If you were part of last Thursday’s Boom Doom & Zoom webinar, you’d recall Paul (Rickard) asking me if I’d buy more CBA shares if I was participating in the buyback. As I said to Paul at the time, I still haven’t made up my mind on the subject.

I hold this great investment product in my super fund, so this buyback is a big deal.

I also said to Paul that I could wait for some silly market sell off and load up on our best bank then, though it could mean waiting a few years for that to happen.

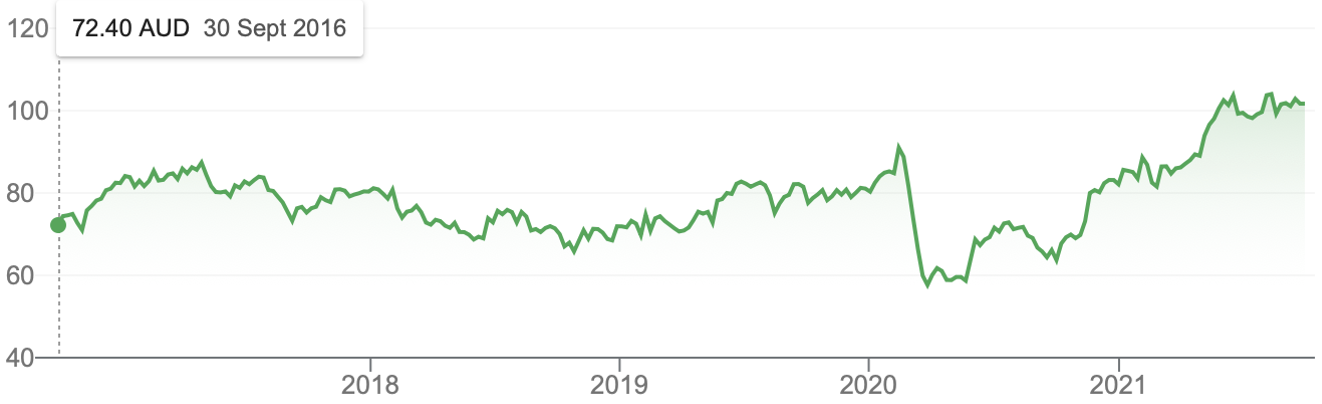

Recall that with the 2020 Coronavirus crash, CBA fell to $57, and if you’d gone long, you’d be up 77%!

After I said that, Paul asked me about the other banks. Once again, I didn’t have an answer because I’ve been chasing value play stocks, where I think the reopening of the economy will provide some nice windfall profits.

But Paul has got me thinking about the other banks so I thought it was time to get more certain on my view on whether they’re a buy or not.

Let’s go to the analysts on FNArena and see what the experts are thinking. And let me add that when US market commentators speculate on what stocks look set to do well going forward, they regularly say: “…energy, industrials, travel-related and financial stocks”.

We often play ‘follow the leader’ with Wall Street, not just on what the overall market or indexes do — we tend to copy US sector movements as well.

So what financial stocks are being backed by the experts who live and breathe stocks daily?

Let’s kick off with the CBA. A stock that now trades at $101 is tipped to fall to $90. That’s a slide of 11%. This has been influenced by the buyback but I think these experts don’t know how committed CBA shareholders are. That said, my wait-and-buy on a big dip looks like an OK play.

You might ask: what about the dividend? That will make me go looking for better dividend plays. I’ll look at that next week. I could also simply invest the proceeds in our SWITZ fund, which should do about 6% after franking. Marcus Bogdan (who runs the fund for Contango Asset Management) is an expert dividend chaser. I could even buy another income fund to add to my diversification.

But what about the other banks and financial companies out there? Do they look like decent plays?

I’m going to use this measurement: will they pay me 10% plus this year? If they do, they could be a goer.

Let’s kick off with Westpac (WBC), the bank that’s been in more trouble than Indiana Jones in the Temple of Doom. Here the analysts tip a 12.3% gain. If you add in dividends and franking, this could be a 17% rise over the next 12 months. Its current share price is $25.25 and the most optimistic assessor (Citi) sees it as a $30 stock ahead.

In 2015, Westpac was a $39 stock, and while the financial world has become harder for banks to make profits with the growth of mortgage brokers, fintechs and the pressures post the Hayne Royal Commission, seeing WBC as a $30 plus share price doesn’t look all that far-fetched.

Westpac (WBC)

Looking at the other big banks, the analysts think ANZ has 8% upside, but the broker Morgans seems to be seeing something others are missing. It has a $34.50 target, while its current price is $29.60, which implies a 25.87% rise lies ahead for Westpac.

Meanwhile, at $28.19, NAB, which is the country’s biggest business bank, is expected to only rise by 3.1%. Even Ord Minnett, the most optimistic professional company watcher, only has a 7.86% gain in its calculations.

What about the regional banks?

Maybe it’s time to ‘think outside the big four square’ and look at the regional banks. Here’s a table of what the experts see for the smaller financial institutions.

Company Ticker Price Target Upside

1. Bendigo Adelaide (BEN) $9.36 $10.39 11%

2. Bank of Queensland (BOQ) $9.21 $10.35 12.4%

3. Suncorp (SUN) $12.45 $13.41 7.8%

As you can see, the analysts like the sector going forward. Even a business like Suncorp, which is a bank and insurer combined, has a total return of about 15% when you throw in the dividend forecast of 4.8% for the financial year 2022 (FY22) and franking.

The forecasted yield for BEN is a nice 5.6% for FY22, while BOQ’s is tipped to be 5.1%.

As businesses, you’d have to think that banks will do better out of the reopening of the economy, though over 2022 and 2023 the housing sector should slow down, with APRA bound to put lending controls on certain borrowers such as investors and those looking for adventurous lenders.

On the plus side, business is bound to be in a more borrowing mood as borders open and lockdowns are scrapped. Banks will also see their bottom lines improve with rising interest rates. And though the RBA thinks it’s holding rate stable until 2024, my economic forecasting tells me that rises will come in 2023 at the latest, as our economy booms next year. The baseline growth forecasts from the RBA is for 4% growth, but I’ve seen other economists with economic guesses much higher than that great growth number.

Even with a 4% growth rate for the Australian economy next year, it looks like banks will be in the money, which should be good news for their shareholders too!

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.