Childcare operators have been among the more disappointing small-cap stocks over the past decade but after heavy falls, some operators look more attractive.

The long-term potential for childcare operators is obvious. Population growth and higher female participation rates in the workforce mean rising childcare demand.

Add to that greater government support for childcare costs – particularly under Federal and State Labor governments – and gradually stronger childcare demand is likely.

Yet various childcare stocks have been perennial disappointments. Oversupply of childcare centres, poor strategy and execution, and terrible governance have blighted listed childcare stocks, to varying degrees. The sector has underperformed.

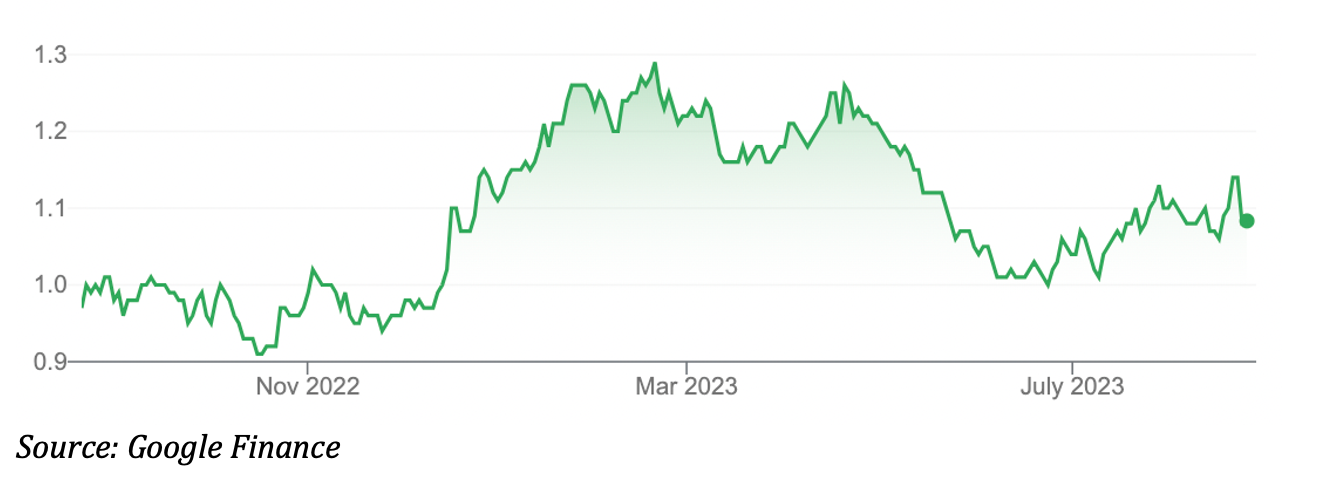

G8 Education (GEM), the largest childcare stock on ASX, has a 10-year annualised total return (including dividends) of almost zero, Morningstar data shows. Over five years, G8 has an annualised average total return of minus 8.5%.

Mayfield Childcare (MFD), a microcap operator, has done better. Its five-year annualised return is 9.3%. Another listed childcare operator, Think Childcare, delisted on ASX in October 2021 after being bought out by Busy Bees, a private-equity-backed operator.

Given the mostly poor performance of listed childcare stocks, I have preferred owners of childcare properties over operators. Well-located and designed childcare centres typically have high occupancy rates and good yield – and far less risk than childcare operators.

