I’ve been watching a Netflix series, “Live to 100: Secrets of the Blue Zones”, this month. The catchy documentary focuses on five communities worldwide where people live extraordinarily long and active lives.

The goal: to discover the secrets of centenarians who are still gardening, dancing, doing karate, walking up hills and loving life. It comes down to gradual exercise, eating well, a positive outlook on life and social connections.

I like Dan Buettner’s work (the filmmaker) and have read up on the ageing population for decades. Readers of this Report know I have commented on ageing many times and described it as the ‘megatrend of all megatrends’.

I’ve noticed more content lately like the Blue Zones. With some Baby Boomers in their late seventies, it’s no surprise that the focus on living past 100 is growing. More people want longer life spans and to remain active late in life.

Who knows where this trend will end? Advances in medicine, longevity science, technology and lifestyle will surely further extend lifespans.

As life expectancy rises, the global fertility rate is falling. The birth rate in the 15 largest countries (by GDP) is now below the replacement rate. Even developing nations in parts of Asia, Latin America and Africa have plunging birth rates.

That means fewer babies and many more elderly people in the next few decades. Or, as one newspaper put it, walking sticks drowning out the patter of tiny feet.

Over the next 40 years in Australia, the number of people aged over 65 will more than double and the number aged over 85 will more than triple, according to the recent 2023 Intergenerational Report from the Federal Government.

The report predicts the number of centenarians in Australia will increase sixfold. Maybe we’ll need to become more like the Blue Zones that Buettner advocates.

Think about the number of people aged over 85 tripling over the next 40 years. Yes, that’s a forecast and multi-decade estimates are invariably wrong. But the Intergenerational ageing forecasts have historically been far too conservative.

All this points to many more Australians needing retirement accommodation in the next few decades. So many, in fact, that I’m concerned the construction of retirement villages will be vastly inadequate for what’s ahead.

To be clear, I’ve focused on retirement villages for this column – not aged-care. Of course, one inevitably leads to the other as people age, but I see a much bigger market for retirement accommodation for active elderly people.

We’ll need more innovation in retirement accommodation. Creating mini communities that embrace Blue Zones concepts is a good place to start. How can physical retirement accommodation help people lead longer, active lives?

For investors, growth in demand for retirement accommodation highlights two messages I have given many times in this column. First, that the best megatrends run for decades and the market often underestimates their power and duration.

Second, that the best companies are leveraged to strong trends and have simple, repeatable business models. Their success comes from scaling the business through a cookie-cutter model that lowers risks. It’s boring but effective.

Here are two stocks leveraged to rising long-term demand for retirement accommodation and opportunities from more active lifestyles.

- Summerset Group Holdings (ASX: SNZ)

Founded in 1997. Summerset has 38 villages across New Zealand (complete or in construction) designed for people aged 70 and over. They choose from villas, townhouses and serviced apartments. The properties have over 7,600 residents.

Summerset is not well known in this market, even though it is a top-50 NZX company (by market capitalisation) and dual-listed on ASX in 2013.

Summerset had total assets of NZ$6.3 billion in 1HFY23. It reported an underlying profit of NZ$87.2 million in the half, up 5.7% on the same half a year earlier.

