It is pretty easy to get turned off by the share market at the moment, and while I feel that this is the time for some selective ‘courageous buying’, many trustees are sitting on the sidelines. So, what are your options for the cash sitting in your SMSF?

Option 1 – Boring old term deposits

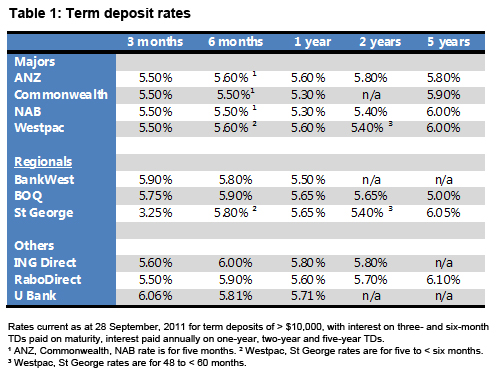

With the government set to continue to guarantee up to $250,000 of each depositor’s funds on a per institution basis (read, What deposit guarantee changes mean for term deposits), a strong case can be made that the ‘name’ of the bank or credit union is irrelevant for deposits up to the cap amount. It is important, however, to check out what happens on the maturity date – a nasty practice that some banks still employ is to let the funds automatically rollover to a new term at an uncompetitive carded rate, unless you contact them prior to the maturity date. The current term deposit rates from the major providers are in Table 1.

Option 2 – Bank hybrid securities that pay fully franked distributions

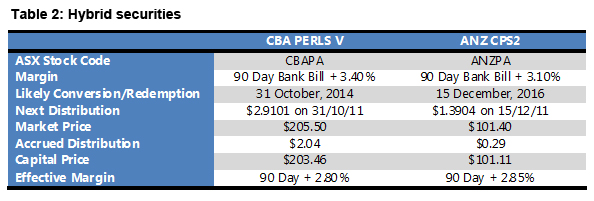

The new ANZ CPS3 issue got off to a good start when it listed on the ASX last week and was trading at par on Friday – not bad given that ANZ raised $1.34 billion and anyone who applied in the public offer received their subscription in full. Two actively traded older issues that represent reasonable value are in Table 2.

Option 3 – A professionally managed fixed income fund

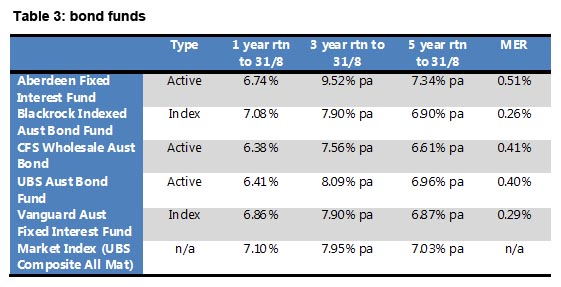

Bond funds have done pretty well over the last few months due to the fall in long-term interest rates. With three-year Australian Government Bonds now yielding only 3.65%, and 10 years at around 4.3%, you will need to be quite bullish on interest rates (bearish on the economy) to expect a material increase in bond prices. Then again, whoever thought 10-year US Treasury Bonds would touch a yield of 1.75%!

Some of the leading Australian bond funds are in Table 3.

The very low government bond yields makes a five-year, government guaranteed term deposit yielding 6.1% look pretty attractive – I’m not sure how many bond funds will beat that over the next five years! If you want to invest directly by buying secondary market issues of government, semi-government or corporate bonds, the fourth option is to talk to one of the specialist fixed interest brokers such as FIIG. The minimum parcel size will usually be $100,000, but it may be as high as $500,000 for some of the corporate bonds.

The very low government bond yields makes a five-year, government guaranteed term deposit yielding 6.1% look pretty attractive – I’m not sure how many bond funds will beat that over the next five years! If you want to invest directly by buying secondary market issues of government, semi-government or corporate bonds, the fourth option is to talk to one of the specialist fixed interest brokers such as FIIG. The minimum parcel size will usually be $100,000, but it may be as high as $500,000 for some of the corporate bonds.

There you have it – four alternatives to cash that have relative security and essentially, income characteristics. For my book, it is probably a mix of longer duration term deposits and the fully franked floating rate bank hybrids.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.

Also in today’s Switzer Super Report

- Roger Montgomery: Ten value dividend-paying stocks

- Tony Negline: Seven rules for claiming personal tax deductions

- Peter Switzer: When to buy the dips