Four months ago (nearly to the date), I looked at what I ‘tongue-in-cheek’ called AAA-stocks. These are good companies but the stock market has smashed them since the Coronavirus crashed share prices in late February and through March last year.

Those companies were what some might think are ‘enfant terrible’ given they haven’t recovered like others that have rebounded nicely over the past 18 months. And given their poor progress (in terms of a rise in their stock-price), should we simply cut, cop our medicine and punt on other companies?

The companies in question are:

- A2 Milk

- Appen

- Altium.

It’s time to take stock on these three stocks.

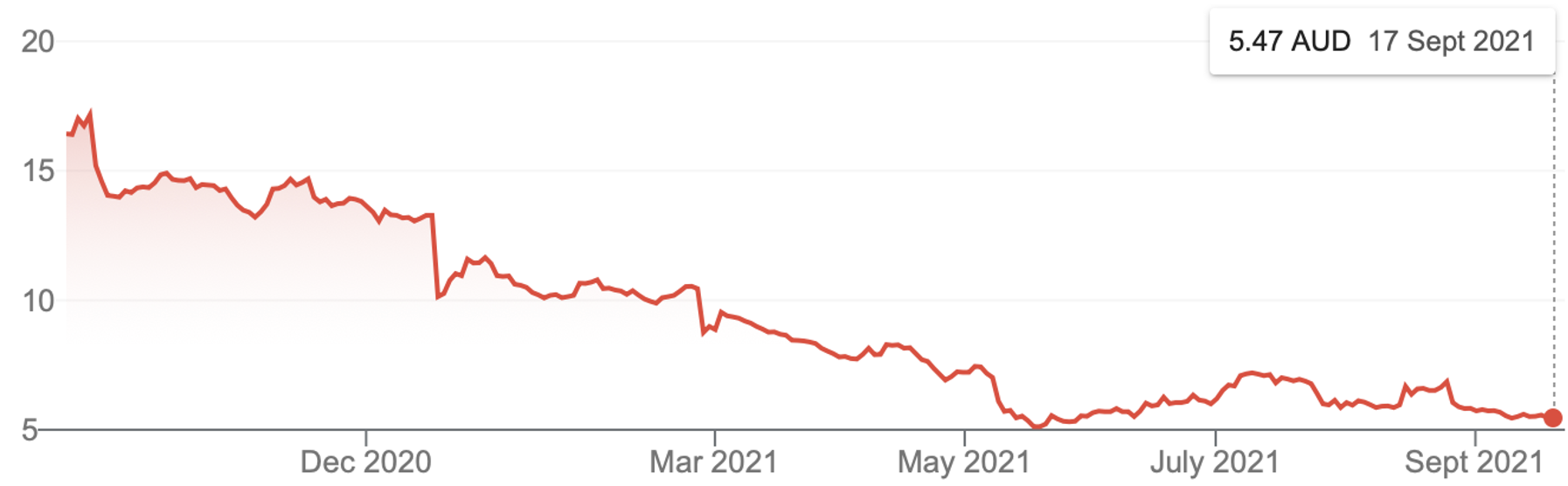

1. A2 Milk (A2M)

This chart above doesn’t make a pretty picture and I can’t say the latest price action is screaming “buy me!”

The only good thing I report is that given I did the story on May 17, its share price has gone from $5.12 to $5.47. That’s a 6.8% gain, which in the whole scheme of things is a nice return if you were influenced by my suggestion that, as Warren Buffett has advised, be “greedy when others are fearful.”

Still, this company is looking like it’s in the doldrums not helped by the persistence of the pandemic, the closed borders (especially here), the lack of Chinese tourists and the current poor state of the political relationship between Canberra and Beijing.

The daigou trade (who are tourists who buy milk powder on steroids to take back to China) is part of A2 Milk’s revenue that is missed and normal holidaying between China and Australia looks a long way off.

I’ve always suggested that the company is so well-regarded and its share price is so low that it could be a takeover target, and on August 16 there was media speculation that Nestle could be sniffing around. A2 Milk’s share price spiked 13%, but so far nothing has come out of this market gossip.

So what are the experts (who run their eyes over listed businesses for brokers and investment banks) saying about A2M? FNArena’s survey says the average price rise ahead is 15%, but Citi’s analysts think it will be higher at 31.6%. Morgan Stanley goes for a 29.8% rise. No analyst sees downside for the company from the current share price — thank God!

I’m holding.