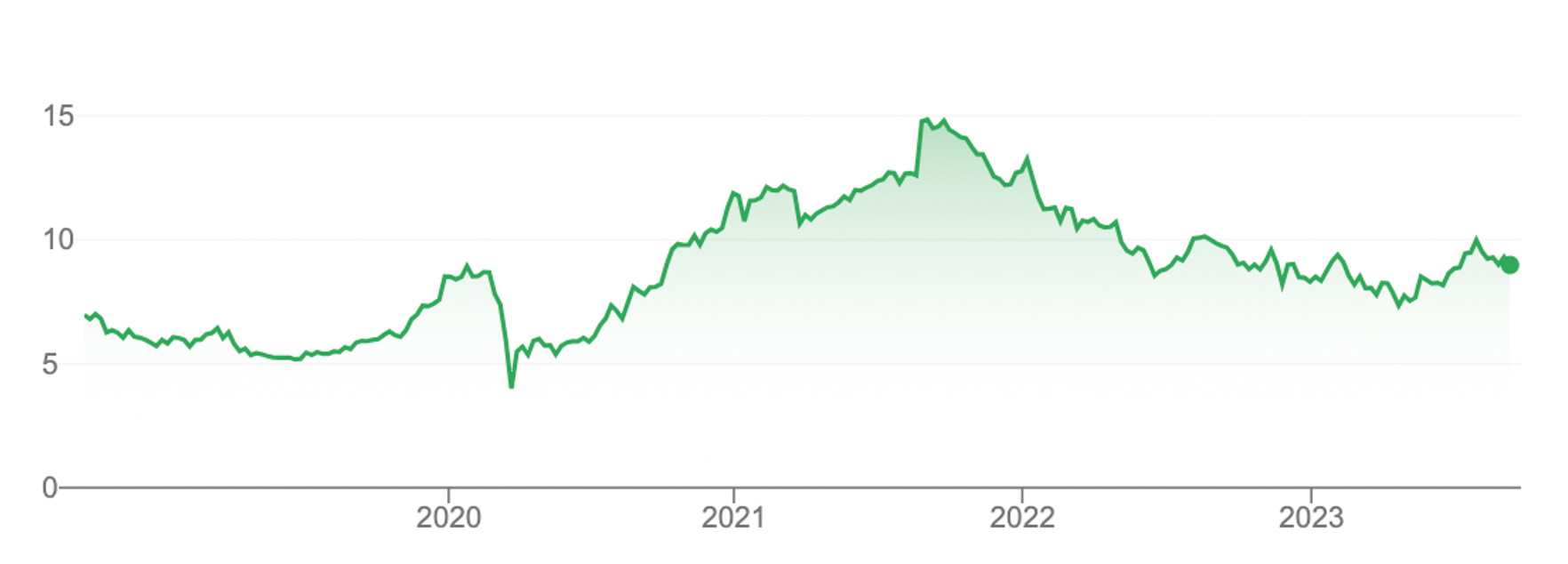

Like other retirement property developers, Summerset has had a tough few years. Its stock has fallen from almost $15 in 2021 to $8.93. A challenging economic environment, lower property activity and rising rates are headwinds.

Summerset has a good pipeline of projects. It recently announced the purchase of two new sites in NZ at Rolleston (Christchurch) and Mosgiel (Dunedin). The Rolleston area is expected to have NZ’s highest population growth over 30 years.

In its H1Fy23 results, Summerset said it has secured enough land to more than double the size of its current NZ business. I didn’t see this comment reported in Australia, which is not surprising as it was buried in the earnings release.

Summerset is expanding into Australia with construction well underway at its Cranbourne North Village in Melbourne. The company owns six other Australian sites, most of which are still working through approval processes.

In NZ, Summerset also has six proposed sites in various stages of development, giving it the largest bank of retirement units in NZ.

I like these types of business models. As Summerset grows, development margins should expand (they were noticeably higher in the 1H23 results) and asset values should rise as land and property values increase.

The main risk is when companies try to grow too quickly and open too many properties. Quality falls, corporate reputation suffers, and debt rises. I don’t see any evidence of that with Summerset given its project pipeline.

At $8.93. Summerset trades on a trailing Price Earnings (PE) ratio of just under 9 times. The stock looks undervalued given its position in a long-term growth market. But expect price gains to be steady rather than spectacular.

Chart 1: Summerset Group Holdings (SNZ)

Source: Google Finance

- Lifestyle Communities (ASX: LIC)

The Victorian property developer has been my go-to stock for retirement accommodation for many years. I have written about it several times for this report over the past decade.