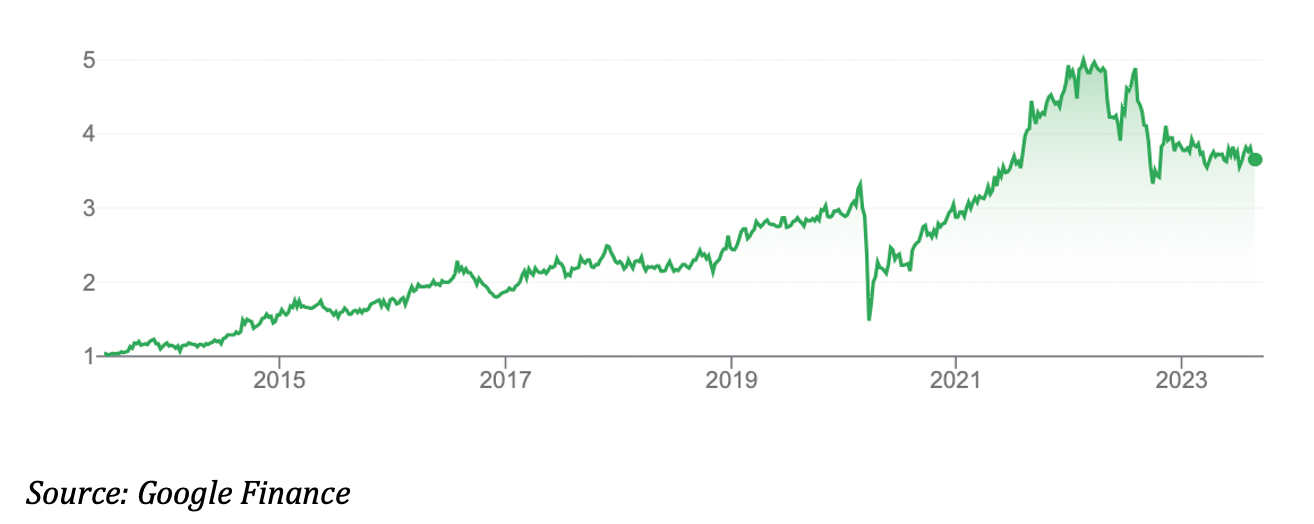

ARENA REIT (ARF) has been my go-to owner of childcare properties (they rent these properties to childcare operators). I have written positively about ARENA several times for this report over the years. ARENA’s five-year annualised total return is 15.14%. Over 10 years, it has returned almost a whopping 17% on average.

To recap, ARENA is a niche Australian Real Estate Investment Trust. (A-REIT). Capitalised at $1.3 billion, ARENA is this market’s second-largest owner of childcare properties with more than 230 long-day childcare centres. The property trust also owns healthcare centres, but childcare comprises most of its portfolio value.

I still prefer ARENA over childcare operators. If anything, ARENA’s fall from a 52-week high of $4.50 to $3.67 has made it more attractive on valuation grounds.

Like many A-REITs, ARENA has underperformed this year as interest rates rose and amid fears of savage downgrades in underlying property values across the A-REIT sector.

Investors fear rising rates will lead to sharply lower values for office, retail and, to a lesser extent, industrial property. That’s why many A-REITs are trading at a large discount to the underlying value of their property portfolio (their Net Tangible Assets).

The market doesn’t believe the NTA or expects it to fall when the A-REIT properties are independently revalued. Valuation downgrades have started, but so far, the extent of the falls exceeds the implied discount to NTA. Simply, the market has been too bearish on some A-REITs at current valuations.

In June, ARENA reduced the value of its portfolio by only $1 million – a change that had a negligible impact on its latest reported net asset value (NAV) per security of $3.42.

Released this month, ARENA’s FY23 result delivered 6% growth in net profit to $60 million, a 6.8% average rental increase, and 1% growth in NAV. For a property sector battered by rising rates, it was a solid result. But ARENA fell a little on the news.

Nothing in that result changed my long-term view on ARENA. Its exposure to childcare properties, medical centres and other government-tenanted properties provides important defensive qualities in this market.

ARENA’s Early Learning Centre (ELC) portfolio had an occupancy of 99.7%. Like-for-like operator occupancy was the highest rate in 10 years for ARENA. I’m surprised the market didn’t make more of that comment and what it means for childcare operators.

The market’s overly bearish view on A-REITs has provided an opportunity to invest in ARENA at a 9% premium to its latest NTA (at the $3.67 unit price). ARENA had historically traded at a larger premium and looks interesting at the current valuation.

Chart 1: ARENA REIT (ARF)

Childcare operators

After so many false starts, why invest in childcare operators now? Granted, there are many headwinds. Part of the childcare sector is still normalising after COVID-19. Labour shortages and rising staff costs are recurring challenges for childcare operators. Regulatory noise and risk are another ongoing issue for the sector.

There are positives. The main one is supply. Fewer greenfield childcare centres are being developed. Many new centres are properties that have been converted to childcare.

Supply of new childcare centres has noticeably contracted, principally because of rising funding costs (as interest rates rose). Tighter supply of new childcare centres is good for occupancy rates at existing centres.

The other positive is labour-force trends. Sadly, as living costs rise, more families will have to work longer hours to make ends meet. That will see more people return to work (as dual-income families) or some people who have a job take on more hours if they can. The result will be slightly higher demand for childcare services.

