A couple of weeks ago I suggested a good long-term investing play might be to create your own tech fund. The overall proposition was you could take the WAAAX stocks, add my ZEET group and throw in the likes of Next DC, Megaport and Nuix.

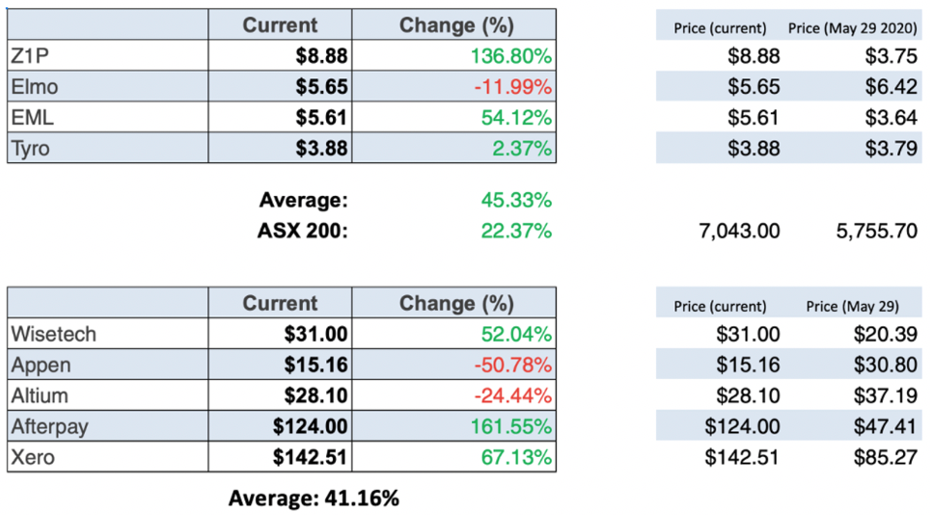

These were the tables showing how well my ZEET stocks (they beat the WAAAX group but these stocks also did well) compared to the ASX 200 index.

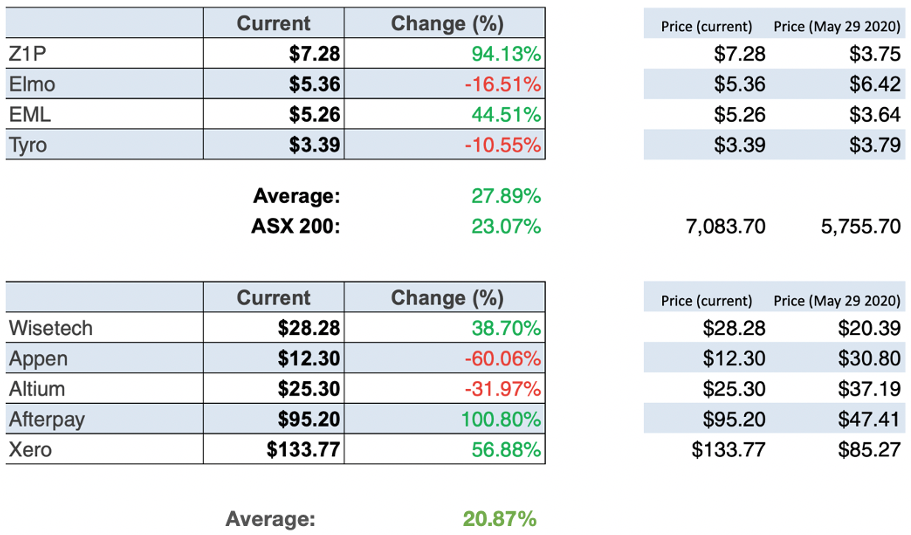

But what a difference two weeks can make, so check out these same tables as of last Friday.

Since inception, the ZEET’s performance was up 27.89%. Two weeks ago, it was 45.33%! The WAAAX group fell from 41.66% to 20.87%, while the ASX Index crept up from 22.37% to 23.07%.

Happily, my ZEET group is still beating the WAAAX group and the ASX 200, but this might change with the current rotation out of growth/tech stocks into value plays, such as the banks.

But it can be a mistake to be overinfluenced by short-term changes in market sentiment. In fact, this rotation out of tech could actually be a good thing for long-term investors.

