Investors can make four key mistakes during equity market corrections. The first is freezing when markets tumble and not capitalising on short-term volatility. As I’ve written before, the key to delivering attractive portfolio returns this decade is adding to portfolios during bouts of heightened market volatility when assets are irrationally oversold. That is, buying stocks when others panic.

The second mistake is not having sufficient cash to pounce on bargains. As markets rally, many people become fully invested, extrapolating gains too far into the future. They don’t take profits on the way up and lighten positions.

Searching for new positions during volatility is the third mistake. Yes, a stock you missed on the way up might become attractive again as its valuation falls. A better approach is topping up exposure to undervalued stocks you already own.

The fourth mistake is underestimating how far markets can fall and how long their recovery takes. Granted, markets have a habit of bouncing back quickly after corrections these days, partly because central banks rush to the rescue by injecting extra liquidity into the system and flattening the business cycle.

But this current correction in Australian equities feels different. Consider its root causes: the up-ending of decades of US foreign policy, an escalating trade war and an unpredictable, erratic US President in Trump.

Global markets have not fully grasped the magnitude of Trump’s agenda or the profound structural changes underway. Moreover, institutional investors are yet to fully comprehend how these changes will affect company valuations.

Five years ago, the world had low inflation/interest rates, lower energy costs, expanding globalisation and relative geopolitical stability. Today, the world faces persistently higher inflation/rates, rising energy costs due to decarbonisation, deglobalisation and geopolitical instability. Wars in Ukraine, Palestine and possibly Taiwan this decade headline a long list of problems.

History is the best guide. We know geopolitical volatility spikes when the current world hegemon decides to relinquish its role. That was the case with Britain before the First World War … look at the volatility between the two world wars.

Today, the US, as the global hegemon, is becoming more isolationist under Trump and retreating from its role as overseer of the liberal international order. Not surprisingly, Russia, China and other major powers are jockeying to gain more power and confirm their status as their regional hegemon.

The take-out for investors is that this is not a normal blip in an overvalued bull market. Nor is it a standard 10% correction that all bull markets require from time to time as part of their inevitable growth over long periods.

I’m not saying a larger market fall is imminent or that investors should move to 100% cash and retreat to the sidelines for the next few months (although some good judges I know plan to do just that, such is market uncertainty).

Rather, we could be in for a period of extended uncertainty given the speed of change under Trump. As Vladimir Lenin is thought to have said: “There are decades where nothing happens; and there are weeks where decades happen”. We’ve seen the equivalent of decades of change in US foreign policy this year.

The tepid bounce-back this week after double-digit falls is concerning. It doesn’t feel like investors have high conviction that the worst is over and that global equity markets will quickly recover their losses. It wouldn’t surprise if a 10% correction in Australian equities extended to 15% over the next few months, in what is a traditionally seasonally weak period for the market.

Power of income investing

It’s times like these when income investing comes to the fore. Income investing is important in all market conditions and especially during periods when the potential for capital growth is constrained due to elevated uncertainty.

The key is to be ‘paid to wait’ while markets sort themselves out. For all the uncertainty now around Trump, expect things to settle down over the next six to 12 months as the market adjusts to new realities under this US administration.

Owning high-quality companies that pay solid dividends will provide some comfort as investors wait for a market recovery to play out.

The outlook for income investing in Australia, however, is deteriorating. Term deposit rates – a no-brainer for income investors in the past year – will fall, albeit slowly, as the Reserve Bank cuts the official cash rate again this year.

Uncertainty in the bank hybrid market – another go-to place for income investors in the past few years – is rising due to the Australian Prudential Regulation Authority’s (ARPA) decision this year to phase out bank hybrids by 2032.

Meanwhile, the main sources of equity yields – Australian banks and miners – face growing pressure. Big dividend cuts by key miners in the latest reporting season reflect the pain for income investors who benefit from resource dividends.

So, where do Australian investors turn to if they want to be ‘paid to wait’ for a market recovery? Fortunately, Australia has such excellent Listed Investment Companies with attractive dividends and also unlisted income funds that provide good yield.

Less considered is investing offshore for dividends. The main hurdle for Australian investors with this strategy is franking credits. Domestic investors who get tax benefits from fully franked dividends on Australian shares don’t get franking credits on their offshore dividends. Currency risk is another consideration.

Against that, Australia’s economy is weak, productivity growth is terrible, and the upcoming Federal election promises a hung parliament where the most likely outcome is Labour having to do deals with the Greens – a scenario that would lead to a less business-friendly policy and lack of reform.

If that happens, watch for a lower average market dividend next year as companies face greater earnings pressure. Even without franking, global equities could provide more compelling dividend opportunities given these risks.

Two funds to consider

Using a fund that provides diversified exposure to dividends from high-quality companies makes sense. As does favouring Exchange Traded Funds (ETFs) that provide that exposure at low cost in a convenient structure through ASX.

The SPDR S&P Global Dividend Fund (ASX: WDIV) is an example. WDIV tracks the S&P Global Dividends Aristocrat Index (AUD), which comprises 100 relatively high dividend-yielding companies across a wide range of countries and sectors.

