In Tony Featherstone’s article today he talks about 4 stocks that will/could benefit from the opening up of the Aussie economy, and at some stage the world economy. In our monthly seminar (held on the first Friday of each month exclusively for Switzer Report subscribers) Peter (Switzer), Paul (Rickard) and their guest Matt Williams, Portfolio Manager at Airlie Funds Management, took a ‘Russian roulette’ question about the travel sector from a webinar attendee. The question from Angus concerned the best travel buy: Flight Centre versus Webjet versus Corporate Travel, versus Qantas. Did our experts have a preference?

“Ah, I can see you want to play the re-opening trade,” said Paul, throwing the first response to Matt.

“We do not own any of those other names and the reason is that they’ve had to recapitalise. So there’s a big hole they have to come out of in terms of their earnings per share and their profits. And they’re going to be spread over a much larger equity base. Also, they’re exposed to the international reopening, less so for Qantas. So really Flight Centre and Webjet, in particular, are all about international reopenings. And that’s few years down the trail,” he said.

Always a rational optimist, Peter added his view: “Matt, I interviewed John Gusic, Webjet’s CEO during the week for our podcast, and he’s happy their share price bounced back faster than expected,” Peter said.

“But he actually said that on the local trade for Webjet, that they will be profitable just by the borders opening up straight away. One thing staggered me and will stagger you. Before the Coronavirus, they had 10,000 retail investors. Now they have 65,000,” Peter said.

No double many of our subscribers are in this large retail number! Peter then fired a question at Matt: “I want to ask this question. A lot of fund managers have been a bit ‘cheesed off’ that all these young people have poured into the market when the market sold off, thinking that these stocks are good value. I guess in the short term they might be stung, but in the long term they probably will eventually get rewarded, do you agree?”

“Absolutely, and I’m certainly not cheesed off that young people are in the market,” Matt retorted. “I think it’s fantastic. They have an interest and they’re learning and they’ll learn more. You learn by making your mistakes and by losing a bit of money, you learn from that,” Matt said.

So Matt’s answer to Angus’s question? “Qantas!” he said.

And Paul’s pick? “I’d choose Qantas too,” he added.

And Peter’s favourite? “I hold all three,” he replied. Is anyone surprised?!

And by the way, Tony has made a good call on Qantas several times in this Report! And to be honest, the others as well! Peter and he have a lot in common!

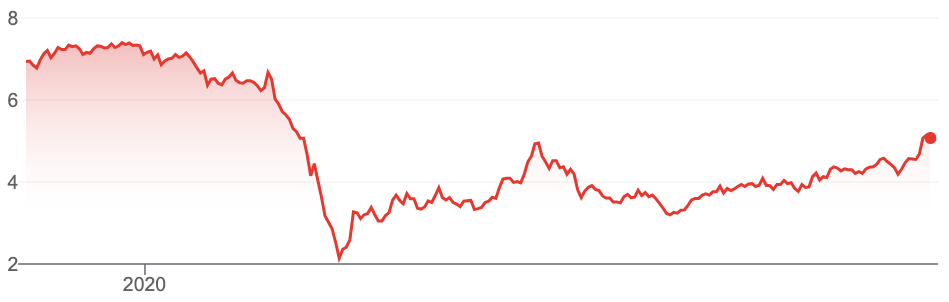

Qantas

Source: Google

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.