The pasta shelves at my local supermarket were half-empty on the weekend. So, too, the mince section. The cheap milk and bread were almost sold out. Later on the radio, a property expert noted a change in the rental market. Some households were taking in more people to spread rental costs. Some two-bedroom apartments had three, four or more people living in them.

The expert expected more renters (who can) to move back with their parents. Why pay higher rents when there is a spare bedroom free at the family home?

Anecdotes abound of people doing it tougher as living costs rise. But basing investment decisions on a tiny sample of anecdotes is dangerous. Retail sales have grown for eight consecutive months to August 2022, beating market expectations.

But that surely is as good as it gets for most retailers. There is enormous pain ahead for consumers as interest rates climb. Heavy falls on the share market this year reflect that. As always, the market is 12-18 months ahead of the real economy.

This week’s respite for global equities is a welcome relief. But it feels more like a “dead-cat” bounce than a sustainable rally while inflation terrorises economies.

Consider property. Some economists I follow expect house prices to drop 5-20% from their peak. In Sydney, prices are 9% off their high, AMP research shows. In Melbourne, that’s 5.6%.

Put another way, Melbourne is about a third of the way through its property correction. Brisbane is probably a quarter there if the 15-20% estimate holds.

Add to that falling superannuation balances and share market investments, and the hit to household wealth (at least on paper) is significant and has further to run.

Then there are living costs. The end of the fuel-excise reduction adds more pressure to petrol prices. Food, medical, energy and education costs are rising. Even the $1 coffee at my local petrol store is now $2 due to rising input costs.

I know this sounds gloomy, but investing is always about looking forward. Ask what the real economy will look like in 12 months when interest rates peak and falling asset values bite much harder. And unemployment rises, albeit off a low base.

Expect more consumers to trade down to even cheaper goods – like the pasta meal I mentioned at the start of this column. Also, expect more consumers to defer larger discretionary expenditure, such as a new couch or an overseas holiday (which is happening now because of costlier plane flights).

I’d hate to sell jet skis, camper vans or other expensive “toys” in this market. There will be a glut of them in the next 12 months as people sell surplus goods. We’ll swing from a shortage of some of these items to nobody wanting them, at least for a while.

Most of all, expect higher levels of distressed debt. Maybe, just maybe, we’ll avoid the worst of it in the property market due to higher lending standards in this cycle. Australia’s economy is still reasonably strong due to high (though falling) commodity prices. But expect to see a lot more distressed debt for smaller items.

Think unpaid credit cards, phone, electricity, water or gas bills. Particularly among households that get swamped by large, sudden increases in rents, food and other costs. Something has to give if living costs continue to increase far more than wage growth.

These conditions should benefit the so-called “hardship stocks”. That is, the companies that buy distressed debt, provide short-term loans for emergency expenses, offer financial counselling services or buy goods through pawnbroking stores.

Hardship stocks are not only in financial services. The market’s two big takeaway food stocks – Collins Food (KFC) and Domino’s Pizza Enterprises (DMP) – should benefit as people trade down to cheaper food. I notice Domino’s is promoting its $5 value pizzas.

However, this week’s focus is on financial-service stocks. Here are two companies that look interesting at their current valuations.

1. Credit Corp Group (CCP)

Credit Corp is Australia’s largest acquirer of purchased debt ledgers (PDL) with about a third of the market. It’s also a growing US player in PDL.

PDL is a fascinating industry. Companies buy ledgers of distressed debt mostly from banks and other financial organisations and utilities. They might, for example, buy the debt ledger of a large number of unpaid credit-card, telephone or utility bills.

This debt is typically at least six months in arrears and has been through a collection process without success. The chances of the debt being recouped fully are so low that the issuers are willing to sell the unpaid amount for cents on the dollar. CCP might pay 5-20 cents on the debt’s face value (per dollar) and aim to recoup double that amount.

Two factors matter most. First, how much PDL companies pay for distressed debt in a competitive market. As more firms compete for this debt, its price rises.

The second factor is the recovery processes. CCP has a habit of exceeding initial debt-recovery projections due to its technology, systems and debt-recovery processes. Low unemployment helps: if people have a job, they are better able to pay an old bill.

CCP should have plenty of debt to buy in the next year or two, at a reasonable price, as more consumers struggle to repay Buy Now Pay Later (BNPL) loans and other finance for impulse purchases. CCP’s market position in Australia is an advantage.

CCP is growing strongly in the US and developing greater scale there. That scale creates greater cost efficiencies and debt-recovery expertise than some of CCP’s US peers.