Yes, it seems a long bow to link inflation to childcare demand. But one way to combat financial pressures is to work more hours, where possible. That, plus greater government assistance, has to support stronger childcare demand in the short run.

To be clear, I’m not suggesting rapid growth in demand or that childcare operators are a screaming buy. Rather, that after years of property oversupply, industry conditions are improving at a time of strengthening short- and long-term demand drivers for childcare.

Few analysts cover childcare stocks these days and the market seems to have largely forgotten about them, judging by their price performance over the past few years. These conditions create opportunity for savvy small-cap fund managers.

For investors who want to invest in childcare operators – the firms that provide the actual day-care – there are two local choices: G8 Education and Mayfield.

On paper, G8 often looks undervalued, but I have been caught out on it before. Commentary in G8’s mixed earnings result this week highlighted significant labour-market shortages and their effect on centre occupancy levels. Clearly, workforce shortages are a large and continuing problem for childcare operators.

Chart 2: G8 Education (GEM)

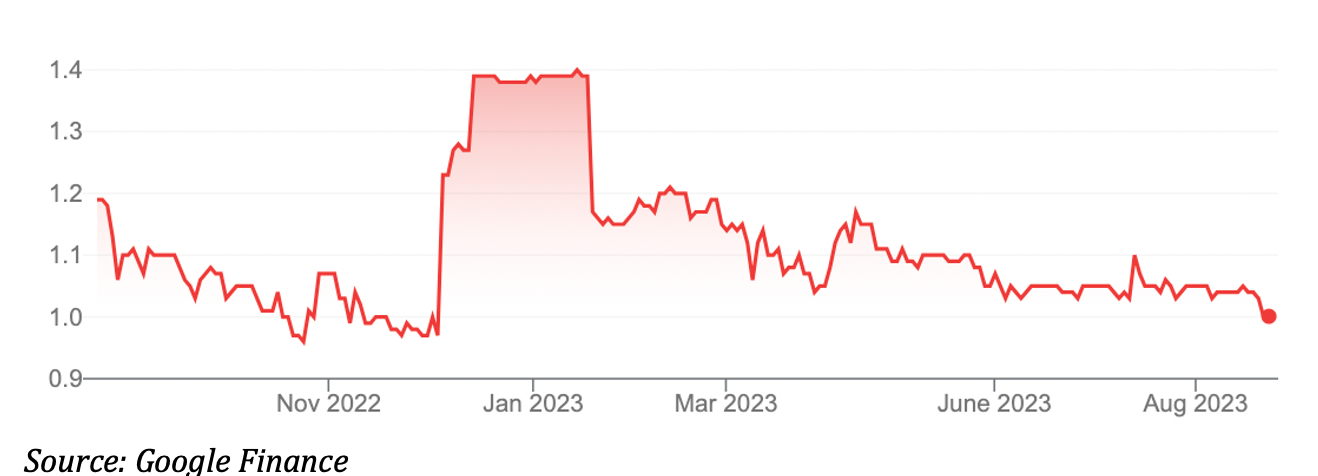

I prefer Mayfield, although accept that as a microcap the stock is too small for conservative long-term investors.

Mayfield owns 35 childcare centres following the successful integration of 14 Genius centres. The combined centres have just over 3,100 places.

I like Mayfield’s strategy. It will consolidate a grab-bag of childcare brands (23 across its centres) into one brand (Mayfield Early Education) to reduce costs and deliver economies of scale. Also, the integration of 14 Genius centres adds about 400 staff to Mayfield and expands its footprint in Queensland and South Australia.

Mayfield is sensibly building scale. Done well (and that hasn’t always been the case in childcare), this model can add more centres and amplify earnings growth. With an occupancy rate of 69% in CY2022, Mayfield has plenty of work to do but should benefit from rising demand and a contraction in supply of new childcare centres.

At $1, Mayfield is on a trailing Price Earnings (PE) ratio of just under 8 times CY2022 earnings and yielding about 7% fully franked. The stock has mostly drifted lower this year and appears out of favour. It fell a little after G8’s results this week (presumably on labour-shortage fears in the childcare industry). That could be an opportunity as investors overlook Mayfield’s’ long-term strategic progress.

As a microcap stock in a historically volatile listed sector, Mayfield suits experienced investors who understand the features, benefits and risks of this form of investing.

Chart 3: Mayfield Childcare (MFD)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis on 23 August 2023.