Two weeks’ ago, ANZ announced a $1.5bn share buyback. Last week, NAB followed suit with a $2.5bn share buyback and today, Suncorp announced a $250m buyback. This Wednesday, when CBA reports its full year profit, it is expected to announce an off-market share buyback of around $5bn.

The banks are awash with capital because in anticipation of a Covid economic meltdown (which didn’t transpire), they slashed dividends, raised capital (in the case of NAB) and have continued to divest non-core assets. For example, CBA’s last reported CET1 capital ratio was 12.7%, well above APRA’s “unquestionably strong” benchmark of 10.5%. With divestments already in train, this is expected to rise to 13.1%. It has more than $10 billion of surplus capital, so there is pressure to return some of this to shareholders and increase the earnings per share.

CBA is also sitting on a truckload of franking credits, and because they are only of value in the hands of shareholders, it is expected to announce an “off-market” share buyback. This will be particularly attractive to SMSFs and other low rate or zero tax rate shareholders.

In this article, I will look at who should consider accepting an off-market buyback and who shouldn’t, and what actions you can take to prepare for the CBA off-market share buyback.

What’s special about an off-market share buyback?

There are two main types of share buybacks. An on-market buyback is conducted on behalf of the company by a broker purchasing the shares on the ASX. The other type is an off-market buyback which is conducted through a tender process, and provided it is an equal access scheme, allows a company to distribute surplus franking credits to its shareholders.

It is this distribution of franking credits that makes the off-market buyback very special. Part of the sale proceeds is treated as a franked dividend, with the other part treated as a capital component. Effectively, the shareholder gets a huge franked dividend with imputation credits, and materially reduced sale price for capital gains tax purposes. This is what makes off market buybacks so tax advantageous to some shareholders, and because shareholders are keen to accept, means that the company can purchase the shares at a discount to the market price.

A typical off-market buyback

The ATO sets the rules for off-market share buybacks so they all have the same playbook.

Firstly, they have to be “equal access”, which essentially means that every shareholder has the right to participate in proportion to the number of shares they own. Next, they are conducted via a tender process, where shareholders nominate the price they want to receive for selling their shares. This is expressed as a discount to the market price in a range from an 8% discount through to a 14% discount.

Because the buyback is capped in size, the company accepts tenders from those shareholders offering to sell at the lowest price (highest discount) and rejects those offering to sell at a higher price (lower discount).

The buyback comprises two components – a capital component and the balance as a fully franked dividend. Normally, the fully franked dividend is a lot larger than the capital component.

Finally, for capital gains tax purposes, the sale price is determined by the ATO (essentially the market price less the franked dividend). Effectively, the shareholder sells the shares at a price well below the market price – which either minimizes capital gains tax payable or leaves the shareholder with a capital loss than can be used to offset other capital gains.

Should you accept?

The premise is that you should accept the buyback if your effective sale price (after tax) is higher than you could achieve by selling the same shares on the ASX. If you feel that you want to maintain your shareholding, you can buy those same shares back on the ASX.

Let’s take an example, a ‘hypothetical’ CBA share buyback.

We will assume:

- CBA’s market price is $100

- The buyback is conducted at a price of $86.00 (a discount of 14% to the market price)

