A family friend recently asked where I would invest $10,000 in this market – a deceptively complex and potentially dangerous question.

“Cash,” I replied. As readers know, I think the US equity market is overvalued. The S&P 500 index trades on a trailing Price Earnings (PE) ratio of almost 29 times.

A forward PE for the S&P 500 of 22.3 times at end-July 2025 is well above the 30-year average of 17 times, according to JP Morgan data.

Excluding the market recovery after COVID-19, one has to go back to the turn of the century to find the S&P 500 on a forward PE at this level.

Perhaps Artificial Intelligence (AI) will boost productivity and corporate earnings, justifying current nosebleeding US valuations. Or, more likely, that capital flowing into index-tracking passive funds is driving indices unsustainably higher.

Whatever the case, it’s a good idea to lift the portfolio cash allocation in anticipation of increasing equities exposure at more attractive prices.

That does not mean dumping stocks and taking shelter. Nor does it mean overlooking opportunities that emerge. Overvalued markets can still present opportunities to buy quality, undervalued assets that others overlook.

As I told my friend, from a portfolio perspective, I’d wait for a market pullback or correction before putting more capital to work in equities at these levels.

As we enter the market’s seasonally weak period around September, that opportunity might not be far off, judging by continued gains in US equities.

From a global equities perspective, all roads lead to the S&P 500 index, by far the most important index that dominates global indices by weighting. A pullback in US equities would drag other equity markets, including ours, lower.

Unfortunately, “cash” was not a sufficient answer for my friend. Having watched equity markets rally, he wanted actionable ideas to invest in now.

So, I asked some questions. Would the $10,000 be invested for the short term (0-3 years), medium term (3-7 years) or long term (7-plus years)?

What was his investment focus (capital growth, income or a mix of the two) and goal? What was his risk tolerance? What other investments did he own?

In the end, I suggested three approaches designed for beginners, those with intermediate knowledge and advanced investors.

I also suggested he seek independent advice from a licensed financial adviser if he wanted to construct and maintain a larger portfolio.

Here were the three suggestions to invest $10,000:

1. Beginners

Investing in a diversified fund that owns hundreds of stocks makes more sense than buying a few stocks directly, given the $10,000 investment size.

That narrows the choice to Exchange Traded Funds (ETFs), Listed Investment Companies or Unit Trusts. Another issue is using active or passive funds.

I prefer listed equity funds that are easier to buy and sell than unit trusts, and in this case favour active over passive funds. With several equity markets near record highs, I want to use managers who can navigate and exploit falling markets.

Given this idea is for beginners, I’ll stick to Australian equities. But our share market, too, looks overvalued. The Morningstar Fair Value Estimates suggests the S&P 500 index is 12% overvalued at the current level.

Listed Investment Companies (LICs) offer Australian equity exposure at a double-digit discount. The market’s two largest LICs – Australian Foundation Investment Company (AFIC) and Argo Investors – trade at unusually large discounts.

At their current share price, AFIC and Argo are at a 13% discount to their pre-tax Net Tangible Assets (NTA), based on Bell Potter numbers.

AFIC normally trades at a small premium to NTA, and Argo at a small discount, based on their average NTA over five years.

With the LIC market badly out of favour, AFIC and Argo provide an opportunity for new investors to buy $1 worth of Australian shares for 87 cents.

Prospective investors in AFIC could benefit from gains in the Australian equity market over the next seven years, and a narrowing of the gap between AFIC and its NTA towards its long-term average (a small premium to NTA).

The investor might split the $10,000 between the two LICs. But given the high stock overlap in the two LICs, I’d invest that capital in AFIC.

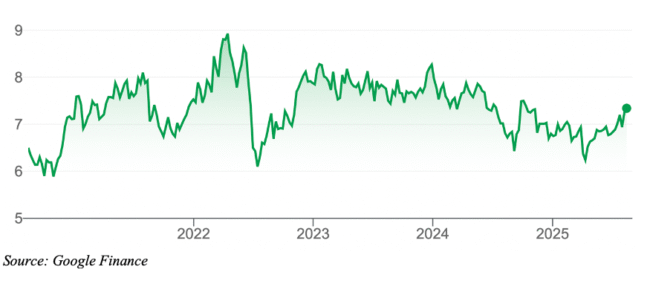

Chart 1: Australian Foundation Investment Companies

2. Intermediate

Here, I assume intermediate investors can hold the idea for at least the medium term (3-7 years), preferably longer, and that they have a higher risk profile.

