has happened to Square (now known as Block) after they bought Afterpay for $39bn!

I think you can see why I can’t easily dump these stocks and you might also note they are not only tech stocks but also payments companies and the payments sector has been beaten up as you can see from what has happened to Square (now known as Block) after they bought Afterpay for $39bn!

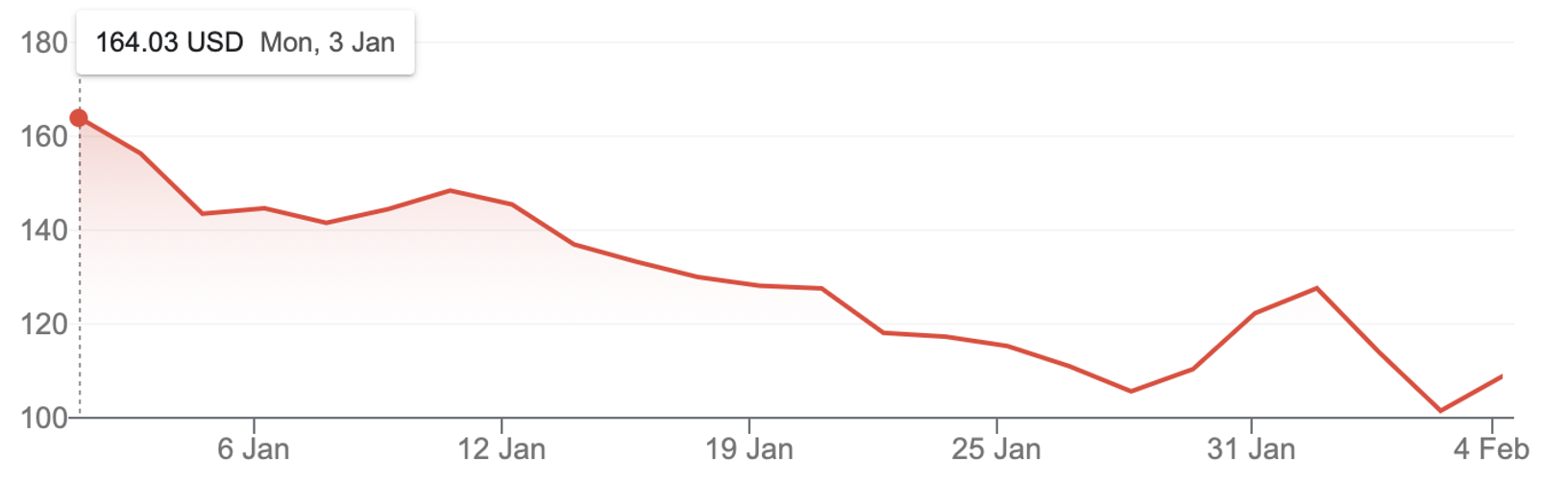

Block (SQ)

This stock has fallen 34% this year and 61% since August last year. I like the recent kick up, which was a 7% rise on Friday. It’s still probably early days, but it proves to me that there are believers in this company, which one day will be good for other payments companies.

I’m betting on tech stocks in a speculative way, based on the history of stock markets rotating out of some sectors to go into others. And I’m betting also on a history of markets overbuying and then overselling, which then leads to a re-rotation back when the stock prices look too bad to be true!

Throw in my belief that the positives of very good economic growth will eventually overcome the negatives from rising interest rates, then that should be good for growth/tech stocks.

I also liked it last week when shares in Alphabet (Google) rose by 7.5% and shares in chipmaker Advanced Micro Devices rose by 5.1%, on the strength of good company reporting results. Solid economic growth should eventually deliver better numbers for tech companies and the stock market will probably overreact to the upside. I want to buy before that happens.

By the way, the ZEET stocks are speculative but if you want a really stable tech stock, you could easily look at Xero. Here the analysts expect 20.8% but the most optimistic forecasters are Citi and Credit Suisse, whose experts expect a 44% increase.

That’s a big rise for a quality company!

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.