- The capital component is $26.00

- The fully franked dividend is $60.00, which has $25.71 of franking credits

- The deemed sale price for CGT purposes is $40.00

- The original purchase price was $60.00

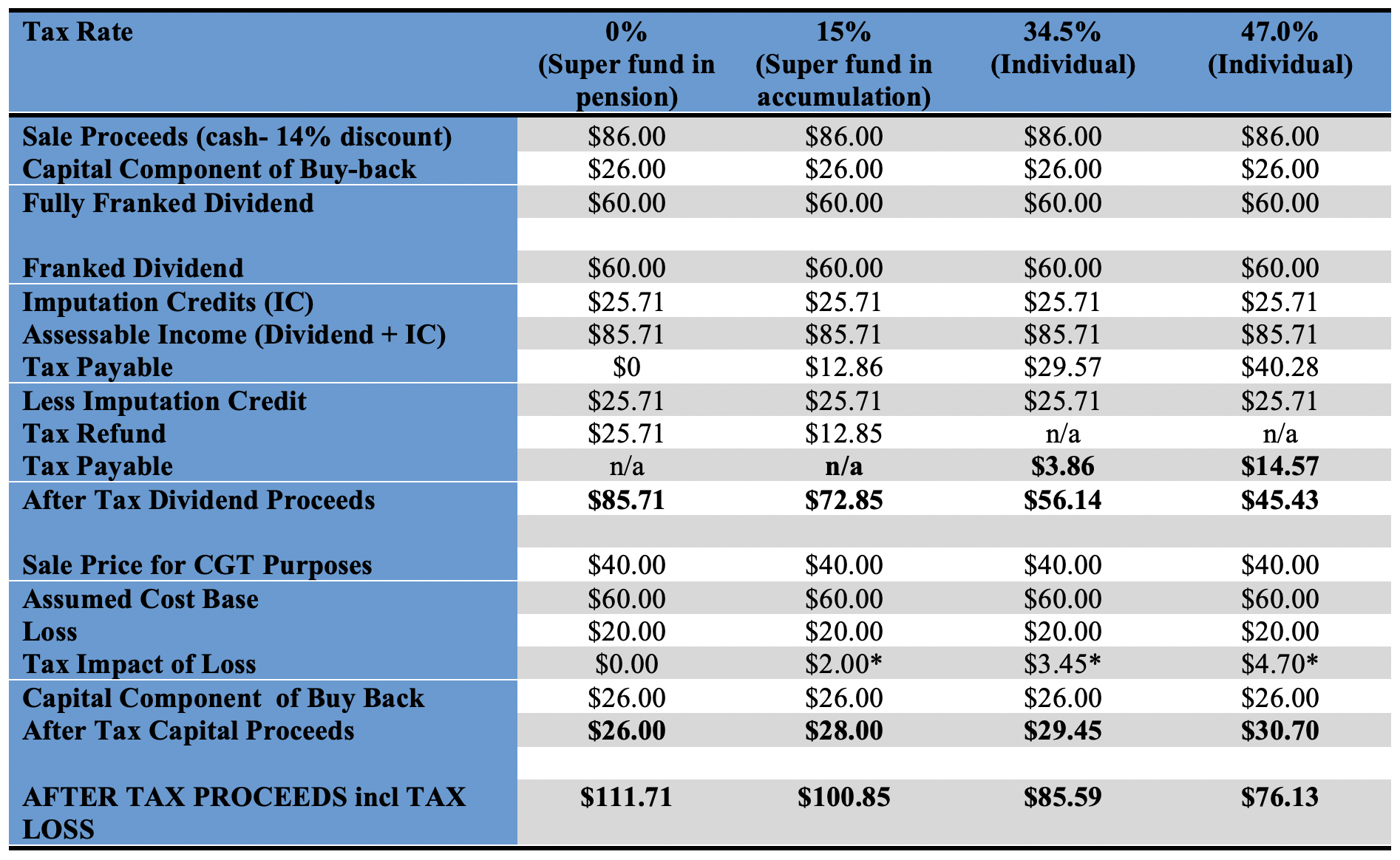

The table below shows the outcomes for 4 shareholders accepting the buyback: a SMSF paying tax at 0% (a fund in pension), a SMSF or super fund paying tax at 15% (a fund in accumulation), and then for individuals paying tax at the rates of 34.5% and 47%.

Starting with the dividend component of $60.00, the 0% taxpayer will get a full refund of the franking credits of $25.71, so it is worth $85.71. For the 15% taxpayer, they will keep half the franking credits so in cash terms, it is worth $72.85. For the individuals paying tax at 34.5% and 47%, they will have to pay some tax on their dividend, reducing the proceeds to $56.14 and $45.43 respectively.

Discount 14%, Original Purchase Price of $60.00, Market Price $100.00

* Value of losses can only be accessed by applying against other capital gains

On the capital side, the cash component is $26.00. With a deemed sale price of $40.00 and an assumed cost price of $60.00, the tax loss is $20.00. This isn’t worth anything to the 0% taxpayer, but for the super fund paying tax at 15%, this could be used to save net tax of $2.00 on other capital gains (15% tax rate, one third discount). For the individuals paying tax at 34.5% and 47%, they could save (after the application of the 50% discount) capital gains tax of $3.45 and $4.70 respectively on other gains.

Adding the after tax dividend proceeds to the after tax sale capital proceeds, the net value of accepting the buyback is:

- For the 0% taxpayer, $111.71

- For the 15% taxpayer, $100.85

- For the 34.5% taxpayer, $85.59

- For the 47% taxpayer, $76.13

From a tax point of view, it is a “no-brainer” for the 0% taxpayer to accept. For the 15% taxpayer, it is marginally favourable (if they sold on the ASX at $100, they would generate a capital gain of $40.00 and pay tax of $4.00). So, the $100.85 from the buyback compares to net proceeds of $96.00 from selling on the ASX.

The individual taxpayers shouldn’t accept. $85.89 for the 34.5% taxpayer compares to net proceeds of $93.10 if sold on market, and for the 47% taxpayer, the comparison is even less favourable at $76.18 and $90.60. (This assumes a cost price of $60.00, ASX sale price of $100.00 and capital gain of $40.00).

Off-market buybacks are sensitive to the discount and the size of the fully franked dividend, and marginally sensitive to cost price. (If the dividend is high, the discount is invariably 14%). But as can be seen from the table above, they are brilliant for 0% rate taxpayers such as a SMSF in pension, can be ok for other low rate taxpayers such as a SMSF in accumulation, and unattractive to most high rate taxpayers. If you are in this category, throw the offer document in the bin!.

Can you prepare for the off-market buyback?

The critical issue to resolve when accepting a buyback invitation is do want to sell the shares outright, or do you want to replace them?

If you are happy to sell them, fine. If you want to replace them, then working on the assumption that the buyback will be keenly sought and that you will be accepted for part of your shareholding, you can buy your shares back on the ASX once details of the scale back are known. Alternatively, you can top up your holding in advance of the completion of the buyback.

Some investors will use the period between the announcement of the buyback and the entitlement date (or ‘ex-date’) to buy CBA shares on market. The ‘ex-date’ is typically 3 working days after the announcement. Caution is recommended regarding the application of the ’45 day holding rule’ (which determines eligibility to claim franking credits).

An alternative strategy is to note that one of the reasons CBA’s share price has been so strong has been the anticipation of this buyback, and so it might be opportune to consider “replacing” by investing in another of the major banks such as NAB.

Let’s hope that CEO Matt Comyn doesn’t disappoint on Wednesday.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.