Thematic ETFs suit this task. Chosen well, they provide exposure to a diversified portfolio of stocks based on promising themes, several of which have featured in this column over the past two years.

The first theme is global banks, represented by the Betashares Global Banks Currency Hedged ETF (ASX: BNKS). I’ve covered that ETF in detail this year, so won’t expand on it here, other than to say US and particularly European banks still trade on attractive PE multiples below those for banks here.

The second theme is global resource stocks. As new mines become harder and costlier to find and develop, minerals-supply constraints will continue to grow. Less supply in copper and other key minerals, at a time of rising demand due to the boom in renewables, will underpin the commodity supercycle.

The Betashares Australian Resources Sector ETF (ASX: QRE) provides exposure to mining stocks. QRE is heavily weighted in BHP (35% of the fund at end-July 2025), Woodside Energy Group (9%) Rio Tinto (8%) and Fortescue (5%).

I like BHP at its current valuation, so prefer QRE to the VanEck Australian Resources ETF (ASX: MVR), which has a maximum stock weighting of 8%. Much depends on whether investors already own BHP directly in their portfolio. Buying QRE could risk an overlap for investors holding BHP shares.

The third theme is global defence stocks. As I have written this year, geopolitical risks will necessitate sharply higher spending on defence this decade, particularly with President Trump demanding US’ allies lift their weight on defence.

The VanEck Global Defence ETF (ASX: DNFD) provides exposure to 31 large global defence companies. Up 47% over 12 months to end-July, DFND is due for a breather. Still, the defence sector has solid growth prospects this decade.

In terms of allocating the $10,000, prospective investors might divide that equally between the bank, mining and defence ETFs. Before doing so, they should do further research of their own or seek financial advice.

Chart 2: Betashares Australian Resources Sector ETF

- Advanced

This section assumes investors are experienced, have a higher risk tolerance and are more active, focusing on shorter-term ideas over the next 0-3 years.

Five ideas stand out. The first is investing in a recovery in Chinese equities through the iShares Large-Cap China ETF (ASX: IZZ). Yes, Chinese equities have high regulatory and market risks but are priced at a substantial discount to developed-market equities that might underestimate their recovery prospects.

The second idea is betting on further gains in Chinese tech companies through the new Global X China Tech ETF (ASX: DRGN). This complex ETF, providing exposure to 20 leading Hong Kong tech stocks, is not for the risk averse.

The third idea is taking advantage of weakness in copper after President Trump surprised the market with tariffs on imports of semi-finished copper products.

The copper price fell about 20% on the news, even though copper supply is becoming more constrained and demand from electric vehicles and other renewable infrastructure for copper is rising. The Global X Copper Miners ETF (ASX: WIRE) provides exposure to a basket of leading global copper stocks.

The fourth idea is gaining exposure to the commodity supercycle. As the US and China increasingly use commodities in economic warfare, expect heightened volatility in commodity prices and more opportunities to buy commodity stocks.

The Global X Bloomberg Commodity Complex ETF (ASX: BCOM) provides exposure to a broad basket of hard and soft commodities that is difficult for retail investors to replicate. BCOM, a complex ETF, uses derivatives, investing in a range of commodity futures contracts. As such, it should be considered a higher-risk ETF.

Gold equities are the fifth idea. They have lagged gains in the gold bullion price over the last few years. Although gains in the gold price might be slower from here, it’s hard to see gold falling substantially, given persistent central bank buying, structurally higher inflation and rising geopolitical risks.

More likely, gold equities will continue to narrow the performance gap with gold bullion in the next few years. Providing exposure to 63 gold stocks, the VanEck Gold Miners ETF is up 40% over one year to end-July 2025. Yet it trades on a forward PE of only 13 times, suggesting further upside over the next few years.

Given the higher risk profile of these ideas, advanced investors might consider allocating their $10,000 to some or all the ideas.

Chart 3: Global X Copper Miners ETF

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 13 August, 2025.