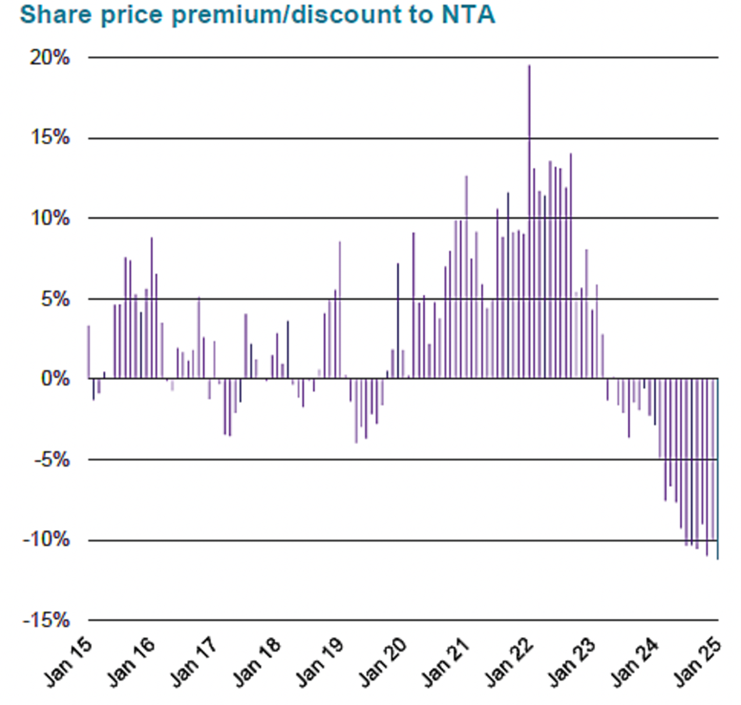

Australian Foundation Investment Company (AFIC) has a great chart on its website showing its premium or discount to Net Tangible Assets (NTA). The chart, shown below, displays only a few periods when the Listed Investment Company (LIC) traded at a slight discount to its NTA in the past decade.

Until 2024, that is, when AFIC, like most LICs, was priced at an unusually large discount to NTA, meaning it is worth less than the assets it owns.

Chart 1: AFIC share price premium/discount to NTA

Source: AFIC

AFIC trades at a 9% discount to its latest stated pre-tax NTA. Put another way, prospective investors in AFIC are buying $1 worth of assets in its investment portfolio for 91 cents – seemingly a bargain, on paper.

I’ve singled AFIC out because it is the market’s largest LIC and among its best regarded. When a LIC of AFIC’s quality trades at a persistent large discount to the value of its underlying assets, extra attention is required.

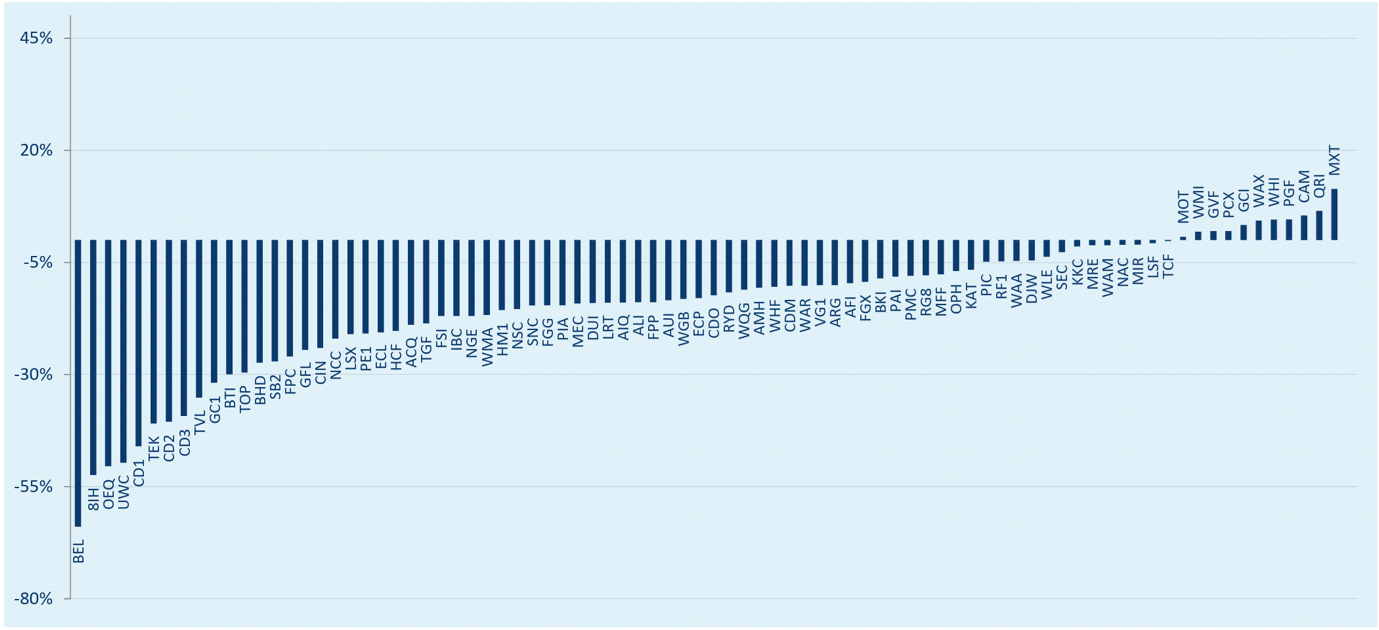

The Australian LIC sector is a sea of red for discounts to NTA. The chart below, from the ASX Investment Products monthly report, shows most LICs trading at a substantial discount to NTA. Only a tiny group trade at a premium.

