I don’t know when the bear market in global equities will end. Nobody does. COVID-19, Russia, China, inflation … it’s too soon to say the worst is over.

I am, however, sure of some things. First, large falls in company valuations this year, particularly in growth stocks, have already priced in a tsunami of bad news ahead. As newspapers obsess about inflation and interest rates, the market looks to FY24.

Second, relying on historical benchmarks is dangerous. A fund manager recently commented that bear markets on average last 300 days. On that measure, we are about halfway through the selloff. But this bear market is a different beast. History is less of a guide.

Third, everything is moving faster. The Reserve Bank is raising interest rates at the fastest pace in 30 years. The US economy is in a technical recession yet has a booming job market. European 10-year bond yields are falling. Volatility is amplified.

This suggests a more intense, shorter bear market than normal. That doesn’t mean it will be any less painful for investors who overpaid for growth stocks. Or that the market won’t be littered with “bear-market” traps that destroy capital.

This is a difficult time to invest, principally because the market is still determining the depth of a recession in advanced economies. If inflation is cooling (as bond markets suggest), rate rises could be less aggressive than central banks have communicated.

That would imply a mild, brief recession in the US. The market would increasingly price in falling rates in FY24 and beyond, to kickstart ailing economies. That’s good for growth stocks and partly explains recent gains.

The opposing view says this is a “relief rally” and bear-market trap. Policymakers will battle to bring inflation back to 2-3% because of the Russia-Ukraine conflict and rising wage demands. Savings built up during COVID-19 add other uncertainties; rates can rise but people keep spending because of money tucked away during the pandemic.

In this scenario, long-duration growth stocks have further to fall; the bear market probably has another leg down; and a long, grinding recovery is likely. Worse, people who invest too early in anticipation of a recovery destroy more capital.

I have favoured the second scenario for the past 12 months. Over the last year, capital preservation and defensive yield investing have been recurring themes in this column. I’ve barely covered technology stocks in Australia during that time.

That view still holds. My base case is that there are probably another six months of pain ahead as the bulls and bears slug it out, and the market bottoms out.

But to be frank, trying to determine the short-term market direction is guesswork. More important is assessing each company on its merits and focusing on valuations rather than today’s news. Still, it pays to have a roadmap and adjust your view accordingly.

I recently wrote about three broad phases in bear markets: valuation multiple compression, earnings compression and capitulation. We’re past the first phase: markets lashed valuations of growth stocks when interest rates rose.

We’re near or at the end of phase two: earnings compression. Although we are yet to see the big wave of earnings downgrades in Australia, the market has priced in a lot of this, judging by Price Earnings (PE) multiples. The forecast “E” in PE is coming down.

I’m not convinced about the third phase: capitulation. Some might argue that massive falls in speculative tech stocks and other risky areas signal capitulation. It just doesn’t feel like there’s enough pain yet or people giving up on investing. Maybe that happens when rates peak and cost-of-living pressures sadly force more people to sell assets.

If I’m right, the market has another tough period ahead, particularly around the traditionally weak September/October period. But a significant and more sustained New Year rally in equities would not surprise as expectations of rate cuts build.

Game plan

How should retail investors prepare? Right now, the best decision is no decision. It’s tempting to dive back into growth stocks, but the risks are high. I’d rather miss the early stage of a recovery than get caught in a bear trap. Nobody picks the exact turning point.

Instead, focus on capital preservation and sustainable dividend yield (that should always be a key focus, regardless of market conditions). Ensure your portfolio has sufficient cash to redeploy fresh capital to equities. Have your game plan ready so you know what to buy and can do so quickly when the time comes.

Every investor, of course, is different. My comments above relate to investors who are in the accumulation phase and creating wealth. Retirees who live off the income on their portfolio would approach conditions differently. Develop the right plan for you.

Quality tech companies are part of my game plan. Generalisations about tech these days are dangerous: every company relies on tech, in one way or another. But focusing on the world’s top tech companies makes sense. Their recovery will be more sustainable as markets become confident that inflation is cooling and the trajectory of rate rises will start to even out.

