One of the jobs we’re supposed to do here is to pinpoint stocks that have been underestimated or undervalued but have a promising future. We’re also expected to be pretty good on guessing the economic and market future, though we get excused when we miss a potential pandemic, when the body charged with the task of picking such things (i.e. the World Health Organisation or WHO) missed it for a damn long time!

Given all this, I want to outline the investing territory ahead and then point to a group of stocks that should be beneficiaries of the reopening trade, the progress back to normal and then at least two years of economic boom.

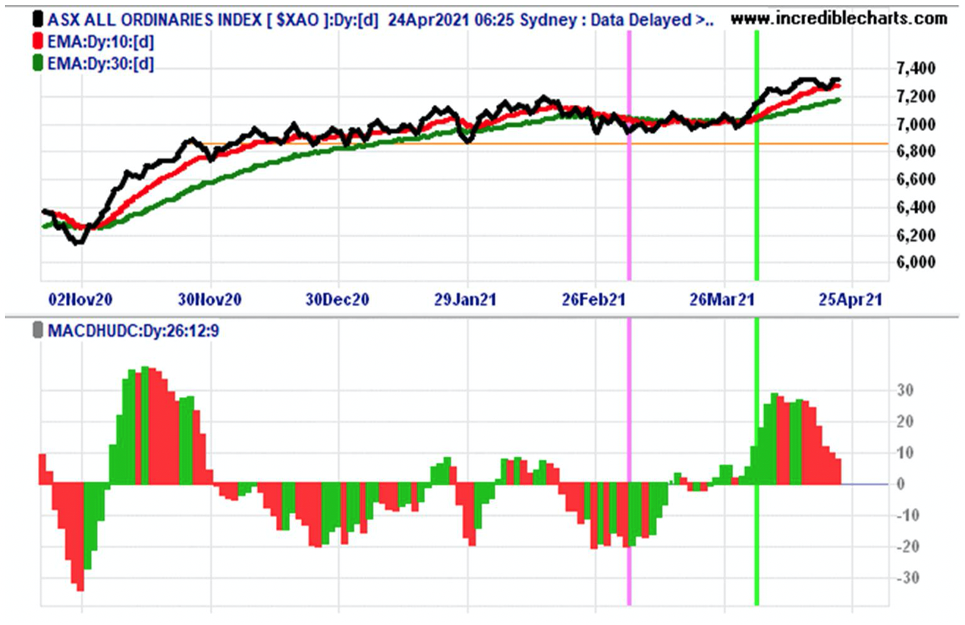

These charts reinforce my positivity for stocks.

Over the weekend I read the take of ex-NSW Treasury Secretary Percy Allen on the short-to-medium term trend analysis for the local stock market. Here it is in a nutshell:

“The Australian stock market is bullish on short-to-medium-term trend analysis The All-Ords red 10-day trend line fell below its dark green 30-day one on the 5th of March, but on Tuesday 6th April it rose above its 30-day one, as can be seen in the upper half of the chart above.

“Also its price momentum as measured by its MACD oscillator went strongly positive as can be seen in the lower half of the chart. However, in the last week the market’s momentum has slowed dramatically.

(What does Percy mean by the MACD oscillator? It’s one of the most popular and widely used technical analysis indicators that traders and analysts use to gauge momentum in markets).

And what does Percy say about the medium to long-term view?

“Since the 20th of October, the All-Ords index has been bullish on medium-to-long term trend analysis because its 30-day trend line has been above its 300-day one. The upturn in the monthly Coppock momentum indicator after October 2020 confirmed the Australian share market crash of February-March (the first crash since 2007-09) was over.”

(What’s this Coppock Curve he mentions? It’s a long-term price momentum indicator used primarily to recognise major downturns and upturns in a stock market index. It is calculated as a 10-month weighted moving average of the sum of the 14-month rate of change and the 11-month rate of change for the index.)

And what’s his complex analysis telling us?

“Presently, both the short-to-medium term trend and the medium-to-long term trend analyses are bullish.”

Thanks Percy.

Recently, Investopedia.com reminded me of what Peter Lynch thought about when investing for the long term. He talked about ten-baggers, which were stocks that increased tenfold in value over time. He attributed his success to a small number of these stocks in his portfolio.

But this does require the discipline of hanging on to stocks even after they’ve increased by many multiples, if he thought there was still significant upside potential.

As a group, what stocks have the potential to give you ten-baggers?

Given we have an economic boom ahead because of the huge fiscal stimulus worldwide, the historically low interest rates that are expected to stay low for a long time and the big rollout of vaccines, I want to be invested in stocks that are leveraged to a big, new age future.

And given a portfolio manager from the very successful US fund WCM recently told me that the digital age “is only in its infancy”, I want to be in tech stocks.

From a local point of view, you could easily put together your own tech fund by combining the famous WAAAX stocks with my less than one-year old ZEET group of stocks. And I’d also throw in Megaport, Next DC and Nuix.

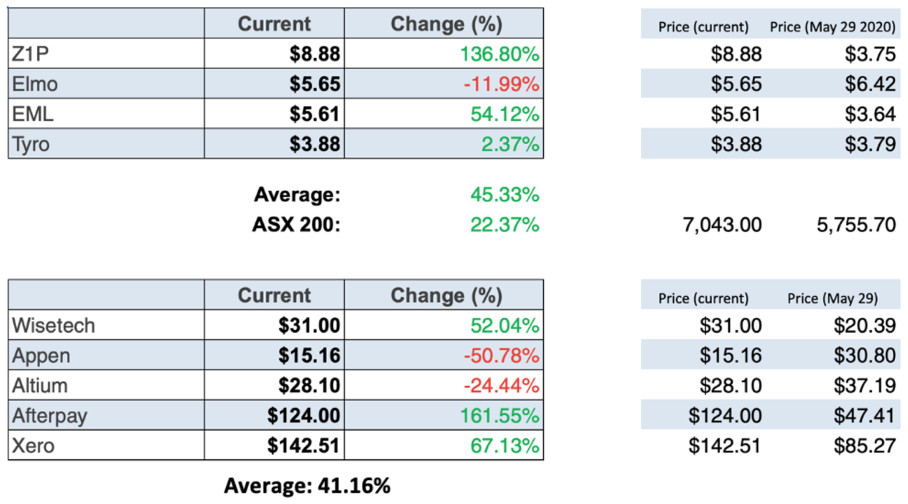

Back at the end of May last year, I tipped you into my ZEET stocks. Let’s see how they performed against the S&P/ASX 200 Index and the WAAAX team.

As you can see, the ZEET group was up 45.33% on Friday, while the WAAAX group was up 41.16%. And they completely blitzed the S&P/ASX 200 Index, which came in at a nice but sedate 22.37%!

Have a look at the tables below and let’s think about the lesson:

Clearly these stocks can’t always rise. Some may be due for a sell off, but I’m betting that over time these stocks linked to a new age will perform. This explains why they’ve done so well over the past five years. And this gives us a clue about the future.

Look at a laggard in the group, such as Elmo Software, and its five-year story adds to my argument.

ELO 5 years

The company is up roughly 133% in five years!

And now look at Appen and you see an even better story.

Appen 5 years

Appen is up 750% in five years.

What about Altium’s story? Look at the graph below. Altium is up 336% in five years.

Altium 5 years

The simple yet compelling story is that I want to be heavily exposed to the businesses and industries of the future, so the investing equation equals:

WINNERS = WAAAX + ZEET + NXT + MP1 + NXL

Tech is hot and will remain so for some time into the future. And that’s where I want to be.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.