Chart 2: LIC Premium/Discount to NTA

Source: ASX at 29 November 2024

Having followed the LIC market for many years. I can’t recall a time when so many LICs traded at such large discounts to their NTA. Rarely has the LIC sector been as out of favour as it is now, despite its benefits for income investors.

This widening discount to NTA provides an increasingly attractive entry point for investors in a few LICs, although premiums and discounts to NTA are never clear-cut. More on that – and LIC opportunities – shortly.

First, a quick recap – what is a LIC?

LICs are ASX-listed companies that manage a fund that invests in equities or other assets. Investors buy and sell shares in the LIC, not units in its underlying fund, as is the case with unit trusts and Exchange Traded Funds (ETFs).

As closed-ended funds, LICs have a fixed pool of capital to invest, meaning they don’t have to sell stock when the market falls to meet investor redemptions, or buy more stock when the market rises, to put extra capital to work. That’s an important distinction with open-ended fund structures like unit trusts.

But a LIC’s closed-ended structure means its share price can deviate from the value of the underlying assets (NTA). One LIC could trade at $1.10 a share when its NTA is $1 a share. Another could trade at 90 cents when its NTA is $1 a share.

LICs trade at premiums and discounts to NTA for many reasons. The market might price a LIC at a persistent, large discount to NTA because it has a poor investment performance or patchy dividend record. Conversely, a LIC could trade at a premium if the market rates its performance, personnel and prospects.

Discount or premium data on their own is not enough information to invest. What matters is whether the size of the discount or premium is warranted.

A useful guide is comparing a LIC’s current premium or discount to its long-term average. LICs tend to revert to their median discount or premium over time, although that’s not always the case.

A LIC trading at an unusually large discount to its historic average could be a buying opportunity. Just as one trading at an unusually large premium could be a sell.

Consider AFIC. Its current discount of 9% to NTA compares with an average premium of 3.3% over the past five years, Bell Potter data shows. During that period, AFIC has traded at a maximum discount of 11.2% and maximum premium of 19.6%

Clearly, AFIC is at an unusually large discount compared to its long-run average.

The next step is determining if that widening discount is warranted. Two pieces of data help here: the underlying investment performance and the dividend.

AFIC in February announced its portfolio returned 13.2% over one year, just ahead of the 12.7% return in the S&P/ASX 200 Accumulation Index. Over five and 10 years (to 31 December 2024), AFIC has returned a touch below its benchmark index, albeit with less portfolio volatility and consistent dividends.

So, AFIC’s investment return – while steady rather than spectacular – doesn’t warrant such a large discount to NTA. Moreover, although AFIC is an active manager, it tends to deliver index-like returns at low cost.

AFIC also lifted its interim dividend in recent results for the half-year ended 31 December 2024. AFIC’s dividend has been consistent for a long time, meaning its widening discount to NTA cannot be explained by patchy dividends.

The best explanation for its larger discount to NTA is the most obvious: fewer recent buyers for this LIC and others. As more investors flock to ETFs, demand for more LICs is contracting. That’s an opportunity in the right LICs.

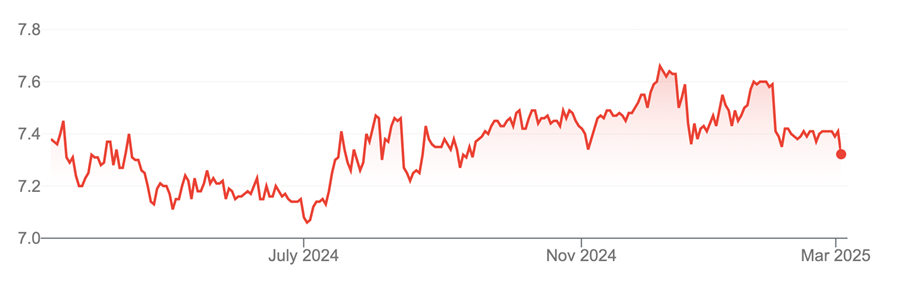

Chart 3: AFIC share price (ASX: AFI)

