If corporates needed an excuse to spend more on technology services in 2023, they found it through several high-profile, prominent cybersecurity breaches this year.

From the Optus to Medibank attacks, data theft potentially affected millions of Australians. Twenty-four data breaches (affecting 5,000 people or more) from January to June 2022 were reported to the Office of the Australian Information Commissioner.

No doubt, directors of ASX-listed companies are asking more questions in Board meetings about their organisation’s cybersecurity defences and strategy. And giving the green light to management to boost spending on technology.

It’s not just cybersecurity. From artificial intelligence to big data and cloud computing…companies are investing more in technology to digitise their operations. None of this is new but these technology megatrends will play out for decades.

That’s good for Information Technology (IT) service providers. Several ASX-listed companies that help large and small organisations design and implement technology projects rallied in 2022. Some can do even better in 2023.

Technology services are one of my favourite themes for next year. To be clear, I’m focusing on consultancy-like service providers that, for the most part, implement software from other firms. This is not a contrarian punt on tech developers.

It’s a bit like investing in the companies that provide the picks and shovels for mining rather than the explorers. IT service companies should have plenty of work in 2023.

Tech researcher Gartner forecasts worldwide IT spending will rise 5.1% to US$4.6 trillion in 2023. Gartner says demand for IT next year will be strong as organisations push ahead with digital business initiatives in response to economic turmoil.

I like IT services for three main reasons. First, it’s reasonably defensive. I don’t agree with Gartner that enterprise IT spending is recession-proof, but management teams of large organisations are more likely to lift rather than cut spending on IT projects.

Second, I suspect the market could underestimate how much IT work is created by deglobalisation and “onshoring”. As geopolitical risks rise, many Western companies are bringing more of their manufacturing back home to safeguard against global supply-chain risks. A lot of tech investment will be required to reconfigure supply chains.

Third, I like the quality of ASX-listed tech services companies. Australia has some terrific tech services companies that have been great investments. I identified two of them – Technology One and Data3 – in August 2020 for this Report.

I wrote at the time: “… COVID-19 will create years of work for IT services companies. [The pandemic] is speeding up trends well-established before the pandemic: e-commerce, online banking, content streaming, e-learning, remote working and so on. Faster-than-expected digitisation of business must be a multi-year tailwind for quality IT services companies.”

Technology One (TNE) has rallied from $8.99 in that August 2020 report to $14. TNE is a high-quality company but looks a touch overvalued after recent share-price gains, based on consensus analyst estimates. I’d wait for better value.

Data3 has rallied from $5.14 to $6.23 since that August 2020 report and still offers reasonable value based on its projected earnings growth.

Dicker Data is another strong tech services company that offers okay value for long-term investors. Objective Corporation is another tech services firm to put on the portfolio watchlist after price falls this year.

Here are two other ways to play the tech services trend in 2023:

1. NextDC

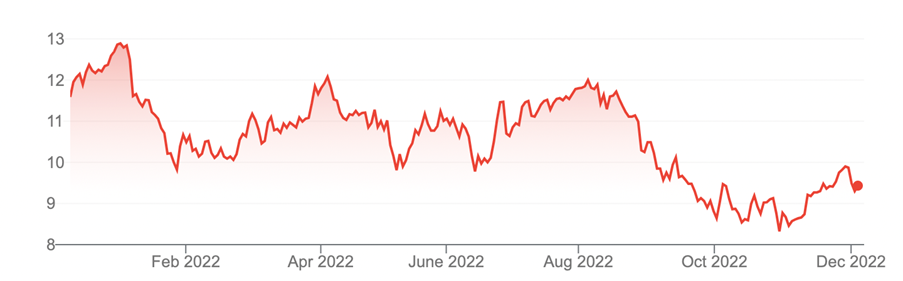

I’ve written favourably about the data-centre operator this year, only to watch it fall from a 52-week high of $12.93 to $9.15.

Once a market darling, NextDC lost ground after its FY22 result in August. The company delivered a solid result, but the market expected more. Competition is rising as more players enter the data-centre market and NextDC had a capital-intensive year.

For all the short-term challenges, NextDC has strong long-term prospects. As the management said at NextDC’s FY22 result, digital infrastructure has a mission-critical role to play in the new digital economy and so does the well-run Next DC.

