Commercial radio’s audience in the major capital cities has grown by 1.4 million listeners to over 17 million in the last five years, estimates Deloitte Access Economics.

Released this week, the Deloitte survey found just over eight in 10 listeners to commercial radio/audio did so at least weekly.

Deloitte said radio-industry profitability had recovered since the COVID-19 pandemic and is “on track to strengthen” as economic conditions improve in the next few years.

Yes, care is needed with industry-sponsored consulting reports based on a small sample. Commercial Radio and Audio (CRA) commissioned Deloitte to measure the radio industry’s economic contribution. The survey had 1,042 respondents.

But it’s worth asking why radio stocks are near multi-year lows as Australia’s radio industry continues to grow its audience – and defy predictions it will be roadkill in a fragmenting media landscape.

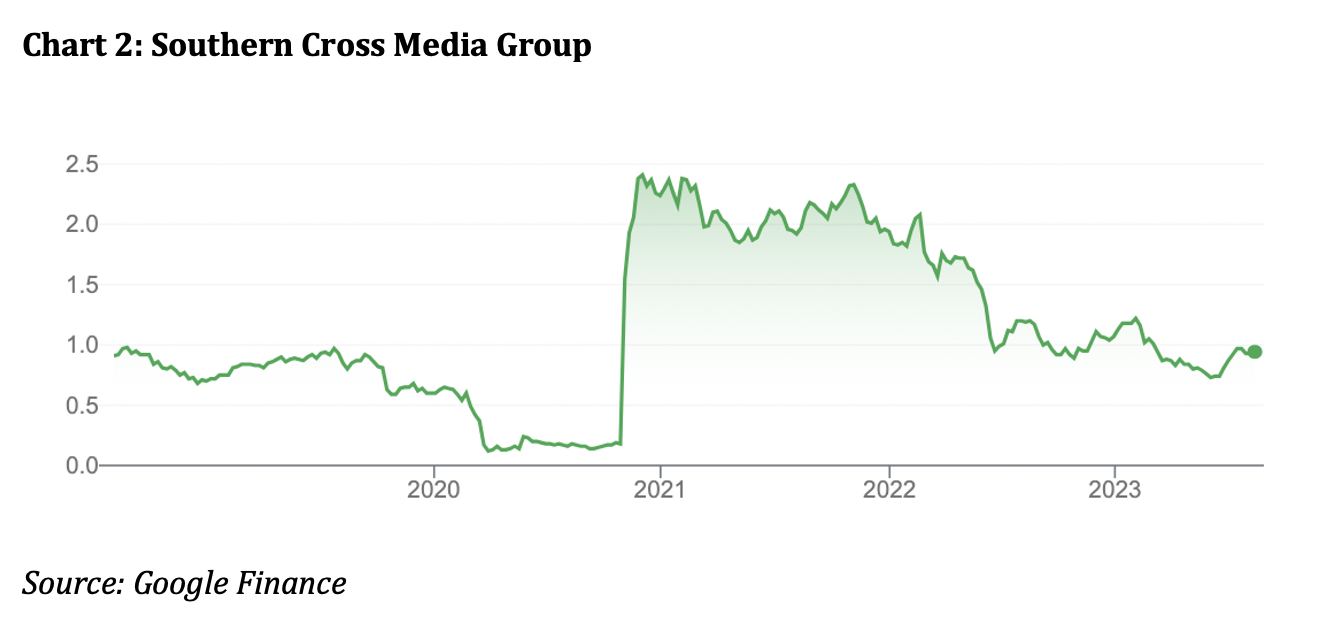

Southern Cross Media Group has fallen from a 52-week high of $1.24 to 94 cents. The regional radio and TV group traded above $2 in late 2020.

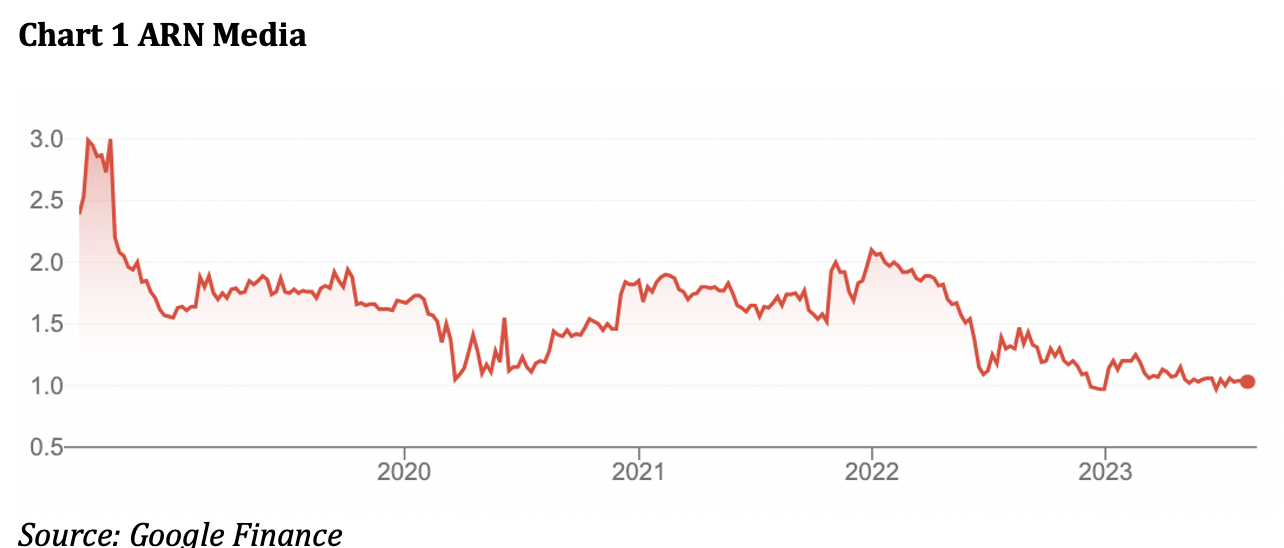

ARN Media has slumped from a 52-week high of $1.50 to $1.02 cents. ARN (formerly Here, There and Everywhere) traded above $2 in late 2021.

