In October 2020, Alibaba Group Holdings traded near US$300 on the New York Stock Exchange. Today, shares in the Asia e-commerce giant are US$90.

In early 2021, Tencent Holdings was HK$757. Now, shares in the technology and entertainment titan are HK$300 and falling fast.

If it were any other market, fund managers would snap up these stocks. At US$90, Alibaba is on a forward Price Earnings (PE) ratio of 11.5 times. For comparison, Amazon.com is on a forward PE of 86, Morningstar Inc data shows.

China, of course, is no ordinary market. Its government’s crackdown on tech regulation has been a massive drag on the sector. Many analysts continue to downgrade the valuations for Chinese tech stocks. Others believe the Chinese tech sector is “un-investable” because of the risk of government privatisation of tech.

The de-listing of some Chinese firms from US securities exchanges, a consequence of China-US hostilities, has further hurt sentiment. China’s struggling economy, its zero COVID-19 policy, and inflamed tensions toward Taiwan are other problems.

China’s economic woes are affecting corporate earnings. This month, Alibaba’s quarterly revenue growth declined for the first time (as a listed company).

I could add other headwinds for Chinese tech stocks. The big problem is that sentiment is hostage to Chinese government actions. Tech stocks there briefly rallied in late June but quickly reversed gains amid signs of fresh regulatory probes into tech leaders.

So, as US tech stocks rally from their mid-June lows, Chinese tech stocks are still on their knees. The Hang Seng Tech Index ETF – a barometer of the 30 largest tech stocks in Hong Kong – is down 25% year-to-date.

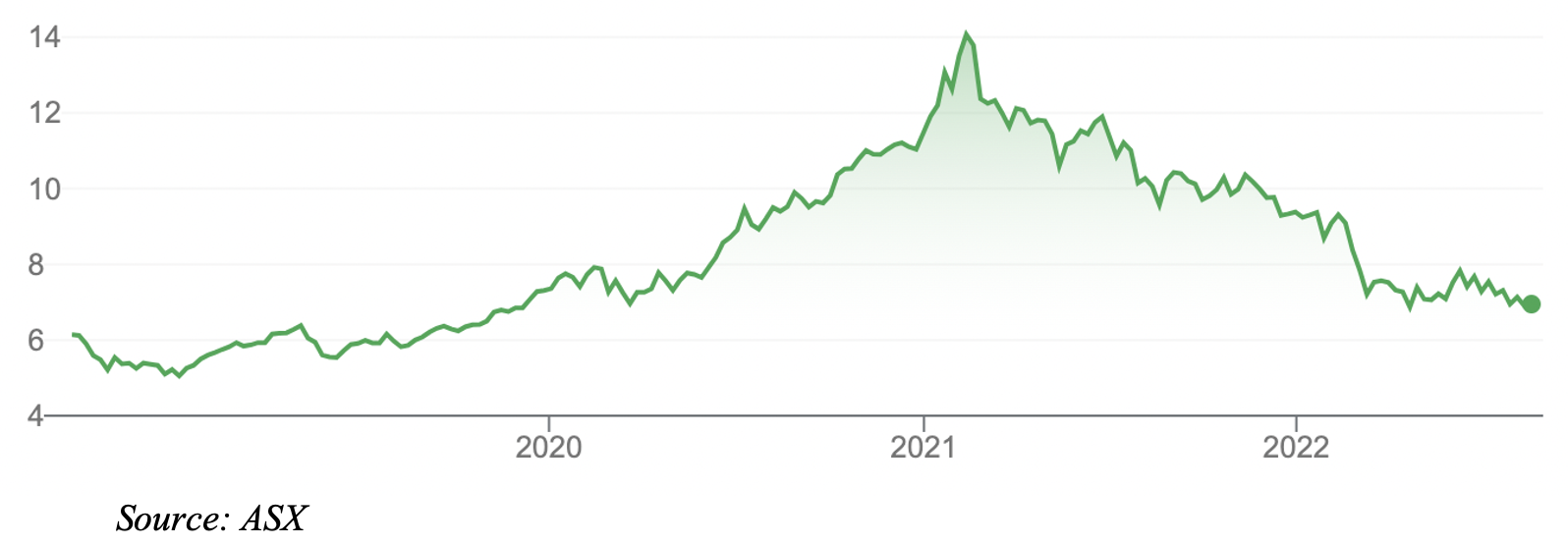

On any measure, Chinese tech stocks (in aggregate) have been a bloodbath in recent years. The Hang Seng Tech Index has given back almost its entire gains over the past four years. Few market rollercoasters have had such a steep rise and fall.

