I read an interesting article recently about the effect of index funds on active investment strategies and company valuations.

As money pours into passive index funds, more investment bankers, broking analysts and active managers are factoring index activity into valuations.

They’re paying even more attention to index inclusion and exclusion for companies, and what expected index buying of a stock will do to its valuation.

That’s no surprise. In 2022, index funds overtook active funds by assets under management and the gap continues to grow. Right or wrong, more investors and advisers are using passive funds that replicate an index.

Consider the Commonwealth Bank. It has a great record and has delivered an excellent earnings result this month. Australia’s best bank deserves to trade at a premium to other local banks, given its performance and technology advantages.

But a forward Price Earnings (PE) of 26 for CBA is more than double the multiple for Bank of America – a world-class bank that serves a much larger market in the US compared to Australia. US banks look undervalued, and CBA looks overvalued.

No doubt index funds that own what’s in their underlying index are partly responsible for CBA’s high valuation. As CBA’s weighting in the S&P/ASX 200 rises, index funds have to buy more of it, thus adding to buying in the stock.

Value investors argue that owning more of a stock that’s getting ever more expensive – and less of stocks that are falling and becoming more attractive – is nuts. But the boom in passive funds is fuelling momentum-based investment strategies.

It’s worrying when active managers start buying stocks partly on the basis of whether index funds will have to buy them, if included in a key local index such as the ASX 200 or S&P/ASX Small Ordinaries Index.

I’ve long argued that the next market crash will be sparked by index funds that own an ever-narrowing group of stocks and drive their valuations to the moon. It never ends well when more investors own the same small group of stocks.

Earnings season

This brings me to week two of earnings season. As I wrote last week, it feels like volatility around profit reporting continues to rise. The market whacks companies that disappoint even slightly and boosts those exceeding expectations.

Algorithmic trading and index fund buying and selling are creating more noise around the earnings season. As the market focused on rising stocks with the tailwind of index buying, my focus is on falling stocks that index funds are selling.

Momentum-based strategies that buy rising stocks and sell falling ones might suit traders and active investors, but my investment style is to identify out-of-favour companies that offer value – or have an emerging recovery.

Aurizon Holdings (ASX: AZJ) is a case point. I wrote positively about the rail operator and rail infrastructure owner for this report in December 2024 ‘Getting paid while waiting for a stock to recover’. I argued that the market had become too bearish on Aurizon at $3.37 a share. Aurizon has since eased to $3.14. Index funds that replicate the ASX 200 have reduced their Aurizon holding in recent years.

The big knock on Aurizon is having more than 80% of its underlying earnings exposed to domestic coal production through rail haulage. With long-term demand for coal expected to wane, amid Environmental, Social and Governance (ESG) concerns, Aurizon needs to diversify its business in a hurry.

The Queensland-based company this week reported underlying earnings (EBITDA) of $814 million for 1HFY2025, down 4% on the previous corresponding period. The interim dividend of 9.2 cents per share was down 5%.

Above-rail coal volumes Aurizon transports were up 6%, but bulk volumes fell 19% due to lower grain railing, the end of a key contract and a derailment in Western Australia. Aurizon’s diversification into bulk and containerised freight haulage – to reduce its reliance on coal – has so far underwhelmed the market.

Aurizon maintained its forward guidance range of underlying earnings but said profits and capital expenditure would be at the low end of the range. The company also announced an extra $50 million for its on-market buy-back, taking it to $300 million. Aurizon shares were a touch weaker on the news.

The big news from the earnings announcement was Aurizon confirming it will again contemplate splitting its rail tracks and haulage businesses. It’s a legacy of Aurizon’s previous ownership by the Queensland Government that it has a rail-haulage business that moves coal, grain and other commodities, and manages rail networks in Queensland, South Australia and the Northern Territory.

It makes more sense to split this business, as is the case in the US where rail infrastructure operators and rail-haulage firms tend to be separate businesses with different capital needs, business models and return on equity. Aurizon could potentially unlock value by demerging its rail networks business.

Splitting Aurizon’s integrated structure into two standalone companies (rail haulage and rail networks) would be a step in the right direction. So, too, separating the coal rail haulage, which is out of favour with ESG-focused investors wary of coal, and the bulk haulage business.

Whatever happens, two things are clear. First, cost cutting and a share buyback by Aurizon are not enough to arrest its share-price decline. Some serious financial engineering is needed, something management recognises judging by their comments in its interim result. Second, there is value in Aurizon for patient, long-term investors who can tolerate further potential short-term losses.

Morningstar’s $4.50 per share valuation for Aurizon suggests the stock is materially undervalued at the current $3.14. I’m not as bullish but see value there for contrarian investors and like Aurizon’s expected yield of above 5%.

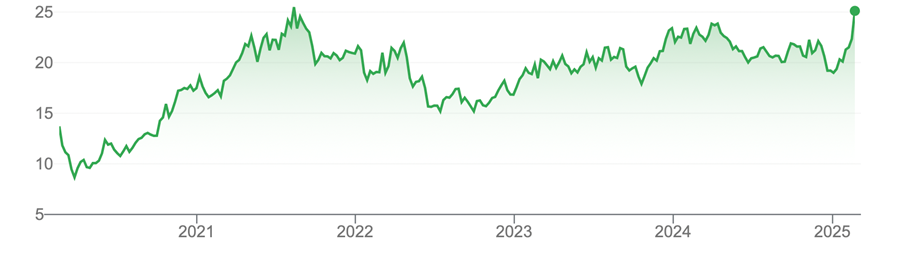

Chart 1: Aurizon

Source: Google Finance

BlueScope was another recent earnings-season highlight. BlueScope shares leapt 11% after Australia’s largest steel producer noted that steel prices in the US had risen after Trump restored 25% tariffs on all imported steel to the US.

Readers will recall I nominated BlueScope as a key beneficiary of Trump’s tariff agenda. I wrote on February 5 in this report: “Among manufacturers, BlueScope could benefit from tariff changes due to its significant US steel-making operations. A trade war could reduce the number of cheaper steel imports entering the US, benefiting local manufacturers such as BlueScope.”

I thought BlueScope looked fully valued but have since revised that view. The stock is no screaming buy, particularly after Monday’s price gain. But Trump’s tariffs on steel are a big tailwind for BlueScope, given it makes a big chunk of its earnings in the US. BlueScope believes this tailwind will offset any headwinds from China dumping more cheap steel into Australia.

A price target of $26.70, based on the consensus of 13 analysts who research BlueScope, suggests the stock is modestly undervalued at the current $24.94 That looks about right. BlueScope is trading a touch below fair value but has potential to surprise on the upside given machinations in US trade policy.

A larger recovery in BlueScope’s share price would attract more buying from index funds, adding to renewed momentum in the stock. I wouldn’t buy on that basis, but having large US steel-making operations – at a time when Trump wants to encourage more local production – is an increasingly valuable market position.

That said, it wouldn’t surprise if BlueScope gives back some of this week’s gain in the following days. The price spike looked overdone in the context of its earnings report, and probably more due to the market’s intense focus on tariffs.

Still, there’s more to like about BlueScope, amid further confirmation that the US is the world’s best steel market to be in right now.

From a charting perspective. BlueScope appears to have broken out of previous share-price resistance around $24.

Chart 2: BlueScope

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 19 February 2025.