I like stocks that defy big sell-offs and here’s a table of those that went up on Friday when the market’s S&P/ASX 200 Index was down 1.77% (or a big 120 points).

Given the ability of these stocks to defy the gravity of a very negative market, let’s see if there are any other trends that recommend these stocks.

On principle, I have a problem with agricultural stocks because there are too many curve balls from droughts, bushfires and floods, as well as wars that can push commodity prices up and down.

So are there any from the above list that might be showing good reasons to buy or not buy?

1. Baby Bunting worth a punting?

Let’s kick off with a company such as Baby Bunting (BBN). It was up 5.51% on Friday and year-to-date it’s off 28.09% and down 6.51% over the last month. At the same time, the overall market was down 14.7% year-to-date and off 9.39% over the past month.

Baby Bunting 17/06/22 (BBN)

BBN is a company that seems to be trying to create an uptrend, but right now it’s not convincing. Meanwhile, the analysts surveyed by FNArena are in the company’s corner, with an average rise of 58.9% predicted. And five out of five company watchers like BBN, with Morgan Stanley the most positive with a 71.64% call. So this one’s worth watching.

2. Electric vehicles could drive this company

Carsales.com was up over 8% on Friday. I believe this is a perfect tech company that will benefit not only from the time when the market says interest rate rises are on hold or finished but also from the freeing up of China from its lockdown.

Car supplies will eventually increase and prices will fall but that should bring forth new buyers. Also, the demand for electric vehicles will be red hot over the next three years and CAR should be a beneficiary.

The average rise expected by analysts is 17.2% and only one analyst is recommending to lighten the hold on this company, while Credit Suisse has an “outperform” call tipping a 29.52% rise.

I’m with them on this company but what does the chart tell us?

The one-month chart looks interesting with a 2.79% rise, while the S&P/ASX 200 Index has dropped 9.39%. I MC’ed the Australian Automotive Dealers Association conference a couple of weeks ago in Brisbane and Carsales.com is a really big deal for this industry.

Carsales.com (CAR) one month

3. Consider adding more EML

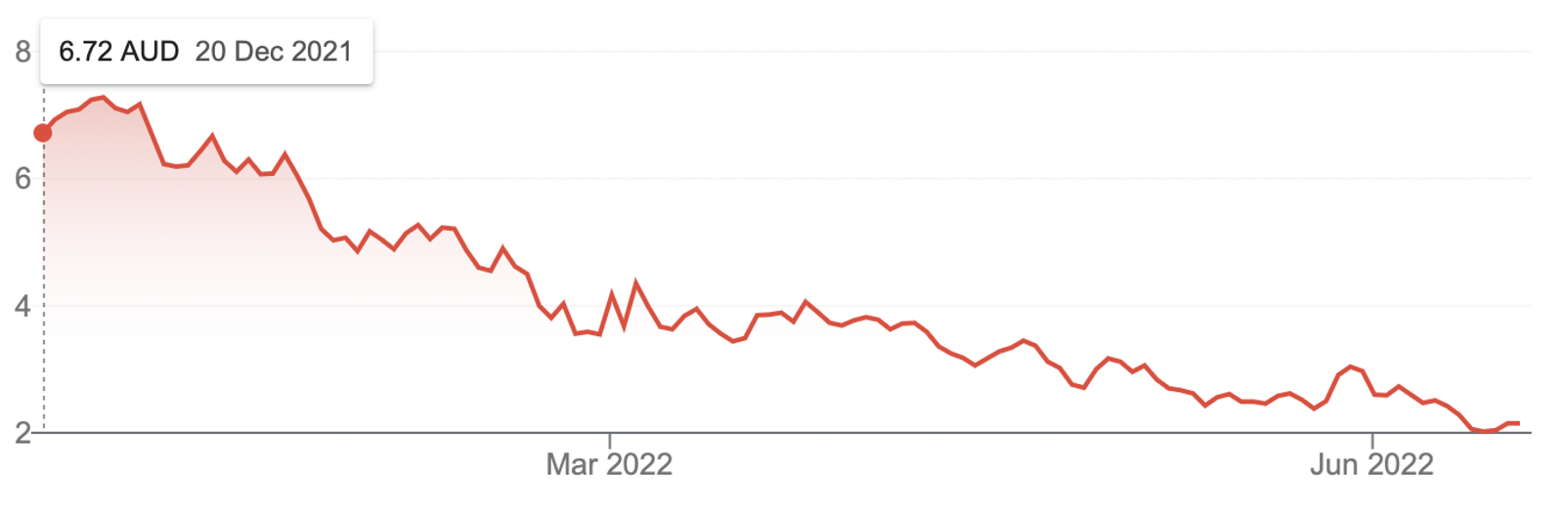

One of my favourites that’s proved to be a disappointing company is EML Payments (EML). It rose over 9% last Friday. Over the past month, it has only dropped 0.68%, and despite management’s ability to goof up just when the market is starting to like the company’s future, three out of three company experts like it. The average expected rise is 100%, with Macquarie looking for a future price of $3.45, which would be a 138% rise on its current price of $1.45.