To be clear: conservative investors should avoid Chinese tech. However, experienced active investors who have a high-risk tolerance – and understand the benefits of buying when news is at its worst – could look at Chinese tech.

I also note that several fund managers and analysts suggested buying Chinese tech in the past 12 months, given beaten-up valuations in the sector. Their call was far too early and destroyed even more capital in the sector.

Active investors might allocate a tiny amount of capital to the sector as more signs of recovery start to emerge. They should be prepared for short-term volatility and potential losses. And able to trade in and out of the sector quickly, if needed.

Tech positioning

To recap, I have written on tech for three weeks now in this column. US tech stocks began to rally in mid-June and the gains quickened from late July.

I emphasised that conservative investors could put tech on their portfolio watchlist, waiting for signs that inflation and interest-rate expectations have peaked (that’s good for long-duration growth stocks, such as tech).

I wrote that active investors could buy tech early. They should focus on the highest-quality tech stocks through the ETFS FANG+ ETF. The fund includes Alibaba and Baidu, a prominent Chinese tech stock, in its top-10 holdings.

Last week, I identified thematic tech funds, notably the Betashares Cloud Computing ETF. Cloud computing and semiconductors are two of my favourite long-term tech trends. I also covered local data-centre stock NextDC in that column.

This week, the focus is on Asian tech. In the short term, the US tech rally will encourage more investors to look at Asian tech stocks, as they did in late June before the latest probe in the sector.

Second, the more I read about China’s innovation policy, the more I think that Chinese listed tech has a future (albeit one far less certain compared to US tech). Faster technology development is critical for China in its geopolitical battles.

This week’s Economist edition has an excellent feature on China’s new tycoons. It notes there is a new wave of high-growth firms in tech and other sectors looking to list in Hong Kong through an Initial Public Offering. It’s a useful read for investors who are trying to understand the Chinese government’s approach to innovation and entrepreneurship – and why privately owned tech firms are still part of that equation.

Asian tech

Prospective retail investors in Asian tech should use ETFs that provide diversified exposure rather than invest directly in a few stocks. They should use ASX-quoted ETFs for Asian tech exposure rather than buy ETFs on overseas exchanges.

Two Asian tech ETFs on the ASX stand out. The first is the BetaShares Asia Technology Tigers ETF (ASIA). It provides exposure to the 50 largest tech and online retail stocks in Asia (excluding Japan). The ETF has a mix of internet, media, semiconductor and technology stocks. Just over half of the ETF is invested in Chinese companies.

ASIA’s underlying index has underperformed. The one-year return is -32% to end-July 2022. Over one month, the index was down 6%. Since its inception in 2018, ASIA has had an annualised return of 5.6%. That’s poor given the risks involved.

Early investors in ASIA did well in 2019 and 2020. But those still holding their ETF have been battered ever since by relentless falls in Asian tech shares.

ASIA traded on a forward PE ratio of 15.4 times at end-July 2022, BetaShares data shows. That’s relatively low for the market’s largest Asian tech firms, even if one believes forecast earnings in the sector probably have further to fall, even from here.

ASIA has risky Chinese tech stocks and also has higher-quality companies, such as Samsung, in other Asian markets.

