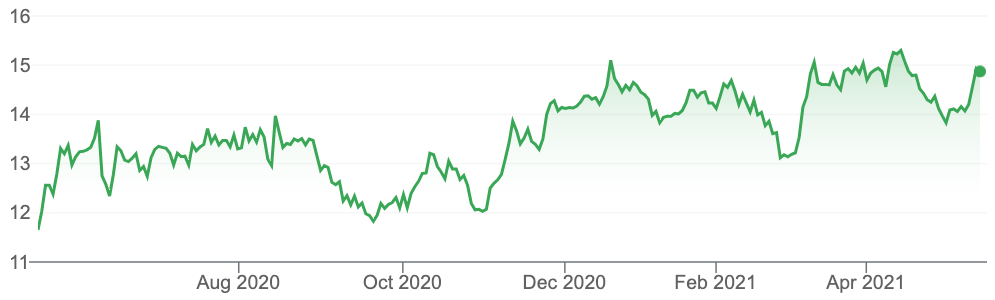

Computershare Limited is an Australian stock transfer company that provides corporate trust, stock transfer and employee share plan services in a number of different countries. With the world focused on the risk of inflation and higher interest rates, Computershare is exposed positively to rising interest rates, says Julia Lee.

“Computershare in particular has high exposure to US cash rates. Other stocks that benefit from rising rates include QBE, ASX and banks.

“Computershare has a share registry business, US mortgage servicing business and corporate markets business. Registry business is resilient, while potential upside comes from the US mortgage servicing business. Around 50-60% of its revenue comes the US,” Julia says.

Computershare (CPU)

Source: Google

‘HOT’ stock #2

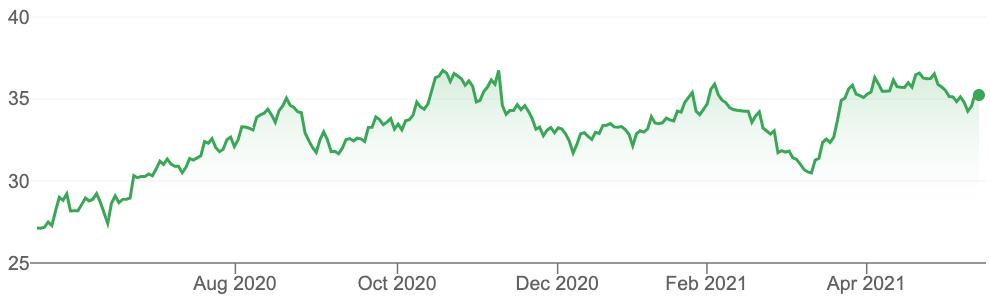

Raymond Chan is a fan of Sonic Healthcare Limited (SHL), an Australian company that provides laboratory services, pathology, and radiology services. Sydney-based, SHL has become one of Australia’s largest diagnostic companies, with a presence in Australia, New Zealand, the US, the UK, Germany, Switzerland, Belgium and Ireland. As the largest medical laboratory provider in Australasia and Europe and the third largest in the US, SHL has over 37,000 employees.

“We see COVID-19 testing continuing into the foreseeable future, with growth potential in COVID serology testing, Raymond says.

“Its global base business is increasingly resilient, benefitting from geographical diversity. “With a strong balance sheet (gearing 21.6x; A$1.3bn headroom), SHL is opening the door to acquisitions, contracts and joint ventures, he adds.

Sonic Healthcare (SHL)

Source: Google

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.