I respect that some investors will not hold coal companies in their portfolio because fossil-fuel assets that contribute to climate change are not aligned with their personal values.

These investors prefer ethical funds that avoid harmful sectors. All power to them.

Readers of my work for the Switzer Report know I am a great believer in the biggest megatrend of them all: renewables. As more countries make carbon-neutral pledges, the push towards renewable fuels and away from fossil fuels will be faster than the market expects.

Nevertheless, megatrends have a habit of overshooting as hype abounds. Investors latch on to the trend and neglect companies on the other side of it, even though they offer value.

This is true of some oil, gas and coal stocks today. Although commodity prices are rallying, several energy stocks are in the doldrums. Their production is rising at a time of sharply higher energy prices, but investors don’t want to know these stocks.

Coal-related stocks, in particular, look oversold. A colleague told me on the weekend he wouldn’t go near coal stocks because coal is a sector in terminal decline that will be littered with stranded assets as the world hurtles towards renewable energy.

He’s partly right. But it’s a question of timing and valuation. Simplistic, blinkered views about sector risks, which are long way off, inevitably create value for active investors who are more interested in what is happening on the ground and how that is reflected in share prices.

Australia’s coal sector, or second-largest exporter, is expected to have strong momentum over the next 3-5 years as the global economy recovers after Covid, and steel production rises to meet surging demand.

In its latest Resources and Energy Quarterly, the Federal Government forecasts metallurgical coal (mostly used to make steel) to rise from US$133 a tonne in 2021 to US$166 by 2026. Metallurgical coal exports will rise from a low of $23 billion in FY21 to $30 billion by FY26.

Thermal coal (mostly used for electricity production) will rise from an average US$64.50 a tonne in 2021 for the Newcastle benchmark price, to US$73 by 2023, before easing to US$60 in 2026. Exports will rise from almost 200 million tonnes in FY21 to 231 million tonnes by FY26.

Simply put, coal prices and export volumes will improve over the next few years as Asian economies recover from Covid. That will offset the effect of China’s coal import restrictions on Australia, although the risks of lower premiums for our coal is significant.

Coal-stock valuations are factoring in much bad news. Many coal-related stocks are trading at multi-year lows, despite coal-price gains over the past 12 months.

Here are two coal-related stocks that offer value. I mentioned another coal-related microcap, the mining-services provider Mastermyne Group (MYE), in last week’s column.

1. Aurizon Holdings (AZJ)

Investing in coal is not just about commodity producers. Rail operator Aurizon Holdings is Australia’s largest hauler of metallurgical coal. About two thirds of its above-rail revenue is from hauling metallurgical and thermal coal; the rest is from bulk haulage.

Aurizon’s latest investor presentation outlined six scenarios for coal demand. They ranged from strong commodity demand to rapid decarbonisation of economies by 2040.

As an aside, kudos to Aurizon for presenting detailed long-term scenario analysis and modelling. I wish more companies disclosed similar information to inform investors.

No scenario planning and modelling are perfect, but Aurizon’s forecasting indicates it should have resilient, average annual free cash flow under the scenarios tested. Annual cash flow would range from $500-650 million over 20 years, depending on the scenario.

The main upside is Aurizon’s bulk operations. They could grow faster than the market expects, enabling the company to reduce its reliance on coal over time. Demand for bulk commodities should continue to rise as food demand in Asia increases.

Aurizon believes there is potential to double its bulk volumes over 10 years as it expands into new markets. That’s a big goal but achieving it would mean the company has a more balanced commodity portfolio and a chunk of the business uncorrelated to the coal price.

So, as part of the business is affected by a declining long-term demand for coal, another part of Aurizon (bulk freight) should benefit from the move towards clean energy, which in time should add further demand for bulk-freight services.

Aurizon fell from a 52-week high of $5.07 to a low of $3.44, before rising to $3.88. At the current price, it is on a forecast FY22 Price Earnings (PE) multiple of about 14 times and yielding around 7 per cent, partly franked. The dividend alone, which should rise a little in FY22, makes Aurizon interesting for income investors.