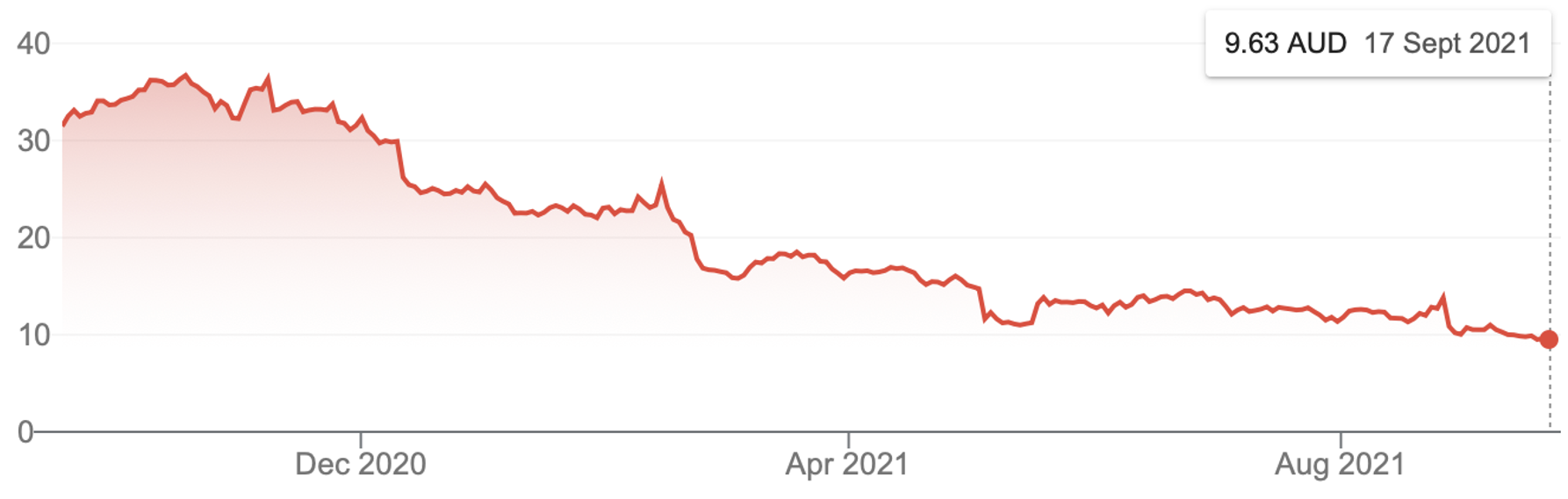

2. Appen (APX)

Appen (APX) has surprised me that it hasn’t started to show an uplift from the faster reopening of the US following its better vaccination programme. The feeling was as US business, especially in Silicon Valley, started to head back to normal, a company like Appen, which has a lot of big tech customers, would see greater ‘love’ from the market. However this chart tells a different story so far.

Appen (APX)

In May, this was an $11.13 stock. It’s now $9.63. That’s a 13.4% slide and really makes me wonder if this company has lost the plot. But then I looked at its five-year chart, which got me thinking.

Appen (APX)

This was a $30.38 stock before the Coronavirus crash and then rebounded to $40.08 by August last year. But as the US and Europe went into second-wave problems, it dived again.

