The earnings performance of retailers is an early highlight from the current half-year reporting season. From JB Hi-Fi to Nick Scali, Myer Holdings and Cettire, a luxury goods platform, results have been better than the market expected.

The results accord with this columnist’s view that the market became too bearish towards retailers. With so much economic gloom and doom, the bears had the upper hand on stocks leveraged to consumer discretionary spending.

Relying on top-down, macroeconomic views for stocks decisions rarely works, for three reasons. First, the news is backward-looking. As the market frets about a slowing economy, the smart money is looking 12 months ahead to lower inflation, interest rate cuts and an improving economy. That’s good for retailers.

Second, valuations for many retail stocks have priced in an enormous amount of bad news. Nobody doubts that consumers are having it tough and that more pain is ahead as the full brunt of 13 consecutive rate rises hits home. The question is whether retail stock valuations have already factored in these problems.

Third, bottom-up company analysis matters most. During my time covering share markets, I’ve seen some retailers outperform in horrible conditions. And others underperform when they had strong tailwinds. Arguably more than any sector, retailing relies on the skill of the CEO who has their hand on the till.

The latest earnings season confirms that view. JB Hi-Fi beat market expectations yet again, even though a slowing economy should be a handbrake on sales of electronic goods. I thought JB HI-Fi looked pricey after its rally over the past few months, but its shares spiked higher on the strong profit result this week.

My strategy this year has been to identify small and mid-cap retail stocks left behind in the rally. Rather than rehash the usual favourites – JB Hi-Fi, Nick Scali, Lovisa Holdings and Super Retail Group – I examined retailers that had underperformed or were recovering after heavy price falls.

These included Kogan.com, Temple & Webster, Accent Group and Michael Hill International. I also flagged Cettire in a recent column on online retailers, but wish I’d covered it before it’s cracking recent profit result.

Two more beaten-up small-cap retailers are added to the list this week: KMD Brands, the outdoor adventure wear company, and Universal Holdings, a fashion chain that targets young adults. Both stocks have many challenges but also sharply lower valuations due to the market’s bearish view on retail.

1. KMD Brands (ASX: KMD)

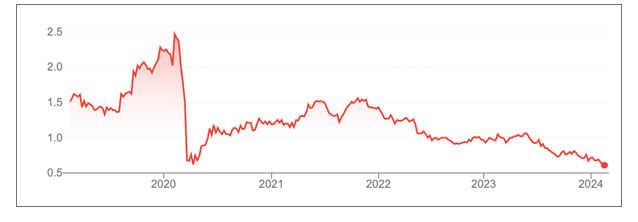

Shares in this dual-listed company, which owns the Kathmandu, Rip Curl and Oboz brands, have been smashed in the past few years. From a peak of almost $2.50 just before the March 2020 pandemic, KMD has slumped to 60 cents.

The losses have accelerated this year. KMD has dropped 42% below its 52-week high ($1.08) as the market reacts to a weak trading update.

In December, KMD said group sales were 12.5% below last year, for the first four months of FY24. Kathmandu sales were particularly hard hit due to unseasonably warm, dry weather, which affected sales of its puffer jackets and rainwear.

Declining wholesale sales for the Rip Curl (surfwear) and Oboz (hiking boots) brands also weighed on sales. Other firms that stock these goods cut back on their inventory due to uncertain trading conditions, hurting sales of Rip Curl and Oboz.

That’s the bad news. The good news is KMD’s group gross margin improved due to good control of operating costs. Healthy direct-to-consumer sales for Rip Curl and Oboz was another rare highlight in the trading update.

Kathmandu is the main problem. Unseasonable weather patterns are clearly a problem for a retailer that relies heavily on outdoor wear sales. Who wants to buy a warm puffer jacket when parts of the country are experiencing heatwaves?

Longer-term problems, in this columnist’s opinion, include Kathmandu’s push to attract younger consumers through brighter-coloured, trendier clothing. The risk is that Kathmandu alienates its traditional customer base, something Country Road did years ago when it focused on younger customers and annoyed its older customer base.

Another issue is the longevity of Kathmandu’s product offering. How many expensive puffer jackets and raincoats do people need? How often do they buy new ones? And how much will consumers pay for puffer jackets, given that every second retailer now seems to sell them, often at big price discounts?

Online marketing is another issue. I’ve long thought that Kathmandu’s loyalty program (the old Kathmandu Summit Club), with its 2 million members, is one the company’s great assets. However, to this columnist, the well-meaning, new Out There program feels confusing and less appealing that the previous iteration.

Yet for all the challenges facing KMD, Kathmandu is a still a great brand with a loyal following and a massive customer database.

The key issue, of course, is valuation. At 60 cents a share, KMD brands is capitalised at $428million. KDM is on a trailing Price Earnings (PE) multiple of about 13 times and a price-to-book ratio of 0.55 times, Morningstar data shows. Both valuation metrics are undemanding.

A handful of broking firms that cover KMD have an average price target of 92 cents, suggesting the stock is undervalued.

KMD will take time to fix and needs the weather gods on its side, at least in the short-term. But at 60 cents, the market is pricing in a lot of bad news to continue.

If KMD can’t stem the falling sales growth, a larger retail predator could pounce on the stock through a takeover. Alternatively, a private equity firm could acquire KMD, privatise and fix it, away from the glare of an exchange listing.

Some savvy contrarian fund managers and company insiders have increased their shareholding in KMD in the past few months, taking advantage of price weakness. As often happens, the smart money is buying when everybody else seems to be selling.

Chart 1: KMD Brands

Source: Google Finance

2. Universal Store Holdings (ASX: UNI)

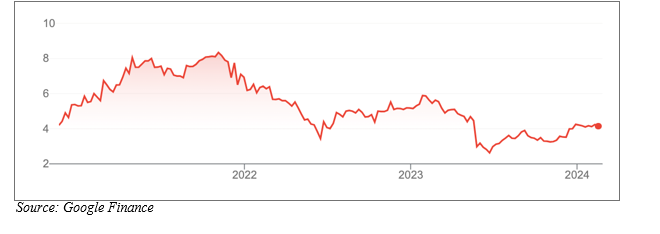

Shares in this fashion retailer have been battered, falling from a 52-week high of $5.94 to $4.19. The stock has recovered some ground this year (its 52-week low was $2.45) but remains miles below peak prices above $8 in 2021.

UNI’s target market of younger consumers has been hit by sharply higher rents and university fees this year. It’s harder to buy that $80 hoodie at UNI when your weekly rent is up $50 or you’re groaning under uni debt repayments.

At its AGM in November 2023, UNI noted signs of improving sales trends in FY24, despite negative store sales growth.

Like-for-like sales at UNI were -6.4% for the first 20 weeks of FY24, compared to the same period a year earlier. For the trading weeks between October and November, like-for-like sales growth improved to -4.4%.

If that trend continues, UNI could be the through the worst of its sales slump. Longer term, there is plenty of scope for UNI to grow through store openings. It expected to open seven new stores in the first half of FY24 and another 4-7 stores in the second half, taking store numbers to 104-107 by end-June 2024.

For all its near-term challenges, the well-run UNI has an excellent position in the youth-fashion market – and plenty of young customers who like its offering.

At $4.19, UNI is capitalised at $321 million. An average price target of $4.73, based on the consensus of 10 analyst forecasts, suggests UNI is moderately undervalued. That view looks reasonable given the spending challenges facing young consumers as rents and other living costs climb.

Chart 2: Universal Store Holdings

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation, and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 14 February 2024.