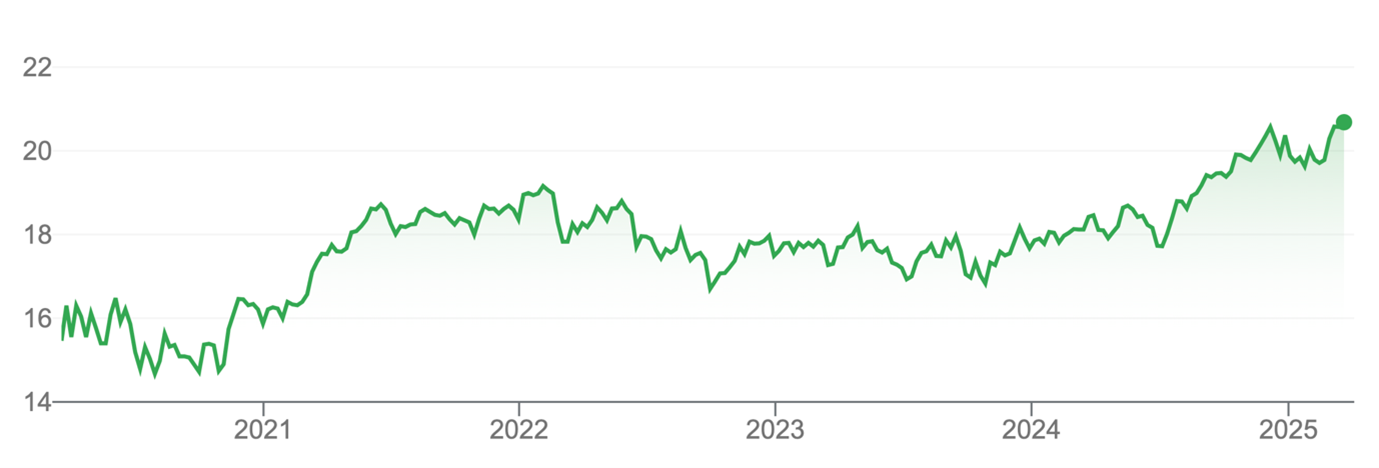

WDIV’s trailing dividend yield of 5.55% compares favourably with Australian shares. The indicated dividend yield on the S&P/ASX 200 Index at end-February 2025 was 3.79% before franking, S&P data shows.

WDIV returned almost 19% over one year to end-February 2025, and 8.5% annualised over three years. With an average Price Earnings (PE) ratio of 11, WDIV’s valuation is undemanding. The ETF is no world beater but looks like a steady way to achieve yield from global equities at lower risk.

Chart 1: SPDR S&P Global Dividend Fund

Source: Google Finance

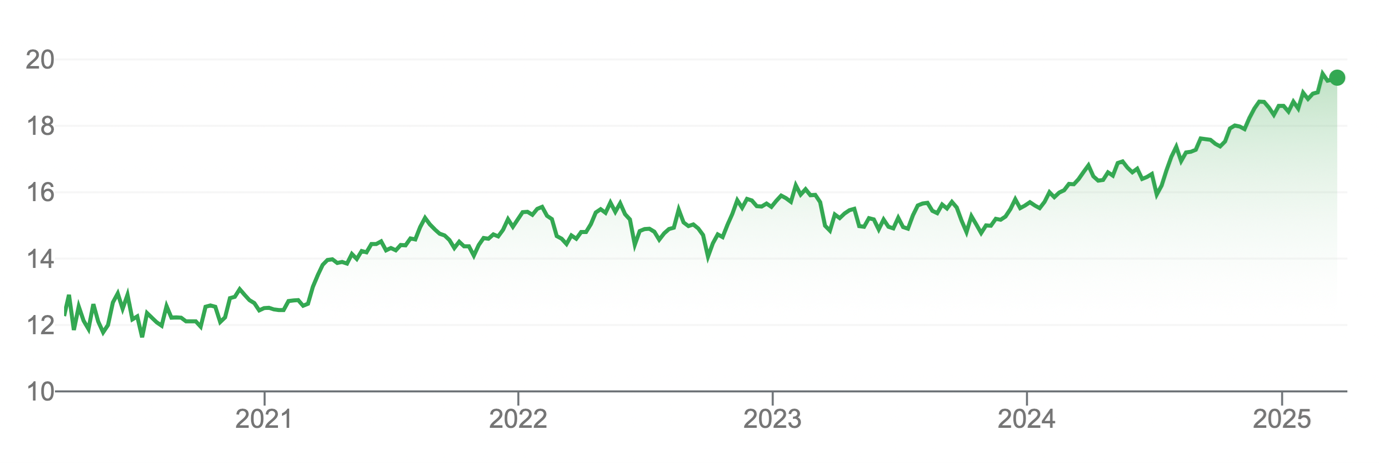

The Betashares Global Income Leaders ETF (ASX: INCM) is another option. Like WDIV, it invests in a portfolio of 100 high-yielding companies (ex-Australia).

INCM has returned 28% over one year to end-February 2025 and almost 15% annualised over three years. Its methodology selects high-yielding companies, screened for their potential to deliver consistent, attractive quarterly income.

INCM’s 12-month distribution yield is 4%. The ETF has a much higher weighting in US shares compared to the WDIV, increasing its risk profile. INCM’s forward PE is only 11 times, despite gains in its underlying index this year.

WDIV is the more conservative option of the two to weather the current market storm. But there’s a lot to like about INCM’s performance since inception, its methodology and portfolio holdings.

Chart 2: Betashares Global Income Leaders ETF

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 19 March 2025