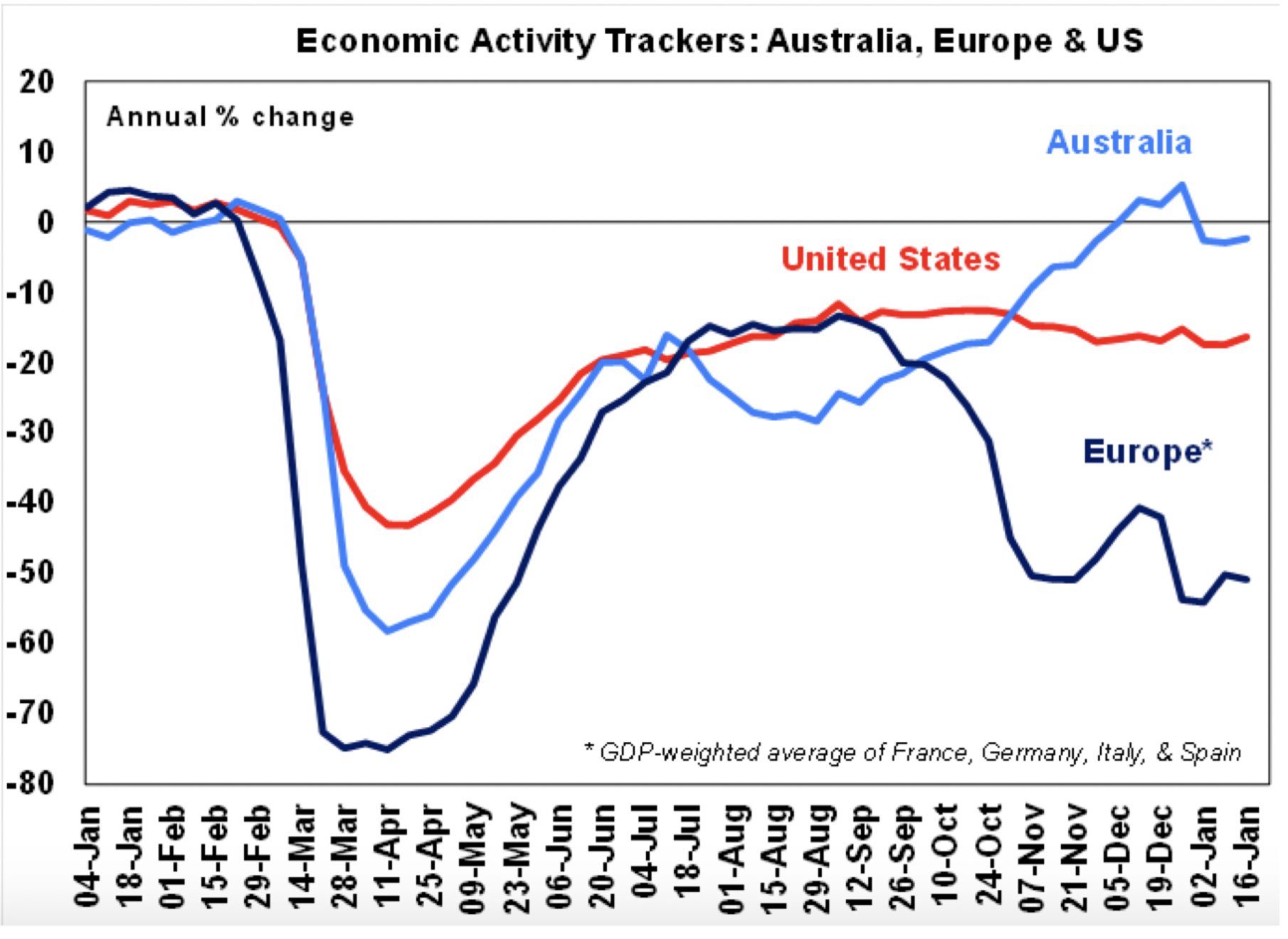

The chart below shows how the USA’s economic activity tracker flattened as death cases spiked. Look at Europe’s economic nosedive as our economy was surging, despite Victoria’s lockdown struggles.

I suspect in 2022 that APX will see business customers return. Even if it’s not to old levels, there should be better profits and a higher share price ahead. That’s not just my view, with Citi’s analyst so excited, as they’re tipping, wait for it, a 95.22% rise ahead!

The average expected gain is 43% and every analyst agrees, with the smallest predicted rise ahead being 14.23% from Credit Suisse. On the strength of that, I have to hold and could even buy more!

