Right now, along with many other market players, I’m hoping that April 2 will bring us some clarity about the Trump tariffs. If that happens, you’d want to be a buyer now for a big payoff from the stocks that will benefit from the hope for lucidity after Wednesday US time. Since February 14, when tariff talk spooked stocks, the Dow Jones index is down 6.9%, while the tech-heavy Nasdaq Composite is off 13.5%, showing Trump has effectively trumped tech stocks. The most cautious investor will wait until Thursday and if the news is good, they’ll buy tech on a rising trend, but the news will have to be surprisingly good on tariffs.

Writing for theverge.com, US financial commentator Jay Peters noted that President Donald Trump’s tariffs on goods imported from Mexico, Canada, and China are, in effect, hitting US goods made elsewhere, but these are sold in the States. The Big Tech companies have remained mostly silent despite the potential impact tariffs could have on their businesses.

While companies such as WalMart, Target and Best Buy have admitted that prices will rise because of tariffs, Peters reported that “Google spokesperson Jose Castaneda, Microsoft spokesperson Kate Frischmann, and Nvidia spokesperson Stephanie Matthew declined to comment.” And he added that “Amazon, Apple, Meta, Nintendo and Samsung have not commented.”

What company CEO would want to link Trump tariffs to price increases? But this is why stocks are being sold off and the more tariff hittable products you sell, the more likely your share price has copped it.

Since February 19, Xero (a tech stock that rises and falls with US tech stocks) is off 16.3%, while NextDC, (another tech darling locally) is down 19.9%.

Did I say Trump has trumped tech?

The direction of the share prices of tech companies will heavily depend on what decisions and announcements President Trump unleashes this week and Jay Peters captured what a lot of major market influencers would be thinking: “The Trump administration is chaotic, so the nature of the tariffs could change at any moment.”

He added: “We may not see the real lasting effects of these tariffs on tech companies until their next major product launches. Could the iPhone 17 have a higher price? Will you have to pay more for the next generation of Ray-Ban glasses? We just don’t know, yet.”

Given all this, collecting a few tech companies might pay dividends by year-end, assuming the tariff threat becomes less uncertain.

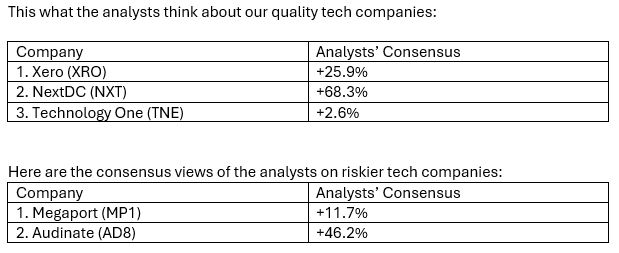

My favoured play right now is the following:

- BUY: Xero and NextDC.

- BUY: HNDQ for the top 100 stocks in the Nasdaq Composite Index.

- BUY: IHVV for the S&P 500 on the basis that Trump won’t make decisions to KO the US stock market in 2025.

- Look at local small cap fund managers who will be sifting through the companies that have seen their share prices fall but will benefit from falling interest rates in Australia, having no exposure to Trump tariff hits and who are possibly winners from applying AI to their production and/or their marketing processes.

Post these Trump tariffs, there are compelling reasons to buy stocks, especially those that have struggled over the past couple of years of spiking interest rates, and more recently because of the uncertainty that the US President has delivered since mid-February.