Aurizon’s valuations look reasonable for a stock that has underperformed the Australian share market over the past five years, as investors became too bearish on coal and its rail haulage.

Chart 1: Aurizon Holdings (AZJ)

Source: ASX

2. New Hope Corporation (NHC)

New Hope and its nearest listed peer, Whitehaven Coal (WHC) , offer value at current prices. I’ll stick with New Hope, even though it is closer to fair value than Whitehaven.

New Hope has two open-cut coal mines: the fully owned New Acland mine, north of Oakey in Queensland, and the 80%-owned Bengalla mine, west of Newcastle in New South Wales. The company also has cattle-grazing and oil operations that are smaller contributors to revenue.

New Hope rallied in late May after it released a solid third-quarter activities report. The company said it was “well placed to finish the year with a solid financial result”.

New Hope rallied again this week (a day after I finished this column!) after reaffirming production guidance and upgrading earnings guidance.

In its May quarterly activities report, New Hope said its Bengalla mine realised an average coal sale price of $105.41 a tonne for the third quarter, from $87.42 in the previous quarter. That shows the effect of strong gains in the coal price over the past 12 months and how they flow through to New Hope’s bottom line.

In Queensland, New Hope is preparing for the Stage 3 approval process for its New Acland mine to be heard in the State’s Land Court in November. New Hope forecasts New Acland will deliver about a fifth of its total coal sold in FY21. The market, it seems, is ascribing little value to New Acland at the current price.

Overall, New Hope is having a better end to FY21 than the market expected, thanks to higher-than-expected production at Bengalla and elevated coal prices.

New Hope shares have been volatile in recent years. After trading above $4 in early 2019, they hit a 52-week low of $1.05 as coal stocks lost favour. They have since recovered to $1.88 as the market focuses on higher coal prices and improving production at Bengalla.

New Hope’s three-year, annualised total shareholder return (assuming dividend reinvestment) is almost negative 10%, showing just how far its stock has fallen.

To be clear, New Hope is no screaming buy. Morningstar valued it at $2.15 (before this week’s news), suggesting a modest margin of safety for prospective investors.

Morningstar values Whitehaven at $3.05 (against the current price of $2.10) and it too has rallied in recent weeks. Although Whitehaven appears to be the more attractive of the two stocks on valuation grounds, its recent downgrade was a setback.

With New Hope, a share-price pullback or consolidation would not surprise after the rally in June. Technical analysts (chartists) will pay closer attention to New Corp because its price has broken through resistance after a long accumulation (sideways) period. This pattern can imply a new price up leg is forming, but is not always reliable.

Everything depends on the coal price remaining elevated – or only edging lower – in the next few years, and Bengalla, the key to New Hope, continuing to ramp up production. Both events seem likely, but are not yet fully reflected in New Hope’s valuation.

The big unknown, of course, is Covid and how that affects coal supply from Indonesia, Colombia and other nations. Unlike commodities such as copper, which are arguably more of a supply story, coal should benefit from rising Asian demand as the region recovers from Covid.

Capitalised at $1.6-billion, New Hope suits experienced investors who understand the features, benefits and risks of investing in mid-tier mining companies. It has further to rally if coal prices remains elevated for longer than the market expects.

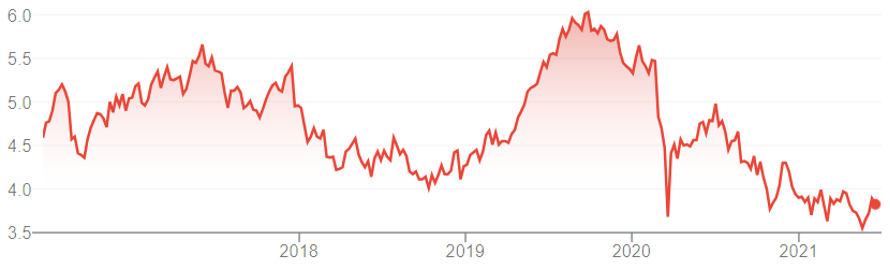

Chart 2: New Hope Corporation (NHC)

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 16 June 2021.