Idea one: ETFS Fang+ (FANG)

FANG provides concentrated exposure to 10 of the world’s largest tech companies. Stocks include Apple, Microsoft Corp, Tesla, Alphabet (owner of Google), Amazon.com, Meta Platforms (owner of Facebook), NVIDIA, Netflix, Alibaba Group and Baidu.

FANG is equally indexed (each stock is roughly worth about 10%), meaning no single stock can dominate. Like other ETFs, FANG is bought and sold on the ASX like a share.

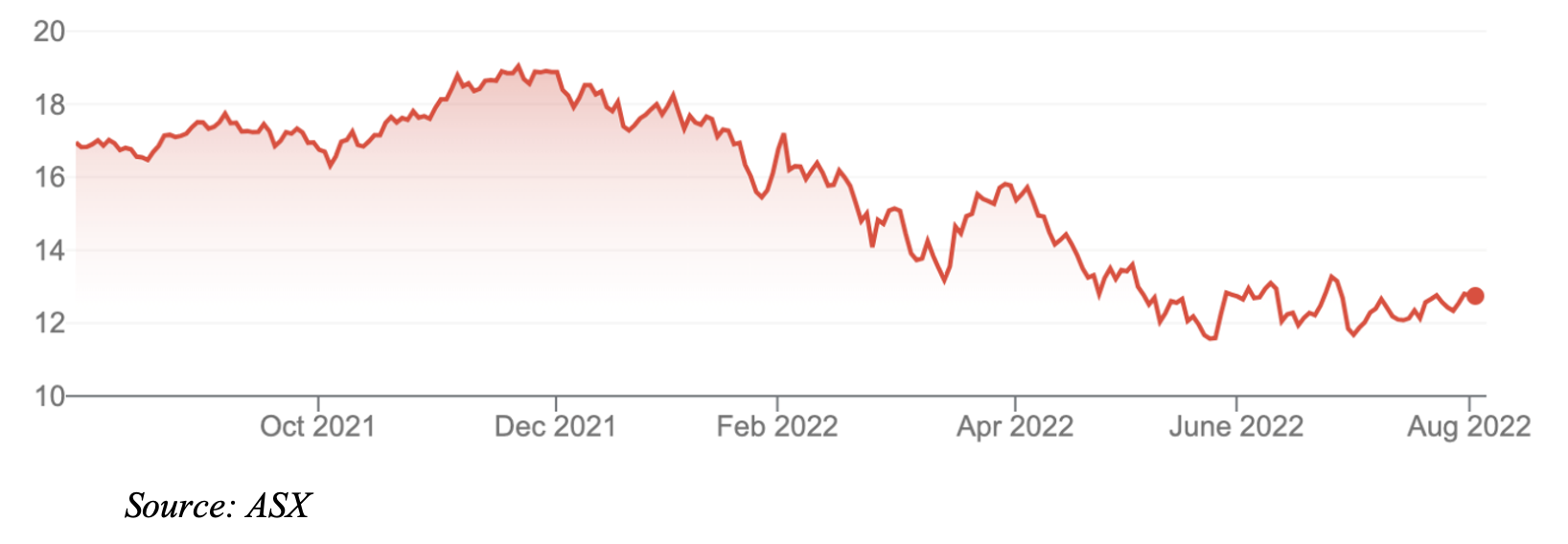

After a torrid time for tech, FANG is down almost 30% year-to-date. It now trades on a PE multiple of about 31 times. At their peak, the FANG stocks (a smaller subset than in this ETF) traded at almost 60 times earnings.

I have reservations about some stocks in FANG, notably Netflix, Meta and the Chinese tech stocks (due to Chinese regulatory risk). But I favour getting diversified exposure to the world’s best tech companies in one trade, at a low fee. It’s hard to see Google losing its dominance or people losing interest in Apple devices anytime soon.

I’d put FANG on the portfolio watchlist, with a view to buying later this year. Big tech can fall a long way, but equally has plenty of room for recovery. Don’t be put off if you feel like you will miss the early stage of a tech recovery.