Sports Entertainment Group, another media micro-cap, is down from a 52-week high of 28 cents to 18 cents. The stock traded above 30 cents in early 2021.

Across the market, small media stocks have been hammered. Investors fret that companies will slash advertising budgets as the economy slows. Cyclical small media stocks are seemingly among the last places to invest in a downturn.

A weakening economy is always bad news for advertising volumes. I recall editing magazines over the years that hurt when the economy slowed. Advertising cuts can be brutal: cancelling ads is a quick (albeit short-sighted) fix when budgets are pressured.

It’s also true that parts of the media can be less cyclical than investors realise. Regional radio advertising is an example. It, too, suffers when the economy slows, but not by as much as TV advertising in capital cities, at least in relative terms.

The market’s blinkered approach to cyclical small-cap stocks creates opportunity. The market has already priced a slowing economy and lower profit growth into radio stocks, judging by current valuations. I expect more earning downgrades from radio stocks to come, but the market looks too bearish on radio stocks at recent prices.

Prospective investors in radio stocks need to understand the features, benefits and risks of investing in micro-cap stocks; have at least a three-year timeframe; and the conviction and patience to invest in a heavily out-of-favour market segment.

For all the doom and gloom, radio continues to reach a large number of Australians each week and grow its audience. Population growth will bring more listeners over time and longer travel commutes will drive higher radio usage in cars.

Make no mistake: a slowing economy will hurt radio stocks. But there could be some upside if more people switch from paid TV streaming services to free radio channels; or if advertisers focus on cheaper radio ads to boost short-term sales.

Here are two radio stocks to watch.

- ARN Network (ASX: A1N)

ARN owns 58 radio stations across 33 markets, 46 Digital Audio Broadcasting+ stations nationwide, and iHeartRadio, a digital entertainment platform. ARN is best known for its top-rated KIIS network (featuring Kyle Sandilands and Jackie O) and Pure Gold.

In June, ARN announced the acquisition of a 14.8% stake in Southern Cross Media Group for $38.3 million – a deal it described as “representing attractive value for ARN Media’s shareholders”. It’s always interesting when organisations that know their industry best build strategic equity interests in struggling competitors during downturns.

In last-quarter 2021, ARN announced the acquisition of Grant Broadcasters for $307.5 million. Grant is one of Australia’s oldest regional radio broadcasters with 46 radio and digital operations. The deal was a good fit with ARN and boosted its regional exposure.

On a pro forma basis, ARN’s 2022 revenue rose 5% to $345 million year-on-year. Its underlying earnings (EBITDA) fell 4%. The business took a large impairment charge ($250 million), reflecting economic uncertainty in its markets.

Clearly, ARN is in a transformation program with the strategic investment in Southern Cross, acquisition of Grant Broadcasters, disposal of its 25% interest in Soprano Design for $66.3 million, a share buyback and other investment costs.

Over the next few years, ARN looks in good shape to benefit as an economic recovery (when interest rates are cut in 2024) boosts advertising volumes.

More will be known on 24 August when ARN reports its results for the FY23 half. Bad news from ARN won’t surprise, such is the state of the advertising market. That could create the entry point if ARN falls further from here.

At $1.02, it is on a forward Price Earnings (PE) multiple of about 7 times and yielding around 10%. With a market capitalisation of $312 million, the market is valuing ARN just above the price it paid for Grant Broadcasters 18 months ago.

Nobody can rule out more short-term price pain for ARN, particularly if its half-year result disappoints this month. But in three years, I suspect we’ll look back on ARN’s valuation today as a bargain entry price.

- Southern Cross Media Group (ASX: SXL)

Southern Cross describes itself as Australia’s largest live and on-demand audio creator and broadcaster. The company has 100 broadcast radio stations (including Triple M), regional TV stations and the LiSTNR digital audio platform.

Broadcast radio accounted for almost three-quarters of Southern Cross’s H1 FY23 results. TV contributed most of the rest, followed by LiSTNR, which is growing quickly off a low base and has good potential to scale its operations.

Southern Cross has been a volatile stock for much of the past decade. It required an emergency capital raising during COVID-19 and has since substantially reduced debt.

Southern Cross’s radio operations still haven’t fully recovered from COVID-19 and now face a cyclical downturn. The regional TV business is being affected by the proliferation of alternative digital content channels (who wants to watch regional TV as much when residents there can stream Netflix or get news on-demand).

Beneath the gloom, Southern Cross still has valuable assets (it is one of only two national radio networks). Regional radio broadcasting tends to be more resilient and Southern Cross is strongly leveraged to an advertising upturn if it arrives in the next few years.

The stock looks cheap. Morningstar values Southern Cross at $1.80, versus its current price of 93 cents. Judging by the large discount to estimated fair value, the market expects much bad news when Southern Cross reports its full-year results on 17 August.

Of the two radio stocks, I prefer ARN Media at the current price. I like ARN’s transformation strategy and its implementation and can see the pieces coming together.

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 9 August 2023.