At $9.15, NextDC looks undervalued compared to a consensus forecast of $12.25, based on 13 analyst price targets. I’m not as bullish as the consensus and think Morningstar’s fair value of $11 for NextDC looks closer to the mark.

As Morningstar notes, NextDC has a “big opportunity in front of it … with ample room to increase its data-centre footprint and reap the financial benefits that its larger scale should provide … We expect the firm’s importance for cloud connectivity to grow”.

Granted, NextDC is a technology infrastructure rather than a service company. But there’s a lot to like about its position in a long-term growth market.

At this level, it wouldn’t surprise to see a larger tech infrastructure company, private equity firm or Australian Real Estate Investment Trust swoop on Next DC. The stock looks a touch undervalued for long-term investors and a takeover candidate for 2023.

Chart 1: NextDC

Source: Google Finance

2. Hansen Technologies

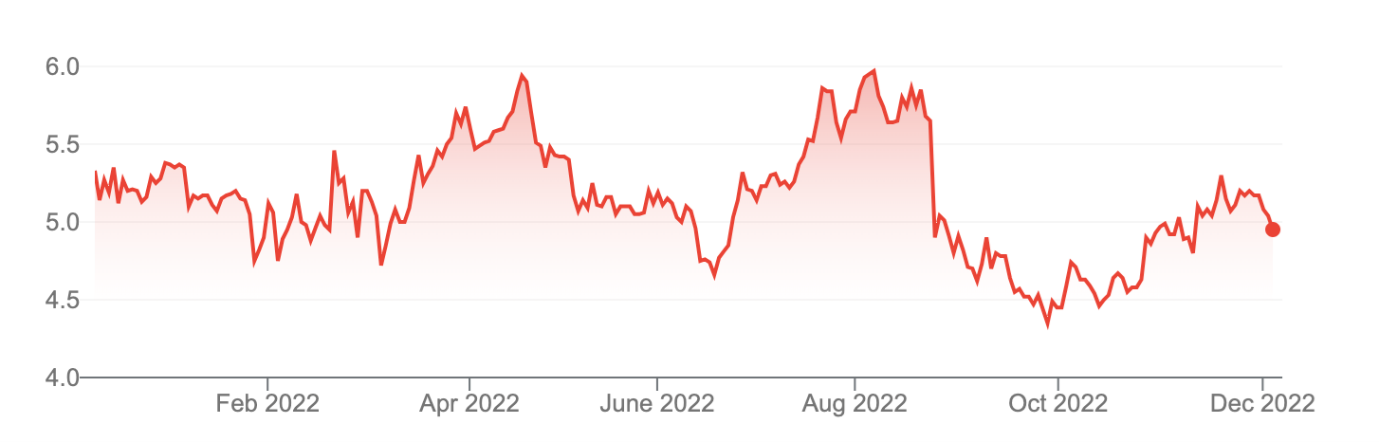

As I have written previously, Hansen has been one of this market’s most consistent small caps for several years. It chugs along, growing earnings and rewarding investors.

Hansen sells billing software for utilities, energy, pay-tv, telecommunications and other sectors. That’s mission-critical software for companies in these fields and the type of service that has “high switching costs”, meaning it is hard to change providers.

Hansen has barely missed a beat over the past decade. Revenue has grown consistently each year, earnings are rising, Return on Equity is good, and debt is low.

Hansen won’t shoot the lights out with growth, but its defensive earnings and steady performance in a volatile sharemarket are attractions. There’s a lot to like about founder-led companies that deliver consistent growth that compounds over time.

In 2021, BGH Capital, a private equity firm, tried to acquire Hansen and was rebuffed by the latter’s board. Hansen was undervalued then and is better value now after share-price falls this year. Hansen itself continues to grow through small acquisitions – and has a good long-term record with deals and their implementation.

Hansen has fallen from its 52-week share-price high of $6.10 to $4.93. It’s hard to align the extent of that price fall with Hansen’s short- and long-term performance. No doubt, general weakness in tech stocks has affected Hansen.

It wouldn’t surprise to see utilities increase their technology spending next year as prices in the sector rise, more consumers struggle to pay utility bills, and cybercrime becomes an even bigger threat.

Hansen has some good tailwinds in its industry, and a business model and market position (due to its size) that provides other advantages.

Chart 2: Hansen Technologies

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at December 12, 2022.