Source: Google Finance

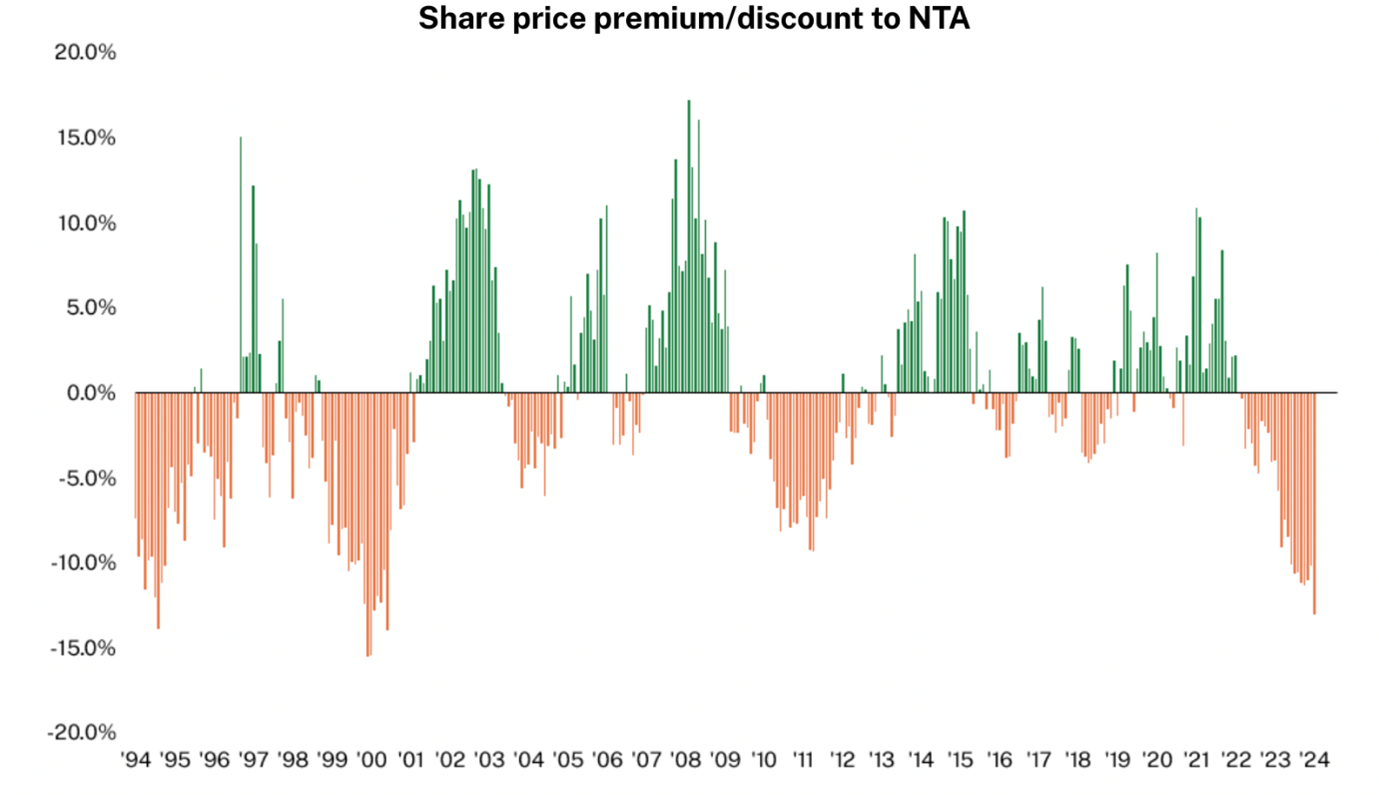

Now let’s repeat the exercise with Argo Investments, the market’s second-largest LIC. Like AFIC, Argo has been around a long time and is highly regarded.

Also like AFIC, Argo trades at an unusually large discount to NTA. Its current 8% discount compares to an average 0.5% discount over five years.

Chart 4: Argo share price premium/discount to NTA

Source: Argo Investments. To 31 January 2025

In the recent interim result for the 1HFY25, Argo’s investment performance (as measured by its NTA) was a touch ahead of the ASX 200 Accumulation Index.

But over five and 10 years, Argo’s investment performance is slightly below its benchmark index. That’s not unusual; many active managers underperform their benchmark over long periods, S&P data shows.

Argo’s dividend history is consistent. Apart from a dividend cut in 2021 during COVID-19, Argo’s dividend has edged slightly higher over the past decade. Like AFIC, Argo’s dividend performance does not explain its discount to NTA.

That said, it’s always important to consider the counter argument with investments. LICs arguably deserve to trade at a larger discount to NTA than they have in the past because interest in parts of this sector is waning due to the boom in index investing.

I’ve long thought Australia has too many LICs, is over-represented with small- and micro-cap LICs, and has too many managers that lack scale and investor relations resources. We’d be better off with fewer, larger LICs.

Structural LIC debates aside, the reality is that two of the market’s best LICs are trading at an unusually large discount to NTA and yielding more than 5% after franking.

With the Australian equity market trading at 7% above fair value on Morningstar numbers, investors need to look harder to find value. Buying LICs that offer large-cap Australian equity exposure, at a significant discount, is one strategy.

It may take time for AFIC and Argo to close their discount to NTA and return to a premium, given market sentiment towards most LICs. But for investors wanting low-cost exposure to the ASX 200, with moderate active management, both LICs are worth further investigation at their current price.

Chart 5: Argo Investments share price (ASX: ARG)

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 5 March 2025.