At its peak, this was a $5.71 company and if the leadership can let the company live up to the potential that analysts see, then this could be an interesting investment. I plan to get the CEO on my TV show ASAP.

I’m toying with buying more to reduce my overall holding cost. Fortunately, my exposure is small but I could think about increasing my stake, especially if CEO Tom Cregan can raise confidence levels when I interview him.

EML Payments Limited (EML)

4. My tip on ZIP

Right now I can’t punt on the likes of Zip, which is caught up in the slagging of the Buy Now Pay Later (BNPL) sector as every man and his dog, including Apple, are invading the sector with new rival products.

I do expect that both Zip and Afterpay (now Block) will make a stock price recovery over the next year, when tech stocks get re-rated, but not to their previous highs.

5. Not on my tab

Pointsbet (PBH) is another company that did well on Friday, up 2.1%, but I find this sector overcrowded and difficult to make projections on.

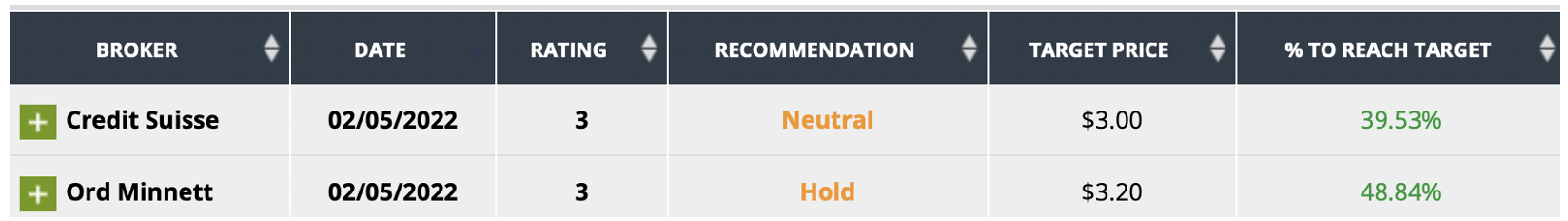

This is what FNArena’s surveyed experts are saying:

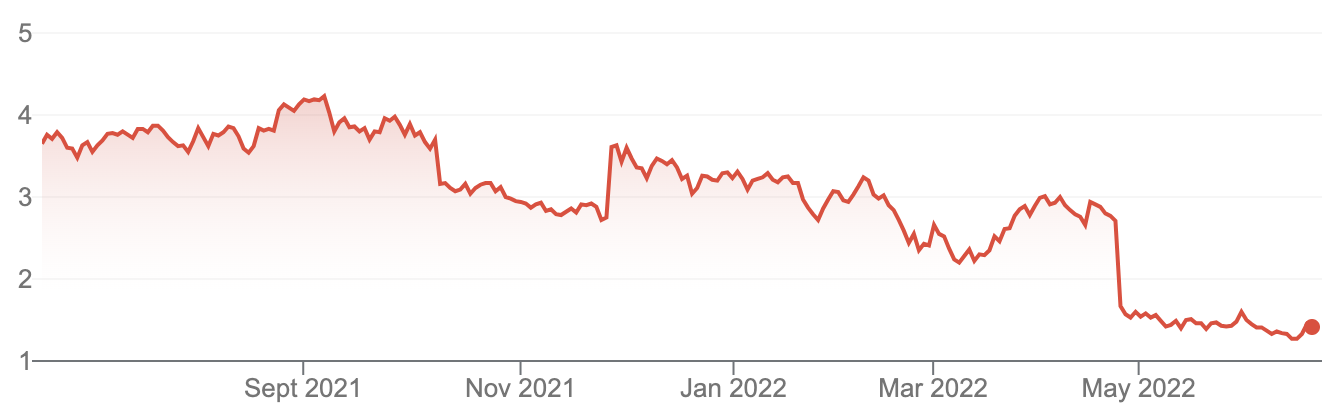

Quite frankly, there are much better quality companies that have been recently sold off that I’d rather be investing in, which will be the subject of next Monday’s story, after we see how the week goes. Given my belief that I can’t see any good news coming for a month or two, we have time to load up on these better businesses. The six months chart of PBH doesn’t make me keen to gamble on this operation at the moment.

Pointsbet (PBH) six month

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.