BetaShares Asian Technology Tigers ETF (ASIA)

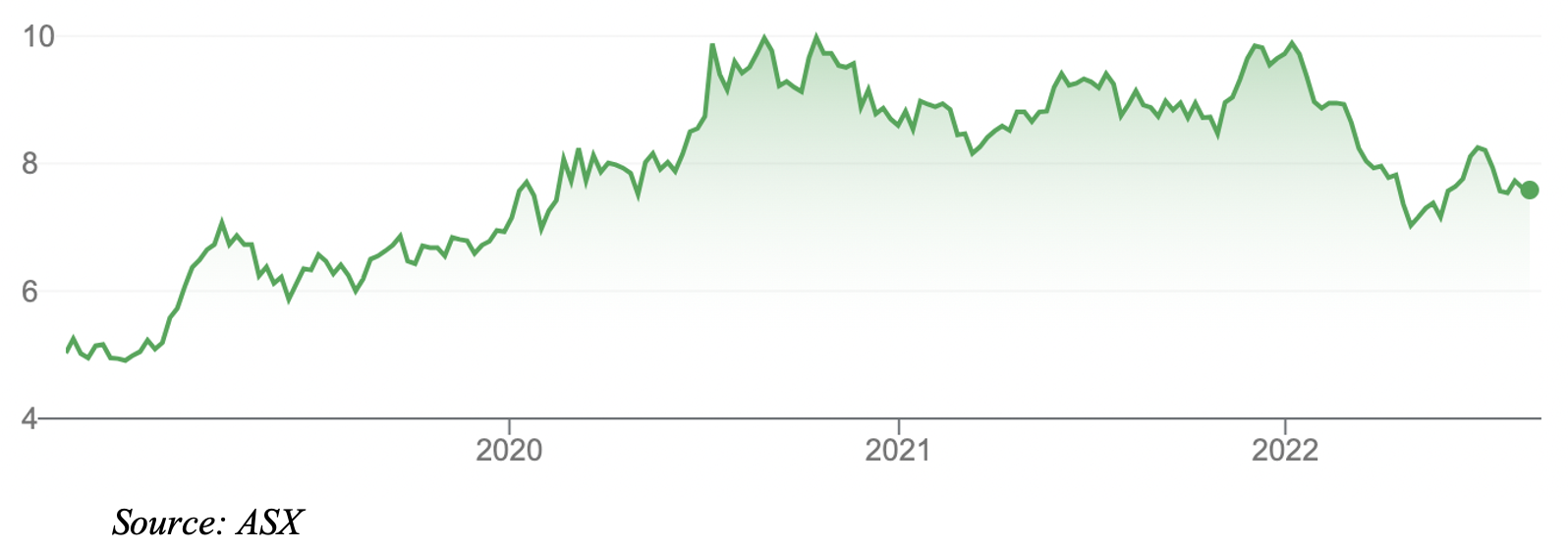

Another Asian tech option is the VanEck China New Economy ETF. It owns 120 stocks across a range of sectors, so is less exposed to Chinese tech. Food, beverages and tobacco, consumer durables and biotech make up almost half of the ETF by sector.

CNEW’s lower tech exposure has reduced its losses. The ETF is down 14% over one year to end-July 2022. That’s less than half the loss of ASIA. The downside is that CNEW doesn’t offer the same leverage to any potential recovery in Chinese tech.

CNEW is also a smart-beta ETF: it uses an index that tries to find Chinese companies that offer the best Growth at a Reasonable Price (GARP) attributes. It weights company prospects according to growth, value, profitability and cash flow. CNEW is also equally weighted, meaning no stock can dominate the ETF.

Investing in Asian tech – and choosing between the CNEW and ASIA ETFs – ultimately depends on your risk profile. Active investors and traders who are betting on long-term recovery in Chinese tech could favour ASIA, mindful of the potential for continued short-term losses and heightened volatility. Investors who want exposure to a Chinese recovery, but less regulatory risk in tech, could use CNEW.

Conservative investors who believe China generally, and its tech sector, in particular, are too risky, should avoid its equity market. It’s one thing to buy when news is bad, and another to buy when there’s no way of knowing how bad the news could get.

VanEck China New Economy ETF (CNEW)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 17 August 2022.