There is much risk. Government support during COVID-19 left many consumers with higher savings, meaning they are less likely to default on debts. Conversely, if interest-rate rises crush more households, CCP might recoup less debt than expected.

This is an unusual cycle for debt collectors. Rapid rate rises could push more households to the brink. But the job market is exceptionally strong. I suspect CCP will continue to beat market expectations on its debt-recovery rates.

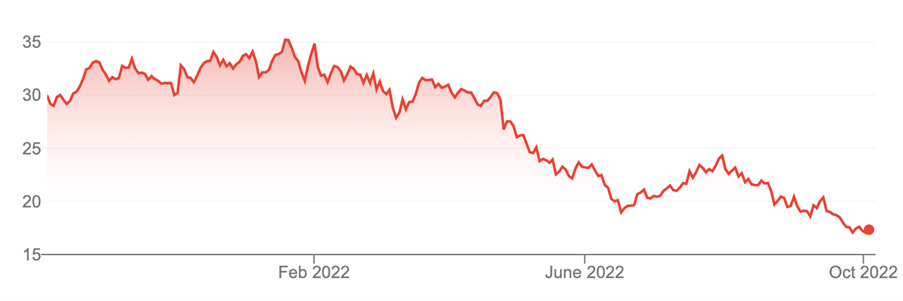

CCP soared from $10 in early 2020 to $33 in early 2021 as the market reappraised its growth prospects. The stock has since fallen to $17 in a weak market.

CCP’s current price compares to an average price target of $27, based on the consensus of six analysts. Morningstar values CCP at $30.50.

The consensus looks too bullish. But CCP is a quality company that has fallen too far this year. Conditions should favour the largest debt collectors in the next 12 months.

Chart 1: Credit Corp Group

Source: Google Finance

2. FSA Group (FSA)

FSA provides credit, debt solutions and direct lending services to people and small businesses. It says it is the largest business of its kind in Australia.

FSA helps people enter into payment arrangements with their creditors, or structure debt agreements, personal insolvency agreements or bankruptcy. Home and personal loans are also provided for clients to consolidate debt or buy a home or car.

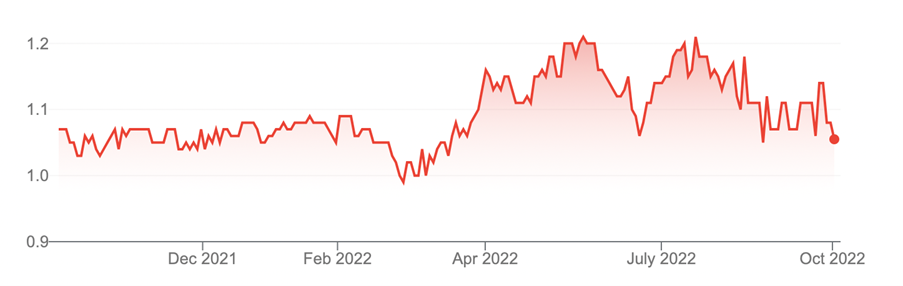

FSA has a good business model and should have more people using its services to consolidate debts in the next 12-18 months. But the stock has gone sideways for two years and never realised its potential. The five-year annualised return is minus 1%.

In FY22, FSA’s net profit decreased 14% to $17.2 million. COVID-19 affected inquiry levels for FSA’s services. There was a fall in informal and formal debt agreements that FSA advises on. Presumably, government handouts during COVID-19 and the ability to withdraw $20,000 from superannuation helped more people repay their debts.

FSA expects demand for its services to recover in FY23. Longer term, FSA is steadily building its loan book. It had $541 million of home, personal and asset finance loans at FY22, up 21% on a year earlier. The goal is $1.7 billion of loans within 3-5 years.

FSA will be worth a lot more than it is today if it achieves that loan book. Its acquisition of an asset-finance business in FY22 should be a tailwind. However, FSA looks like it’s heading back to $1, a previous point of share-price support.

As a thinly traded microcap stock, FSA suits experienced investors who understand the features, benefits and risks of this form of investing.

FSA has a low market profile, is not followed by many brokers and operates in an intensely competitive market (on the lending side of the business).

The company needs a few big wins to reignite market interest, but lower credit demand (as the economy slows) as rates rise could dampen growth in its lending business.

That said, FSA provides a timely service and has operated for more than 20 years. My hunch is many more consumers will need help to consolidate outstanding debts in the next two years. If FSA can’t grow faster over the next few years, it never will.

Chart 2: FSA Group

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 4 October 2022.