There are always interesting and exciting stories in the small-share-price end of the ASX; here are three, in very different industries, that I think are worth a punt.

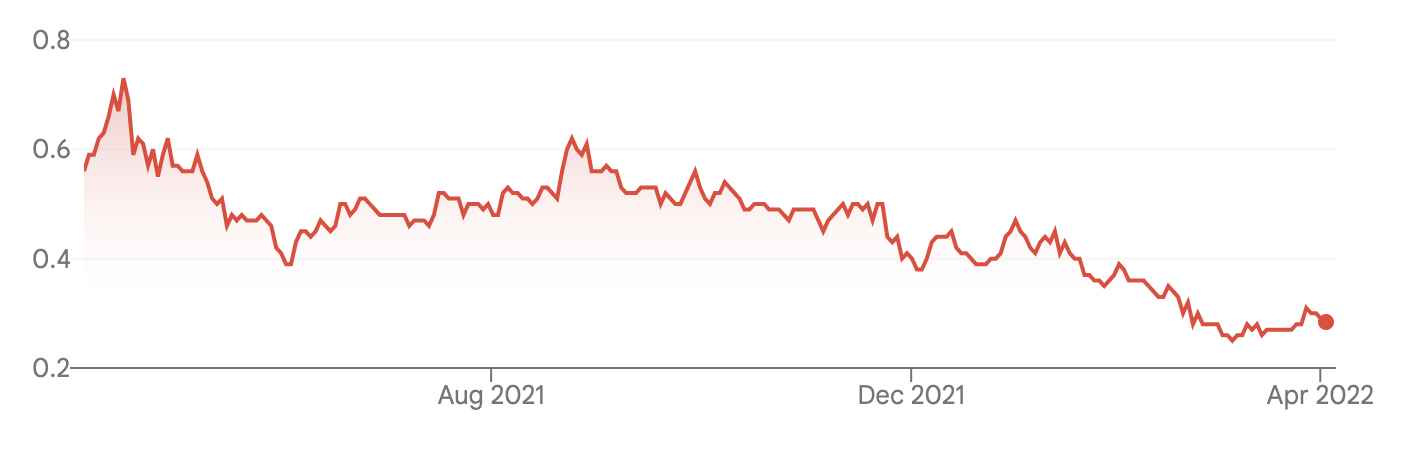

Webcentral (WCG, 29 cents)

Market capitalisation: $77 million

12-month total return: –48.2%

Three-year total return: –47% a year

Analysts’ consensus valuation: n/a

A long time ago, Webcentral Group was the web hosting company Melbourne IT, which was a Tech boom darling, trading near $15 – but then came the 2000 tech bust. Those days are long gone, but the digital services company – which merged with telecommunications carrier 5G Networks in November last year – is creating an integrated telco, data centre, domain and hosting business serving more than 330,000 government, enterprise, wholesale, and small and medium businesses (SMB) customers across Australia and New Zealand.

WCG offers these customers services in domain registration and portfolios, cloud, data centre, data networks, managed services, digital marketing and hardware & software.

All the major metrics were on the rise in the half-year to December 2021 – revenue up 25% (at the top of the guidance range), EBITDA (earnings before interest, tax, depreciation and amortisation) up 15% to $7.1 million (above guidance), EBITDA margin up one percentage point to 15%, and gross margin up six percentage points, to 58%. Operating cashflow generation is exceptionally strong, with the cash balance at June 2022 forecast to be about $14 million, rising to about $55 million at June 2023.

The domain release of .au launched last month, and in itself is a $9.6 million revenue opportunity from 370,000 eligible .com.au domains that are currently managed by Webcentral. Holders of these .com.au domains have a window until September 2022 during which only they can buy the .au domain from WCG – they can then keep both domain names and have them redirect traffic to the same website. Doing so for a reasonable expense protects the domain; in the UK, when a similar change occurred, domain sales rose by 30%.

WCG has given guidance for the combined group to achieve EBITDA of $23 million on a pro forma basis in FY22, incorporating about $2 million worth of merger synergies, and that should be the basis for further growth. Despite being still in a net-loss position, the company is now a simplified corporate entity with a strengthened balance sheet and improved liquidity – Webcentral Group looks nicely poised for growth.

Webcentral (WCG)

