Historically when people have said “this time it is different” the market has proved them wrong. But with the arrival of Donald Trump, this time things are unquestionably different. So, the question is: Will his difference work against the market, punishing investors who remain long stocks.

When it comes to investing in stocks, history says the five most dangerous words to believe in when stocks are hitting all-time highs on a regular basis are the following: “This time it is different!”

This is the kind of observation that could give investors the comforting notion that they can ignore signs that are saying that this market is too hot, and you should get ready for a pullback, or even a crash.

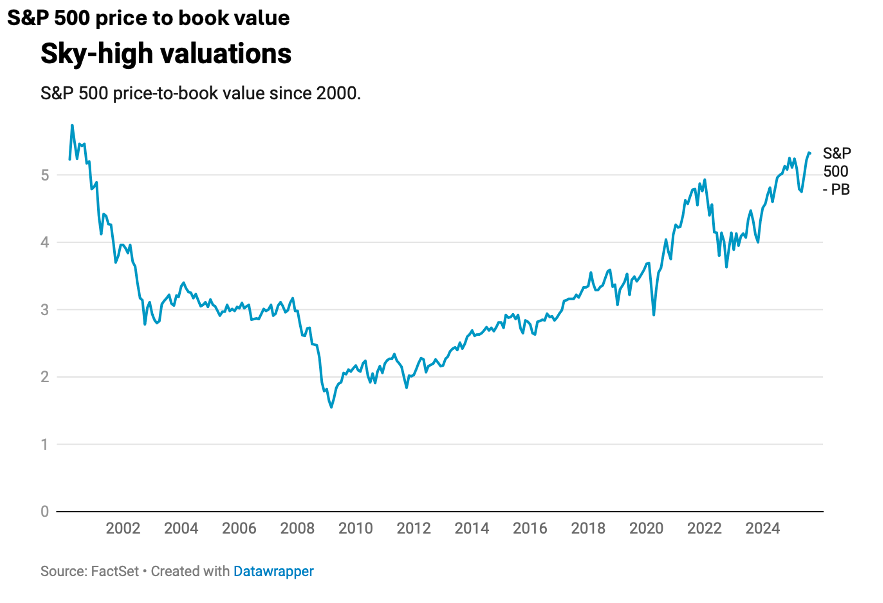

One guy preaching caution right now is the often bearish Bank of America strategist Michael Hartnett, who notes that the S&P 500 is 5.3 times the price-to-book value. This measure compares a company’s assets to its debts or liabilities.

The last time this market indicator was so high was before the dotcom crash of 2000.

Looking at this, Harnett wrote to his clients. CNBC reported that he said: “It better be different this time.”

Remember September and October historically aren’t good for stocks, even Harnett found reasons to punt on positivity. This is what he thought would be different that could help stocks: “Hartnett gave several reasons why the market may not suffer the same fate it did a quarter century ago, when similar valuations were present,” CNBC’s Fred Imbert reported. “Among them are investor aversion to bonds, millennials and Gen Z gravitating more to stocks than real estate to build wealth and, of course, the AI boom.”

This week the market expects the Federal Reserve will help the cause for stocks and Donald Trump’s tariff effects on the overall economy with a rate cut, which is expected by over 90% of the money market.

While the Trump team is calling for a 0.5% cut, I suspect last week’s inflation data will make the Fed resistant to a jumbo-style half a percent cut.

In fact, the eyes of the market will be glued on the central bankers’ annual get together at the picturesque Jackson Hole. The main game will be deciphering what the likes of Jerome Powell is thinking when it comes to US rate cuts.

Right now, markets expect rate cuts. And the rotation I’ve been talking about is showing more promise, with the Russell 2000 (the small cap index) up 2.6% this week, while the S&P 500 gained only 0.85%, while the Nasdaq only rose 0.75%.

The play I’ve been recommending for that rotation out of the big caps, such as CBA and Wesfarmers, has been EX20, which captures mid to small caps numbered 21 to 200. This ETF was up 1.27% last week, while the S&P/ASX 200 only added 1.06%.

Over the past year, EX20 is up 14.46%, against the S&P/ASX 200 that only gained 12%.

The more rate cuts in the US and here, the greater should be this burgeoning rotation. “Will small-, mid-caps outperform large caps? That’s the question,” said Brian Leonard, portfolio manager at Keeley Gabelli Funds. “We think there’s a possibility they do.”

So, what Jackson Hole and what Fed chief Powell says will help or hurt stock prices this week, the facts have been that the US before Trump’s ascendency to the presidency had a Goldilocks scenario for the economy — not too hot, not too cold — and the President keeps delivering promises such as tax cuts and deregulation on top of potential rate cuts, which rationally keeps US investors true believers that the stock market can keep defying gravity.

On Friday, UBS put a note out tipping stocks will go higher, and investors should put their cash to work. Meanwhile, Barclays wasn’t even negative on financial stocks that often cop a sell-off when rates are cut. “Regarding concerns around owning financials into lower rates: the history of Fed cutting cycles since 1990 suggests falling rates are not a headwind for the sector unless the central bank is cutting into a recession,” wrote strategist Venu Krishna. “Earnings and valuations are supportive, and we remain positive on the sector.”

While I’ve been cautious lately, last week I started putting my clients’ cash to work with EX20, WCMQ, IHVV and the likes of BHP, CSL and NXT still my preferred way to get exposure to capital gain without taking too much risk.

While I also like Eley Griffiths’ Small Cap Fund, there are others that do well when it’s time for rotations out of big caps. These fund managers benefit from rate cuts and their knowledge of quality businesses that see big improvements to their bottom lines when the cost of borrowed money falls.

As I’ve said for some time, if Donald behaves, we’ll make money from stocks at least into 2026. The main reason I say this is that President Trump is very different and he’s creating a very different environment for stocks. While he’s dangerous, those five words i.e., ‘this time it is different’ are less scary until he does something crazy like play too hardball with Beijing.

We have 80 days or so before we see Trump and Xi Jinping decide on a trade deal. I’m praying we don’t see “big trouble in big China”!