ETFS FANG+

Idea two: BetaShares NASDAQ 100 ETF (NDQ)

I prefer the FANG ETF because it provides exposure to high-quality tech names. That’s always important and especially so when the market is uncertain about the outlook for inflation and interest rates and what that means for long-duration growth stocks.

The BetaShares NASDAQ ETF is an easy, low-cost tool to gain exposure to the tech-heavy NASDAQ exchange in the US. With 100 stocks, there’s more diversification in NDQ compared to FANG, which is split between 10 stocks.

Tech stocks comprise about half of NDQ. Consumer discretionary and staples comprise 22%; communication stocks 17%; and health about 6%. By stock, the top holdings are Apple, Microsoft, Amazon.com, Tesla and Alphabet.

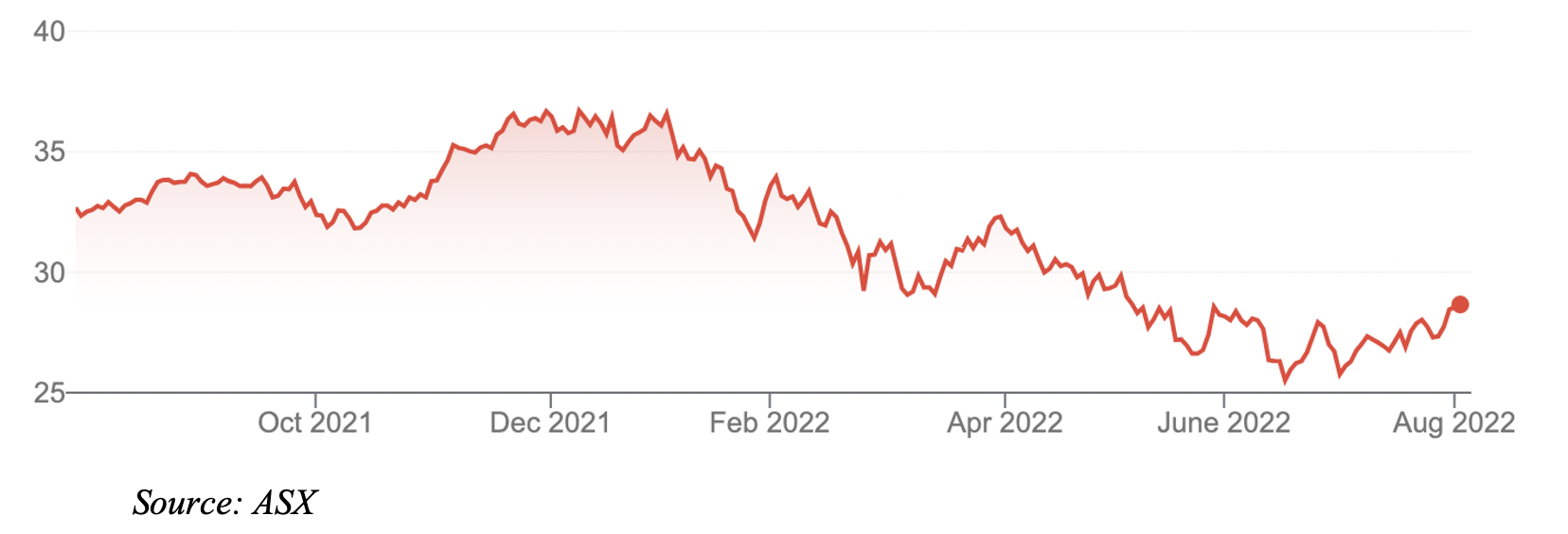

NDQ returned -23% year-to-date. After soaring in 2021, NDQ was battered when global tech stocks slumped this year.

Like FANG, NDQ is unhedged for currency moves, meaning investors need a view on the Australian dollar’s direction against the Greenback. NDQ costs 0.48%; FANG is 0.35%.

If the scenario I’ve outlined above holds, it will pay to start adding tech exposure – slowly and with a focus on the FANG stocks – to the portfolio core. It’s too early to do that yet, although those with a higher risk tolerance might be happy to go early. I’d watch and wait for a few months. But setting strict timelines is risky in a market where everything is moving faster.

BetaShares NASDAQ 100 ETF (NDQ)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 3 August 2022.