This was the view of arguably the world’s biggest tech and innovation investor on the planet. Her name is Cathie Wood and her ARK Innovation ETF (ARKK) has been a bolter, up 153% in 2020, but it’s down around 30% in three months!

See the parallel with my ZEET and the WAAAX stocks? Given this, let’s see what Cathie told CNBC over the weekend. (Yep, while you’re watching footie and have smashed avocado and latte breakfasts, I was still working for you – and me!)

And by the way, after last week’s sell off of Appen, which surprised the company’s CEO as he wasn’t aware of any new bad news for the business coming down the pike, I started to ponder what was ‘’appening’ to Appen?

More on that soon. Let me get back to what Cathie taught me. Her ETF’s top holdings are Tesla (11%), Square 6.5%, Teladoc Health (6.3%), Roku (5.5%) and then there’s Zillow Group, Zoom Video, Baidu, Shopify, Spotify Technology and Exact Sciences.

Asked if she was rattled by the sell off and 30% loss in market value of her fund, she replied: “I love this set up. This rotation was good news because it means the bull market is broadening. It’s strengthening.”

Cathie’s point is that as an investor with a five-year horizon, where she plays great ideas and future themes as a longer-term investor, “nothing has changed but the price.” And this is after the worst month on record!

On the subject that a lot of the companies she invested in over 2020 that brought spectacular returns and were beneficiaries of the stay-at-home economy because of the Coronavirus, she presented an interesting argument that might help us find ‘value’ in tech stocks!

Cathie believes companies leveraged to the stay-at-home world of 2020 are actually platform companies for the new world. And those doubting these businesses long term (disaffection, if you like) has already been priced in.

In the local context, look at the recent pullback of JB Hi-Fi. It started the Covid phase at a share price of $41.55, nose-dived to $24.29, and then mastered the selling online game to top out around $54. It has now lost about 13%. While it’s not a tech company, it is a beneficiary of everything tech in retail.

JB Hi-FI

And the people who buy from JB Hi Fi are the kind of people who Cathie thinks about when she invests in companies for the future. “We’re not going back to the old world” Cathie insisted. The new world wants better, faster, cheaper and more creative and she singled out Zoom as the big winner out of the pandemic world. Zoom’s cost saving and even its revenue-generative potential will mean that it will get a bigger chunk of spending on communications from companies going forward. I know how my business uses Zoom for our TV programmes to acquire CEO guests, who used to be so much harder to access. Our online Strategy Day was made so much better because of the Zoom connections.

Now to Appen. What’s ‘appening there?

Wikipedia gives a neat summary of what Appen does:

“Appen’s customers use machine learning for a variety of use cases including automatic speech recognition (ASR), computer vision, increasing conversions in eCommerce, delivering more meaningful and personalized advertising, enhancing social media feeds or improving customer service capabilities with tools like chatbots and virtual assistants. For machines to demonstrate artificial intelligence, they need to be programmed with human-quality training data that helps them learn. Appen uses crowdsourcing to collect and improve data and has access to a skilled crowd of more than 1 million part-time contractors who collect, annotate, evaluate, label, rate, test, translate and transcribe speech, image, text and video data to turn it into effective machine learning training data for a variety of use cases. Most of the company’s revenues are earned offshore and clients include eight of the top 10 largest technology companies.”

Appen’s share price slumped 21% last week but after being smashed on Thursday, it did rebound 5.67%, showing not all investors doubt the company, which got an F at Macquarie’s company show-and-tell conference last week.

“Mixed messages” and “no guidance for 2021” were two criticisms about the CEO’s report, and it has created anxiety about the AGM at the end of the month.

Interestingly, Bell Potter’s Chris Savage has a “hold” recommendation and a price target of $13.65 but it was formerly $19.25! This implies a 7.8% upside. The consensus of analysts still says an 80.9% gain is possible but there’s bound to be some more downgrading of the company in coming weeks.

The range of forecasted share prices in the future from the five analysts surveyed went from $16 from Macquarie to $30.90 from Citi!

Appen remains a gamble, but it is in Cathie Wood tech/innovative company space. If it’s bought among a group of tech stocks, so you don’t have excessive exposure to it, Appen still looks like a worthwhile play. Gee I hope the company’s CEO, Mark Brayan isn’t sitting on bad news that comes out at the AGM.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.