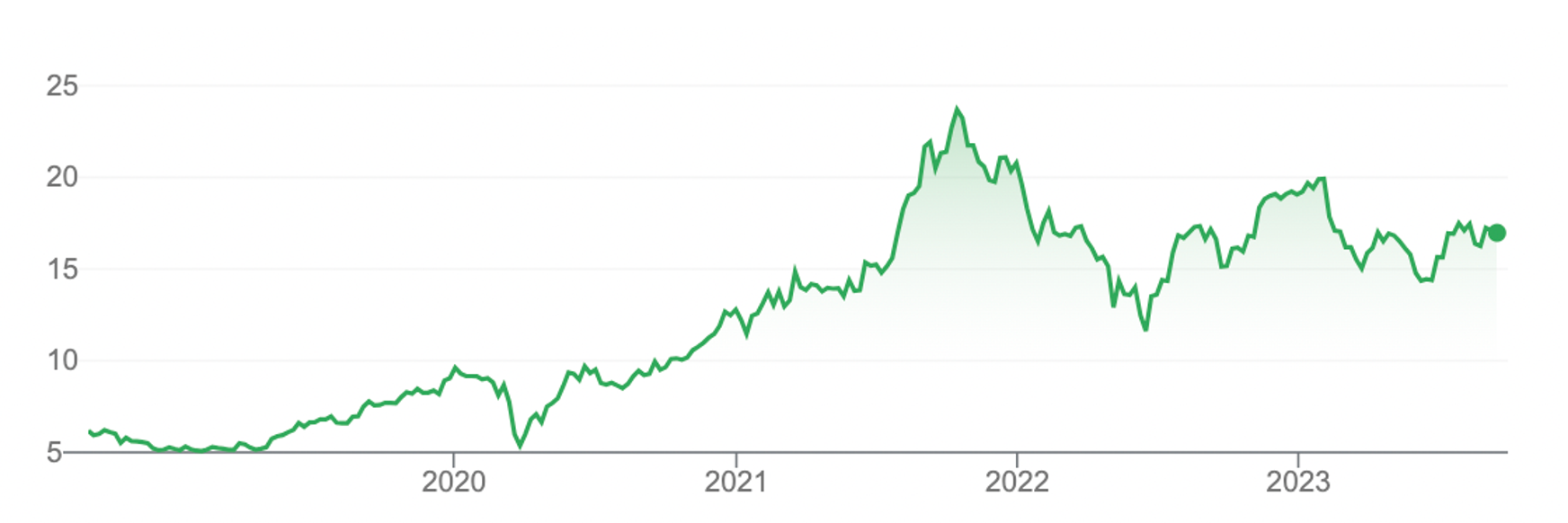

Lifestyle Communities is one of the market’s best-performed small-cap stocks. Its five-year annualised total return (assuming dividend reinvestment) is 24%. Over 10 years, Lifestyle Communities has a 35% annualised return.

Lifestyle Communities typifies why I like companies that have cookie-cutter business models that roll out proven concepts into long-term growth markets. Done well, you can get an attractive return for years, at lower risk.

To recap, Lifestyle Communities develops residential communities for older people seeking to downsize. It focuses on the Melbourne to Geelong corridor.

Lifestyle Communities cleverly targets empty-nesters and downsizers; older people who sell their family home, buy cheaper accommodation and use the rest to boost their retirement savings and lifestyle.

The company uses a mix of equity and debt capital to develop greenfield sites and create communities. Capital recovered from those communities is recycled into the next project and so on.

Then there is a recurring revenue stream from managing communities. It’s a clever business model. Build one residential community, settle the property sales, then build the next. Then, receive a recurring low-risk revenue stream each year that slowly builds as more homes are sold.

Melbourne is a good market for Lifestyle Communities The city has accessible flat land at the fringes and is not saturated with affordable housing developments for retirees. Lifestyle Communities can grow for years in Victoria alone.

After soaring above $23 in late 2021, Lifestyle Communities has fallen to $17.08 Its share price ran too far, too fast after COVID-19, making a share-price pullback inevitable. Nothing fundamentally has changed about the company.

In its recent FY23 result, Lifestyle Communities said it expects to see a large increase in construction in FY24 with seven new projects launched last financial year. It forecasts higher settlement volumes in FY24, FY25 and beyond.

Like Summerset, Lifestyle Communities has built a large land bank that will underpin future growth and has several projects under construction.

An average share-price target of $19.14, based on the consensus of seven analysts, suggests Lifestyle Communities is moderately undervalued at the current $17.08. The consensus looks about right.

Prospective investors in Lifestyle Communities might see an opportunity to build a position in one of the market’s top small-cap companies.

The stock suits long-term investors who want leverage to a trend (rising demand for retirement accommodation) that will take decades to play out.

Chart 2: Lifestyle Communities (LIC)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 13 September 2023.