The change to the law about the number of members in an SMSF has been a long time in the making, given it was originally proposed to commence from 1 July 2019 and was then finally introduced to Parliament in September 2020.

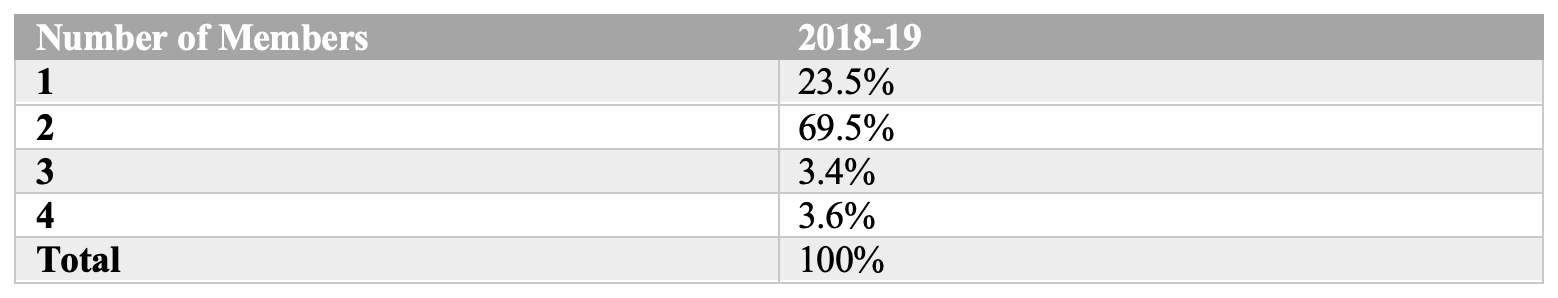

A recent ATO SMSF Quarterly Statistical report (from March 2021) shows the latest SMSF annual return data available and the distribution of SMSFs based on the number of members is as follows:

From this we can see that one or two member funds are far more popular membership structures for SMSFs, so the desire to increase a fund’s membership up to six may not be that sought after, but the opportunity exists.

Factors to consider

Expanding the number of members within an SMSF brings with it potential opportunities but there are also a range of issues to consider. Like anything, it’s important to check what the trust deed/governing rules of the SMSF say in relation to the matter and the structure of the fund. Given an SMSF is a type of trust, it’s also important to check the relevant state laws in relation to how many individual trustees a trust can have. If it’s limited to four, and a fund intends to have more than four members, then a corporate trustee will be required.

Under the SMSF governing rules, with the exception of single member funds, all members must be either individual trustees or directors of the corporate trustee of their SMSFs and vice-versa. Hence, in terms of being members of SMSFs and running SMSFs, the same rules and responsibilities apply to all members alike. We’ll cover off on the opportunities and potential issues raised by increasing fund membership now that it’s possible in the realm of SMSFs.

Importantly the change to the definition of an SMSF makes some technical changes to a number of Sections within the Superannuation Industry (Supervision) Act 1993 reflect the increase from four to six, namely the acquisition of an asset from related party rules, the in-house asset rules and the trustee signing requirements. The signing requirements are the most significant change, as indicated below.

Here are the opportunities

- Investment opportunities may be increased as having a larger pool of funds may enable a fund to invest in a larger asset like property that may not otherwise be possible.

- More trustees/directors means potentially more expertise in making investment and financial decisions for the SMSF.

- A larger pool of funds may allow greater ability to diversify investments and spread risk. For example, adding children in a SMSF it may give a fund the opportunity to diversify its investments. It’s important to consider whether it is necessary that children’s benefits are segregated from the assets of their parents within a fund. If so, separate bank and investment accounts would be involved and the SMSF accountant or administrator must have the skills and systems to handle segregated investments.

- There may be a potential savings in overall administrative costs. This would depend on the investments and transactions made in the SMSF amongst other factors. Fixed fees for an SMSF may also be lower than percentage-based fees across individual superannuation accounts.

- A greater pool of members may help with any liquidity issues of an SMSF. For example, there may be a greater ability to service debt through a Limited Recourse Borrowing Arrangement as potentially there are more contributions being made; or the cashflow generated from any children’s contributions or rollovers into the SMSF could be used to meet certain liabilities for older members, such as pension drawdown requirements.

- SMSFs are great vehicles for building wealth and can boost the financial literacy of all members, regardless of age, when operated properly. Introducing SMSFs to children in their teens when they commence work and start receiving super can been a trigger for these younger members to be more involved in the investment of their super savings. These members may already be ahead when it comes to savings and wealth creation by simply having engagement with their super at an earlier age. However, children aged under 18 cannot be trustee of the fund or director of a corporate trustee until they turn 18.

- Adding children as additional members to an SMSF may help allow for the inter-generational transfer of fund assets where possible. Depending on the capacity of the children to contribute and the timeframes involved, the need to sell fund assets on death may be eliminated or significantly reduced.

Here are the ‘potential’ issues

- There is potentially more conflict in decision making with more people involved. There would be a greater need to develop a workable dispute resolution mechanism for the fund should the need arise.

- The member’s age and retirement status will affect their risk profile, investment horizons, and liquidity and cash flow requirements. Therefore, an SMSF may want to segregate the investments which could potentially offset any savings in fees. While adult children and parents can run separate investment portfolios and allocate earnings to the specific account balance(s) supported by a particular portfolio, this brings additional administrative complexities and costs.

- Investment strategies would need to be reviewed frequently as trustee decisions must be made in the best interests of all beneficiaries and not just in the best interests of the beneficiaries with the majority balances in the SMSF.

- Administratively it is more difficult needing documents signed by more people (for example getting 6 people to sign a document might not be easy!) However this is offset somewhat by requiring at least half of all trustees to sign financial statements.

- Including children as members and trustees of an SMSF puts them in a situation where they have access to the resources of the fund. This access had dire consequences in the Triway Superannuation Fund which was established with three members: Mum, Dad and Son. The son had a drug addiction and withdrew monies out of the SMSF without his parents knowledge. Once discovered the parents were complicit in trying to cover it up. This left the parents with a non-complying SMSF and no super.

- In case of divorce or separation, nothing is beyond the reach of the family court – including the assets of the family super fund. This means that even if the spouse/de facto of your adult child is not a member of your SMSF, they still may have an entitlement to some of the funds in the SMSF, which will be intrusive on the fund’s operations.

- Including children as members and trustees of an SMSF mean they would be privy to information about your SMSF entitlements and any arrangements you have put in place (e.g. individual member balances, any reversionary pensions, binding death benefit nominations).

- Control is probably the most important factor when ensuring the wishes of a deceased member are carried out correctly when it comes to estate planning. In the case of Katz v Grossman, the trustees of the SMSF were a father and daughter. The father completed a non-binding nomination requesting the trustee to split his super balance 50/50 to his daughter and son upon his death. The son was not a member or trustee of the SMSF at the time of his father’s death and the daughter appointed her husband as the replacement trustee and proceeded to pay 100% of her father’s benefits to herself. The Court found in her favour – as trustee her (and her husband) had discretion as the nomination was not binding on the trustee.

Here’s our conclusion

As can be seen, there are many considerations in who should be involved in an SMSF. Now more than ever with the opportunity to have up to six members in a fund, it is important to ensure that only the right people are invited to join an SMSF. Given the number of cases where adding adult children as members or trustees of an SMSF has caused issues for the existing members/beneficiaries, it is not a decision to be made lightly.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.