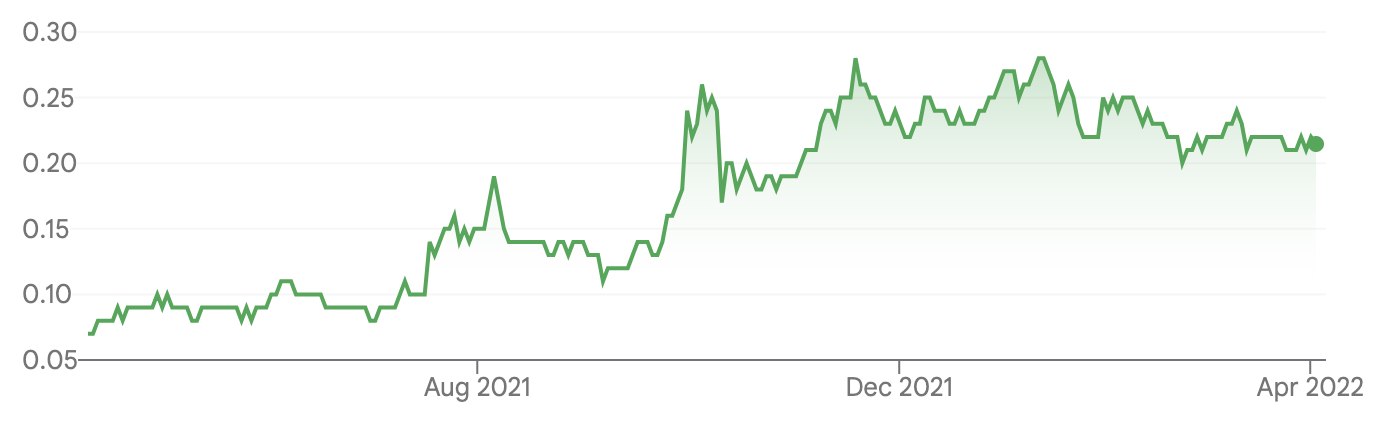

Novatti Group (NOV, 24 cents)

Market capitalisation: $83 million

12-month total return: –49%

Three-year total return: 5.3% a year

Analysts’ consensus valuation: n/a

Little-known payments player Novatti delivered an outstanding half-year to December 2021, boosting total revenue by 48%, to $12.3 million, receipts from customers increasing by 63%, to $25 million, and a strengthened balance sheet, with net assets up nearly 370%. The company’s payment processing business more than doubled its revenue, to $9.1 million. First-half sales revenue was greater than Novatti’s total sales revenue for FY20, just 18 months ago.

Novatti is expanding in the online business-to-business (B2B) payments space – it facilitates payments between parties that include banks, fintechs and non-financial businesses. The company says that it has established a global B2B payments ecosystem – it “enables businesses, from corner stores and start-ups to global organisations, to pay and be paid, from any device, anywhere.” Novatti aims to capture a piece of the fee stream behind every digital transaction. Novatti is taking the next step and applying to APRA for a restricted Australian banking licence, a process that was delayed by the regulator because of the pandemic.

Recent expansion has included taking a 19.9% stake in ASX-listed small-business accounting software supplier Reckon, and moving to integrate Novatti’s payments systems into Reckon products; the two parties will initially focus on incorporating payments offering in the Reckon One solution and new invoicing app. The launch of an integrated payments solution will seek to add value to Reckon’s 114,000-plus cloud-based users.

Last year Novatti also bought ATX, a leading South-East Asian payments fintech, based in Malaysia, which provides traditional retail stores and kiosks with digital payment services, such as third-party bill and product payments. Novatti’s other plank of Asian expansion is in partnership with global blockchain and crypto solutions provider Ripple: this partnership leverages the global cryptocurrency, XRP, to process cross-border payments instantly, and spearheads Novatti’s exposure to the broader growth in the use of cryptocurrency globally.

The network expansion is being carried out in partnership with Siam Commercial Bank, one of Thailand’s largest banking groups, through RippleNet. The partnership is now generating revenue in both Thailand and the Philippines. Added to the growth of Emersion – Novatti’s fully-owned billing subsidiary – the company, despite currently being a loss-maker, looks to be nicely positioned for further growth in the multi-billion dollar global payments market.

Novatti Group (NOV)

Predictive Discovery (PDI, 21.5 cents)

Market capitalisation: $296 million

12-month total return: 190.5%

Three-year total return: 170.6% a year

Analysts’ consensus valuation: n/a

Gold explorer Predictive Discovery is developing its Bankan gold project in Guinea, having discovered the orebody in a major gold-producing region of the country called the Siguiri Basin in mid-2020. Predictive Discovery has speedily established a 3.65-million-ounce resource at Bankan, while showing that there is multi-deposit potential on its tenements, with four of ten identified structural targets returning strong gold intersections already – all are open along strike and at depth and require follow-up deeper drilling. This is on top of the knowledge that the high-grade mineralised zone below the initial discovery continues to depth.

The 3.65-million-ounce resource (at 1.56 grams per tonne of gold) is the largest maiden resource in West Africa since 2012. West Africa has become the leading gold jurisdiction globally, being the number-one region for most gold discoveries over the past decade, and the number-two global gold producing region (as of 2020). The company describes Bankan as “West Africa’s next Tier-1 gold mine” – it says that Bankan “shares the best qualities of tier-1 deposits, namely outstanding grades and widths combined with excellent mineralisation continuity.” There is both straightforward open-pit and (high-grade) underground mining potential, and the project has simple metallurgy. The project has the full backing of the Guinean government, and PDI says Bankan is “well-positioned to become Guinea’s largest gold producer within five years.”

Over the remainder of the year, Predictive will run a variety of drilling programs to follow up the new gold discoveries, and widen exploration on the Bankan project, both on the known deposits and these emerging gold discoveries – it is considered highly likely that the 3.65-million-ounce resource will be extended. Watch the news flow for further share price rises for PDI.

Predictive Discovery (PDI)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.