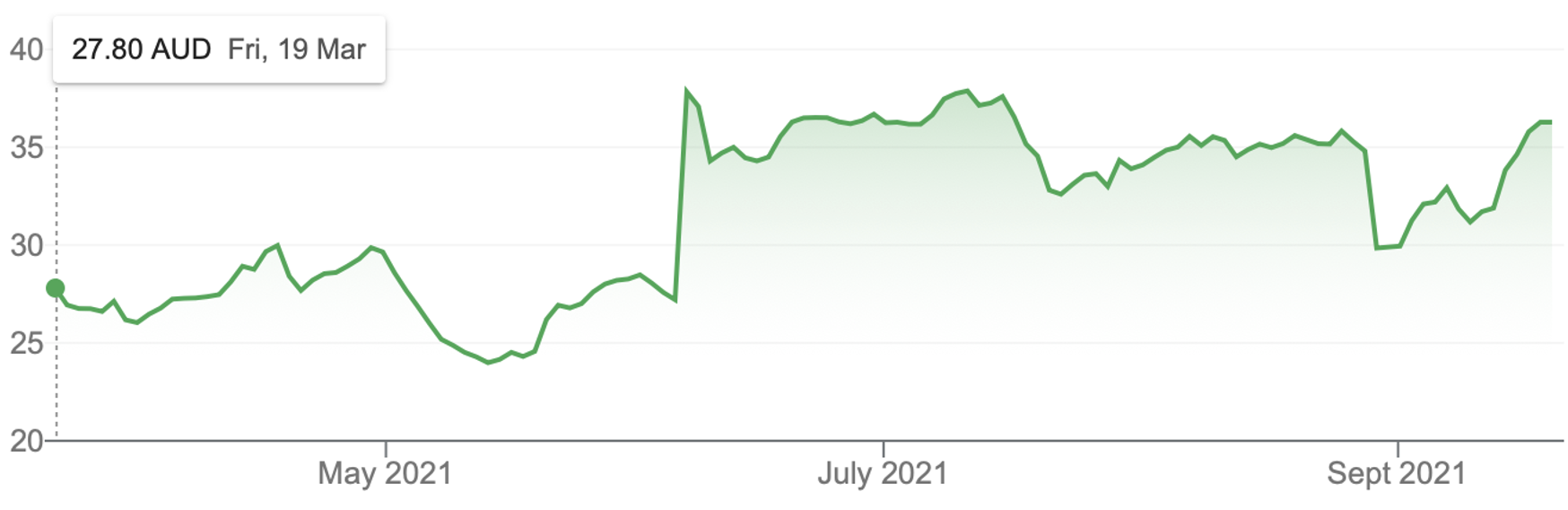

3. Altium (ALU)

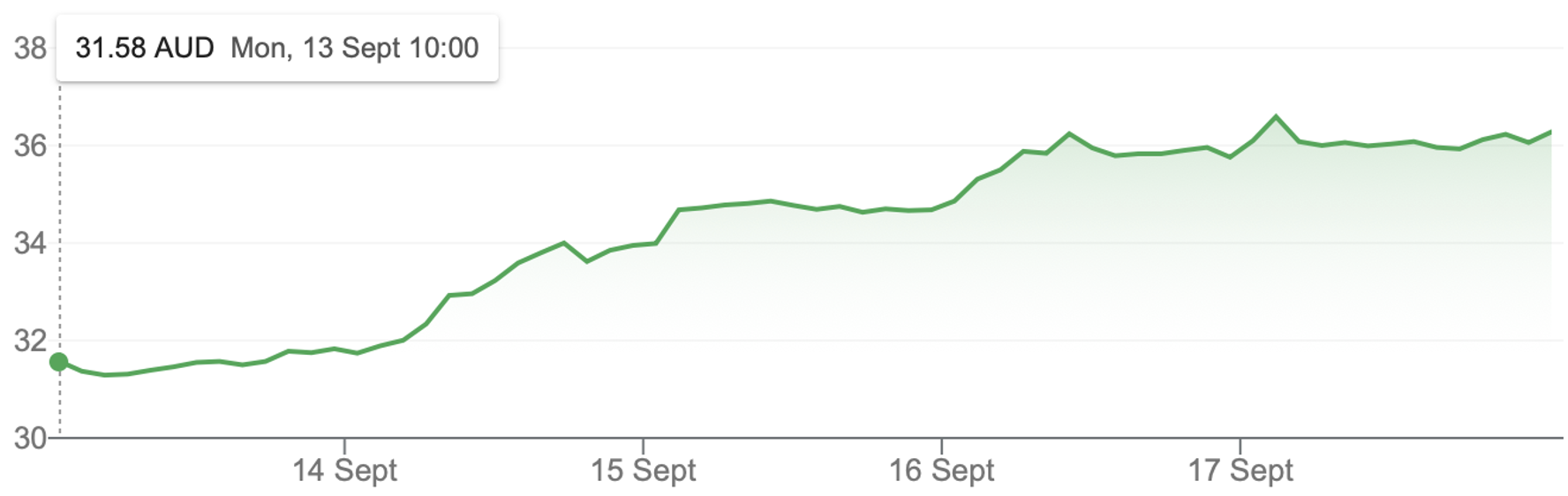

What about Altium? This one is a surprise package because this tip from me has delivered on its promise. On May 17 it was a $24.52 stock. It’s now $36.28. That’s a 48.7% gain. That kind of thing makes me a proud stock assessor!

Altium (ALU)

But like as they say in the bible: the last will be first and the first will be last. The analysts who liked Altium in May, have now gone off the company.

The average view is that the company has a 13.2% downside, with the most negative being Macquarie which sees a 25% slide! Citi is the least negative with a – 2.43% tip on the stock price.

I’m not sure how to play ALU because it had a great five-day showing last week — up 14.4%! And I’m a great believer in the old maxim that the trend is your friend until it bends!

ALU 5 days

I’m going to get my charts guy, Mike Gable of Fairmont Equities, to give me the technical assessment on ALU before I go dumping it.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.